EURCAD What Next? BUY!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.5784 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.5907

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADEUR trade ideas

EURCAD Buyers In Panic! SELL!

My dear subscribers,

This is my opinion on the EURCAD next move:

The instrument tests an important psychological level 1.5952

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5888

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

We are going long on the EUR/CAD with the target of 1.607 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURCAD 1H longEURCAD 1 H made a beatiful sharp drop, now stalling arround some good support levels.

When such a drop happens with no pullback formed yet I'm happy to buy the way down.

Because the pullback has to come soon buyers step in at the support levels.

My plan is simple I open a manual grid at the support levels I draw and aim for a 2R profit

Current grid 3 levels

1 market order

2 buy limits

Tp 2R

extra confirmation RSI is oversold

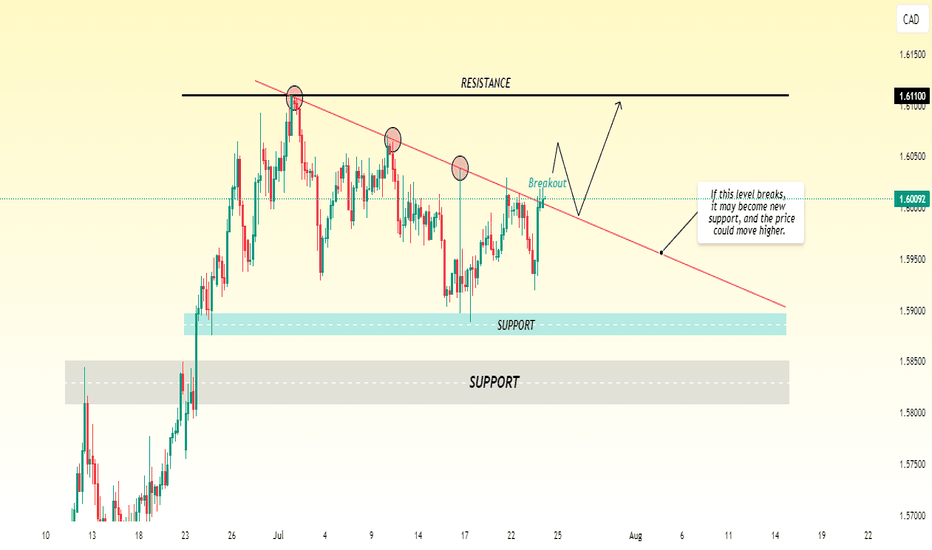

EUR/CAD Tests Resistance — Bullish Breakout in Sight?EUR/CAD appears to be showing bullish momentum and is likely heading toward the 1.6110 level. Currently, the pair is testing a key resistance zone. If the price manages to break above this resistance with strong volume or confirmation, we could see further upside continuation toward the next target at 1.6110. Traders should watch for a clear breakout and possible retest of the broken level turning into support, which could provide a good entry point for long positions.

