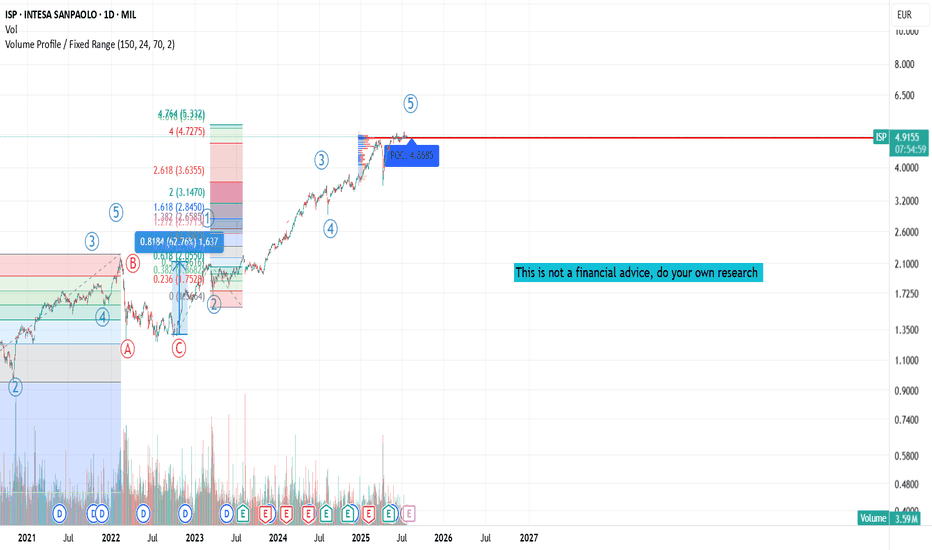

Isp - one of the best ! I've been following Intesa Sanpaolo closely for years.

I started out as an observer, then became a dedicated analyst, and eventually it turned into an investment opportunity.

Between 2018 and 2020, I bought and sold the stock several times, always guided by objective analysis and medium-term strate

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.477 CHF

8.15 B CHF

49.26 B CHF

14.23 B

About INTESA SANPAOLO

Sector

Industry

CEO

Carlo Messina

Website

Headquarters

Turin

Founded

1991

ISIN

IT0000072618

FIGI

BBG007FJNPY8

Intesa Sanpaolo SpA engages in the provision of financial products and banking services. It operates through the following segments: Banca dei Territori, IMI Corporate and Investment Banking, International Subsidiary Banks, Private Banking, Asset Management, and Insurance. The Banca dei Territori segment oversees the traditional lending and deposit collection activities in Italy. The IMI Corporate and Investment Banking segment deals with corporate and investment banking; and acts as a partner for corporates, public administration, and financial institutions. The International Subsidiary Banks segment operates on international markets through subsidiary and associated banks. The Private Banking segment specializes in the asset management of private and high net worth individuals. The Asset Management segment develops solutions targeted at the firm's customers, commercial networks, and institutional clientele. The Insurance segment includes Intesa Sanpaolo Vita, Fideuram Vita, Intesa Sanpaolo Assicura, and Intesa Sanpaolo Assicura. The company was founded in 1931 and is headquartered in Turin, Italy.

Related stocks

ISP | Intesa SanpaoloScreener Buy Idea

Intesa Sanpaolo SpA engages in the provision of financial products and banking services. It operates through the following segments: Banca dei Territori, IMI Corporate and Investment Banking, International Subsidiary Banks, Private Banking, Asset Management, Insurance, and Corpora

Intesa Sanpaolo SpA (ISP) | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

# Trend | Time Frame Conductive | Weekly Time Frame

- General

📉 Short ISP?

Hey guys, currently we have MIL:ISP with the following technical analysis which would indicate a higher probability of another bearish impulse.

1. Nice clear bearish impulse on larger degree

2. Corrective ABC pattern within range of 61.8 % retracement

3. Bearish impulse on lower degree breaking

ISP - 9 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

-

Trading Idea - #Intesa #SanpaoloBUY

ENTRY: 2.34 EUR

TARGET: 2.65 EUR (+13%)

STOP: 2.19 EUR

1.) Intesa Sanpaolo is moving in a strong upward trend.

2.) Third rejection on the lower trend line indicates an entry and a trend continuation.

