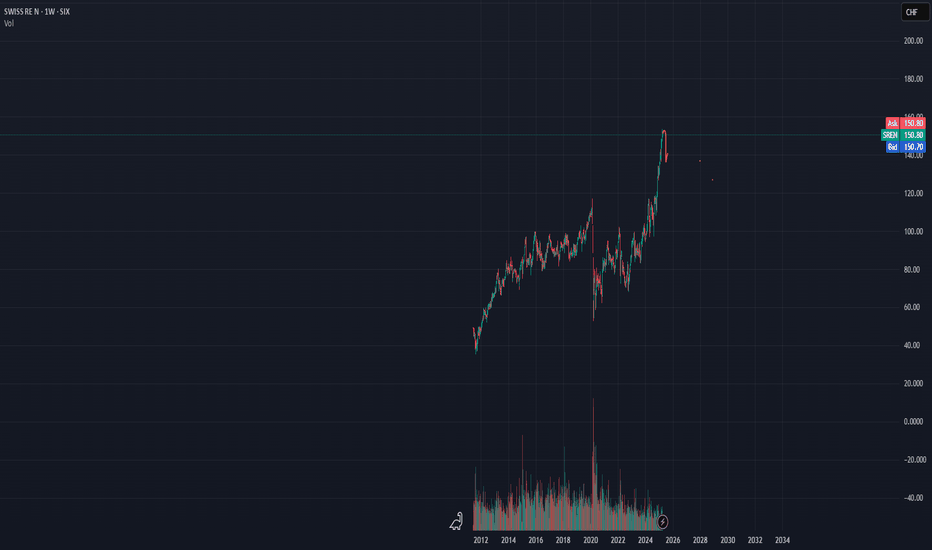

Swiss RE Crash ahead?+low volume

+MACD overbought

+RSI overbought

+increase in dividends

+Divested insurance company stake

+Thailand & Myanmar earthquake uncertainty

+Trump tariff unceartainty

+Most shares are in the hands of baby boomers, who are on the brink of retirement

+I really don't see how the next generation will buy into this stock, as most millenials, GenZ etc.

have no freaking idea what this company is doing

+ITS TIME TO PANIC

SR9 trade ideas

Swiss Re (SREN.vx) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company Swiss Re (SREN.vx). Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is one of the world's largest reinsurers, as measured by net premiums written. Swiss Re operates through offices in more than 25 countries and was ranked 118th in Forbes Global 2000 leading companies list in 2016.It was also ranked 313th on the Fortune Global 500 in 2015. The Channel Down broke through the resistance line on 24/11/2022. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 60 days towards 85.64 CHF. Your stop-loss order, according to experts, should be placed at 68.16 CHF if you decide to enter this position.

Swiss Re's stock is up by 2.9% over the past three months. Given that the markets usually pay for the long-term financial health of a company, we wonder if the current momentum in the share price will keep up, given that the company's financials don't look very promising.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Swiss Re AG bullish scenario:We have technical figure Triangle in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Re AG is a reinsurance company based in Zurich, Switzerland. It is the world's largest reinsurer, as measured by net premiums written. The Triangle has broken through the resistance line on 17/06/2021, if the price holds above this level we can have possible bullish price movement with a forecast for the next 15 days towards 89.50 CHF. Our stop loss order should be placed at 83.10 CHF if we decide to enter this position.

SREN.vx bullish scenario:SREN.vx bullish scenario:

We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Founded in 1863, Swiss Re operates through offices in more than 25 countries. Swiss Re was ranked 118th in Forbes 2000 Global leading companies 2016. It was also ranked 313th in Fortune Global 500 in 2015. The Channel Down has broken through the resistance line at 03/11/2020, if the price holds above this level we can have possible bullish price movement with forecast for the next 13 days towards 73.10 CHF. Our stop loss order should be placed at 62.22 CHF if we decide to enter this position.

FUNDAMENTALS

- Swiss Re and carmaker Daimler announced a joint automotive and mobility insurance venture on Monday, seeking to tap into a wealth of new data generated by highly automated vehicles to help insurers to calculate risk.

SREN.vx bullish scenario:We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Founded in 1863, Swiss Re operates through offices in more than 25 countries. Swiss Re was ranked 118th in Forbes 2000 Global leading companies 2016. It was also ranked 313th in Fortune Global 500 in 2015. The Channel Down has broken through the resistance line at 03/11/2020, if the price holds above this level we can have possible bullish price movement with forecast for the next 13 days towards 73.10 CHF. Our stop loss order should be placed at 62.22 CHF if we decide to enter this position.

Fundamentals:

- Swiss Re and carmaker Daimler announced a joint automotive and mobility insurance venture on Monday, seeking to tap into a wealth of new data generated by highly automated vehicles to help insurers to calculate risk.