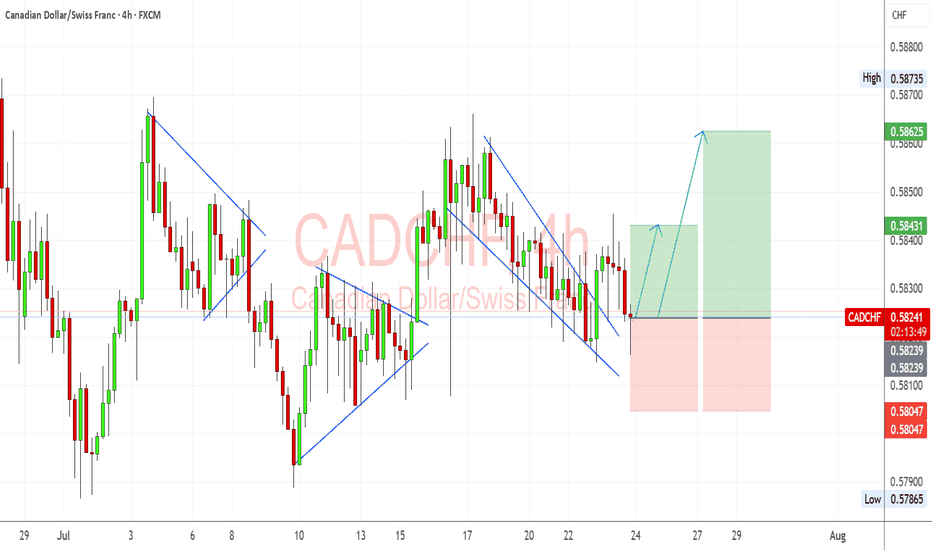

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

CADCHF trade ideas

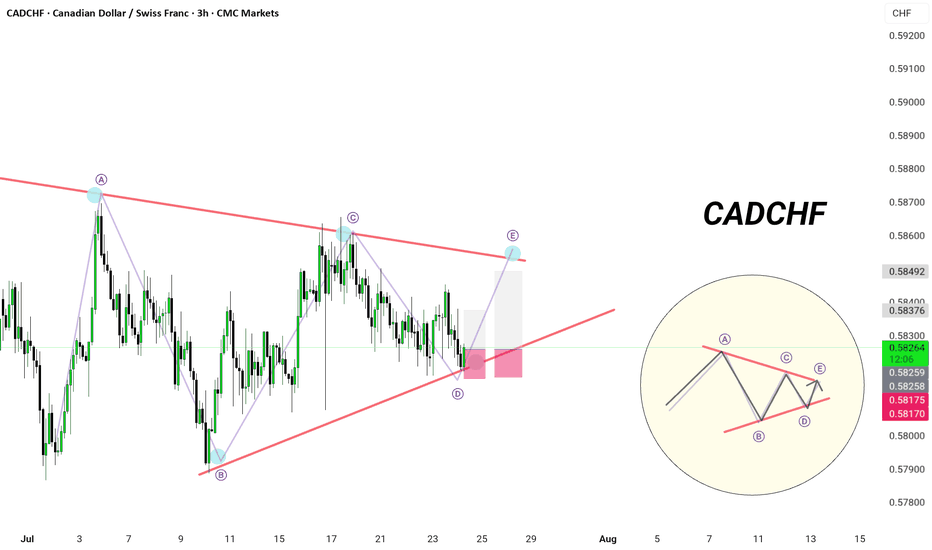

CADCHF | 3H Chart |

🎯 Triangle Tightens — Precision Required

In true Monaco fashion — elegance meets precision.

🟪 Pattern: Contracting Triangle (ABCDE)

⚙️ Price perfectly respecting dynamic structure

📍Currently printing leg D → E with bullish momentum from the base trendline

🎯 Anticipated move towards 0.5849 resistance zone

🧠 Playbook Setup:

📈 Long from 0.5817–0.5820

🎯 Target: 0.5837–0.5849

🛑 Invalidation: Close below 0.5817

🚧 Wave E = decision point

Breakout or reversal? Play the retest like a gentleman.

