CADJPY BUY AnalysisBuy Analysis Overview:

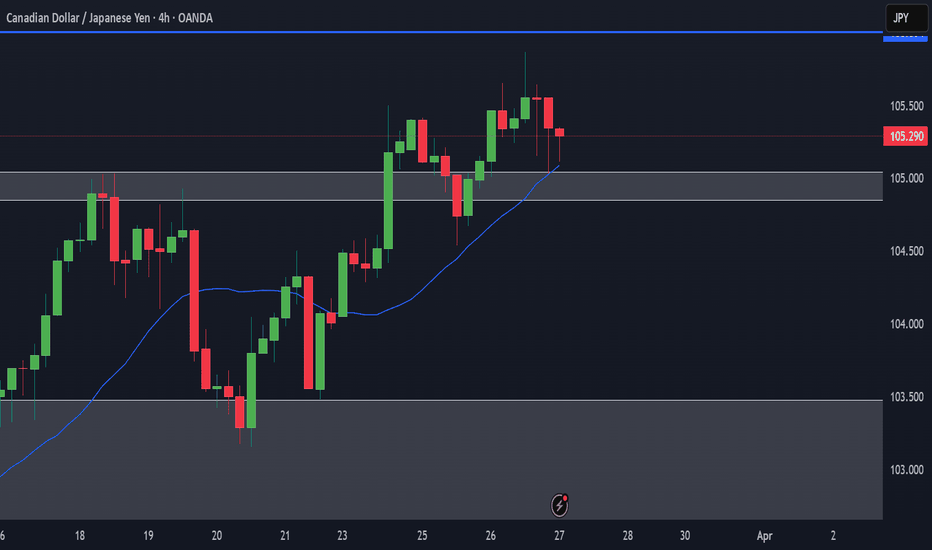

1. Clear Bullish Market Structure

• The chart shows a series of higher highs and higher lows, confirming bullish momentum.

• Price has broken previous resistance levels and is now using them as support (e.g., zones around 105.000 – 105.260).

2. Retest of Previous Breakout Zone

• Price recently broke above a significant resistance (now turned support) around 105.200 – 105.300.

• It’s currently retesting that area — a bullish continuation pattern if it holds.

• The current consolidation just above the support zone is a healthy sign of buyers defending the level.

3. Support from Moving Averages

• Price is sitting above both the 50 EMA (blue) and 100 EMA (black), which are also sloping upward.

• These EMAs are acting as dynamic support, further strengthening the bullish outlook.

4. Entry from Demand Zone

• The small demand zone (light blue box) around 105.200 has been tapped multiple times without being broken — showing strong buying interest.

• Ideal spot for buy entries with minimal drawdown.

5. Clear Upside Target

• If the support holds, the next bullish target is around 106.500 – 107.250.

• The top green zone (~107.259) marks a logical take profit, based on historical supply and prior swing highs.

⸻

Entry & Risk Plan:

• Entry Idea: Long around 105.200–105.300 zone (on confirmation of bullish candle or engulfing pattern)

• Stop Loss: Below 104.950 (beneath the demand zone to avoid fakeouts)

• Take Profit Zones:

• TP1: 106.500

• TP2: 107.250

CADJPY trade ideas

CASRJPY 1H Analysis buy setup Entry: Around 105.050 - 105.300 (based on the marked zone for potential breakout)

Target (TP)

First TP: 106.000 (near resistance zone)

Second TP: 106.350 (upper trendline resistance)

Stop Loss (SL) 104.500

SL: Below the trendline, around 105.000 for safer risk management.

Support & Resistance Levels

Support Levels:

105.050 (Key support)

104.500 (Major support)

Resistance Levels:

105.800 (Intermediate resistance)

106.350 (Upper trendline resistance)

Trade Idea

Wait for a bullish confirmation candle above 105.300 to confirm entry. If price retests the trendline and shows bullish momentum, that could provide a better entry with tighter risk.

CADJPY Will Fall! Short!

Take a look at our analysis for CADJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 105.385.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 101.727 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CAD/JPY H4 | Overlap support at 50% Fibonacci retracementCAD/JPY is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 104.63 which is an overlap support that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 104.05 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 106.13 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Shorting opportunity on CADJPY possible!Hello Traders,

We’re keeping a close watch on CAD/JPY for a potential selling opportunity. The pair has been in a strong downtrend for months, and the bearish pressure remains intact. At the moment, price has retested its falling trendline resistance, making this a key level to monitor.

I'll be looking for short entries from this zone, with targets set at 103.630 and an extended target at 101.470.

If you find this analysis helpful, a boost would be greatly appreciated. Thank you!

CADJPY uptrend detected ! 106.000 TargetThe current price is positioned at a crucial key level, serving as a significant point of interest for market participants. Given this strategic positioning, we anticipate an upward movement in the short term, driven by potential buying momentum and market optimism. If this level holds as a strong support, it could act as a catalyst for bullish sentiment, encouraging further price appreciation. However, it remains essential to monitor market conditions and external factors that may influence price dynamics, ensuring a well-informed approach to trading decisions.

Accurate Entries using the H4, I am BUYING CADJPYAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Bullish momentum to extend?CAD/JPY is falling towards the pivot which has been identified as an overlap support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 104.86

1st Support: 104.28

1st Resistance: 106.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CADJPY What Next? SELL!

