CMCSA to Long, Double bottom6/1/2018 Weekly demand zone confirmed

Entry at demand zone: 34

Stop below this zone: 32

Target1: 40; risk/reward=1:3

Target2: 42, risk/reward=1:4

This is a trading school homework. I need 6 months to practice trading plan.

If you like it, thank you for your support. Please use SIM/Demo account to try it, until my trading plans get high winning rate.

In my real trade, I use options. I bought Jun C35 Call, limit 2.74;

Stop lost about 1.50.

Sum of my ideas:

5 active, 7 winner, 1 loser, 0 pending for condition;

4 analysis only, 8 cancelled;

CTP2 trade ideas

Buy CMCSA now till end of FebruaryCMCSA is a large sustainble company. My opinion is to buy now at such a low levels and hold it till Take profit line (purple).

Since the last 4q statement was not good the stock price slumped, however it does not mean the company won't recover rapidly.

IMHO one month and you take it with a good profit.

Have a good Day!

Comcast oversold and undervaluedCMCSA beat earnings last week but a potential run higher was thwarted by the overall negative news/low confidence in the market. Average analyst 1yr target is $51 and most of the bearish commentary on CMCSA is around the company's $100 billion debt. Long term performance outlooks are bearish but there is definitely some room for short term profit and indicators are suggesting a potential entry point here. Watching for a confirmed bottom and return of bullish momentum.

Comcast Corp buy opportunities with new monthly demand levelsOn Comcast Corp american stock #CMCSA we have a clear monthly uptrend with new demand levels being created while breaking all time highs. In an uptrend with demand levels being created and respected, no shorts are allowed, only buying the underlying stock at new demand imbalances.

This is a longer term analysis for Comcast Corp, you can use lower timeframes to take a trade on this stock. By taking into consideration the long term big picture trend, we will be adding more odds when buying Comcast.

Two monthly demand imbalances have been created around $42 and $36 per share, price did not retrace to strong demand level at $36 but it did retrace to the imbalance at $42.

A crisis is due but not as big as you might think Over the years I grew frustrated with EWI counts of SPX500 and tried diving into individual stocks myself for better clues on what to expect.

I think we are either in or about to start a primary wave four in most tech stocks which now drive SP500 performance. I will be posting more ideas on MSFT, AAPL, AMZN and any stock that demonstrates a clear technical picture.

Comcast bounce potentialI'm seeing lots of call-buying in Comcast (CMCSA) today, partly because it has fallen to a support level, and partly because of news that the company will invest 2 billion dollars in a streaming service in partnership with NBC to compete with Disney, Hulu, and Netflix. Honestly this is a crowded space, Comcast may be too late to the game, and profitability for the service is still five years away, but hype around the new streaming service could still buoy the stock this week. Comcast has a 7.7/10 analyst summary score and a 2% dividend return. The stock tends to beat earnings estimates and has a reasonable P/E of about 16.

Comcast Continues to aim for ATHEntry level $45.40 = Target price $47.25 = Stop loss $44.83

Moving averages in nice bullish formation.

Company profile

Comcast Corp. is a media, entertainment, and communications company, which engages in the provision of video, Internet, and phone services. It operates through the following segments: Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Corporate and Other. The Cable Communications segment provides video, Internet, voice, and security and automation services under the Xfinity brand. The Cable Networks segment consists of national cable networks, regional sports, news networks, international cable networks, and cable television studio production operations. The Broadcast Television segment includes NBC and Telemundo broadcast networks. The Filmed Entertainment segment involves in the production, acquisition, marketing, and distribution of filmed entertainment. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; and Osaka, Japan. The Corporate and Other segment includes operations of other business interests, primarily of Comcast Spectacor. The company was founded by Ralph J. Roberts in 1963 and is headquartered in Philadelphia, PA.

COMCAST - DAILY CHART Hi, today we are going to talk about Comcast and its current landscape.