📊 Bias: Short-term bullish to complete the structure — then react, not predict.

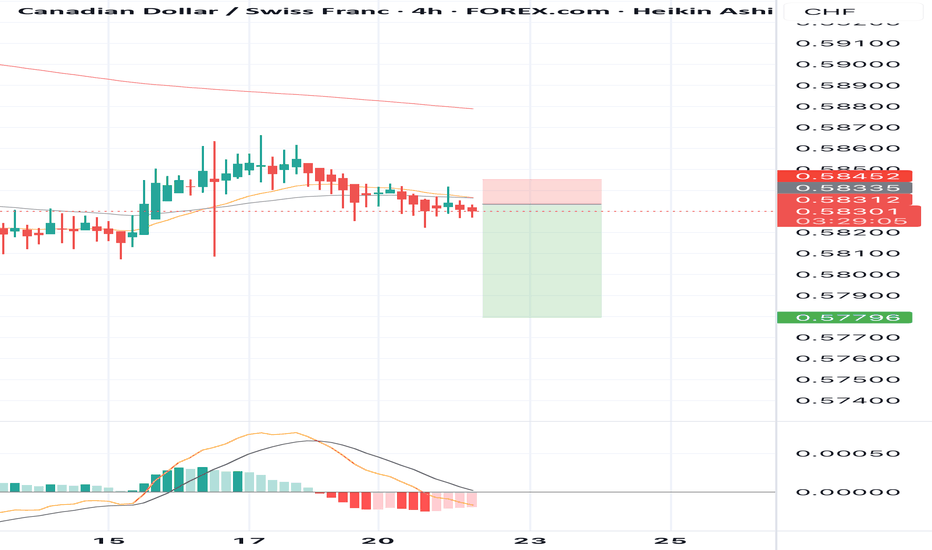

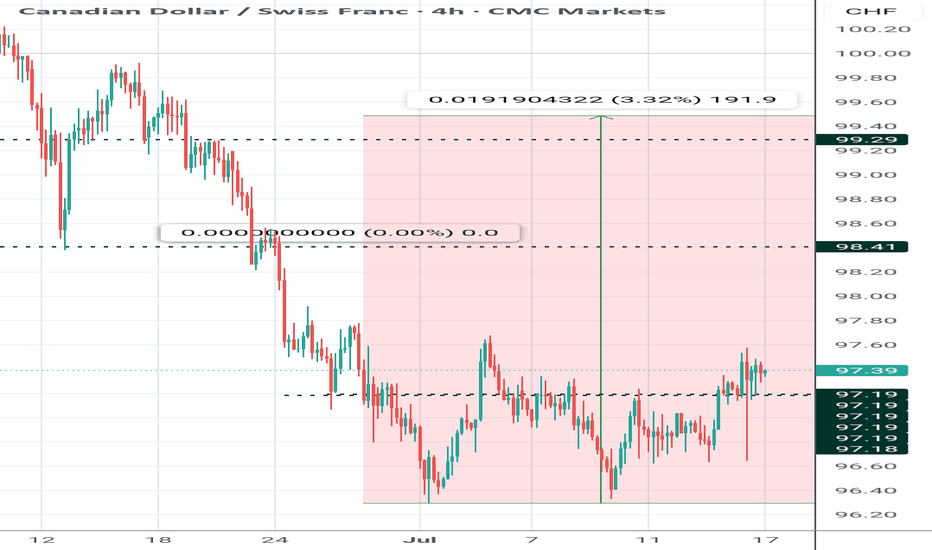

SELL CADCHF now for 4h time frame bearish trend continuationSELL CADCHF now for 4h time frame bearish trend continuation

SELL CADCHF now for a four hour time frame bearish trend continuation..........

STOP LOSS: 0.5845

This sell trade setup is based on hidden bearish divergence trend continuation trading pattern...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything.

