SAP: Macro PotentialPolitical uncertainty and questionable economic policies from the U.S. administration are eroding investor confidence globally, prompting a search for more reliable investment opportunities outside the U.S.

Currently, the performance of European stock markets is outpacing that of the U.S. markets.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.706 CHF

2.94 B CHF

32.13 B CHF

1.05 B

About SAP SE O.N.

Sector

Industry

CEO

Christian Klein

Website

Headquarters

Walldorf

Founded

2014

ISIN

DE0007164600

FIGI

BBG006M6YJP2

SAP SE engages in the provision of enterprise application software and software-related services. It operates through the following segments: Applications, Technology, and Support; Qualtrics; and Services. The Applications, Technology, and Services segment includes sale of software licenses, support offerings, and cloud subscriptions. The Qualtrics segment sells experience management cloud solutions. The Services segment offers professional services, premium support services, implementation services for software products, and education services on the use of products. The company was founded by Hasso Plattner, Klaus Tschira, Claus Wellenreuther, Dietmar Hopp, and Hans-Werner Hector on April 1, 1972 and is headquartered in Walldorf, Germany.

Related stocks

Should You Buy SAP After Its Price Drop?

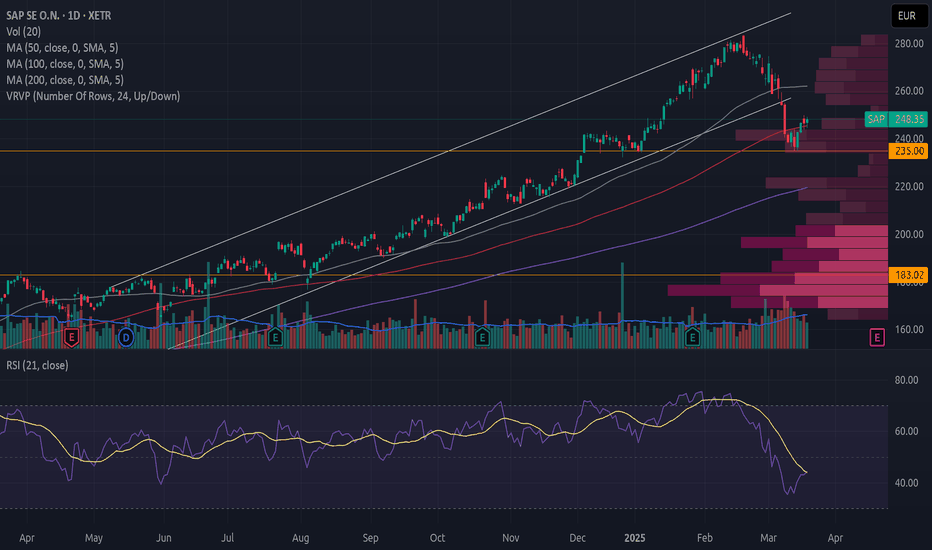

SAP has broken down from an upward trend with high volume.

The price decline has stalled around the resistance level at 235. The volume profile shows a sharp drop in trading activity at this level when prices approach from both below and above, making this a significant resistance zone.

There are

SAP - could this be the top for the main driver of the DAX ?SAP has the highest market cap in the DAX (315 billion €) and has had an impressive run since the 2022 lows. Price shot up from 80 to 280 in one steep channel.

Looking at the chart since the IPO, you can see a five wave structure that might have come to an end at the upper trendline of the channel

SAPSAP - Monthly from the beginning year 94 - Strong uptrend since '22.

A few companies determine the performance of the German DAX. One of these "tanks" is SAP. The chart seems to be on its way to 310.80 EUR per share, a Fibonacci-Extension in green. This level represents the end of Cycle wave III in

SAP’s Cloud & AI MomentumSAP’s Cloud and AI Momentum: Why This Tech Giant Remains a Top Buy in 2024

SAP is a Germany based company specializing in enterprise application software

It operates through three key segments:

1.Applications, Technology & Services: This segment focuses on selling software licenses, subscriptions

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SAPM

SAP SE IS 18/31Yield to maturity

2.90%

Maturity date

Mar 10, 2031

A2G8VU

SAP SE MTN 18/30Yield to maturity

2.67%

Maturity date

Mar 13, 2030

XS217671566

SAP SE IS 20/29Yield to maturity

2.61%

Maturity date

May 18, 2029

A2G8VT

SAP SE MTN 18/26Yield to maturity

2.30%

Maturity date

Mar 13, 2026

A2TSTF

SAP SE IS 18/28Yield to maturity

2.29%

Maturity date

Mar 10, 2028

XS217671558

SAP SE IS 20/26Yield to maturity

2.21%

Maturity date

May 18, 2026

SAPF

SAP SE MTN 14/27Yield to maturity

2.08%

Maturity date

Feb 22, 2027

See all SAP bonds

Curated watchlists where SAP is featured.

Big software stocks: Red pill gains

9 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of SAP is 237.384 CHF — it has decreased by −0.50% in the past 24 hours. Watch SAP SE stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange SAP SE stocks are traded under the ticker SAP.

SAP stock has risen by 1.38% compared to the previous week, the month change is a −4.31% fall, over the last year SAP SE has showed a 33.23% increase.

We've gathered analysts' opinions on SAP SE future price: according to them, SAP price has a max estimate of 329.11 CHF and a min estimate of 148.57 CHF. Watch SAP chart and read a more detailed SAP SE stock forecast: see what analysts think of SAP SE and suggest that you do with its stocks.

SAP stock is 0.73% volatile and has beta coefficient of 1.05. Track SAP SE stock price on the chart and check out the list of the most volatile stocks — is SAP SE there?

Today SAP SE has the market capitalization of 281.78 B, it has decreased by −2.86% over the last week.

Yes, you can track SAP SE financials in yearly and quarterly reports right on TradingView.

SAP SE is going to release the next earnings report on Jul 22, 2025. Keep track of upcoming events with our Earnings Calendar.

SAP earnings for the last quarter are 1.38 CHF per share, whereas the estimation was 1.26 CHF resulting in a 9.30% surprise. The estimated earnings for the next quarter are 1.36 CHF per share. See more details about SAP SE earnings.

SAP SE revenue for the last quarter amounts to 8.63 B CHF, despite the estimated figure of 8.68 B CHF. In the next quarter, revenue is expected to reach 8.52 B CHF.

SAP net income for the last quarter is 1.70 B CHF, while the quarter before that showed 1.51 B CHF of net income which accounts for 13.25% change. Track more SAP SE financial stats to get the full picture.

Yes, SAP dividends are paid annually. The last dividend per share was 2.22 CHF. As of today, Dividend Yield (TTM)% is 0.91%. Tracking SAP SE dividends might help you take more informed decisions.

SAP SE dividend yield was 0.99% in 2024, and payout ratio reached 87.71%. The year before the numbers were 1.58% and 99.63% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jun 29, 2025, the company has 109.12 K employees. See our rating of the largest employees — is SAP SE on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SAP SE EBITDA is 10.05 B CHF, and current EBITDA margin is 27.88%. See more stats in SAP SE financial statements.

Like other stocks, SAP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SAP SE stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SAP SE technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SAP SE stock shows the buy signal. See more of SAP SE technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.