CADJPY trade ideas

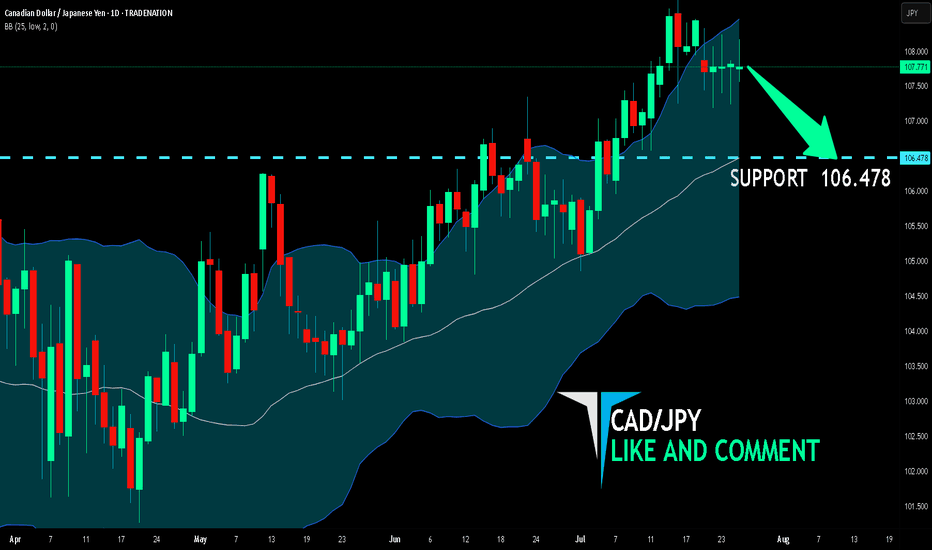

CAD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

CAD-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 106.478 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the CAD/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

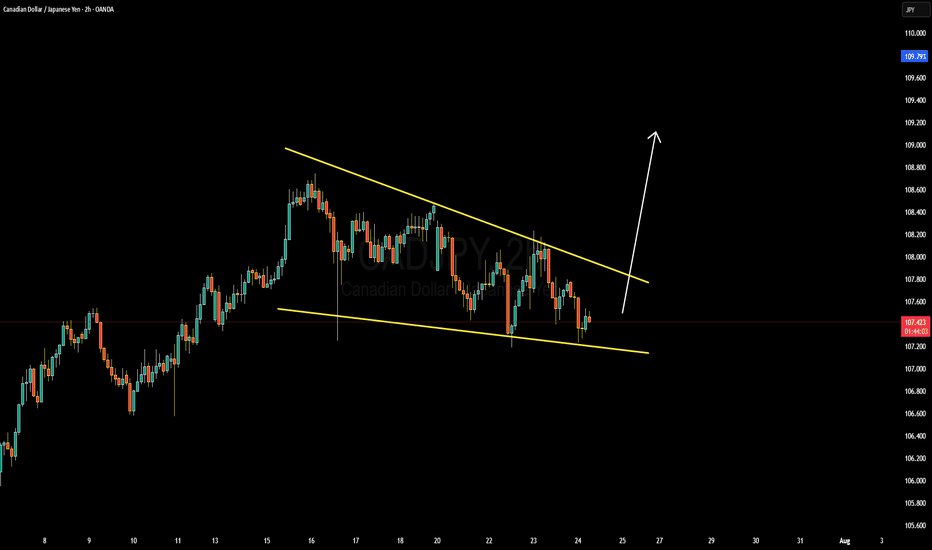

CADJPY Is Bearish! Sell!

Take a look at our analysis for CADJPY.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 107.345.

Considering the today's price action, probabilities will be high to see a movement to 106.396.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CAD/JPY Enters Bearish Trend on 4H Chart – Key Levels to MonitorCAD/JPY Enters Bearish Trend on 4-Hour Chart – Key Levels to Monitor

The CAD/JPY currency pair has recently confirmed a bearish trend shift on the 4-hour timeframe, signaling potential further downside in coming sessions. This technical deterioration follows a decisive breakdown below the previous swing low, accompanied by significantly higher trading volumes – a strong indication of increasing selling pressure. The high-volume breakdown suggests institutional participation in this move, giving added credibility to the emerging downtrend.

