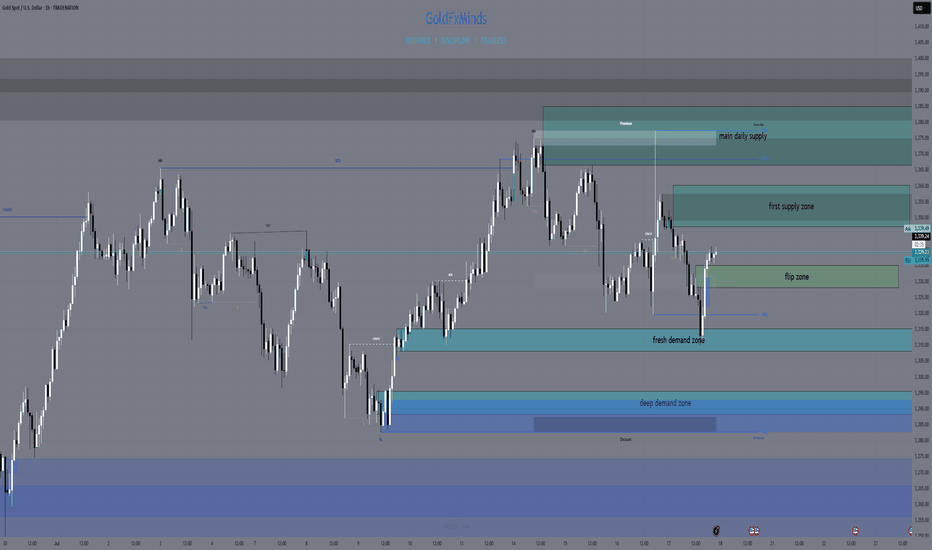

XAUUSD Daily Sniper Plan – July 14, 2025Hey team 👋 and welcome to a fresh new week on the charts!

We’re starting this Monday without any major news — just pure price action, clean zones, and structure doing all the talking. No distractions. No excuses. Let’s lock in our focus and let the market show us where the edge is.

🔸 Bias: Bearish while below 3390

Last week’s rejection from the H1 premium zone (around 3375) created clear signs of exhaustion. Price is now forming lower highs and lower lows, with clean CHoCHs on both H1 and M15. Until we reclaim 3390, we remain bearish — waiting for the next lower high to form.

🔽 Sniper Sell Zones (above current price)

3360–3370 → H1 premium FVG + CHoCH OB + EMA5 cap

3380–3390 → Inducement zone + internal imbalance + RSI divergence

🔼 Sniper Buy Zones (below current price)

3310–3320 → Discount FVG + BOS base + HL support

3280–3290 → Final HL structure zone + fib 61.8% + OB + RSI oversold

🟡 Decision Zone:

3330–3340 → Neutral zone

→ Wait for break and retest or rejection confirmation.

→ No setup = no trade.

🧠 Battle Plan – Execution Scenarios:

🔴 Scenario A – Bearish Setup Active:

If price returns to 3360–3370 or 3380–3390 and shows M15/M30 rejection → enter short.

Target: 3330 → 3310.

If 3390 is broken and held → cancel short bias.

🟢 Scenario B – Bullish Setup Activated:

If price sweeps 3320 or 3290 and reacts with strong bullish PA (engulfing or CHoCH) → enter long.

Target: 3340 → 3360.

No confirmation = stay flat, do not anticipate.

🟡 Scenario C – No Reaction / Choppy Flow:

If price consolidates between 3330–3340 without clean rejection or break → wait.

Let price show its hand. Today is Monday — we need clarity, not emotion.

Every level in this plan was drawn with purpose — no shortcuts, no borrowed zones.

If you value structure, discipline, and originality in your trading, you’re in the right place.

Your support means everything — I see every 🚀 and every comment, and I appreciate this community deeply.

Let’s keep growing, with real work and real structure.

Follow GoldFxMinds — we stay sharp, we stay true. 💛

📎 Trade Nation Disclaimer

Chart and structure based on Trade Nation broker feed on TradingView. For educational purposes only — not financial advice.

