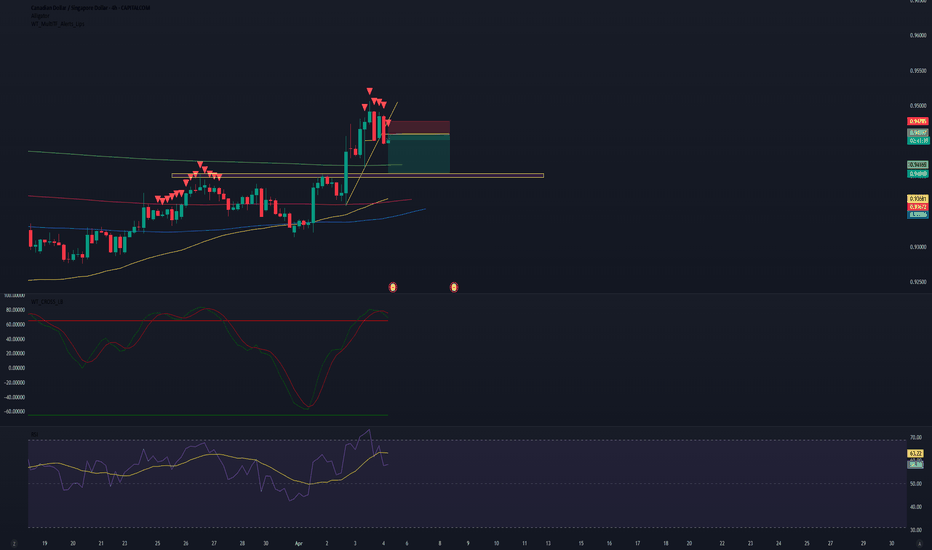

CAD/SGD – Setup WatchWe’re closely watching CAD/SGD for a potential pullback into a major resistance zone — a level that has proven to be super strong in recent history.

If price pulls back cleanly into that area and the VMS criteria align (Volume, Momentum, Structure), this could shape up to be a high-probability setup.

📌 No prediction here — just preparation.

We don’t chase trades. We wait for full alignment.

Keep an eye on this one — it’s on the radar.

CADSGD trade ideas

CAD/SGD SHORT Investment Opportunity

Hello everyone, I am Andrea Russo, a Forex Trader, and today I want to share with you a trading strategy that I am currently following on the CAD/SGD currency pair. This analysis is designed to help traders better understand the dynamics of this pair and optimize their trades.

CAD/SGD SHORT Position Analysis

I decided to enter a SHORT position on CAD/SGD at the level of 0.9460, with a profit target (Take Profit) set at 0.9405 and a stop loss at 0.9479. This setup was chosen after careful technical and fundamental analysis.

Strategy Rationale

Technical Analysis: The chart shows significant resistance around the level of 0.9470, which has rejected the price several times in the past. In addition, momentum indicators suggest a possible downside.

Fundamental Analysis: Recent economic news points to weakness in the Canadian dollar against the Singapore dollar, making this SHORT position particularly attractive.

Risk Management

Risk management is key in any trade. With a stop loss of 0.9479, the risk is well defined and limited. The risk/reward ratio is favorable, with the potential for gains greater than losses.

Trader Tips

Monitor the Market: It is important to follow economic news and events that could affect the CAD or SGD.

Adjust Strategy: If the market moves against the position, consider closing the trade or reviewing the stop loss and take profit levels.

Discipline: Always stick to your trading plan and do not let emotions influence your trading.

Conclusion

This SHORT position on CAD/SGD represents an interesting opportunity for traders looking to take advantage of the current market conditions. Always remember to do your own analysis and trade with caution.

Happy trading everyone! Andrea Russo, Forex Trader

CAD/Singapore Dollar ShortSingapore:Asia´s Switzerland getting stronger on China´s boosting industry and strong copper

Canada weaker because of Trump´s tariffs and weaker economy

Rockets: Entries

Yellow zone is not stop zone.It is the zone where I sell more:i COVER MY SELLS in thise zone.

Your stop should be based on your risk management decision taking

Trade Signal Alert: CAD/SGDWe have identified a selling opportunity for the CAD/SGD currency pair based on the EASY Quantum Ai strategy.

Direction: Sell

Enter Price: 0.95839

Take Profit: 0.95666

Stop Loss: 0.96166

Our analysis highlights several key factors supporting this forecast:

1. Technical Analysis: Recent chart patterns indicate a downward trend. The currency pair has been consistently making lower highs and lower lows, suggesting bearish momentum.