Critical Technical Developments:

1. Trend Structure Breakdown - The pair has established a clear sequence of lower highs and lower lows

2. Volume Confirmation - The breakdown occurred with notably elevated trading volumes

3. Momentum Shift - Oscillators like RSI remain below key levels, supporting bearish momentum

Key Price Levels:

Downside Target: 105.00

This psychological support level represents the next major target for bears. Historical price action shows this area has previously acted as:

- A pivot point for multi-week reversals

Upper Resistance: 109.00

This level now serves as critical overhead resistance where:

- Previous support becomes new resistance

- Sellers are likely to re-emerge on any retests

- A close above would invalidate the current bearish structure

Trading Strategy Considerations:

For bearish traders:

- Short positions on pullbacks toward 107.50-108.00 may offer favorable risk/reward

- Position sizing should account for potential volatility spikes

- Initial targets can be scaled at 106.50 followed by 105.00

For potential buyers:

- Caution advised until clear reversal signals emerge

- The 105.00 level may offer a potential bounce opportunity if supported by:

- Bullish candlestick patterns

- Divergence on momentum indicators

- Reduction in selling volume

Risk Management Notes:

Traders should monitor:

- Crude oil price fluctuations (key CAD driver)

- Bank of Japan policy signals

- Canadian employment data (upcoming releases)

The current technical setup favors bearish positions, with the 109.00 level acting as a critical line in the sand for any trend reversal scenarios. As always, strict risk management remains essential given potential volatility in this currency cross.

CADJPY Expected Growth! BUY!

My dear friends,

CADJPY looks like it will make a good move, and here are the details:

The market is trading on 107.35 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 107.90

