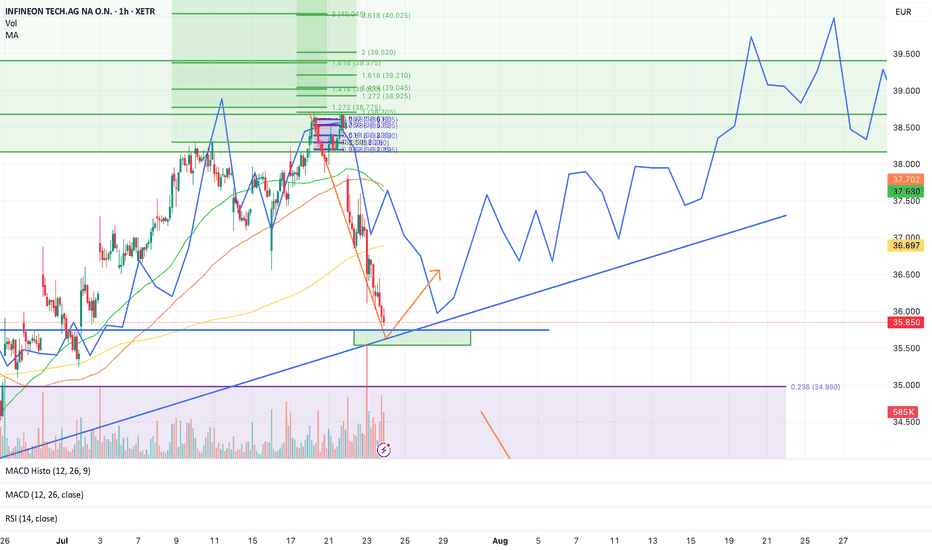

Infineon next big moveInfineon (IFX) – Potential Reversal at Trendline Support

Price has sharply corrected from the local highs around 38.7–39.0 EUR, reaching the major ascending trendline support in the 35.5–36.0 EUR demand zone.

🔹 Key points:

Strong upward trendline (blue) acting as dynamic support.

Price has reached a green demand box with confluence from previous structure.

MACD is bearish but momentum is oversold.

RSI at ~25 indicates oversold conditions with potential for a bounce.

Projected path: Possible short-term consolidation or retest of the trendline, followed by a bullish continuation towards 38.9, 39.2, and 39.5 EUR Fibonacci levels.

Targets: Fibonacci extensions at 1.272 (38.92 EUR), 1.618 (39.21 EUR), and the psychological 40 EUR zone if bullish momentum continues.

🔻 Invalidation: Clear breakdown below 34.98 EUR support (0.236 retracement) with volume confirmation could invalidate this reversal setup.

IFX trade ideas

INFINEON Bullish Momentum --> 40.00 EUR (Buy & Hold < 12 Months)Infineon is undervalued at present and shows upside momentum in the long-term. Stock might follow a negative trajectory in the next weeks but eventually should pick up positive momentum in the second half of 2024. Target price for this trade is somewhere around 40.00 EUR which will be most likely accomplished until the first half of 2025.

Infineon in descending channel + horizontal channel + resistanceInfineon is currebtly at the top of a descending channel and just below a strong volume and ichimoku resistance. I think that it may decrease to the next support and then, maybe, to the fibo retracement.

This analyse is not and advise and is not for financial investment.

INFINEON TECHInfineon Technologies is not only the largest semiconductor manufacturer in Germany, but it also holds the record for the world's smallest safety chip. This tiny chip, measuring just 0.6 square millimeters, is used in airbags and other critical safety systems in cars. Its small size allows for more compact and efficient designs in vehicles.

Infineon Technologies is a major supplier of semiconductor components and systems to a wide range of leading companies across various industries. Some of the well-known companies they supply include:

1. Automotive: Bosch, Continental, Denso, Valeo

2. Industrial: Siemens, Schneider Electric, ABB, STMicroelectronics

3. Consumer Electronics: Apple, Samsung, Sony, LG Electronics

4. Data & Telecommunications: Cisco Systems, Huawei, Ericsson, Nokia

We will be looking for small entries along the trend line. If the price breaks and remains below the trend line, we will be looking at our accumulation zone.

Infineon Germany Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Next buying opportunity Infineon? We are between 2 horizontal SR levels. An ascending trend line gave us support in the end.

If this will hold again and we get a 4h buy signal I see the orange marked path for possible.

Should we break this trendline, we still get support in the white zone, there is then to pay attention to the Wavereader whether we go the red way.

Both variants look to me like new highs.

Infineo on watchlistInfineon maybe a good buy canditate!

They simply told, that they can not produce enough chips for the market and also TSMC can not produce enough. There is a shortage of a product in the market, which will lead to a rise of the chip prices.

Long term profit for infineon, even when they now make not good earnings in this or maybe next quartal.

A good buy entry maybe is the support line about 31 € for an cheaper entry, but patientliy wait! Maybe it also break for a cheaper entry price to take now.

So on watchlist for the next 2 weeks for a good entry.

IFX about to break the channel after parabolic recoveryHey guys,

IFX - or Infineon manufactures all kinds high tech of components for EVs and is in some cases almost the only supplier. No wonder this stock has recovered so dramatically over the last month. I'm bullish on this stock and would buy a strong break of the former High.

No financial avice, just my personal opinion.

Infineon may be good position if it came back upPutting Infineon on my watchlist for a possible upward move, like it was in November.

If it crosses again the MA200 (4h) and the MACD turns positiv, an upward trend is possible.

Currently infineon is downward since it is also in the tech portfolios, which have a down move together.

But infineon is also a major company producing semiconductors for the automobile industrie, which has high demand on semiconductors (which are short right now) and car sells going up this year.

So infineon maybe completly undervalued, since it is an industry leader in a segment with high demand and their customers want to buy.

Long, but we may wait this week or two, to be sure it will happen now.

Unjustified down pressure is possible for the tech segment, which we should be aware of.