CFDGOLD trade ideas

HelenP I. Gold will continue to decline and break support levelHi folks today I'm prepared for you Gold analytics. After a prolonged period of consolidation, we can observe how price has formed a symmetrical pennant pattern. Price respected both the descending and ascending trend lines, bouncing several times from each side. Recently, gold tested the upper boundary of the pennant near the 3390 resistance level but failed to break through, confirming the strength of the resistance zone between 3390 and 3400 points. Following this rejection, the price started to decline and is now approaching the support level around 3305. If this support doesn’t hold, the price may drop further and break out of the pennant downward. In that case, the nearest significant target lies at 3280 points — near the lower trend line and previous reaction zones. Given the current structure, repeated rejection from resistance, and narrowing volatility inside the pattern, I expect XAUUSD to exit from the pennant and move down, breaking the support zone. That’s why I remain short-term bearish and set my goal at 3280 points. If you like my analytics you may support me with your like/comment.❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold 30Min Engaged ( Bearish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish Reversal 3378 Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

☄️ Hanzo Protocol: Dual- Entry Intel

Zone Activated: Deep Analysis

➕ 4 wicks connected at 3378

➕ 7 wicks connected at 3385

➕ Body Close at 3370

➕ Body Close at 3385

➕ Liquidity at 3380

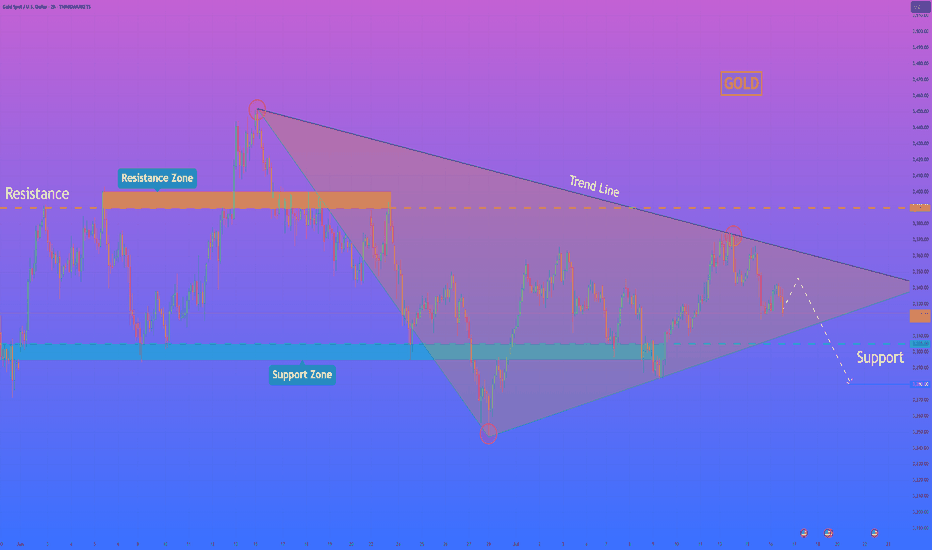

GOLD (XAUUSD): Mid-Term Outlook

Analysing a price action on Gold since March,

I see a couple of reliable bullish signals to consider.

As you can see, for the last 4 month, the market is respecting

a rising trend line as a support.

The last 4 Higher Lows are based on that vertical support.

The last test of a trend line triggered a strong bullish reaction.

The price successfully violated a resistance line of a bullish flag pattern,

where the market was correcting for almost a month.

A strong reaction to a trend line and a breakout of a resistance of the flag

provide 2 strong bullish signals.

I think that the market may grow more soon and reach at least 3430 resistance.

An underlined blue area will be a demand zone where buying orders will most likely accumulate.

❤️Please, support my work with like, thank you!❤️

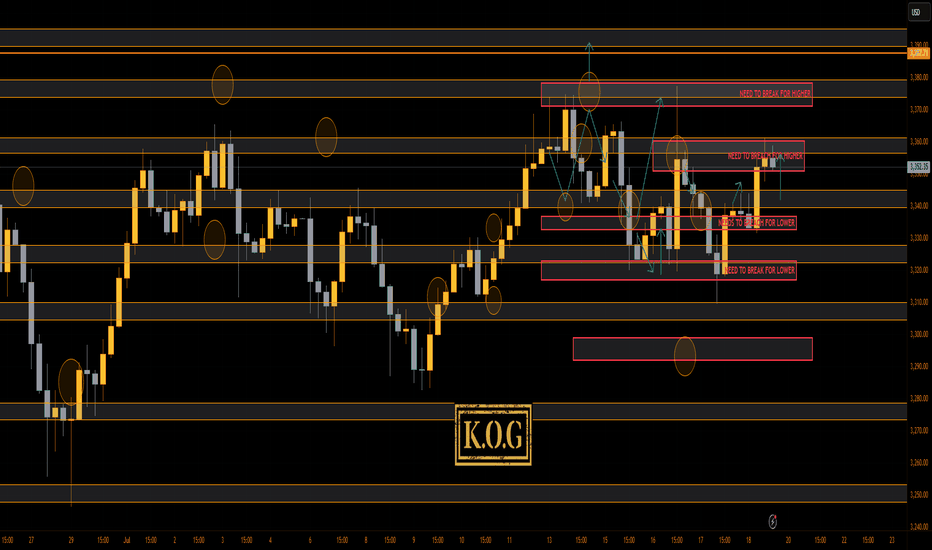

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

What a week on the markets with our KOG report plan working well, the red boxes moving with price, the Excalibur targets being completed and then most of the bias level targets completing as well.