Remember to risk only what you are comfortable with….....trading with the trend, patient and good risk management is the key to success here

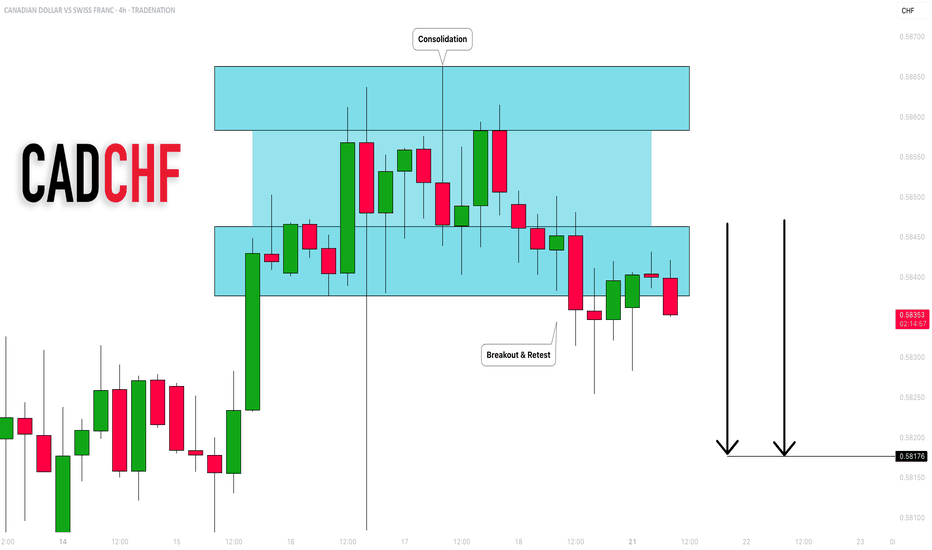

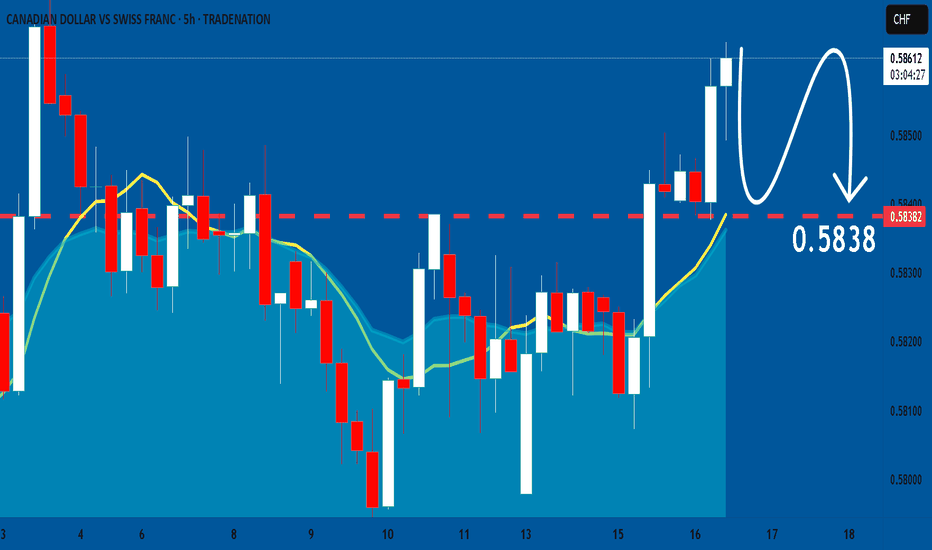

CADCHF: Bearish Outlook Explained 🇨🇦🇨🇭

CADCHF completed an intraday consolidation within a horizontal

parallel channel.

Its support was broken on Friday and we see a positive bearish

reaction to that after its retest.

