Key facts today

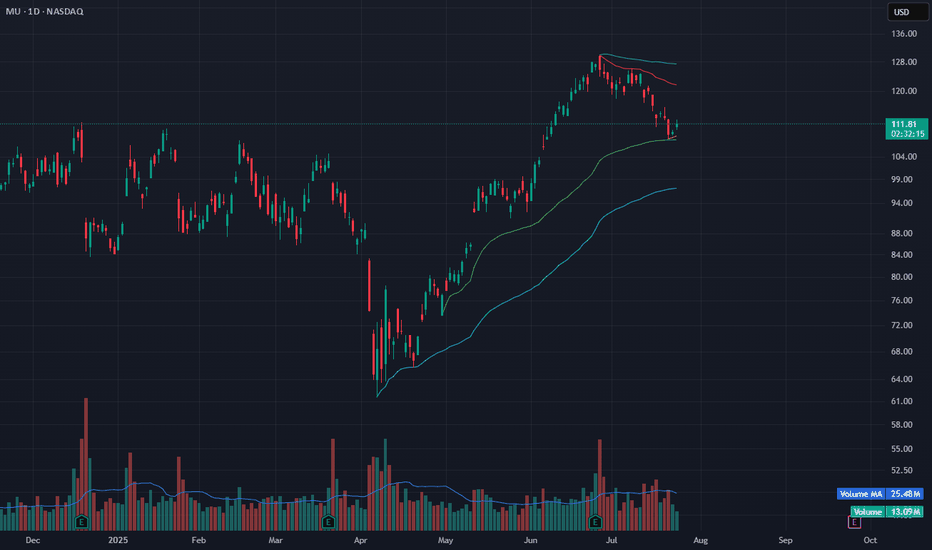

Micron Technology (MU) has pulled back 17% from June highs, stabilizing near $100 after retesting a previous breakout. The stock is currently down 0.2% at $107.55.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.600 CHF

661.51 M CHF

21.35 B CHF

1.11 B

About Micron Technology

Sector

Industry

CEO

Sanjay Mehrotra

Website

Headquarters

Boise

Founded

1978

FIGI

BBG006TLS105

Micron Technology, Inc. engages in the provision of innovative memory and storage solutions. It operates through the following segments: Compute and Networking Business Unit (CNBU), Mobile Business Unit (MBU), Embedded Business Unit (EBU), and Storage Business Unit (SBU). The CNBU segment includes memory products and solutions sold into client, cloud server, enterprise, graphics, and networking markets. The MBU segment is involved in memory and storage products sold into smartphone and other mobile-device markets. The EBU segment focuses on memory and storage products sold into automotive, industrial, and consumer Markets. The SBU segment consists of SSDs and component-level solutions sold into enterprise and cloud, client, and consumer storage markets. The company was founded by Ward D. Parkinson, Joseph Leon Parkinson, Dennis Wilson, and Doug Pitman on October 5, 1978 and is headquartered in Boise, ID.

Related stocks

MU Bounce at VWAP Support – Eyeing Relief Toward $118MU is showing signs of a potential reversal after a multi-week pullback. Price held the anchored VWAP zone (green line) near $109 and bounced today with a +1.83% move on 13M volume.

This level also aligns with the lower Bollinger Band — a common mean-reversion setup after extended downside. A short

MU WEEKLY TRADE IDEA (2025-07-29)

### 🚀 MU WEEKLY TRADE IDEA (2025-07-29)

**Micron Technology (MU) – Bullish Call Play**

🔹 **Sentiment:** Moderate Bullish

🔹 **C/P Ratio:** 2.91 (Bullish Flow)

🔹 **RSI (Weekly):** 53.6 📈

🔹 **Volume:** Weak (⚠️ caution — low conviction)

---

### 🎯 Trade Setup

* **Strike:** \$116.00

* **Type:** CALL

MU eyes on $95/97: Double Golden fib zone Ultra-High GravityMU looking to exit a Double Golden zone $95.33-97.23

Break could pop to next resistance zone $109.41-111.38

Expecting some orbits around this ultra high gravity zone.

.

Previous Plot that caught the bottom EXACTLY:

==================================================

.