Have a look at Sundays report and compare the move and levels shared, you'll see how well we've managed to track this. Only thing we haven't got (yet) is that curve ball, so let's see how we close today and open on Sunday.

For now, support below is at the 3340 level with resistance 3370. We may just see a late session move here so play caution.

KOG’s bias for the week:

Bullish above 3350 with targets above 3360✅, 3373✅, 3375✅ and 3383 for now

Bearish below 3350 with targets below 3340,✅ 3335✅, 3329✅, 3320✅ and 3310✅ for now

RED BOX TARGETS:

Break above 3365 for 3372✅, 3375✅, 3382, 3390 and 3406 in extension of the move

Break below 3350 for 3340✅, 3335✅, 3329✅, 3322✅ and 3310✅ in extension of the move

Wishing you all a great weekend and we'll see you on Sunday for the KOG Report. Please do take some time to hit the boost button, it's very much appreciated.

As always, trade safe.

KOG

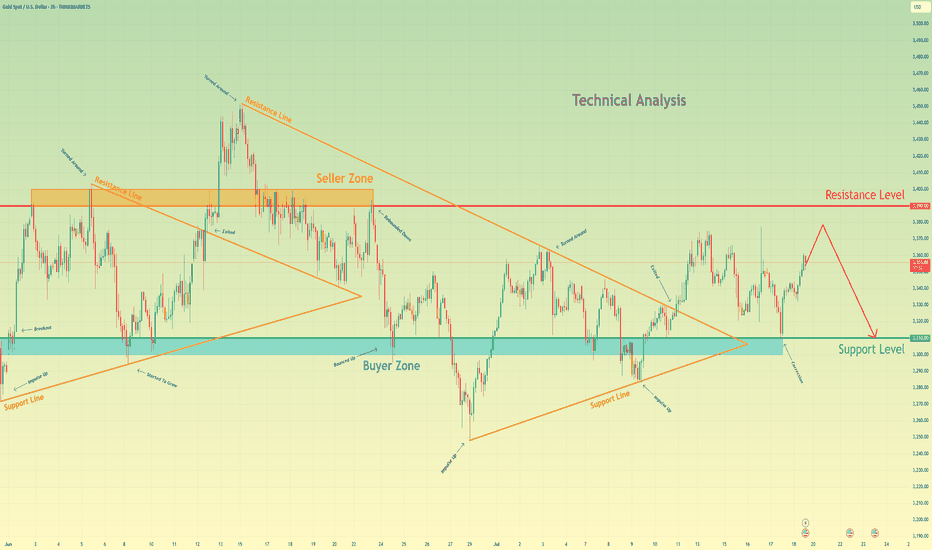

Gold may rise a little and then drop to support levelHello traders, I want share with you my opinion about Gold. Initially, gold was trading within a large consolidating pennant, showing both upward and downward impulses as it moved between the converging trend lines. The price eventually saw a breakout from this pattern, followed by a strong impulse up, but this momentum stalled as it approached the major horizontal resistance level at 3390. This level, which corresponds with the upper seller zone, has proven to be a significant barrier for buyers, rejecting the price and confirming a strong seller presence in that area. Currently, the market is in a corrective phase after being rejected from the highs. The price is drifting upwards once again in what appears to be a final retest of the aforementioned seller zone. This slow upward movement lacks the impulsive strength of the previous trend, suggesting that buyers are losing control and sellers are preparing to defend the 3390 resistance level once more. I expect this corrective move to fail upon reaching the seller zone around 3390. After this retest, I anticipate a sharp reversal and the beginning of a new downward trend. The logical target for this move is the major support level at 3310, an area that has historically acted as a strong buyer zone. That is why my TP is set at 3310. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Gold Looks Bullish: technical and fundamentalHi Guys!

Gold is starting to flash major bullish signals, and this time, it’s not just about the chart. The technical setup is clean, but we’re also seeing fundamental tailwinds that could fuel a bigger move.