2. Economic Indicators: Economic data from Canada has shown signs of weakness, particularly in areas such as employment and retail sales, which may put downward pressure on CAD.

3. Market Sentiment: Investor confidence in the Singapore Dollar (SGD) remains strong due to the country's stable economic outlook and robust financial health, increasing the likelihood of SGD appreciation against CAD.

This signal is generated using the sophisticated algorithms of EASY Quantum Ai, ensuring high accuracy in identifying profitable trading opportunities.

Trade carefully and always monitor the market for any sudden changes. Happy trading!

Forex Trading Signal for CADSGDDear Traders,

We have identified a potential short trade opportunity for the forex pair CADSGD. Below are the details of the trade signal:

Direction: Sell

Enter Price: 0.97968

Take Profit: 0.97797667

Stop Loss: 0.98130667

This forecast has been generated using the EASY Quantum Ai strategy, which leverages advanced algorithms and historical data analysis to provide high-probability trade setups. Our analysis identifies several key factors that suggest a decreasing trend in the CADSGD pair:

1. Technical Indicators: Recent price action shows bearish patterns, confirmed by pivotal resistance levels at 0.9810. Momentum indicators such as the RSI and MACD are indicating a bearish divergence, suggesting a downtrend.

2. Fundamental Analysis: The economic data from Canada shows a potential slowdown in certain sectors, while Singapore’s economy displays relative stability. This divergence in economic performance is likely to put downward pressure on CADSGD.

3. Market Sentiment: The overall market sentiment appears to favor the Singapore dollar over the Canadian dollar due to prevailing geopolitical factors and trade uncertainties.

Please ensure to place the trade according to the specified parameters and always manage your risks appropriately.

Trade wisely and let's aim for profitable trades!

Best regards,

Your Trading Team

CADSGD- RangeboundCADSGD is rangebound since 6 April with no clear HH or LL. To trade the range there are 2 scenarios, either one, if executed will cancel the other scenario.If it breaks the support to the downside sell order should be executed at S2 or if it breaks the resistance to the upside buy order should be executed at R2. Support and Resistance levels are clearly marked on the chart

✨ CADSGD: ITF CURVE ANALYSIS (1D) ✨ (UPTREND)NOTE: TP1 has already been secured. This is a new position for some and add-on for others.

MO @ 0.9926 - TRIGGERED

BSO @ 0.9933 ⏳

BLO1 @ 0.9921 ⏳

BLO2 @ 0.9900 ⏳

TP1 @ 0.XXXX - ALL POSITIONS SHAVED BY 25%

TP2 @ 1.0056

TP3 @ 1.01728

TP4 @ 1.0250

🔑

BLO = BUY LIMIT ORDER

BSO = BUY STOP ORDER

ITF = INTERMEDIATE TIME FRAME

MO = MARKET ORDER

TP = TAKE PROFIT

Intermediate time frames (4 hours to 6 day):

— Offer a clearer picture of the underlying trend compared to short-term frames.

— Provide more opportunities for confirmation signals and technical analysis.

— Allow for more flexible trading schedules, trades can be held overnight.

— Suitable for swing traders and some positional traders.

CADSGD ____ INCOMING BULLISH MOVEHello Traders,

We have a situation whereby there are multiple confluences for this bullish move.

To start with, on the monthly chart, we can see that price is retracing while forming an 'M' pattern which will complete at the monthly demand orderblock which is a 'W' pattern. This simply means that we should expect bullish price movement.

On the weekly chart, we have an unmitigated demand zone and the price is approaching this level while creating an 'M' pattern. The expectation is that the price will mitigate this zone and rally.

On the daily timeframe, you will notice there is a demand orderblock that is yet to be mitigated. This orderblock is also in alignment with the equilibrium price level of the weekly demand orderblock.

This pair is on my radar and my alert has been set. Waiting for the price to trade into that zone.

Follow for more updates like this.

Cheers,

Jabari

CADSGD is showing rangebound movement since 25 Jul 23CADSGD is showing range bound movement since 25 Jul 23. Trade plan has been prepare for both bullish and bearish breakouts as shown on the chart and levels have been marked. Entries have been placed on breakout of S2 and R2 for long and short entries respectively.

Perfect automated detection of Butterfly & DeepCrab PRZ - LongA bullish-type Butterfly pattern occurred.

If the price drops to 0.97606, a bullish-type DeepCrab pattern could occur.

Also on the daily chart, bullish-type Butterfly pattern is occurring.

Long after seeing the rebound.

*Harmonic patterns are automatically detected using the indicators below.

- Harmonic auto-detect PRO