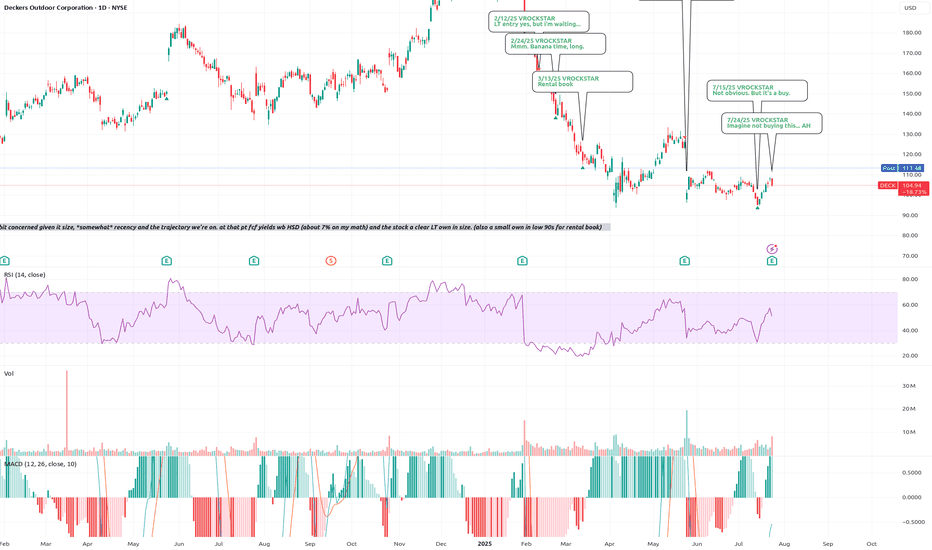

8/1/25 - $deck - 50% position8/1/25 :: VROCKSTAR :: NYSE:DECK

50% position

- if you have followed long enough, you know that when i write this sort of thing, it's maybe 5-10x a year, at most

- i still think anything can happen here in the mkt, so there are a lot of arrangements i've made in my portfolio to account for furth

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.185 CHF

855.23 M CHF

4.42 B CHF

146.01 M

About Deckers Outdoor Corporation

Sector

Industry

CEO

Stefano Caroti

Website

Headquarters

Goleta

Founded

1973

FIGI

BBG00LVD7299

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer. The UGG Brand segment offers a line of premium footwear, apparel, and accessories. The HOKA Brand segment sells footwear and apparel that offers enhanced cushioning and inherent stability with minimal weight, originally designed for ultra-runners. The Teva Brand segment focuses on the sport sandal and modern outdoor lifestyle category, such as sandals, shoes, and boots. The Sanuk Brand segment originated in Southern California surf culture and has emerged into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories. The Other Brands segment includes the Koolaburra by UGG brand. The Direct-to-Consumer segment consists of retail stores and e-commerce websites. The company was founded by Douglas B. Otto in 1973 and is headquartered in Goleta, CA.

Related stocks

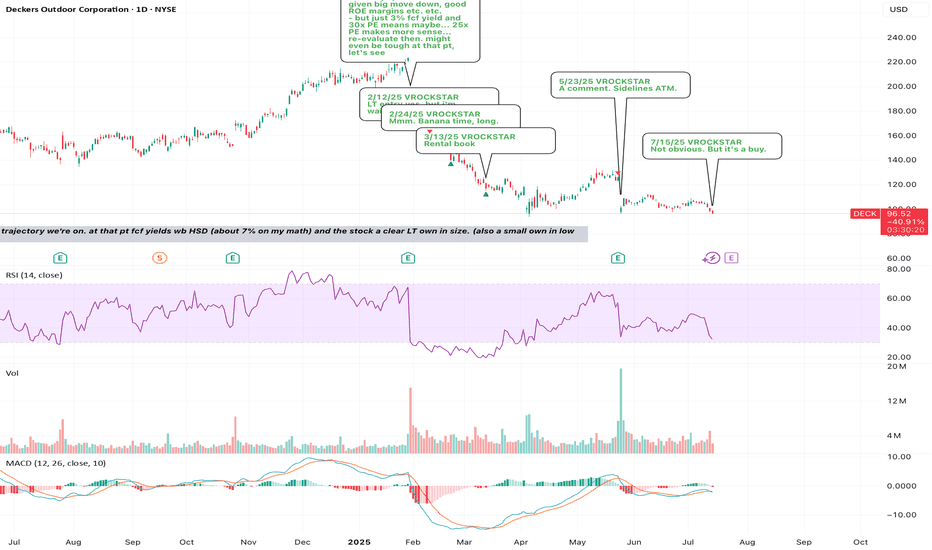

8/8/25 - $deck - Don't fud yo hoka8/8/25 :: VROCKSTAR :: NYSE:DECK

Don't fud yo hoka

- idk why 7+% fcf yield, buybacks, 35%+ ROICs, growth in 2H (worst behind us) and growing HSD++ is unattractive in this tape

- but i'll take the over here

- here's the deal... NASDAQ:CROX result was pretty bad. but honestly even that thing's a