Let’s break it down

1. Technical Setup: The QML Reversal Is In Play

On the 1H chart, Gold is showing a textbook Quasimodo (QML) reversal pattern. Price made a lower low, then reversed up to break structure, and now it’s pulling back and respecting the key QML zone around $3,296.

This zone has turned into strong support. As long as we stay above it, the structure suggests a continuation toward $3,367 — a clean upside liquidity target and the previous high.

Strategy: Look for pullbacks into $3,296 for potential long entries with targets around $3,367 or higher.

2. Fundamental Tailwinds: Why Gold Is Gaining Strength

The fundamentals are stacking up in Gold’s favor right now. Here’s what’s fueling the move:

- Weakening USD & Rate Cut Expectations

With the Fed increasingly signaling rate cuts by late 2025, the US dollar is losing steam. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Gold, making it more attractive to investors. Traders are already pricing this in.

- Softening Economic Data

Recent U.S. data, including weaker-than-expected job growth and declining manufacturing numbers, points to a slowing economy. That puts more pressure on the Fed to pivot dovish, which historically sends Gold higher.

- Central Bank Demand

Global central banks (especially in Asia) continue to accumulate physical Gold as part of their long-term reserve strategy. That institutional demand provides strong support at lower levels.

Technical + Fundamental = Strong Bullish Bias

We’re seeing a solid confluence here:

Chart says long (QML + bullish structure)

Macro says long (dovish Fed + weaker dollar + safe haven demand)

Drop your thought here!

Gold 30Min Engaged ( Dual Entry's Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal 3357 Zone

🩸Bearish Reversal 3357 Zone

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

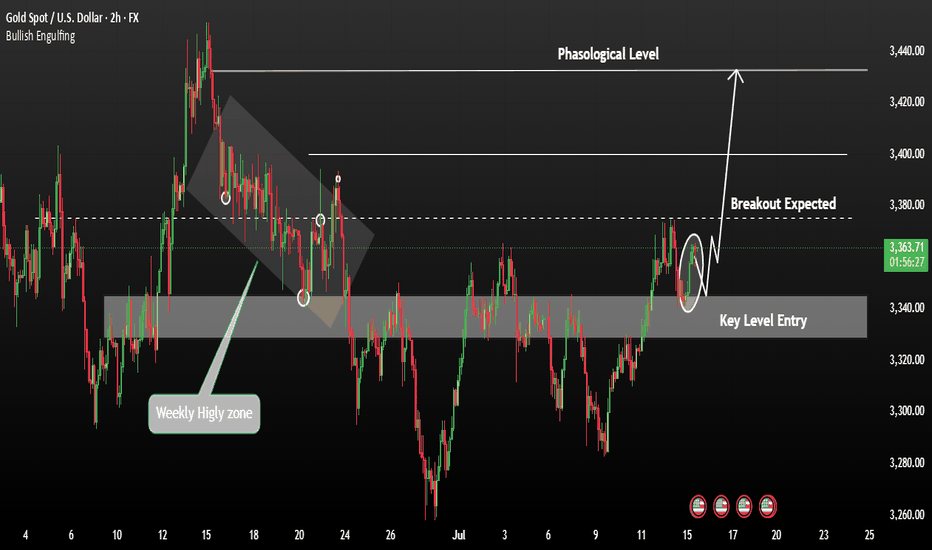

XAUUSD Daily Sniper Plan – July 17-18, 2025Hello traders!

After yesterday’s high-volatility trap and NY session recovery, we now stand at a major structural junction. Buyers reclaimed 3310–3314 with precision, but price is pressing into multi-timeframe supply. Let’s break it down clearly

🔸 HTF Bias

Daily Bias: Bullish correction inside a larger range. Demand at 3310–3305 was swept and respected, but supply at 3347–3360 caps upside.

H4 Bias: Bullish flow into supply. Structure printed clean HLs from 3295–3310. However, current zone is full of short-term profit-taking risk.

H1 Bias: Bullish short-term trend. Price built higher lows from 3310, but now sits at 3340–3347 — reactive zone where momentum could fade if no breakout.