With a high probability, the price will drop to 0.582 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

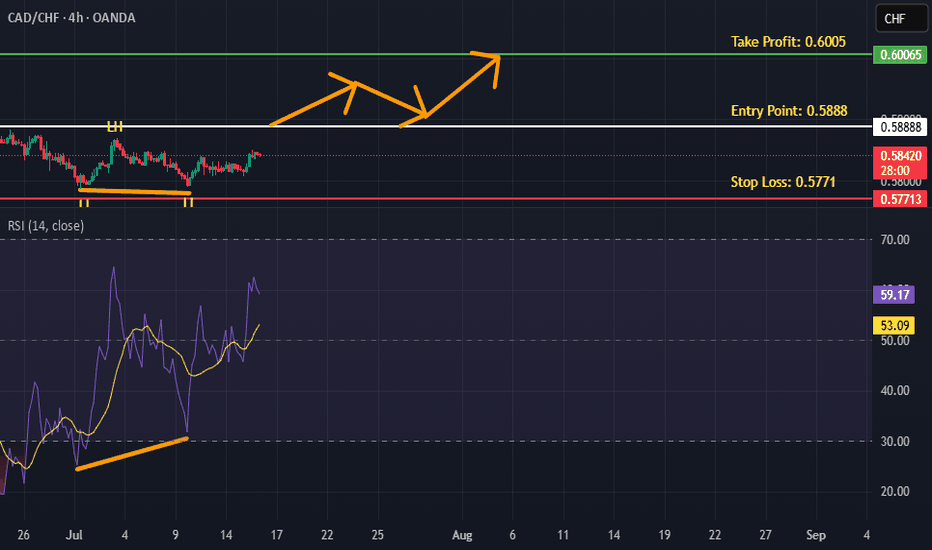

CAD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Previous week’s green candle means that for us the CAD/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 0.578.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CADCHF Buying Opportunity after Strong Support CADCHF is currently respecting a strong support zone, indicating a potential bullish reversal pattern in development. The structure suggests that most of the downward pressure may be exhausted, and buyers could begin to take control.

Price action shows signs of completing a doubt/uncertainty pattern, reinforcing the base formed at support. A strong resistance level lies near 0.59002. If the 4H candle closes above this level, it may confirm a breakout and open the door for further bullish momentum.

You May find more details in the chart.

Trade wisely best of Luck Buddies.

PS: Support with like and comments for better analysis.

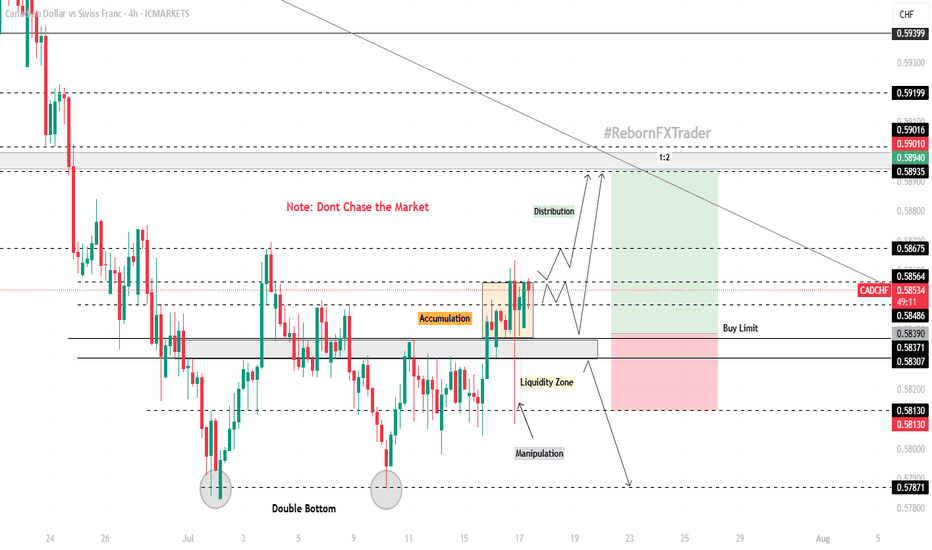

CAD/CHF 4H Technical and Fundamental AnalysisCAD/CHF 4H Technical and Fundamental Analysis

CAD/CHF has shown bullish potential this week, supported by strengthening fundamentals and a technical breakout. From a macro perspective, the Canadian dollar (CAD) continues to benefit from rising crude oil prices, a key Canadian export. With WTI crude trading above $80 per barrel, the commodity-backed CAD gains further momentum. Meanwhile, the Swiss franc (CHF)—often viewed as a safe haven—is seeing mild outflows as risk appetite improves globally and capital shifts toward higher-yielding assets.