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

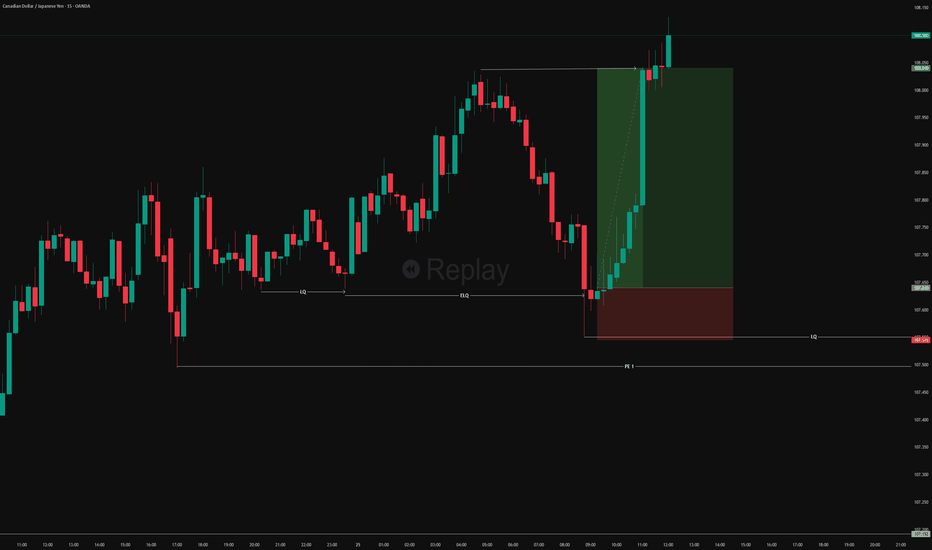

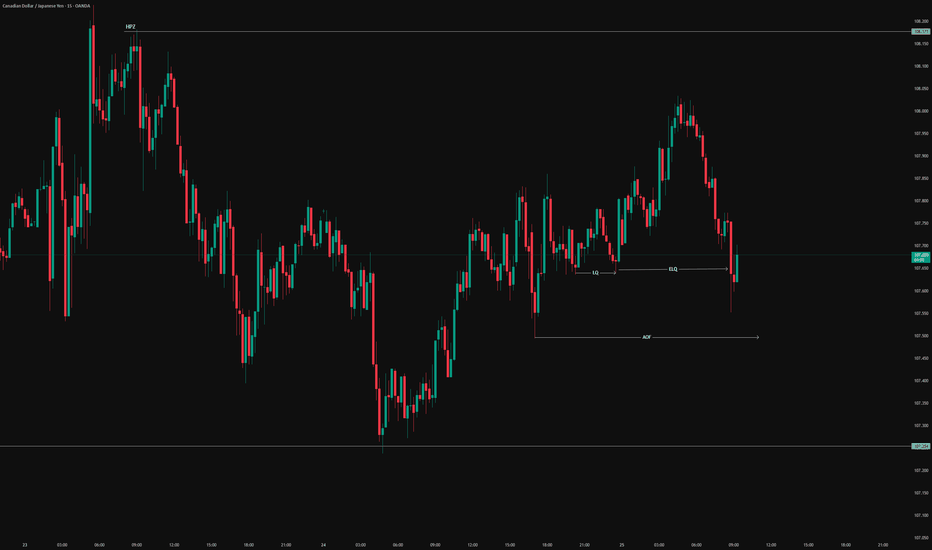

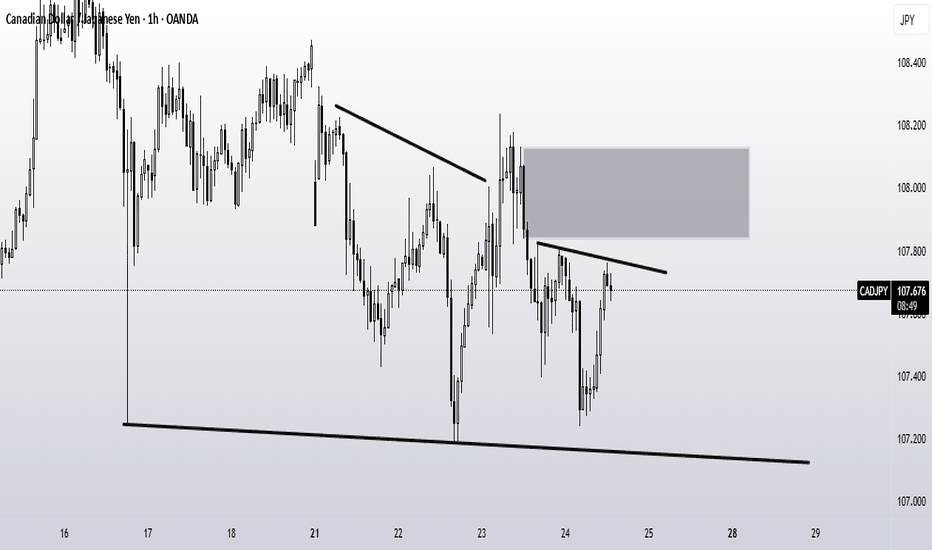

CADJPY Short Day Trade OANDA:CADJPY Short Day Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

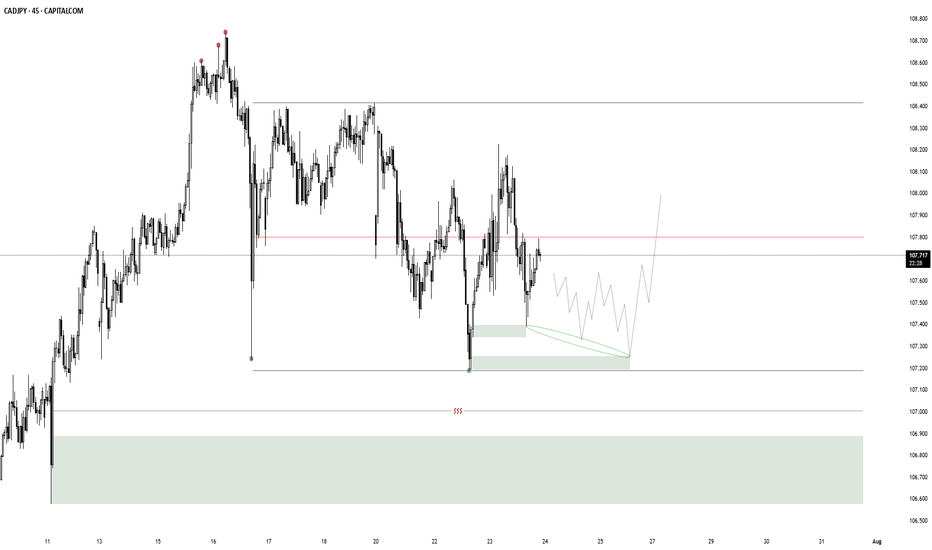

CAD/JPY reaccumulationI am looking for reaccumulation here, since we are in a higher time frame model 1 with an orderflow objective of 111.550. My model 2 POI is the extreme demand. In case there is no confirmation i am watching the liquidity+demand below for a model 1. If none of it confirms i will wait for lower levels.