🔸 Key Structural Zones (with role)

🔺 Supply Zones (Above Price):

3347–3360 (D1/H4/H1 Supply)

🔹 Multi-timeframe confluence

🔹 Previous reaction + NY trap zone

🔹 Expect heavy rejection or false breakout wicks

3366–3385 (D1 Supply)

🔹 Final liquidity shelf for buyers

🔹 Only valid if 3347 breaks clean

🔹 Longs must wait for confirmation after breakout

⚔️ Decision Zones (Middle):

3335–3328 (Intraday Flip Zone)

🔹 M15-M30 structure control

🔹 Buyers can reload here on clean bounce

🔹 If price closes below, opens door for bearish momentum

🔻 Demand Zones (Below Price):

3314–3310 (H1/H4 Demand – Key Buy Area)

🔹 Institutional demand origin

🔹 Price tapped, swept, and reclaimed

🔹 Ideal sniper buys only on retest with bullish M15 BOS

3305–3295 (Deep Reversal Demand)

🔹 Extreme discount

🔹 Valid only if 3310 fails

🔹 High RR buys if liquidity sweep appears

🔸 Sniper Battle Plan 🎯

Scenario 1 – Fade from 3347–3360:

🔹 If rejection signs (M15 FVG + RSI divergence), short toward 3335, 3314

🔹 Only enter if NY open confirms exhaustion

Scenario 2 – Pullback to 3335–3328:

🔹 Ideal quick buys on bounce with confirmation

🔹 Watch for BOS on LTF for sniper entry

Today’s zones require real discipline: no rush, no panic — just clear steps, sharp entries, and clean rejections or retests. You already saw what 3310–3305 reacted. The next move? You plan it. You take it. You own it.

✨ Which zone are you watching for your next move?

Drop a comment, leave a 🚀🚀🚀and follow for more sniper-level clarity — every single day.

Let’s keep mastering this market. Together.

Disclosure: All plans are built on Trade Nation live feed. Educational only.

Gold can reach resistance level, break it and continue to riseHello traders, I want share with you my opinion about Gold. Recently, price formed a clean upward wedge pattern and is showing strong bullish behaviour. After bouncing off the support level at 3275, the price entered the buyer zone (3255 - 3275) and reversed with a confident impulse up, signalling renewed interest from buyers. From there, price has consistently respected the support line, printing higher lows and slowly climbing back toward the resistance level at 3410. This level has acted as a significant rejection area before, but this time, the structure looks stronger. Each pull-back has been shallow, and buyers are stepping in faster. The momentum is slowly building. Now the price is trading just below resistance and moving with a bullish trajectory. I expect Gold to continue its climb, first reaching the Resistance Level, and then targeting the seller zone (3410 - 3430). That’s why I’ve set my TP at 3430 points - right inside this upper area where I anticipate profit-taking and potential reversal. Given the bullish pattern structure, the wedge formation, and the strength of recent impulses, I stay bullish and expect further growth in the coming sessions. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