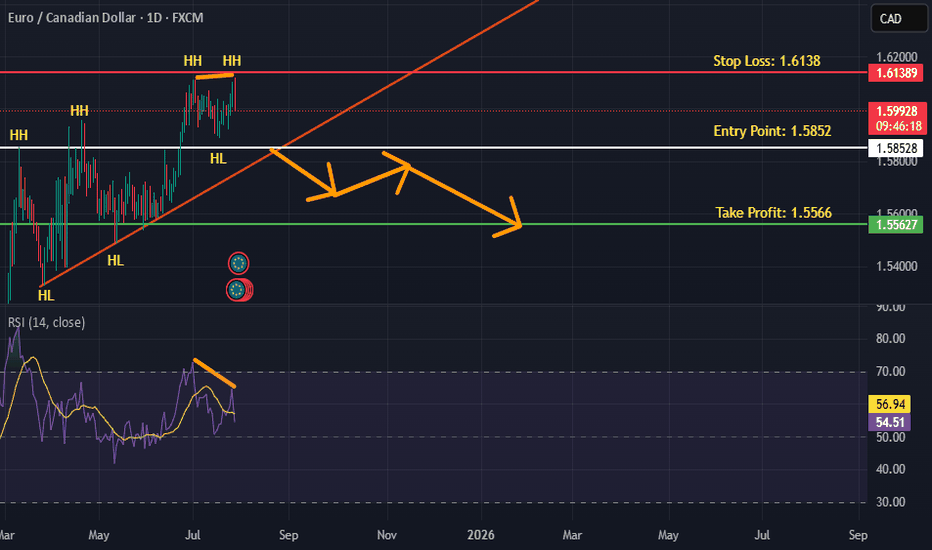

EUR/CAD: Shorting the Climactic Rally Near 1.6000The strong rally in EUR/CAD has pushed the pair into extreme territory, approaching a major psychological and structural resistance zone. While momentum has been strong, this looks like a potential climactic or "blow-off" top, offering a highly favorable risk/reward opportunity to short the pair in alignment with the weak underlying Euro fundamentals.

The Fundamental Why 📰

The core thesis remains bearish for the Euro. The European Central Bank (ECB) maintains a distinctly dovish tone, signaling a willingness to ease policy further to support a slowing Eurozone economy. This fundamental headwind suggests that extreme rallies in Euro pairs are often exhaustive and present prime shorting opportunities.

The Technical Picture 📊

Major Supply Zone: The price is entering a critical multi-month supply zone between 1.5950 and the key psychological level of 1.6000. This is a major ceiling where significant selling pressure is anticipated.

Fibonacci Extension: This area aligns with a key Fibonacci extension level (1.272) from the last major impulse wave, a common zone where trending moves become exhausted and reversals begin.

Pronounced RSI Divergence: A clear bearish divergence is forming on the daily chart. As price makes this final push to a new high, the Relative Strength Index (RSI) is making a significantly lower high, signaling a deep exhaustion of buying momentum.

The Counter-Trade Rationale 🧠

This is a high-level fade. We are positioning for a reversal at a major, technically significant ceiling. The extreme price extension, combined with clear momentum divergence, indicates that the risk of buying at these highs is substantial. By shorting here, we are betting that the powerful technical resistance and weak fundamentals will trigger a significant correction.

