ZB1! trade ideas

TOP 5. Issue 5 from 08.09.2019Weekly update with the outlook on my 5 favorite trading instruments where I place around 90% of the deals.

These include: SPX , Gold , Crude Oil , EURUSD pair and the Emerging markets via USDRUB .

If you like what you see, please fell free to hit the Like bottom and leave your comments.

Disclaimer:

By viewing this video you fully accept and agree that it offers general advice only and that trading the financial markets is a high risk activity and that you understand that past performance does not indicate future performance and that the value of investments and income from them may go up as well as down, and are not guaranteed.

T-Bonds Are Waaaay Overbought, and Primed For A Reversal! (ZB)Hi friends! Welcome to this analysis on the T-Bond futures contracts! Let's get right to it! Looking at the weekly T-Bonds, we can see that price has been exploding to the upside. However, T-Bonds are waaaaaay overbought right now. In fact, we are in record high RSI territory on the weekly chart. So, what does that tell us? Well, if we look at the last few times that the RSI had readings this high on the T-Bond market, we can see that powerful selloffs followed nearly every time without fail. So, based on that, and the fact that we're well above the top of the Bollinger band, I think there is high likelihood that T-Bonds are about to reverse course. Currently, there is no evidence in the price action, to support the argument of a powerful reversal. However, the RSI is tremendously overbought, and the historical response to these overbought weekly RSI levels has been a massive selloff. For now, let's keep an eye out for a reversal candle to close here on the weekly. If we see an inverted hammer, a bearish doji, or just a bearish engulfing candle, we can assume that the top is likely in for this move.

We all know that the Fed has cut rates, and prices are rising as a result. However, I

#PoopLovesYou

I'm The Master of The Charts, The Professor, The Legend, The King, and I go by the name of Magic! Au revoir.

***This information is not a recommendation to buy or sell. It is to be used for educational purposes only.***

-JD-

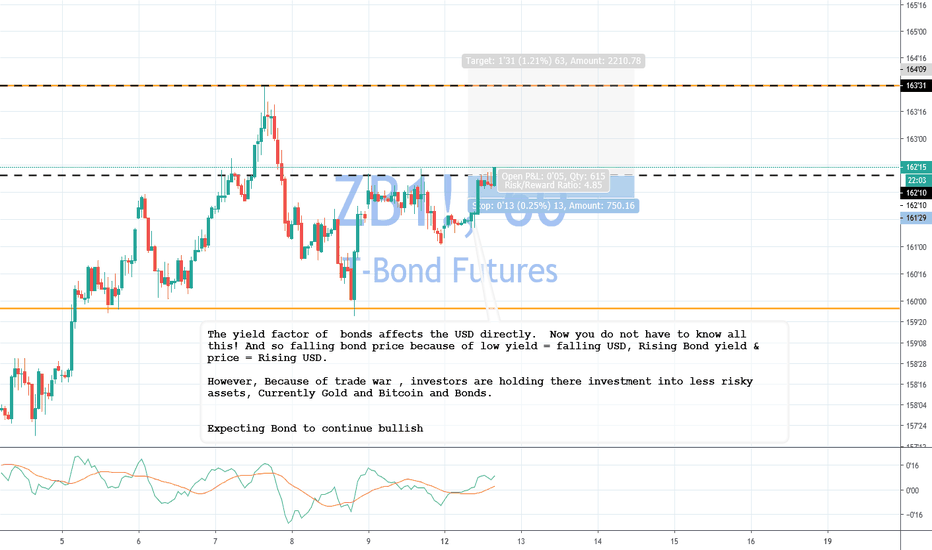

30 Year Treasury BondsThe yield factor of bonds affects the USD directly. Now you do not have to know all this! And so falling bond price because of low yield = falling USD, Rising Bond yield & price = Rising USD.

However, Because of trade war , investors are holding there investment into less risky assets, Currently Gold and Bitcoin and Bonds.