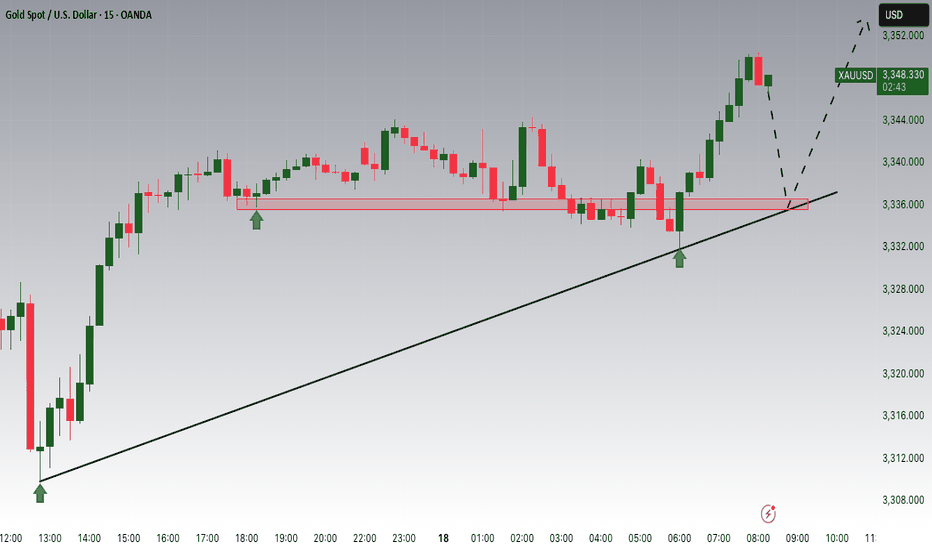

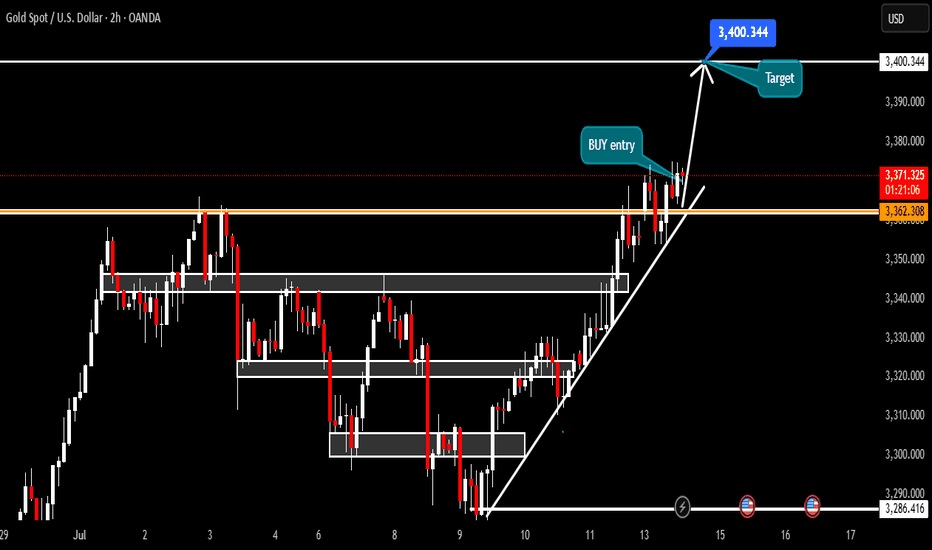

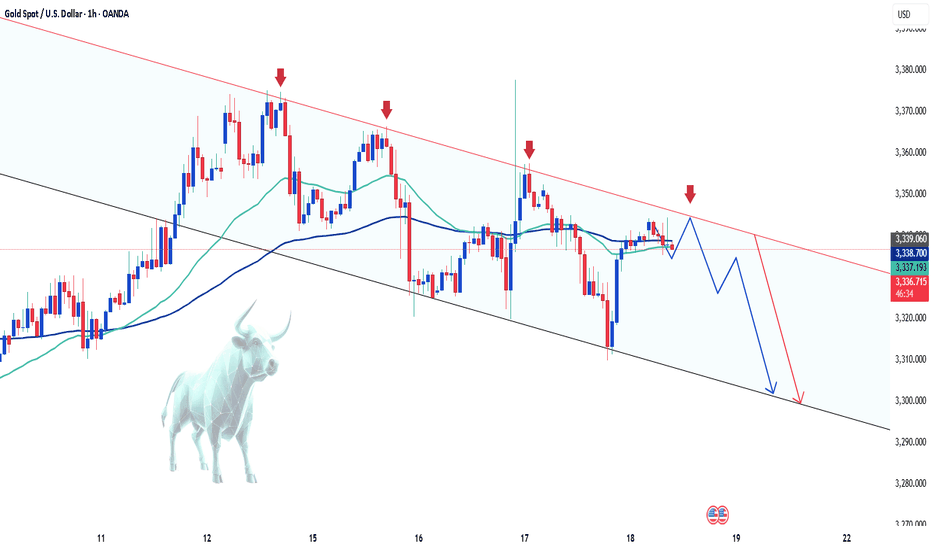

Gold Trade Plan 16/07/2025Dear Traders,

Date: July 16, 2025

📉 Overview:

The chart shows price action at a key confluence zone:

The long-term ascending trendline (black) still holds as strong support.

The blue demand zone aligns with the trendline and the bottom of the descending channel.

A downward-sloping channel indicates short-term bearish correction.

🔍 Likely Scenarios:

A short-term pullback to the 3310–3320 support zone (confluence of trendline and demand).

If this support holds, we may see a bullish rebound toward 3375 and a potential breakout above the channel (toward 3380+).

If the support fails, further downside toward 3280 is possible.

📌 Conclusion: The 3310–3320 zone is critical. Watch for price action signals in this area to decide on long or short positions.

Regards,

Alireza!

GOLD Last move down Next Target after this Breakout?Gold edged higher on Tuesday ahead of key U.S. inflation data, which is expected to provide clearer insight into the Federal Reserve’s future interest rate decisions. Market participants are watching closely for any signals that could influence the dollar and yields, thereby impacting gold prices.

Technical Outlook:

Gold has entered a potential buy zone, showing signs of bullish support Price recently retested the 3353 level, forming a long squeeze setup and now aiming to challenge the resistance at 3373. A successful breakout above 3373 could open the path toward the 3400 and 3432 long-term targets.