The Setup ✅

📉 Pair: EUR/CAD

👉 Direction: Short

⛔️ Stop Loss: 1.63230

🎯 Entry: 1.59490

✅ Take Profit: 1.52008

⚖️ Risk/Reward: ≈ 2:1

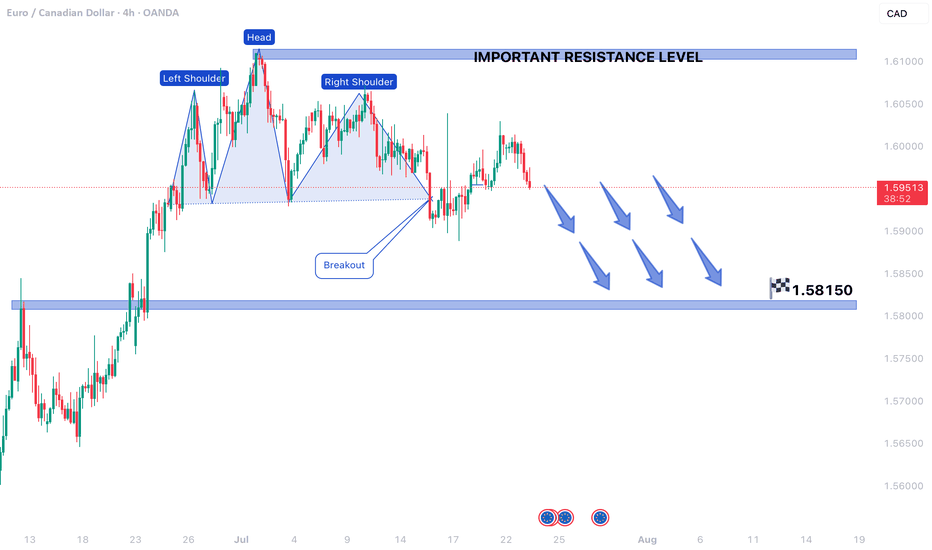

EURCAD is BearishPrice was in a strong uptrend, however now it seems that bulls are exhausted, the notion is further validated by a double top reversal pattern with bearish divergence. If previous higher low is broken with good volume, then we can expect a bearish reversal as per Dow theory. Targets are mentioned on the chart.

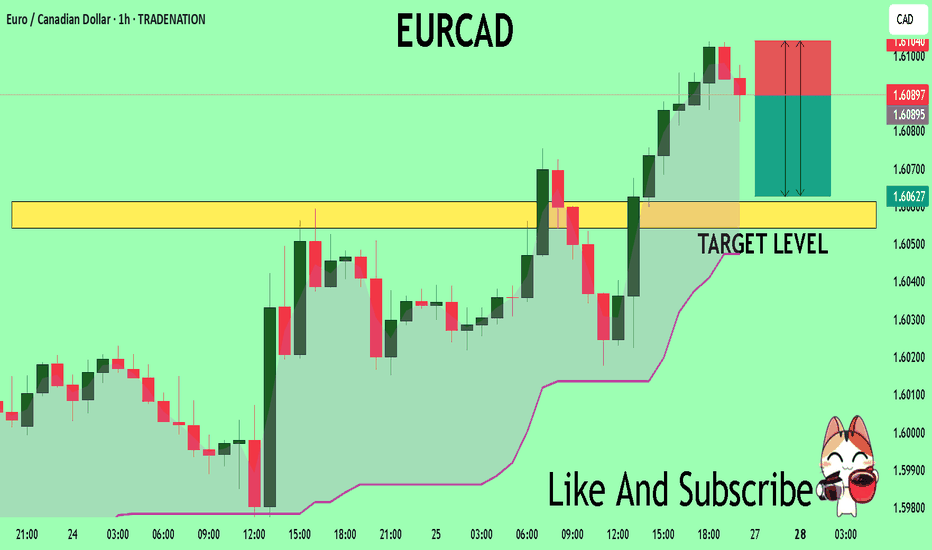

EURCAD The Target Is DOWN! SELL!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.6089 pivot level.

Bias - Bearish

My Stop Loss - 1.6104

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.6061

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

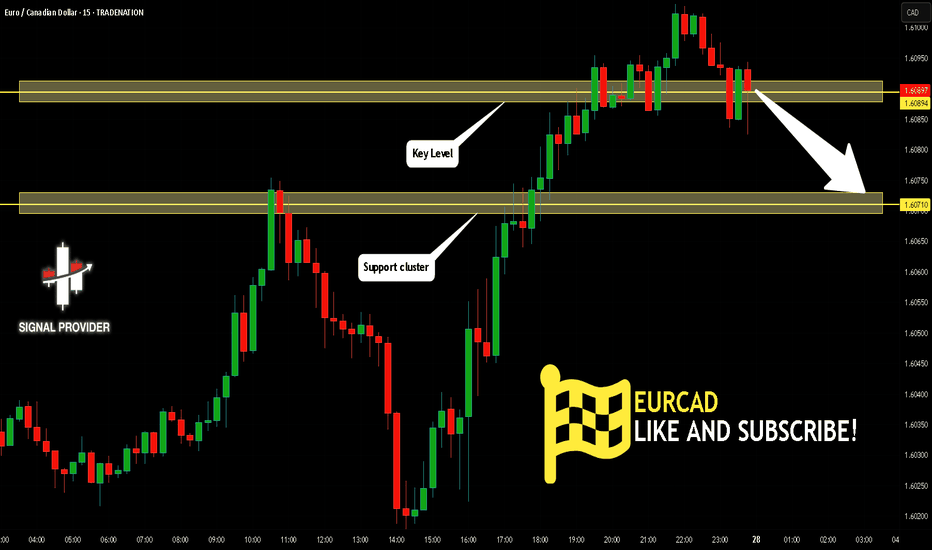

EURCAD Will Go Down! Short!