3.) Intesa Sanpaolo surprises with a jump in profit in the last quarter.

4.) Intesa Sanpaolo

ISP Long TermHi guys, this is my POV on Intesa Sanpaolo, Italian bank that is rushing for the positive sentiment that is driving Italian markets these days, ISP is now breaking resistance so I will expect new highs.

I think a 20 % surge is very likely to happen in the next months, remember to set the stop loss.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

IT0005655375

ISP SC JUN37 USDYield to maturity

10.02%

Maturity date

Jun 23, 2037

XS2918234084

IntesSan 9% 34Yield to maturity

9.00%

Maturity date

Oct 11, 2034

IT0005642779

ISP SC APR35 USDYield to maturity

8.82%

Maturity date

Apr 2, 2035

XS2837717250

ISP SC JUN36 USDYield to maturity

8.24%

Maturity date

Jun 12, 2036

IT0005655342

ISP SC JUN31 USDYield to maturity

8.16%

Maturity date

Jun 23, 2031

IT0005655359

ISP SC JUN33 USDYield to maturity

8.07%

Maturity date

Jun 23, 2033

IT0005642761

ISP SC APR30 USDYield to maturity

8.01%

Maturity date

Apr 2, 2030

XS0355781880

IntesaSanpaolo FRN 21/04/2028Yield to maturity

7.36%

Maturity date

Apr 21, 2028

XS2782313212

ISP SC MAR34 USDYield to maturity

7.33%

Maturity date

Mar 13, 2034

XS2561515292

IntesSan 7.22% 37Yield to maturity

7.22%

Maturity date

Nov 30, 2037

XS2918233276

IntesSan 7% 32Yield to maturity

7.00%

Maturity date

Oct 11, 2032

See all IES bonds

Curated watchlists where IES is featured.

Frequently Asked Questions

The current price of IES is 4.632 CHF — it has increased by 0.92% in the past 24 hours. Watch INTESA SANPAOLO S.P.A. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange INTESA SANPAOLO S.P.A. stocks are traded under the ticker IES.

IES stock has fallen by −2.40% compared to the previous week, the month change is a 3.21% rise, over the last year INTESA SANPAOLO S.P.A. has showed a 27.60% increase.

We've gathered analysts' opinions on INTESA SANPAOLO S.P.A. future price: according to them, IES price has a max estimate of 5.78 CHF and a min estimate of 4.37 CHF. Watch IES chart and read a more detailed INTESA SANPAOLO S.P.A. stock forecast: see what analysts think of INTESA SANPAOLO S.P.A. and suggest that you do with its stocks.

IES stock is 0.91% volatile and has beta coefficient of 1.22. Track INTESA SANPAOLO S.P.A. stock price on the chart and check out the list of the most volatile stocks — is INTESA SANPAOLO S.P.A. there?

Today INTESA SANPAOLO S.P.A. has the market capitalization of 84.22 B, it has decreased by −2.31% over the last week.

Yes, you can track INTESA SANPAOLO S.P.A. financials in yearly and quarterly reports right on TradingView.

INTESA SANPAOLO S.P.A. is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

IES earnings for the last quarter are 0.13 CHF per share, whereas the estimation was 0.13 CHF resulting in a 3.75% surprise. The estimated earnings for the next quarter are 0.12 CHF per share. See more details about INTESA SANPAOLO S.P.A. earnings.

INTESA SANPAOLO S.P.A. revenue for the last quarter amounts to 6.50 B CHF, despite the estimated figure of 6.43 B CHF. In the next quarter, revenue is expected to reach 6.35 B CHF.

IES net income for the last quarter is 2.50 B CHF, while the quarter before that showed 1.41 B CHF of net income which accounts for 77.70% change. Track more INTESA SANPAOLO S.P.A. financial stats to get the full picture.

INTESA SANPAOLO S.P.A. dividend yield was 8.83% in 2024, and payout ratio reached 70.89%. The year before the numbers were 11.20% and 70.39% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 104.53 K employees. See our rating of the largest employees — is INTESA SANPAOLO S.P.A. on this list?

Like other stocks, IES shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INTESA SANPAOLO S.P.A. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So INTESA SANPAOLO S.P.A. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating INTESA SANPAOLO S.P.A. stock shows the neutral signal. See more of INTESA SANPAOLO S.P.A. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.