Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure📉 Corn Futures (ZCU2025) – Heavy Structure, Heavy Pressure

WaverVanir DSS shows continued downside probability in Corn as price compresses below the 0.786–1.272 fib zone and forms a supply rejection cluster near 4.10–4.27.

🧠 Macro Snapshot:

🌽 USDA WASDE (Aug 12) may revise yield upward amid favora

Contract highlights

Related commodities

Sustained Downtrend in Corn Futures: Bears Maintain Control

The price is trading below the middle Bollinger Band (20-day SMA), which is sloping downward.

Lower highs and lower lows pattern confirms the bearish market structure.

Price hugging the lower band or staying in the lower half of the band zone — a classic sign of weakness.

Price repeatedly fails

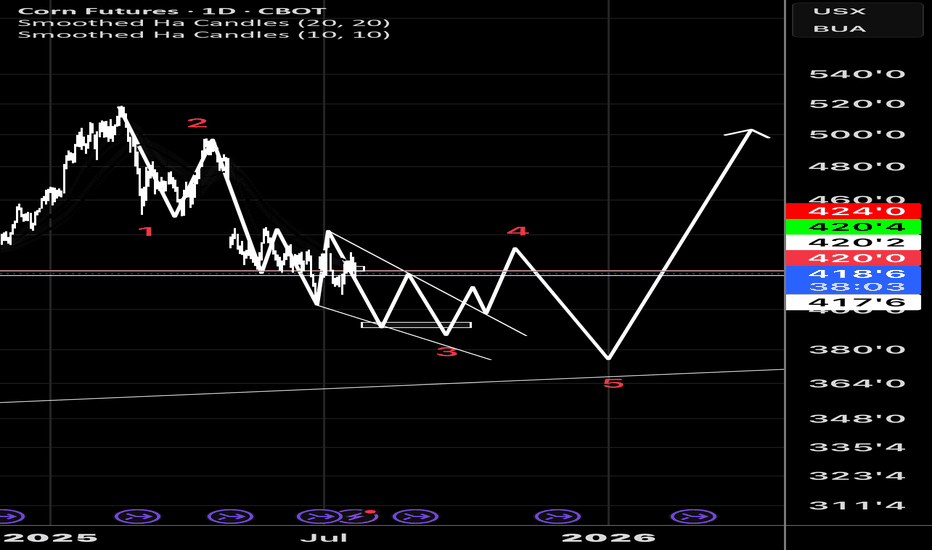

CORN; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no

Weather and Corn: Understanding the Precipitation Factor1. Introduction: Rain, Grain, and Market Chain Reactions

In the world of agricultural commodities, few forces carry as much weight as weather — and when it comes to corn, precipitation is paramount. Unlike temperature, which can have nuanced and sometimes ambiguous effects depending on the growth

Potential Bull Pin Weekly Close on Corn FuturesMight be a bullish close below the yearly open on corn futures.

Tariffs can negatively impact prices but maybe some seasonality will drive some higher prices to make a fresh yearly high at some point this summer.

There have only been seven years since 1981 that have not seen a summer corn price r

ZCU25 CORN... It ALWAYS comes down to cornAND I'M BACK AND DUMBER THAN EVER

Listen up Honkies, this trade has a 93% probability based on the historical data over the last 30 years. So I bet Muhammad my 3rd ex-wife and a half of my second step child. The reason this trade works is easy! We all have felt and understand FUD (Fear, Uncertaint

ZCU25 ITS CORN! AGAINAND I'M BACK AND DUMBER THAN EVER

Listen up Honkies, this trade has a 93% probability based on the historical data over the last 30 years. So I bet Muhammad my 3rd ex-wife and a half of my second step child. The reason this trade works is easy! We all have felt and understand FUD (Fear, Uncertai

Daily ZC analysisDaily ZC analysis

Sell trade with target and stop loss as shown in the chart

The trend is down and we may see more drop in the coming period in the medium term

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Corn Futures (Dec 2026) is 447'4 USX / BUA — it has risen 0.73% in the past 24 hours. Watch Corn Futures (Dec 2026) price in more detail on the chart.

The volume of Corn Futures (Dec 2026) is 1.14 K. Track more important stats on the Corn Futures (Dec 2026) chart.

The nearest expiration date for Corn Futures (Dec 2026) is Dec 14, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Corn Futures (Dec 2026) before Dec 14, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Corn Futures (Dec 2026) this number is 57.67 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Corn Futures (Dec 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Corn Futures (Dec 2026). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Corn Futures (Dec 2026) technicals for a more comprehensive analysis.