From a central bank standpoint, the Bank of Canada (BoC) has struck a cautiously optimistic tone regarding inflation, while the Swiss National Bank (SNB) has already begun cutting interest rates—creating a divergent policy path that favors CAD strength against CHF.

On the technical side, CAD/CHF recently found strong support in the 0.57800–0.58100 zone, where price formed a potential double bottom pattern just below key resistance—a signal often associated with bullish reversal. A minor key level at 0.58300 was broken, followed by a clear accumulation phase. After consolidation, price grabbed liquidity with a long wick but closed above the key level, forming a bullish engulfing candle, suggesting strong buying pressure.

We now await a retracement into our zone of interest to position long entries with favorable risk-reward.

📍 Buy Setup:

Entry: Buy Limit at 0.58390

Stop Loss: 0.58130 (below liquidity grab)

Take Profit: 0.58940 (next key resistance)

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

CADCHF Squeeze Between OB and Trendline – Big Move Coming?CADCHF is compressing within a descending triangle structure, showing signs of bullish intent as it continues to reject a key demand + 1H order block area.

🔹 Trade Idea:

I’m watching for a bullish breakout above 0.58380, which will also confirm a trendline breakout from the descending triangle. Until then, I remain on the sidelines.

🔹 Key Technical Factors:

- Price consolidating inside a descending triangle, squeezing between lower highs and a consistent demand zone

- Repeated rejections from the green demand zone suggest buyers are defending the level strongly

- A clean order block (1H) is aligned with the bottom of this structure, adding confluence for a bullish move

- Above 0.58380 breakout may trigger momentum toward 0.58630, near the supply zone

🔹 Trade Plan:

+ Buy above: 0.58380 (on breakout + close above trendline)

+ First Target: 0.58630 (next resistance/supply area)

* Invalid if: price breaks and holds below the demand zone

⚠️ Note: Entry is only valid on confirmed breakout. Until then, patience and watchfulness around structure edges are key.

CADCHF: Bearish Continuation

Looking at the chart of CADCHF right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

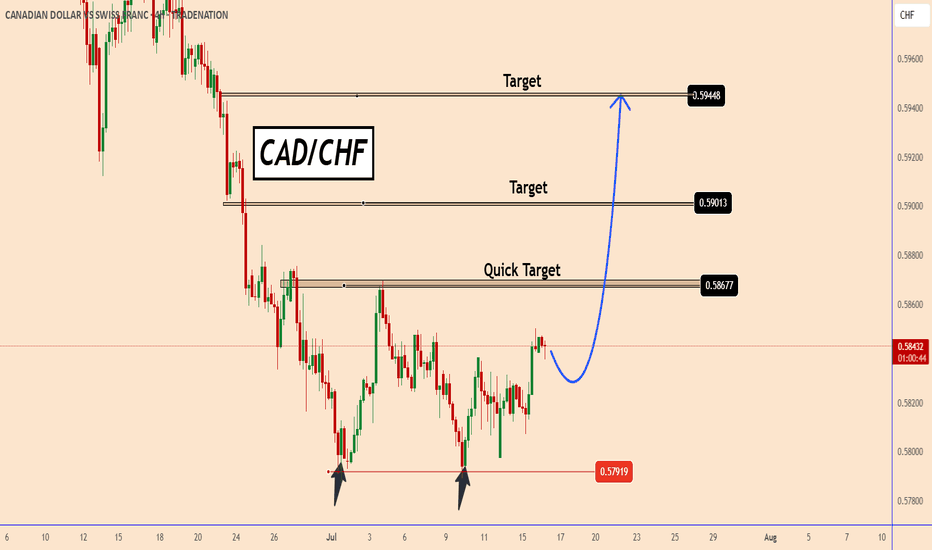

CADCHF found strong support zone near 0.5790CADCHF found a strong support zone near 0.5790

The chances are that the price already completed a doubt bottom pattern. It is not confirmed yet but the support zone is already too strong.

