Where's GameStop Headed? Is there a future?Will the future revolution be tokenized? Is this a dying retail company headed for certain doom?

Seems Ryan Cohen has managed to turn around this company and the launch of GameStop NFT Marketplace trademarked under: "GMerica" The company is also now debt free and C is finding ways to take care of employees as well as bring value to GME

How does the market feel about NFT?

NFT - "Non-Fungible Token" which are unique digital identifier that cannot be copied, substituted or subdivided. Everything is recorded on blockchain used to certify ownership and authenticity.

- Transferable proof of ownership.

Potential Applications:

- Art

-Games

-Music

-Apps

-Movies

-Books

-Tickets

-Stocks - Potential to fix problems with Wallstreet. Can future trading be done on blockchain?

-Authentication

-Counterfeit protection

-Asset titles

- Loans/Mortgages

- 100% verified ballot voting

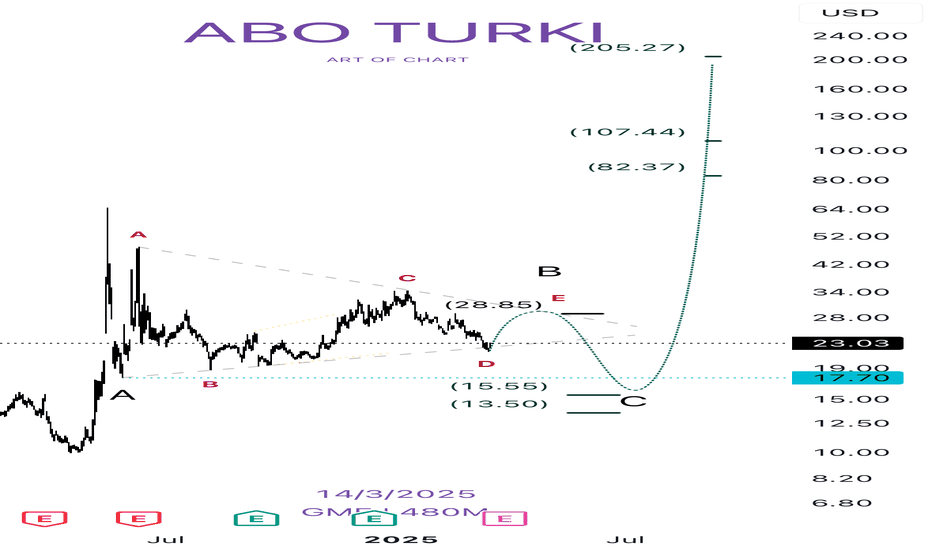

Let's take a look at the Elliott Wave Analysis:

Have you DRS'd?

GS2C trade ideas

GameStop Corp. (NYSE:GME) to add BTC as a Treasury Reserve AssetThe price of GameStop Corp. (NYSE: NYSE:GME ) shares saw a noteworthy uptick of 7% in Tuesday's after hours trading, primarily based on the news that the firm is set to add Bitcoin as its Treasury Reserve asset.

The asset bounced from it's psychological support zone aiming for a move to the $35- $40 price point. This move would be feasible if GameStop Corp. (NYSE: NYSE:GME ) shares break pass the $30 resistant point.

In light of that manner, GameStop Corp. (NYSE: NYSE:GME ) also is set to announced earnings report Tuesday, March 25, 2025, after market close.

About GameStop Corp. (NYSE: NYSE:GME )

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

$GME - More of the same weird stuffHi all,

More of the same weird stuff where GME has been showing signs of wanting to spike for quite some time now. Generally last week and especially on friday it showed parabolic upwards spiking which usually happens when a move is imminent.

If i was my old degenerate self, i'd be buying out of the money calls expiring this week, and i might just do that.

I don't have a perfectly locked on AI model for GME yet so i don't know for sure yet what's going to happen. My model is okay but not perfect, last i have is a signal from the 11'th saying to buy 22.5 Puts and although that trade did win temporarily by dropping GME to 21.90, GME is now at 23.00 so yeah... needs a bit more time to train.

Will update if i see signs of rejection/even more likely to pump.

No idea when it will pump but due to the parabolic way the data is moving, it usually means the move is extremely imminent e.g day/days less than a week etc.

Lets see. Will update once i have more.

Know it's earnings, but TA beyond cons and a beats fills gapAfter the gap is filled (27), we should see a swing movement back towards the current trend levels. The only object in the way of bearish sentiment is likely the catalyst to exceed expectations, which could be short-lived. Either way, we expect a bullish session only to concede to the continuing pattern of a downtrend swing into the teens. Very cautious!!!

