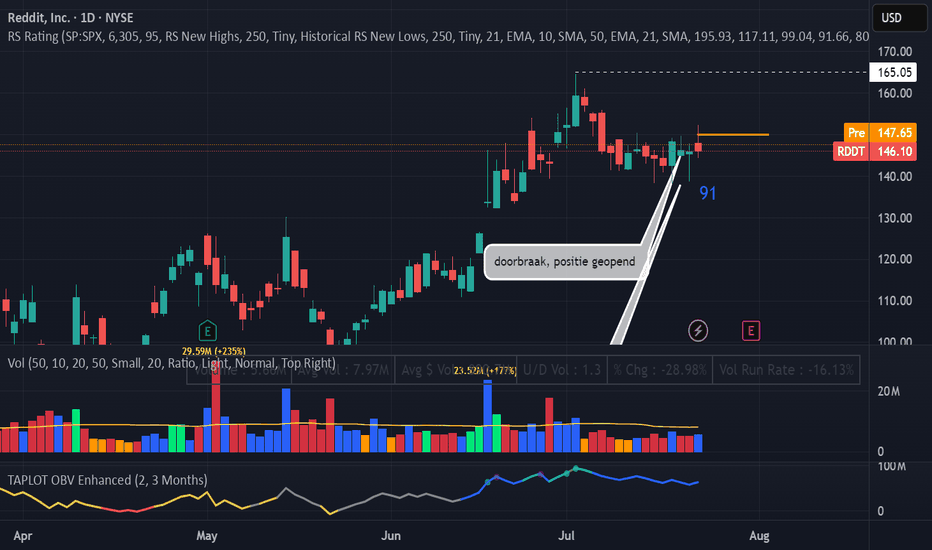

RDDT break out sling shotEntry Trigger: Entry above $149.95 with strong volume

Technical Indicators:

-RS = 91

-clear uptrend

-contracting volume before breakout

-Fundamentals Last 3 quarters show rising EPS and sales

Play

Stop Loss Below the breakout candle

Target Minimum 2.5R / ride the EMA

Sell in to strenght nex pivot

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.572 CHF

−439.82 M CHF

1.18 B CHF

114.44 M

About Reddit

Sector

Industry

CEO

Steven Ladd Huffman

Website

Headquarters

San Francisco

FIGI

BBG01NT31570

Reddit, Inc. operates an entertainment, social networking, and news website where registered community members can submit content. It provides online news services where users can select and rank web content. The firm also offers a personalized filter on the day's story, using previous votes to determine what new things the user might like to read. The company was founded by Steven Ladd Huffman and Alexis Ohanian on June 23, 2005 and is headquartered in San Francisco, CA.

Related stocks

Wallstreetbets and Markets: Is there a correlation? Preface:

As a self proclaimed “market statistician”, I like to do a lot of random research, sometimes useful, sometimes not so useful.

Here is a post about some “not so useful” research I did. Though not so useful, the results are truly interesting.

The results of this analysis are, in my opin

RDDT · 4H — Rising-Wedge Setup with Targets at $172 and $185Setup Summary

Rising wedge structure forming since late June. Price recently pulled back to test support at ~$144–145, where the rising trendline intersects horizontal structure.

Momentum remains bullish: The prior move from $110 to $165 was impulsive, and this consolidation appears corrective so

Reddit, Inc. (RDDT) – Global Growth & Monetization TailwindsCompany Snapshot:

Reddit NYSE:RDDT is a community-centric social media platform, uniquely positioned through user-generated content and authentic engagement. With over 100,000 active communities, Reddit is a magnet for targeted brand advertising and premium ad formats.

Key Catalysts:

AI-Driven I

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RDDT is 116.433 CHF — it has decreased by −3.82% in the past 24 hours. Watch REDDIT INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange REDDIT INC stocks are traded under the ticker RDDT.

RDDT stock has risen by 0.79% compared to the previous week, the month change is a 3.13% rise, over the last year REDDIT INC has showed a 126.57% increase.

We've gathered analysts' opinions on REDDIT INC future price: according to them, RDDT price has a max estimate of 197.04 CHF and a min estimate of 60.57 CHF. Watch RDDT chart and read a more detailed REDDIT INC stock forecast: see what analysts think of REDDIT INC and suggest that you do with its stocks.

RDDT reached its all-time high on Feb 10, 2025 with the price of 209.392 CHF, and its all-time low was 49.907 CHF and was reached on Sep 16, 2024. View more price dynamics on RDDT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RDDT stock is 0.93% volatile and has beta coefficient of 2.21. Track REDDIT INC stock price on the chart and check out the list of the most volatile stocks — is REDDIT INC there?

Today REDDIT INC has the market capitalization of 21.58 B, it has increased by 1.26% over the last week.

Yes, you can track REDDIT INC financials in yearly and quarterly reports right on TradingView.

REDDIT INC is going to release the next earnings report on Jul 31, 2025. Keep track of upcoming events with our Earnings Calendar.

RDDT earnings for the last quarter are 0.12 CHF per share, whereas the estimation was 0.02 CHF resulting in a 647.47% surprise. The estimated earnings for the next quarter are 0.15 CHF per share. See more details about REDDIT INC earnings.

REDDIT INC revenue for the last quarter amounts to 347.37 M CHF, despite the estimated figure of 327.14 M CHF. In the next quarter, revenue is expected to reach 337.75 M CHF.

RDDT net income for the last quarter is 23.16 M CHF, while the quarter before that showed 64.51 M CHF of net income which accounts for −64.11% change. Track more REDDIT INC financial stats to get the full picture.

No, RDDT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 30, 2025, the company has 2.23 K employees. See our rating of the largest employees — is REDDIT INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. REDDIT INC EBITDA is 42.89 M CHF, and current EBITDA margin is −41.91%. See more stats in REDDIT INC financial statements.

Like other stocks, RDDT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade REDDIT INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So REDDIT INC technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating REDDIT INC stock shows the sell signal. See more of REDDIT INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.