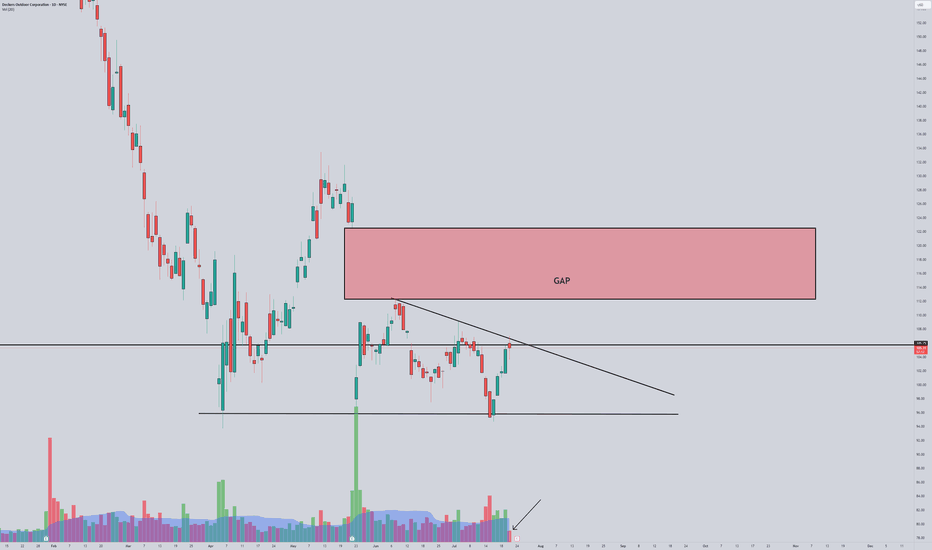

7/30/25 - $deck - Degen time.7/30/25 :: VROCKSTAR :: NYSE:DECK

Degen time.

- look at the last NYSE:ANF report... and tell me you're not noticing the exact same pattern. massive rip. massive gap fill retrace.

- do we re-test pre-report levels mid to low $100s?

- that's what keeps me buying ITM leaps here, but going quite la

7/28/25 - $deck - De risked, a few ways to play7/28/25 :: VROCKSTAR :: NYSE:DECK

De risked, a few ways to play

- mid teens PE

- 2 brands hitting on all strides (pun intended)

- great result, everyone offsides

- the action you're seeing here is MM re-adjusting post pop

- can buy spot/ sell covered calls for healthy mid 40s IV and roll

- my sen

DECK - Is the GAP fill inevitable?📰 Deckers Outdoor (DECK) — Technical & Macro Update

Ticker: DECK | Chart Timeframe: 30‑minute | Current Price: ~$117

Sector: Footwear & Apparel

Date: July 26, 2025

⚡ Market Recap

Deckers made waves this week with a strong mix of earnings momentum and analyst reactions:

👟 Blowout Q1 Earnings: Reven

7/24/25 - $deck - Imagine not buying this... AH7/24/25 :: VROCKSTAR :: NYSE:DECK

Imagine not buying this... AH

- amazing to listen to the mental degradation of "sell side analysts".

- the quarterly ritual when real shareholders must endure management answering the room temperature IQ questions from these "research" providers is a circus

- r

Long $DECK - NYSE:DECK is the only growth story I'm comfortable buying. This was wall street darling for many years. I believe sell off was overdone.

- It has lot of room to run. It is getting traction and NYSE:NKE because of law of large number is not growing much in %age.

- However, NYSE:DECK has l

7/15/25 - $deck - Not obvious. But it's a buy.7/15/25 :: VROCKSTAR :: NYSE:DECK

Not obvious. But it's a buy.

- will reiterate that i'm not on tape so closely this week, but will revert w any comment replies by next week; nevertheless i'm checking in here on the tape

- see what T did today on NVDA/ China?

- you think it's easier or harder to

BUY Deck!!!This is a good opportunity to look out for. We can see that market structure is clearly inducing early buyers to perhaps wipe them out with another bearish leg down to our major demand level.

Looking to set some buy orders at our next major zone to ride this stock up to previous all time highs.

G

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where DO2 is featured.

Frequently Asked Questions

The current price of DO2 is 97.339 CHF — it has decreased by −32.01% in the past 24 hours. Watch DECKERS OUTDOOR CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange DECKERS OUTDOOR CO stocks are traded under the ticker DO2.

We've gathered analysts' opinions on DECKERS OUTDOOR CO future price: according to them, DO2 price has a max estimate of 127.47 CHF and a min estimate of 78.26 CHF. Watch DO2 chart and read a more detailed DECKERS OUTDOOR CO stock forecast: see what analysts think of DECKERS OUTDOOR CO and suggest that you do with its stocks.

DO2 stock is 47.08% volatile and has beta coefficient of 1.53. Track DECKERS OUTDOOR CO stock price on the chart and check out the list of the most volatile stocks — is DECKERS OUTDOOR CO there?

Today DECKERS OUTDOOR CO has the market capitalization of 12.13 B, it has decreased by −10.91% over the last week.

Yes, you can track DECKERS OUTDOOR CO financials in yearly and quarterly reports right on TradingView.

DECKERS OUTDOOR CO is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

DO2 earnings for the last quarter are 0.74 CHF per share, whereas the estimation was 0.54 CHF resulting in a 36.11% surprise. The estimated earnings for the next quarter are 1.28 CHF per share. See more details about DECKERS OUTDOOR CO earnings.

DECKERS OUTDOOR CO revenue for the last quarter amounts to 765.26 M CHF, despite the estimated figure of 714.36 M CHF. In the next quarter, revenue is expected to reach 1.15 B CHF.

DO2 net income for the last quarter is 110.44 M CHF, while the quarter before that showed 134.04 M CHF of net income which accounts for −17.60% change. Track more DECKERS OUTDOOR CO financial stats to get the full picture.

No, DO2 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 12, 2025, the company has 5.5 K employees. See our rating of the largest employees — is DECKERS OUTDOOR CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. DECKERS OUTDOOR CO EBITDA is 1.02 B CHF, and current EBITDA margin is 25.21%. See more stats in DECKERS OUTDOOR CO financial statements.

Like other stocks, DO2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade DECKERS OUTDOOR CO stock right from TradingView charts — choose your broker and connect to your account.