GME Potential Pump to $180GME on the monthly chart is retesting support. It has a good chance of getting to $180 or so unless it breaks down here.

If it starts closing above 180 then it can go a lot higher. Very risky, and not financial advice.

Based on the chart pattern, I will not be surprised to see roaring kitty come out of hiding and posting something soon.

GME Entering Pre Sneeze (Round 2)A few years back, I traded GME based on the 741 theory left behind by RC and RK. I traded 741 trading days from the start of the purple box (June 2021)

It placed me at April 2024, so I waited and purchased my shares then.

Recently, in June 2024, RK released his SEC Chewy Filing (Likely trying to say look back at the month June - its a stretch but just hold on)

I decided to look back and count 741 trading days from the first purple box, starting at October 2016. It placed me at August 2020. Take a look at August 2020 candle and April 2024 candle, and the candles leading up to it.

So October and June both are the start of what is likely 3 year swaps. This means if RK decided to mess around with Chewy, then he forced hedgefunds to enter another 3 year swap with these stocks, forcing another sneeze waay down the road.

Back to my weird old 741 method as the first time through was simply luck combined with watching pressure over time. So I decided to truly look further into why this 7-4-1 and "35 minutes ago" kept appearing in RC and RK's tweets.

Since RK's Return, i've been watching the monthly chart and counting the months from 0-7, 0-4, and 0-1.

i.e., May = 0, June = 1, and so forth.

May to December = 7 Months

December to April = 4 Months

April to May = 1 Month

Damn that looks like its all Green Candles on those months... But what about April and May?

Well, lets go backwards to go forwards right?

Lets take a look at pre sneeze leading up.

September to April = 7 Months

April to August = 4 months

August to September = 1 Month

Wait a minute, are those all green Candles again? And before a Sneeze??? Can't be...

If projected forecasts are correct, and if DFV does make his return, then I believe we entered the pre sneeze faze last year when DFV returned.

He was trying to tell us something.

IF were in the pre sneeze faze which would bring the price back to the $80 area for a 3rd retest, then you can see where the next few months after lead.

It will break that retest with the help of a little kitty.

That's when shit gets frisky again.

Keep an eye out, collateral is drying up and the shit winds are blowing it away.

Edit: The Purple Box contains 35 bars from the start of the box to each bottom before a sneeze, followed by 17 bars of sneezing

As in Ozymandias did it 35 minutes ago.

GME from 32$-26$ ( FTDs )Hi everyone

Sharing a not that the GME stock in the past months drop from 32$ to 26$ in week, and if you look at the FTDs in this days you will find it (-) no reporting until today.

Thats mean many things about (MOASS) and (Short)…

Let us see in the coming days what will happen for this stock.

😉 Good Luck

MOASS: WC: 27.00 Target: 1800-2400 MOASS: 47k-100KTime Stamps:

Intro & Uncertainty in Markets: 0-4

Current Price Structure: 4-16

Next Expected Moves: 16-30

Settlement Projection: 30-42

BTW- totally forgot to mention The Cats/RC's tweets

Havent seen a tweet from The Cat but I wouldnt be surprised if we got one before Tuesday

Additional Future Prediction: They will both tweet again between March 10th and Earnings

MOASS: 06/09 -07/09

$GME - Another oneHi guys,

Seeing a ton of short covering in the last 2-3 weeks for GME in my data.

What i expect to happen:

To keep things simple, i estimate that there will be about 30 days of $22-27 on GME, more likely on the lower end of those prices, then a 11% price increase around early early to mid march, a small drop from profit taking and possibly another 12% price pump mid-end March.

The reasonable thing to do is to wait for you guys to drop it to $22-$23 range before buying in.

imgur.com

The trade:

Not entirely sure from where the +11% pump will start, it could be from 22, 25 or even 27. Due to that i'm buying at $25 call expiring in around 45 days from today and then another one once you drop it to $22 ish. Basically ATM calls expiring before GME earnings as that seems to be the timeframe for what i see in my data.

Will update this if the data changes excessively due to strange and excessive buying/selling caused by this post that may skew this play.

Other:

My AI training on this is still in progress. Will announce my website that uses my strategy on trading GME and a lot of other tickers soon.

GME: Buy ideaOn GME as you can see on the chart, buyers are above the Vwap indicator. Which means we are already in an upward trend.

Furthermore, we would have a continuation of this upward trend if and only if we have the break of the resistance line with force by a large green candle and followed by a large green volume.