On the downside, a retest of the key 3345 level is also possible. This zone between 3345 – 3353 is seen as strong support, and as long as bulls defend it, upward momentum remains likely.

PS: Support with like and comments for more batter insights to share with you.

XUA/USD) Bullish Analysis Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) analysis on the 3-hour

---

Gold (XAU/USD) 3H Technical Analysis Summary

Market Structure: Bullish breakout

Price has successfully broken above both the downtrend line and the support zone (highlighted in yellow), signaling a shift in structure from bearish to bullish.

Key Support Zone:

The yellow zone (~3,335–3,355) was previously a resistance area. After the breakout, it is acting as a strong support level and has been retested.

Trendlines:

Downtrend line: Broken and retested.

Uptrend line: Guiding current price action, supporting higher lows and forming an ascending channel.

200 EMA (blue line):

Price is trading above the EMA 200 (~3,331), confirming bullish bias and providing dynamic support.

Momentum (RSI 14):

RSI is around 67.85, showing strong bullish momentum.

Nearing overbought, so a minor pullback or consolidation could occur before continuation.

Volume:

Increase in buying volume near breakout area suggests institutional interest or strong buyer conviction.

Mr SMC trading point

---

Conclusion:

Price has shifted into a bullish continuation pattern.

A successful break and retest of structure and trendlines increases the likelihood of further upside.

As long as price holds above the yellow support zone and the uptrend line, bullish momentum is favored.

Short-term pullbacks may offer new long opportunities.

---

Please support boost 🚀 this analysis)

Step-By-Step Guide to Building a Winning Gold Trading Strategy

In the today's article, I will teach you how to create your first profitable gold trading strategy from scratch.

Step 1: Choose the type of analysis

The type of analysis defines your view on the market.

With technical analysis you rely on patterns, statistical data, technical indicators, etc. for making trading decisions.

Fundamental analysis focuses on factors that drive the prices of gold such as micro and macroeconomics, news and geopolitics.

A combination of technical and fundamental analysis implies the application of both methods.

For the sake of the example, we will choose pure technical approach.

Step 2: Specify the area of analysis

Technical and fundamental analysis are complex and multilayered subjects. That is why it is crucially important to choose the exact concepts and techniques that you will apply in gold trading.

For example, with a technical analysis, you can trade harmonic patterns, or apply a combination of key levels and technical indicators.

With fundamental analysis, you can build your trading strategy around trading the economic calendar or important news releases.

Here we will choose support & resistance levels and smart money concepts.

Step 3: Select a trading time frame

Your trading time frame will define your trading style. Focusing on hourly time frame, for example, you will primarily catch the intraday moves, while a daily time frame analysis will help you to spot the swing moves.

You can also apply the combination of several time frames.

We will choose the combination of a daily and an hourly time frames.

Step 4: Define your trading zones

By a trading zone, I mean an area or a level on a price chart from where you will look for trading opportunities.

For example, a technical indicator trader may apply moving average as the trading point.

For the sake of the example, we will choose support and resistance levels on a daily time frame as our trading areas.

Step 5: Choose confirmations

Confirmation is your entry reason . It is the set of conditions that indicates a highly probable projected outcome.

For an economic calendar traders, the increasing CPI (inflation) figures can be a solid reason to open a long position on Gold.

Our confirmation will be a local change of character on an hourly time frame.

Step 6: Define your stop loss placement, entry and target selection and desired reward to risk ratio

You should know exactly where should be your entry point, where will be your stop loss and where should be the target.

We will open a trading position immediately after a confirmed change of character, stop loss will lie below the lows if we buy or above the highs if we sell.

Target will be the next daily structure.

Minimal reward to risk ration should be 1.5.

Step 7: Define Your Lot Size and Risk Per Trade

You should have precise rules for the calculation of a lot size for each trade.

For our example, we will strictly risk 1% of our trading deposit per trade.

Step 8: Set trade management rules

When the trade is active, trade management rules define your action:

for example, whether you strictly wait for tp or sl, or you apply a trailing stop loss.

In our strategy, we will move stop loss to entry 10 minutes ahead of the release of the US news in the economic calendar.

Step 9: Back test your strategy

Study the historical data and back test at least 50 trading setups that meet your strategy criteria.

Make sure that the strategy has a positive win rate.

Step 10: Try a trading strategy on a demo account

Spend at least a month on demo account and make sure that you obtain positive overall results.