My dear friends,

Please, find my technical outlook for CADJPY below:

The instrument tests an important psychological level 105.42

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 104.26

Recommended Stop Loss - 106.00

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADJPY shortLooking at a level on CADJPY. Possible short around a 4hr 61.8% retracement and downtrend line with RSI divergence.

For the longer term position I'd like to see the recent low and counter trendline broken to confirm the reversal of the counter trend, also accompanied by volume profiles printing lower POC's.

Current daily profiles aren't providing too much in the way of a reversal other than a previous b shape and a double distribution on yesterdays profile. This double distribution could provide us with a shorter term, possibly intra day short target, as seen in the screenshot.

JPY - The BoJ currently have a 71% probability of a rate hike in their May meeting with inflation holding above their target rate although they have stated they will be cautious adjusting their monetary policy amid global trade risks. Their labour market remains fairly strong with low unemployment and a high level of job openings

CAD - The BoC has cut rates at a much faster pace than other central banks, 7 cut from the high of 5% to the current rate of 2.75%. In their recent policy statement however, they have stated they'll take a more cautious approach going forward as their YoY CPI increased from 1.9% to 2.6%, the highest level in 8 months. A weaker reading in upcoming inflation and/or employment metrics would help to tilt the scales more in favour of a dovish BoC.

Potential risks - Continuing rise in oil prices might prop up the CAD and risks around Trumps tariffs could push back on central banks to make an definitive moves in upcoming rate decisions.

CADJPY: Intraday Bearish Reversal?! 🇨🇦🇯🇵

There is a high chance that CADJPY will retraced from the

underlined blue resistance.

I see strong bearish confirmation on an hourly time frame:

a formation of a bearish imbalance and a change of character.

I expect a bearish move to 105.05

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD/JPY: Bullish Structure Holds with Breakout PotentialThe CAD/JPY market continues to show bullish strength, forming a clear sequence of higher highs and higher lows. On the daily timeframe, an inside bar pattern has emerged, indicating a period of consolidation that may lead to a bullish continuation, especially with the candle closing above the 105.000 level.

At the moment, the price is testing Monday’s high, and a breakout above this point could trigger further upside. The market may form a range around the current level before continuing its move higher from the previous week’s high and the upward trendline. The next target is the resistance zone around 106.300

Lingrid | CADJPY anticipating UPWARD Continuation after PullbackThe price perfectly fulfilled my previous idea . It hit the target. FX:CADJPY market is showing bullish dominance, by the formation of higher highs and higher lows. On the daily timeframe, an inside bar pattern has formed, suggesting a potential consolidation followed by a continuation move since it closed above the 105.000 level. Currently, the price is testing the Monday high, and if it breaks above this level, we can anticipate further upward movement. I expect the price to establish a range around this level before advancing to higher levels from the previous week high and upward trendline. My goal is the resistance zone around 106.300

Traders, If you liked this educational post🎓, give it a boost 🚀 and drop a comment 📣

Elliott Wave View: CADJPY Looking to Rally in 7 Swing WXY StructShort Term Elliott Wave view in CADJPY suggests pair ended cycle from 11.20.2024 high in wave (W) at 101.35 as the 1 hour chart below shows. Pair is looking to correct cycle from 11.20.2024 high within wave (X). Internal subdivision of wave (X) is unfolding as a double three Elliott Wave structure. Up from wave (W), wave ((a)) ended at 103.64 and pullback in wave ((b)) ended at 102.02. Wave ((c)) higher ended at 105.029 which completed wave W in higher degree.

Down from there, wave ((a)) ended at 104.16 and wave ((b)) rally ended at 104.92. Wave ((c)) lower ended at 103.13 which completed wave X in higher degree. The pair resumes higher in wave Y with subdivision as a double three structure. Up from wave X, wave ((w)) ended at 105.49. Pullback in wave ((x)) is in progress to correct cycle from 3.20.2025 low before it resumes higher. Near term, as far as pivot at 101.35 low stays intact, expect dips to find buyers in 3, 7, or 11 swing for further upside. Potential target for wave Y higher is 100% – 161.8% Fibonacci extension of wave W. This area comes at 106.75 – 109 area where sellers may appear for further downside.

Bearish drop?CAD.JPY has reacted off the pivot which has been identified as an overlap resistance and could fall to the overlap support.

Pivot: 105.30

1st Support: 103.56

1st Resistance: 106.09

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CAD JPY Trade Setup 1 hour timeframe CAD JPY Trade Setup 1 hour timeframe

Following last week's trade setup CAD JPY is moving in an uptrend making Higher Highs and Higher Lows, so we will keep looking for Buying opportunities.

CAD JPY is forming a bullish break and retest continuation pattern that also align with the 0.618-0.50 Fib Retracement level.

Lets wait for the price to pull back to the retest level then enter base off candlestick confirmation

CAD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

Previous week’s green candle means that for us the CAD/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 104.075.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD_JPY POTENTIAL LONG|

✅CAD_JPY made a bullish

Breakout of the key horizontal

Level of 104.800 and the breakout

Is confirmed which reinforces our

Bullish bias and makes us expect

A further move up after the

Retest of the new support

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.