Key facts today

Southern Copper Corporation's shares declined by 1.1%, reflecting a broader downturn in copper miners, coinciding with a 0.4% decrease in benchmark copper prices on the London Metal Exchange.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.964 CHF

3.07 B CHF

10.38 B CHF

81.43 M

About Southern Copper Corporation

Sector

Industry

CEO

Oscar González Rocha

Website

Headquarters

Phoenix

Founded

1952

FIGI

BBG00TDM2J81

Southern Copper Corp. engages in the development, production, and exploration of copper, molybdenum, zinc, and silver. It operates through the following segments: Peruvian Operations, Mexican Open-Pit Operations, and Mexican Underground Mining Operations. The Peruvian Operations segment focuses on the Toquepala and Cuajone mine complexes and the smelting and refining plants, industrial railroad, and port facilities that service both mines. The Mexican Open-Pit Operations segment comprises the La Caridad and Buenavista mine complexes, the smelting, and refining plants and support facilities, which service both mines. The Mexican Underground Mining Operations segment is involved in the operation of five underground mines, a coal mine, and several industrial processing facilities. The company was founded on December 12, 1952 and is headquartered in Phoenix, AZ.

Related stocks

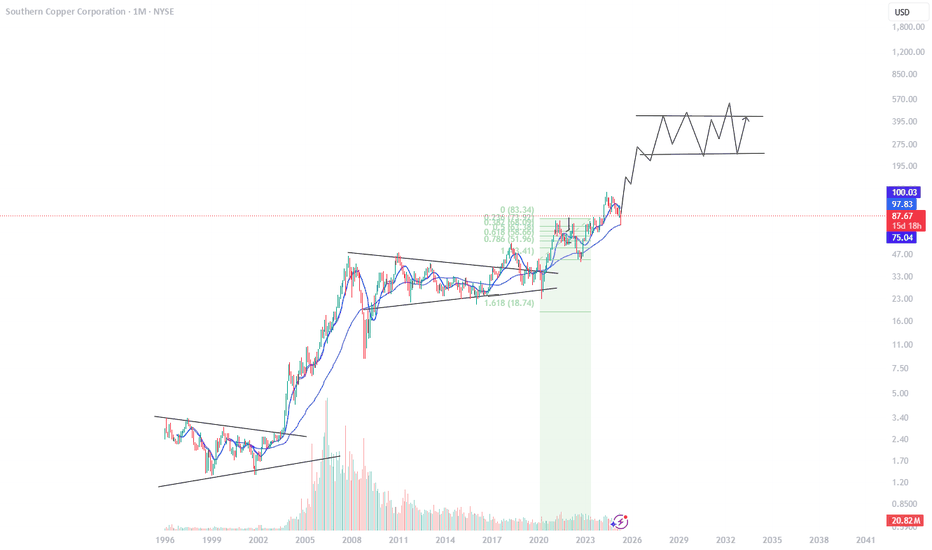

SCCO watch $87.05 above 83.65 below: Key fibs to determine trendSCCO may have bottomed but not yet flying.

Currently fighting Genesis fib above at $87.05

Likely dips need to hold Golden Covid at $83.65

Of course we have the Copper > Econ > China thing,

No way to know effects but the fibs say "look here".

=============================================

Copper Equities Breaking Down, Is tthe economy?Copper is very close to losing criyical support.

If this daily chart trendline breaks, there is a big move down into the next support.

Copper Equity stocks are already teing us aa likely breakdown in the commodity is coming.

Is this base metal signaling weaker economic demand & growth?

SCCO bulls struggle at current highs.SOUTHERN COPPER CORPORATION - 30d expiry - We look to Sell at 77.48 (stop at 81.21)

We are trading at overbought extremes.

Posted a Double Top formation.

Bespoke resistance is located at 78.70.

Resistance could prove difficult to breakdown.

Early optimism is likely to lead to gains although ex

Southern Copper top?Southern Copper Corporation has been on a tear the past 2 weeks since the China reopening news. Eventually within another week or so, copper will hit its top resistance level. Here's a SCCO 1 week chart and HG1! comparison using my TTCATR(beta) indicator set to 9 with my commodity channel index comp

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

M

MNRMF4887148

Minera Mexico, S.A. de C.V. 4.5% 26-JAN-2050Yield to maturity

6.98%

Maturity date

Jan 26, 2050

G

GMBX3686196

Grupo Minero Mexico SA de CV 9.25% 01-APR-2028Yield to maturity

5.85%

Maturity date

Apr 1, 2028

M

MNRMF5999370

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

5.35%

Maturity date

Feb 12, 2032

M

MNRMF5999369

Minera Mexico, S.A. de C.V. 5.625% 12-FEB-2032Yield to maturity

—

Maturity date

Feb 12, 2032

See all PCU bonds

Curated watchlists where PCU is featured.

Frequently Asked Questions

The current price of PCU is 78.736 CHF — it has decreased by −9.83% in the past 24 hours. Watch SOUTHERN COPPER CO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange SOUTHERN COPPER CO stocks are traded under the ticker PCU.

PCU stock has fallen by −9.83% compared to the previous week, the month change is a −9.83% fall, over the last year SOUTHERN COPPER CO has showed a −16.29% decrease.

We've gathered analysts' opinions on SOUTHERN COPPER CO future price: according to them, PCU price has a max estimate of 103.23 CHF and a min estimate of 55.90 CHF. Watch PCU chart and read a more detailed SOUTHERN COPPER CO stock forecast: see what analysts think of SOUTHERN COPPER CO and suggest that you do with its stocks.

PCU stock is 10.90% volatile and has beta coefficient of 1.19. Track SOUTHERN COPPER CO stock price on the chart and check out the list of the most volatile stocks — is SOUTHERN COPPER CO there?

Today SOUTHERN COPPER CO has the market capitalization of 63.76 B, it has decreased by −3.98% over the last week.

Yes, you can track SOUTHERN COPPER CO financials in yearly and quarterly reports right on TradingView.

SOUTHERN COPPER CO is going to release the next earnings report on Jul 28, 2025. Keep track of upcoming events with our Earnings Calendar.

PCU earnings for the last quarter are 1.04 CHF per share, whereas the estimation was 1.00 CHF resulting in a 4.25% surprise. The estimated earnings for the next quarter are 0.89 CHF per share. See more details about SOUTHERN COPPER CO earnings.

SOUTHERN COPPER CO revenue for the last quarter amounts to 2.76 B CHF, despite the estimated figure of 2.62 B CHF. In the next quarter, revenue is expected to reach 2.42 B CHF.

PCU net income for the last quarter is 837.35 M CHF, while the quarter before that showed 721.02 M CHF of net income which accounts for 16.13% change. Track more SOUTHERN COPPER CO financial stats to get the full picture.

Yes, PCU dividends are paid quarterly. The last dividend per share was 0.58 CHF. As of today, Dividend Yield (TTM)% is 2.66%. Tracking SOUTHERN COPPER CO dividends might help you take more informed decisions.

SOUTHERN COPPER CO dividend yield was 2.27% in 2024, and payout ratio reached 47.87%. The year before the numbers were 4.65% and 127.51% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 16.13 K employees. See our rating of the largest employees — is SOUTHERN COPPER CO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SOUTHERN COPPER CO EBITDA is 5.99 B CHF, and current EBITDA margin is 55.98%. See more stats in SOUTHERN COPPER CO financial statements.

Like other stocks, PCU shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SOUTHERN COPPER CO stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SOUTHERN COPPER CO technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SOUTHERN COPPER CO stock shows the strong sell signal. See more of SOUTHERN COPPER CO technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.