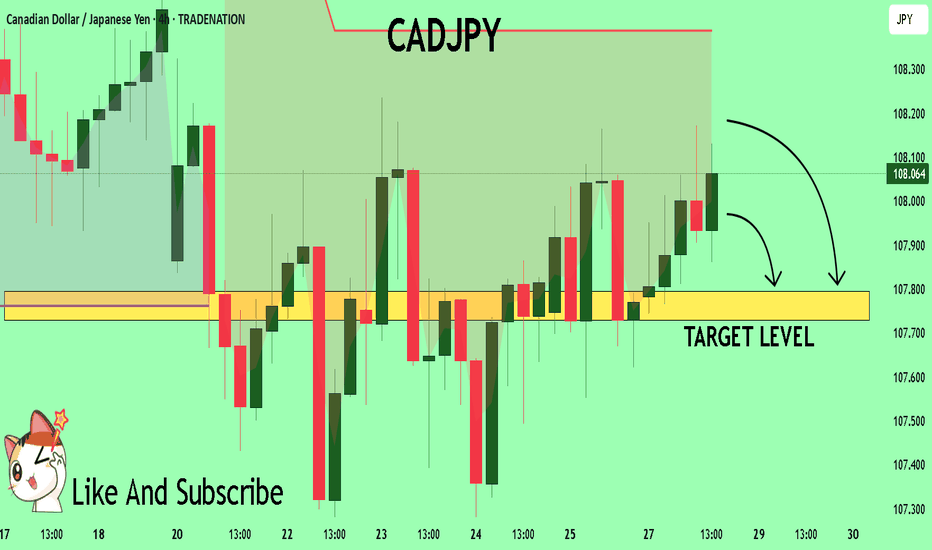

CADJPY Trading Opportunity! SELL!

My dear followers,

I analysed this chart on CADJPY and concluded the following:

The market is trading on 108.08 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 107.79

