MZC1! trade ideas

CBOT CornGood Morning

From a mild Johannesburg and ahead of tonights WASDE (out at 7 pm local time) I would like to share what I feel to be a very RR (risk/reward) trade.

Of all the softs heading into tonight's numbers, I feel that Corn has the highest probability of rallying.

I believe that we can see a rally toward the $4.24 level in the coming days and post tonights numbers.

The targets also fit perfectly in with the 61.8% retracement.

At current levels, this trade presents us with a 31/10 bet based on a stop under $3.71.

This could just be the way to end off the 1st week of 2020….. with some decent $$$$ in your pocket!

Happy hunting and always remember the following: “hard work and discipline will always trump talent when talent does not work hard” ~ anonymous

Giancarlo

CORN Long - Range playNothing really exciting happening here, but a possible small range play looks possible. Price has been bouncing around a ascending channel, currently around the bottom of it. If it price holds and a confirmation of bounce, look to hold a position towards the upper end of channel 380ish area.

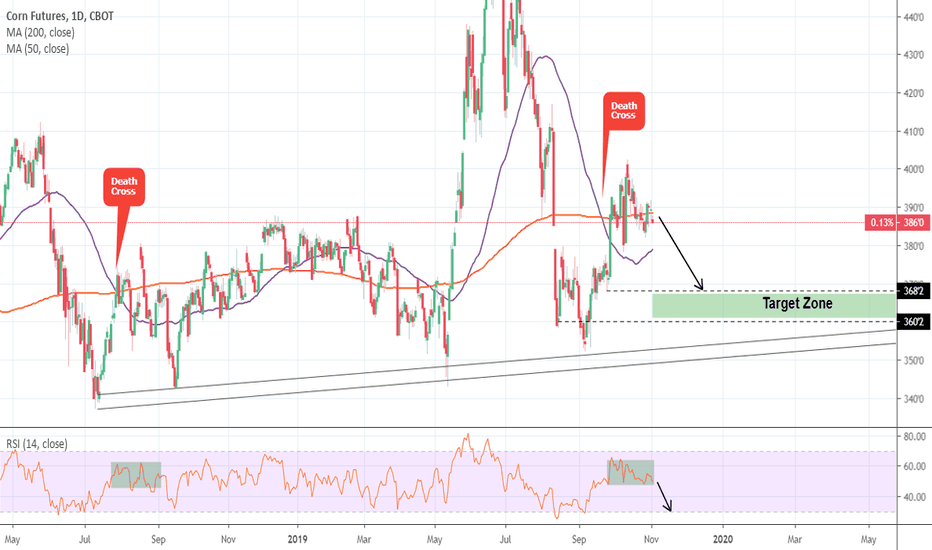

Corn: Short opportunity on 1D Death Cross and RSI.Corn has been consolidating recently following the 402 peak on 1D (RSI = 54.610, STOCH = 53.472, MACD = 0.760, ADX = 18.642) after the September Death Cross. A similar candle sequence took place in August 2018, when after a 1D Death Cross (MA50 under MA200) and a market Top, the price made a new Low (Higher Low on 1W).

Since the RSI is on the same zone as then, we are expecting a decline towards 368'2 - 360'2.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Corn Futures ZC supply and demand forecast analysisSupply and Demand and any trading strategy can be quite overwhelming at times. When looking at the Corn Futures ZC weekly timeframe we can see there is a super strong weekly demand imbalance created around 3600. The strength of that demand imbalance is quite strong, we already have price reacting to it, we are expecting Corn Futures ZC to rally higher, there is a lot of room for Corn Futures to keep on moving to the upside.

You can use Corn Futures options or various ETFs to trade Corn Futures as well, you are not exclusively limited to the Corn Futures ticker. We don’t need any specific tools to learn how to trade Futures or Corn. You can pay attention to Corn fundamental analysis or even Corn Seasonal analysis, but all that will be a lot of hard work just to learn that fundamentals where good to sell Corn Futures but you did not know there was a pretty strong weekly demand imbalance in control and you should have gone long on Corn Futures ZC instead of shorts.

We can day trade and do intraday on Corn Futures as well. Supply and demand can be applied to any market and asset. Futures intraday and day trading is also possible by using simple rules that will help you locate brand new imbalances to trade. You can use other trading strategies to day trade futures and Corn futures. By knowing there is a very strong weekly demand imbalance in control, you can use other trading strategies to plan your intraday trades.

Corn Sep 24 SHORTM pattern

Looking at our daily continuous corn contract we will first use our indicators such as RSI, Stoch RSI, and

MACD to determine possible directional position.

Or RSI is heading down the slightest but has been at this high level three major times with no success to

break through and has gone flat. Our Stoch RSI shows slight less buying pressure with the buy RSI above the sell

RSI, therefore still showing slight, not strong but still bullish presence.

Our MACD shows overbought conditions with our buy and sell looking to cross for selling pressure.

(Only 1 real bearish signs with a reasonable half bullish indicator.)

A 10R chart will show a more favorable move to the downside which will break it through the latest low.

an upside move using this technique is unlikely due to previous candle strength after Sep 17 drop.

We are in lower lows and lower highs pattern and are testing the third resistance touch with little strength

to break out.

THE WEEK AHEAD: GDXJ, /ZC, /ZSEARNINGS:

No earnings announcements this coming week in underlyings with highly liquid options with ideal rank/implied metrics (>70% rank/>50% 30-day implied).

EXCHANGE-TRADED FUNDS:

SLV (82/29)

GDX (74/33)

TLT (71/15)

GDXJ (60/37)

GLD (59/15)

XOP (35/37)

Precious metals ... again, with GDXJ offering the best volatility metrics (>50% rank/>35% 30-day implied)

BROAD MARKET:

IWM (23/19)

SPY (13/13)

QQQ (11/18)

EEM (7/16)

EFA (15/11)

FUTURES:

/SI (82/28)

/UB (71/5)

/ZB (71/12)

/ZN (61/6)

/ZS (63/28)

/GC (59/15)

/ZC (52/28)

Pictured here is a corn short strangle in the October/40 days 'til expiry cycle with strikes camped out around the 1 standard deviation on the put side at 14 delta and the call side at the 13 delta strike, resulting in a delta neutral setup supposedly paying 4.00 at the mid price with break evens at 336 and 409. Naturally, that'll have to be priced out during regular market hours. There also may be some benefit in going out to November, where the implied volatility is at 25.3% versus October's 24.1% and where implied volatility contracts from there into winter and spring with February at 20.5% and April at 17.5%.

An alternative trade would be in October beans; the 830/990 short strangle paying 4.75 with the short put erected at the one standard deviation strike on the put side, the call at the equally delta'd strike on the call. For contrast: corn's implied volatility term structure: October -- 23.3%, November 17.8%, December 19.2%, February 16.6%, April 15.8%.

Naturally, either of these setups can be transformed into defined risk, iron condor trades by buying wings.

VIX/VIX DERIVATIVES:

Yowsa! VIX finished the week at sub-14 (13.74), so it's basically time to hand sit on what you put on in August volatility and wait for the next >20 pop to short.