Comcast is poised to receive increasing attention from the market as the Universal Pictures movie "Cats" that had a budget of about $100 million has been rebuked with an opening of $6.5 million in ticket sales, and reviews labeling the movie as one of the worse of the year, the movie also has hit the theaters with unfinished Visual Effects (VFX), setting this movie to be a huge loss for Comcast and a failed interpretation of the Thomas Stearns Eliot iconic musical.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

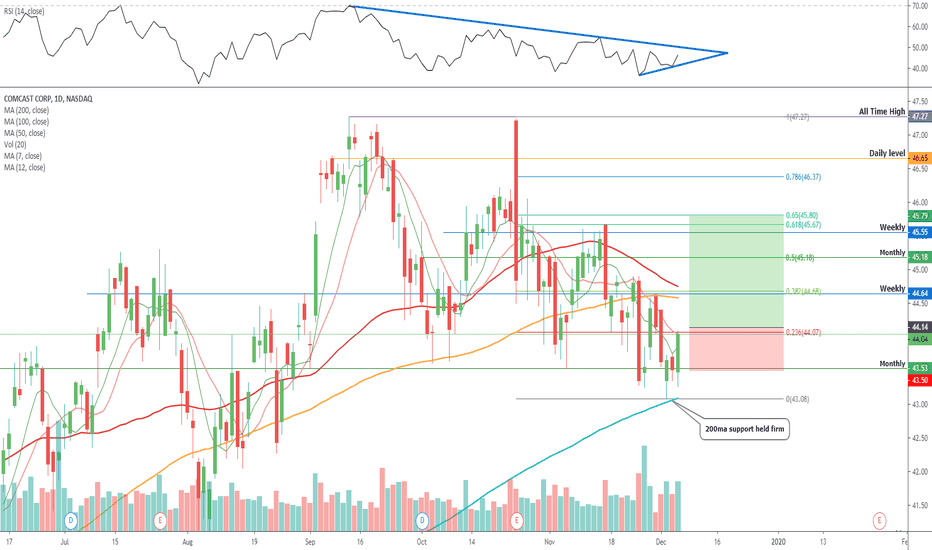

$CMCSA Reversal trade in ComcastEntry level $44.14 = Target price $45.80 = Stop loss $43.50

Average analysts price target $ 52 | BUY

P/E ratio 16

Comcast Corp. is a media, entertainment, and communications company, which engages in the provision of video, Internet, and phone services. It operates through the following segments: Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Corporate and Other. The Cable Communications segment provides video, Internet, voice, and security and automation services under the Xfinity brand. The Cable Networks segment consists of national cable networks, regional sports, news networks, international cable networks, and cable television studio production operations. The Broadcast Television segment includes NBC and Telemundo broadcast networks. The Filmed Entertainment segment involves in the production, acquisition, marketing, and distribution of filmed entertainment. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; and Osaka, Japan. The Corporate and Other segment includes operations of other business interests, primarily of Comcast Spectacor. The company was founded by Ralph J. Roberts in 1963 and is headquartered in Philadelphia, PA.

CMCSA - Weekly Mean Reversion - Bull Put Credit SpreadLow Weekly RSI & Low HV with High Vol.

W RSI <20

Looking for Reversal to Mean higher.

Taking 42.5/40 Bull Put Spread.

with 45 Calls for directional bias Higher.

Dec Exp but aiming to Close in profit well before that...

Good Luck - Watch your $$$ RISK

...Any questions just DM me...

$CMCSA daily #chart falling wedge #fallingwedge #stocks$CMCSA is trying to breakout from a falling wedge on the daily chart

Price has found support at the 23.6% retracement of the DEC'18 - SEP'19 rally

Not very important, but notice the lower volume trend as the price goes down

Yesterday the breakout was negated, surely they will try again today with the broad market stronger

Estimated targets are 45.30 previous year high(T1), 45.99 the gap fill of the 5th SEP low(T2) and 47.27 current YtD high(T3)