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

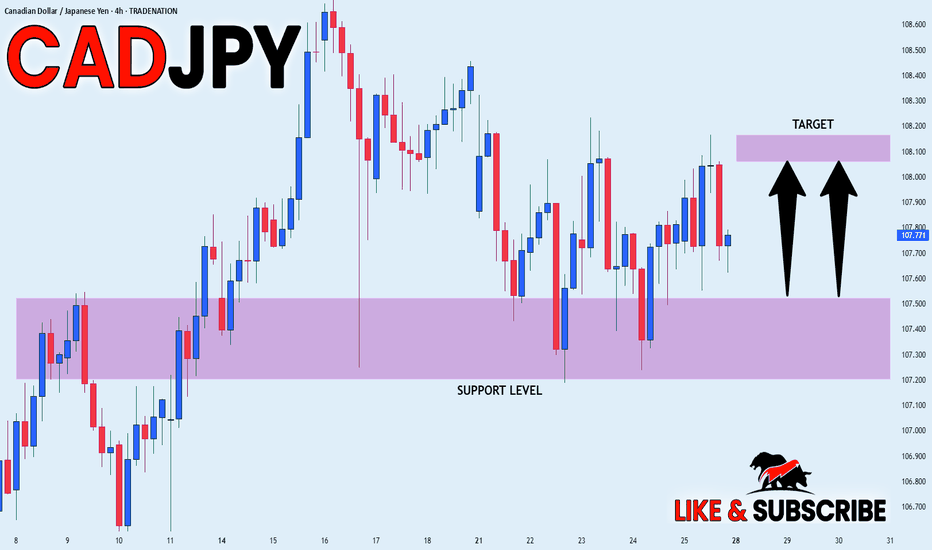

CAD_JPY WILL GO UP|LONG|

✅CAD_JPY will soon retest a key support level of 107.500

So I think that the pair will make a rebound

And go up to retest the supply level above at 108.100

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

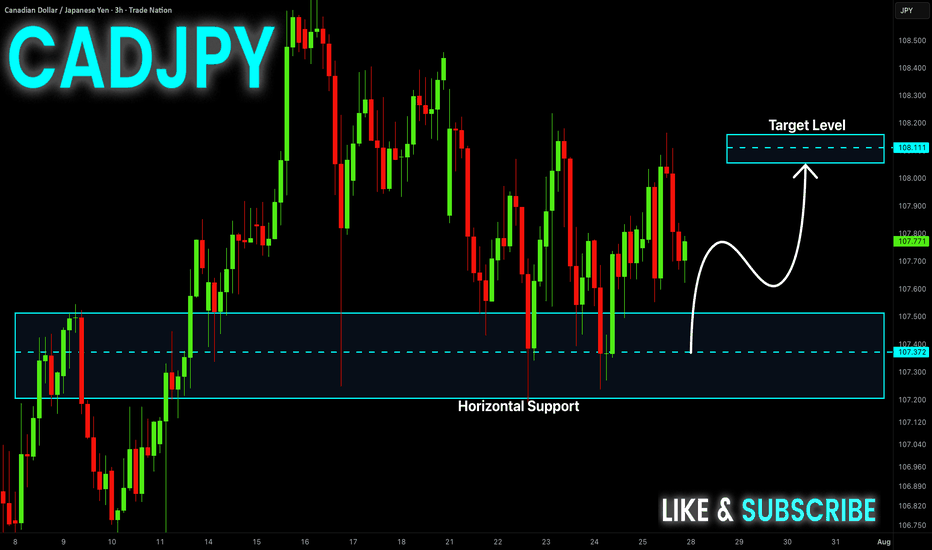

CAD-JPY Rebound Ahead! Buy!

Hello,Traders!

CAD-JPY made a retest

Of the horizontal support

Of 107.400 from where we

Are already seeing a bullish

Rebound and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

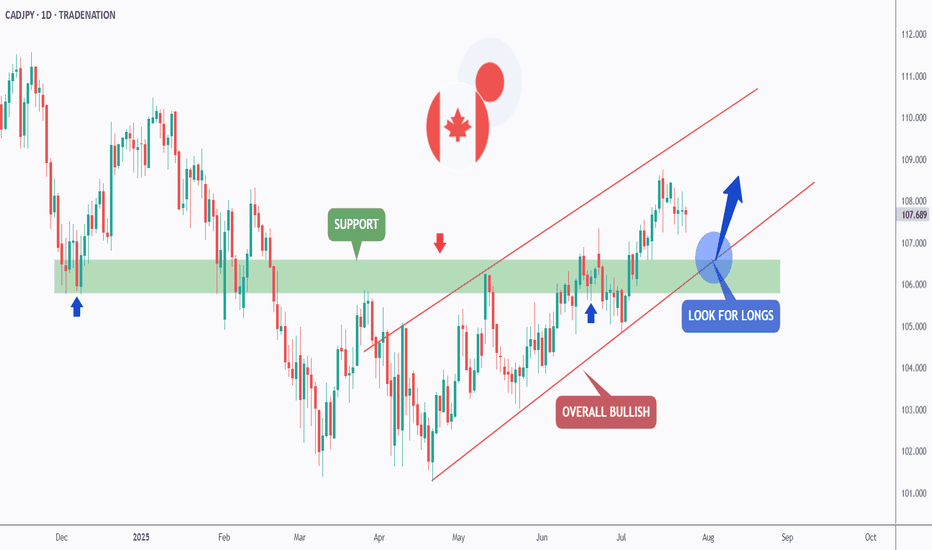

CADJPY - The Bulls Are Stronger than Ever!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CADJPY has been overall bullish trading within the rising wedge pattern marked in red.

This week, CADJPY has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and green support.

📚 As per my trading style:

As #CADJPY approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY Forming Descending ChannelCADJPY is currently trading within a clean descending channel on the 4H chart, offering a classic technical setup for a potential bullish breakout. The pair has been consolidating for several sessions within this structure, making higher lows off key support. The channel is acting as a controlled retracement in a broader uptrend, and price is now reacting from the lower boundary—indicating a strong possibility of a bullish reversal toward the upper zone near 202.70.

Fundamentally, the British pound remains supported by strong wage growth and persistent inflation, which keeps the Bank of England on alert for further rate action. Traders are pricing in the potential for policy tightening to continue or remain elevated longer than expected. In contrast, the Japanese yen stays under pressure due to the Bank of Japan’s ultra-loose stance and its reluctance to normalize interest rates, especially after the latest BOJ meeting reaffirmed dovish policy despite a weakening yen.

The technical setup aligns perfectly with the fundamental landscape. CADJPY is positioned to benefit from yield differentials and risk-on sentiment in the market. A clean breakout above the channel resistance around 199.50 could trigger a wave of bullish momentum, targeting the 202.70 zone and potentially higher if bullish fundamentals persist. The current support zone around 197.40 serves as a tight invalidation level, providing a favorable risk-to-reward for swing buyers.

With this descending channel structure and macro tailwinds favoring strength and CADJPY weakness, I'm anticipating a breakout soon. This setup is one to watch closely, as it blends technical precision with fundamental divergence—a high-probability scenario that aligns with my trading plan.