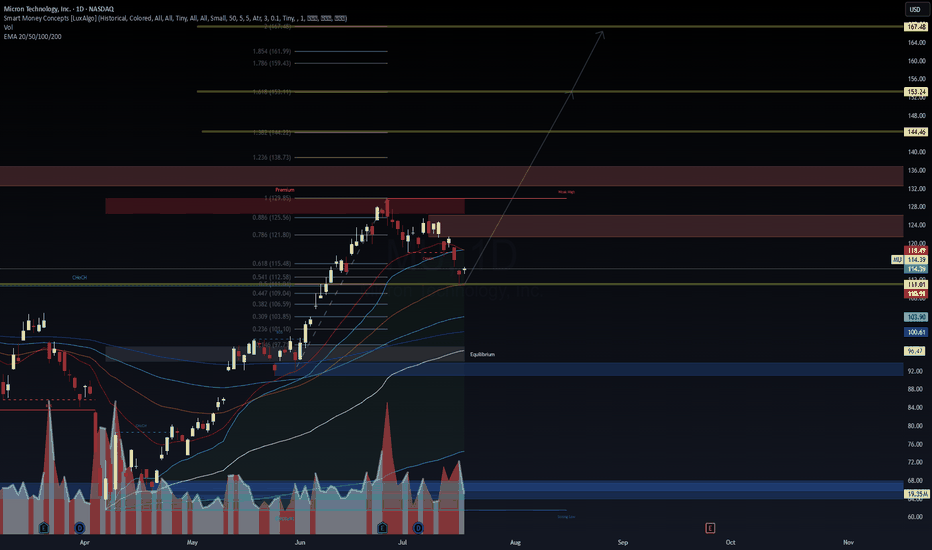

$MU – Preparing for Institutional Flow Reversal?📈 NASDAQ:MU – Preparing for Institutional Flow Reversal?

Micron ( NASDAQ:MU ) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab bef

Bullish flag Pattern on MUIt appears there is a Bull flag occurring in MU. Weve seen an 82% rise since the lows caused by the market drop in April and our now seeing a slight retraction back into the 21 EMA. Price is currently at 118.6 with some support at the 114 level. Using a Stop Loss just below this support level should

Micron Technology - Another +50% rally will follow!Micron Technology - NASDAQ:MU - will rally another +50%:

(click chart above to see the in depth analysis👆🏻)

About two months ago Micron Technology perfectly retested a confluence of support. This retest was followed by bullish confirmation, nicely indicating a reversal. So far we saw a rally o

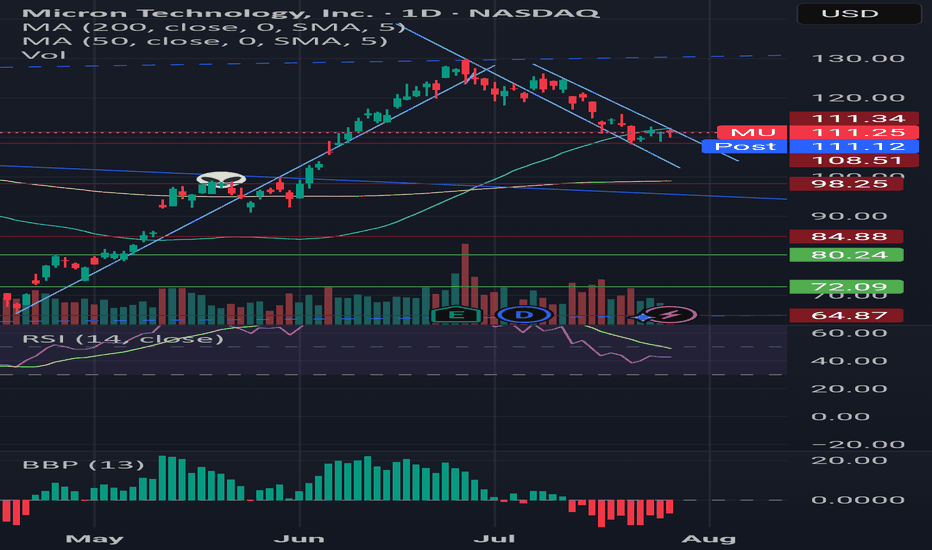

MU - SMC Premium Zone Rejection | Targeting Equilibrium Before E📉 MU - SMC Premium Zone Rejection | Targeting Equilibrium Before Expansion

🔍 WaverVanir DSS Framework | SMC x Fibonacci x Liquidity

We just observed rejection from the Premium zone and 0.886 Fibonacci retracement near $129.85, aligning with prior weak high liquidity. Price has shown signs of distri

Micron Technology Inc.: Optimistic Long-Term Outlook Driven by ACurrent Price: $124.53

Direction: LONG

Targets:

- T1 = $128.50

- T2 = $130.00

Stop Levels:

- S1 = $123.00

- S2 = $120.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging the collective intelligence

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MU5283110

Micron Technology, Inc. 3.477% 01-NOV-2051Yield to maturity

6.77%

Maturity date

Nov 1, 2051

MU5283109

Micron Technology, Inc. 3.366% 01-NOV-2041Yield to maturity

6.55%

Maturity date

Nov 1, 2041

MU6062157

Micron Technology, Inc. 6.05% 01-NOV-2035Yield to maturity

5.29%

Maturity date

Nov 1, 2035

MU5980483

Micron Technology, Inc. 5.8% 15-JAN-2035Yield to maturity

5.22%

Maturity date

Jan 15, 2035

MU5283108

Micron Technology, Inc. 2.703% 15-APR-2032Yield to maturity

5.20%

Maturity date

Apr 15, 2032

MU5568332

Micron Technology, Inc. 5.875% 15-SEP-2033Yield to maturity

4.99%

Maturity date

Sep 15, 2033

MU5537465

Micron Technology, Inc. 5.875% 09-FEB-2033Yield to maturity

4.98%

Maturity date

Feb 9, 2033

MU6062156

Micron Technology, Inc. 5.65% 01-NOV-2032Yield to maturity

4.89%

Maturity date

Nov 1, 2032

MU5732741

Micron Technology, Inc. 5.3% 15-JAN-2031Yield to maturity

4.65%

Maturity date

Jan 15, 2031

MU4858016

Micron Technology, Inc. 4.663% 15-FEB-2030Yield to maturity

4.60%

Maturity date

Feb 15, 2030

MU4795145

Micron Technology, Inc. 5.327% 06-FEB-2029Yield to maturity

4.52%

Maturity date

Feb 6, 2029

See all MTE bonds

Curated watchlists where MTE is featured.

Frequently Asked Questions

The current price of MTE is 88.322 CHF — it has increased by 2.83% in the past 24 hours. Watch MICRON TECHNOLOGY stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange MICRON TECHNOLOGY stocks are traded under the ticker MTE.

MTE stock has fallen by −1.87% compared to the previous week, the month change is a −8.83% fall, over the last year MICRON TECHNOLOGY has showed a 23.59% increase.

We've gathered analysts' opinions on MICRON TECHNOLOGY future price: according to them, MTE price has a max estimate of 161.10 CHF and a min estimate of 80.55 CHF. Watch MTE chart and read a more detailed MICRON TECHNOLOGY stock forecast: see what analysts think of MICRON TECHNOLOGY and suggest that you do with its stocks.

MTE stock is 2.77% volatile and has beta coefficient of 2.19. Track MICRON TECHNOLOGY stock price on the chart and check out the list of the most volatile stocks — is MICRON TECHNOLOGY there?

Today MICRON TECHNOLOGY has the market capitalization of 97.65 B, it has decreased by −5.10% over the last week.

Yes, you can track MICRON TECHNOLOGY financials in yearly and quarterly reports right on TradingView.

MICRON TECHNOLOGY is going to release the next earnings report on Sep 25, 2025. Keep track of upcoming events with our Earnings Calendar.

MTE earnings for the last quarter are 1.57 CHF per share, whereas the estimation was 1.32 CHF resulting in a 19.20% surprise. The estimated earnings for the next quarter are 2.04 CHF per share. See more details about MICRON TECHNOLOGY earnings.

MICRON TECHNOLOGY revenue for the last quarter amounts to 7.66 B CHF, despite the estimated figure of 7.29 B CHF. In the next quarter, revenue is expected to reach 8.70 B CHF.

MTE net income for the last quarter is 1.55 B CHF, while the quarter before that showed 1.43 B CHF of net income which accounts for 8.49% change. Track more MICRON TECHNOLOGY financial stats to get the full picture.

Yes, MTE dividends are paid quarterly. The last dividend per share was 0.09 CHF. As of today, Dividend Yield (TTM)% is 0.43%. Tracking MICRON TECHNOLOGY dividends might help you take more informed decisions.

As of Aug 5, 2025, the company has 48 K employees. See our rating of the largest employees — is MICRON TECHNOLOGY on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MICRON TECHNOLOGY EBITDA is 13.14 B CHF, and current EBITDA margin is 35.86%. See more stats in MICRON TECHNOLOGY financial statements.

Like other stocks, MTE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MICRON TECHNOLOGY stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MICRON TECHNOLOGY technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MICRON TECHNOLOGY stock shows the buy signal. See more of MICRON TECHNOLOGY technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.