The price may face a strong resistance near the first target 0.5870 that is also the strongest target. Once the price moves above that zone it should rise further to the other targets near 0.5900 and 0.5945

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF Sellers In Panic! BUY!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.5811 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.5831

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CRT on Weekly timeframe / Bullish 🎯 Trade Idea:

If you're already in: Good entry, but keep a tight stop below 0.5770.

If you're not in yet: Wait for a bullish confirmation candle (engulfing, hammer, etc.) on the daily or weekly before entering.

TP Zones:

TP1: 0.5900 (minor resistance)

TP2: 0.6040 (key structure zone)

CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.580

Target Level: 0.603

Stop Loss: 0.565

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/CHF: Break, Retest and Go?The market is in a strong downtrend, moving inside a visible steep channel. Price recently pulled back into a previous support-turned-resistance zone. This move appears corrective in nature, with sellers likely waiting for signs of exhaustion before re-entering in the direction of the existing trend.

Now price is reacting to the resistance zone and rejecting further upside, suggesting potential continuation lower. Ideally if price retests without closing significantly above it and forms bearish price action confirmation, it would provide a high-probability short setup: pin bars or bearish engulfing candlesticks right at retest level would help confirm the signal.

From there, continuation toward the middle of the channel becomes likely. The target projection sits near the 0.57300 level. If price fails to break lower and instead closes above the resistance zone, the setup becomes invalid and would indicate potential reversal.

In short, sellers are watching for a break and retest, aiming to ride the move down to target of near 0.57300. The downtrend would be maintained as long as price respects the current resistance and shows more signs of bearish strength.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_CHF STRONG SUPPORT|LONG|

✅CAD_CHF has been falling recently

And the pair seems locally oversold

So as the pair is approaching a

Horizontal support of 0.5790

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF BUY BIASConfluence 1 - “Daily Low Sweep”

• A liquidity sweep of a previous daily low occurred.

• This move typically indicates stop hunts and smart money accumulation, potentially setting up for a bullish reversal.

Confluence 2. Demand Zone (Grey Box)

• Area where price reacted after the sweep.

• Range: approximately 0.58100 – 0.58200

• Price currently respecting this zone, indicating potential bullish order block behavior.

🧠 Projected Price Path

The sketched movement indicates a plan for:

1. Break above current resistance

2. Pullback into breakout area (possibly retesting the demand)

3. Bullish continuation to 0.58470 and ultimately to 0.58800

CAD/CHF Downtrend Dominates Amid Mixed Economic SignalsTechnical Analysis

The CAD/CHF pair remains firmly in a downtrend on the 1-hour chart, with price consistently making lower highs and lower lows, underscoring sustained selling pressure. The price is trading below both the 20-period and 50-period weighted moving averages, which have turned downward, signaling bearish momentum.

Price action recently tested the critical last market bottom near 0.5826, slightly dipping below before a minor rebound. This area acts as immediate support but a decisive break lower could open the way toward deeper retracements at the 127.2% (0.5821), 141.4% (0.5818), and 161.8% (0.5814) Fibonacci extensions, serving as potential targets for bears.

Overall, the technical picture favors continued bearish pressure toward the next Fibonacci support levels. However, a recovery above the 61.8% Fibonacci retracement at 0.5833 and the short-term resistance near the 20-period WMA (around 0.5837) could trigger a corrective rebound toward 0.5845.

Fundamental Outlook

Key upcoming Canadian data, including the Ivey PMI readings on July 8 and the employment report scheduled for July 11, will be pivotal in shaping CAD sentiment. The Ivey PMI is expected to reflect ongoing softness in business activity, while employment figures will be closely monitored for signs of labor market resilience or deterioration.

Swiss economic data will be more limited but important releases such as the SECO Consumer Climate index on July 11 may provide additional insight into domestic demand and sentiment, impacting CHF positioning.