Please, check our technical outlook for EURCAD.

Time Frame: 15m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.608.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.607 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

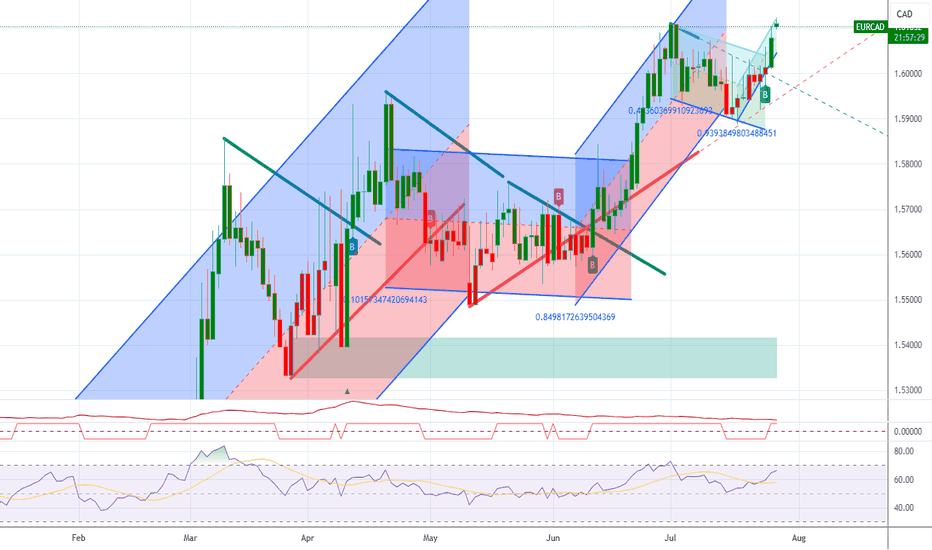

eurcadPrice consolidating after a strong bullish move

Support at 1.5965, resistances at 1.6020 / 1.6054 / 1.6098

📈 If price breaks above 1.6020:

Target 1 → 1.6054

Target 2 → 1.6098

📉 If price breaks below 1.5965:

Target 1 → 1.5940

Target 2 → 1.5900

📌 No entries inside the range — waiting for a clear breakout with confirmation

Strong move likely after this consolidation.

EURCAD | Eyes on the 50EMA — One Bold Candle and I’m All In💌 Still in Love with the Trend — Just Waiting for My Candle to Say “Yes”

1-hour chart has already whispered sweet nothings — a clean buy range has formed, and we’ve just dipped into a lovely little retracement. But guess what?

All my signals say the pullback is over — and it’s almost time to get back on this romantic ride! 😍

💘 WHAT TO DO NOW

✨Entry : I’m waiting for one bold Marubozu candle to confidently close above my 50EMA — no hesitation. Once that happens, I’m jumping in like it’s the last dance of the night. 💃🕺

🛡️Stop Loss:

If the candle is strong and healthy — like a partner I can trust — I’ll place my SL just below it.

If not, I’ll let it go… there’s always another setup waiting with love. ❤️

TP: 1.5985

❓WHAT IF PRICE REFUSES TO COMMIT?

No worries — this is a day trading love story.

While I keep an eye on the 15m chart flirting with the 50EMA, I’ll also glance at the 1-hour to make sure the romantic spark (a.k.a. bullish range) is still alive.

As long as the 1H trend is holding strong, this setup is still valid. 💍

Wish me luck… and may the markets fall in love with me today! 📈💕