Expecting Bond to continue bullish

T-Bonds completing the 1st stage of reversalT-Bonds completing the 1st stage of the reversal, at resistance at the 152 level. If it breaks the 150 level comes into play. This trade is a Reversal Trade because it is against the fundamental backdrop and market momentum, and is a play on the market getting over extended on the long side.

30 Year T Bond Weekly Chart Has very Long Run to Go from Here.30 Years T Bond Weekly Chart break the odd shape of Head and Shoulder Pattern + All the Weekly Down Trend Line also Broken.

The base also has a Solid Built, and has very high potential to start it fresh bull run to the Target Price from current price.

Will watch ZB hold the NECK line in coming Week. It will show the FACT.

Bonds Likely to Close the GapThe whole world was glued to twitter waiting for an update on the trade war from President Trump. However what they received was rather anticlimactic: a tweet about saying we don't need to rush a trade deal, which was later deleted. It is likely the markets will interpret this as a risk-off event, since they were really expecting more clarification.

Currently, the Kovach Momentum Indicators suggest momentum has stagnated. Bonds are currently ranging, and are likely to drift upward, testing the upper bound of the range.

Bonds Due for a RetracementBonds have been gradually overbought owing to a slew of risk off factors including global economic fears, and the trade war. At this point, we may be due for a corrective phase by the end of the week. There is a representative from China flying in, so this may provide a much needed respite from the doom and gloom.

The Kovach Momentum Indicators suggest that momentum is gradually turning negative, which may support our position. Shorting near current levels would provide high risk reward because there is a vacuum zone to the down side, and new relative highs would provide a good stop loss. We know we're wrong if these are breached.

Head and Shoulders in BondsAs I said yesterday, despite global weakness (e.g. weak Chinese PMI last night), bonds look due for a correction from their massive rally last week, pricing in Fed dovishness and perhaps a rate cut tomorrow. We may hold current levels before the FOMC tomorrow as some ranging is expected before such a major event.

The technicals are extremely bearish of bonds. We appear to be in a bear Elliott Wave (Wave 4 to be precise) that is looking for completion. In particular, there is a head and shoulders pattern forming on hour charts, which is very ominous. Bonds tend to obey the tecnicals pretty well, so it is likely this will break down soon.

The Kovach Momentum Indicators have turned sharply south, supporting our view. Furthermore, the current (green candle) has a wick which has appeared to reject the central moving average of the Kovach Reversals Indicator.

ZB At Significant ResistanceThe 30 year treasury futures contract is nearing some significant resistance after rallying all last week. True, it was pricing in a more dovish stance from the Fed, but with stocks nearing highs, we have to wonder when this may bleed into the bond market, continuing a more risk-on tone, and the overall bear phase.

We do appear to be in the 4th (corrective) wave of a bear Elliott Wave. We are hovering just below some significant resistance at 147'24. We can safely assume we are wrong if we break 147'10. This will depend on whether stocks can break (and maintain) new highs. Unless news turns for the worse, they postured well to accomplish this.

The Kovach Momentum indicators do suggest some upward momentum that has dissipated in the short term. However, this still paltry in comparison to the downward momentum we had in the third leg of the Elliott Wave. We are encroaching upon the upper bound of the Kovach Reversals Indicator suggesting that if a reversal was to happen, it would be soon.

ZB Daily Medium Term 1-5 Wave Projection Target ZB

Techincal View:

From the Medium Term ZB View, My View is ZB just completed its Wave 1 Major Uptrend and now retrace for Wave 2.

The Impulse move of Major Wave 3 is forming. I also projected the minor move VWXYZ in Major Wave 3 for reference.

My charts is projected based on the FIBO level and all parameter are matching so far. This will be my guideline and reference chart to trade on ZB.

Kindly feel free to comment of the reason for ZB to go Long or Short.

Agreed my view please click Agreed button or follow me. Thank.

Fundamental View Pro Reason :

1. Feb to pulse on Interest raising for 2019,

2. Market at historical high and Risk for correction is high. Bond will be risk aversion tool.

3.

4.

Con :

1.

2.

3.

4.