If you see consistent profits on a demo account, it is the signal for you that your strategy is ready , and it's time to start trading on a real account.

In case of negative results, modify your trading conditions and back test them again, or build a new strategy from scratch.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD → Retest of consolidation resistance. Breakout?FX:XAUUSD is consolidating in a symmetrical triangle pattern. The price is stabilizing amid a falling dollar and uncertainty...

Gold is recovering after falling to $3,283 thanks to a weaker dollar and lower bond yields amid concerns over Trump's new tariff threats. The announced tariffs against seven countries, including Brazil and the Philippines, have heightened tensions, partially offsetting the Fed's hawkish signals. Markets are now awaiting new data from the US and speeches by Fed officials, which could influence the further dynamics of gold.

Technically, gold is squeezed between the resistance and support of a symmetrical triangle. The price is being aggressively pushed away from support within a bullish trend, but at the same time, gold is testing resistance for the fifth time, which only increases the chances of a breakout.

Resistance levels: 3330, 3345, 3358

Support levels: 3308, 3295

If gold continues to storm the local resistance at 3330 and the triangle resistance during consolidation, we will have a good chance of catching the breakout and growth. An additional scenario could be growth after a shake-up of the triangle support and the global trend.

Best regards, R. Linda!

DeGRAM | GOLD held the trend line📊 Technical Analysis

● Bulls defended the channel‐base 3 280 zone, breaking the six-week falling wedge and reclaiming 3 312; structure flips to higher-highs within the rising channel.

● A close above the wedge lip at 3 355 should unlock the grey range ceiling where the May trend-cap and 3 430 – 3 450 intersect. Pull-backs into 3 300-3 312 are expected to attract bids while the wedge retest holds.

💡 Fundamental Analysis

● US headline-CPI cooled for a second month, knocking 2-yr real yields to one-month lows and trimming Fed-cut timing, while PBoC data show June net gold purchases resuming—both reviving spot demand.

✨ Summary

Long 3 300-3 320; breakout >3 355 eyes 3 430 → 3 450. Invalidate on an H4 close below 3 280.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

I can't say that was a bad day or week. We got the move from 3310 into our Excalibur target level 3332 and then started looking for a potential reversal. Gold, again, had other plans and just continued to activate Excalibur after Excalibur higher combined with the red box break and close, so all we could do as mentioned in the earlier post, is call it a week early.

For now, we have support at the 3350-45 level with resistance here at 3370. I don't think they will want to leave a wick on that 4H, so let's expect a potential retest of resistance.

The week in Camelot:

RED BOX TARGETS:

Break above 3350 for 3355✅, 3360✅, 3362✅, 3365✅, 3374, 3388 and 3396 in extension of the move

Break below 3335 for 3331✅, 3324✅, 3321✅, 3310✅, 3306✅ and 3293✅ in extension of the move

Wising you all a great weekend,

As always, trade safe.

KOG

Gold's Short-Term Decline: What's Next?Hello everyone, what do you think about gold?

Today, gold continues its short-term downtrend. After new data was released at the end of yesterday’s trading session, the USD rose by 0.3%, and U.S. Treasury yields also increased, reducing the appeal of gold. Additionally, the latest unemployment claims data shows improvement in the U.S. economy, which has contributed to the drop in the precious metal.

As of writing, gold is trading around the EMA 34, 89 levels at 3,336 USD. With the recent news, the market is expected to maintain its current stance throughout the day, as no new significant updates are expected.

From a technical standpoint, the downtrend remains in place, with prices continuing to be capped below the trendline. The series of lower highs and lows could likely lead XAUUSD to test lower levels, with the possibility of reaching the 3,300 USD mark.

What do you think about the price of gold today? Let us know in the comments!

XAU/USD : Gold at a Turning Point – Rejection or Breakout Ahead?By analyzing the TVC:GOLD (XAUUSD) chart on the 4-hour timeframe, we can see that price climbed to $3330 today, entering a key supply zone, which triggered a pullback down to $3310. Gold is now trading around $3317, and I’m watching several potential setups closely.

Scenario 1:

If gold stabilizes below $3320, we could see a bearish move toward $3296.

Scenario 2:

If price breaks above the $3333 resistance, it may enter the next supply zone between $3341 and $3351, which could trigger a strong rejection—potentially offering a 100 to 400 pip move.

Now let’s break down the key levels to watch:

Supply zones: $3320, $3333, $3342, $3358

Demand zones: $3303, $3296, $3289, $3278

Monitor how price reacts to each of these zones — they may provide excellent opportunities.

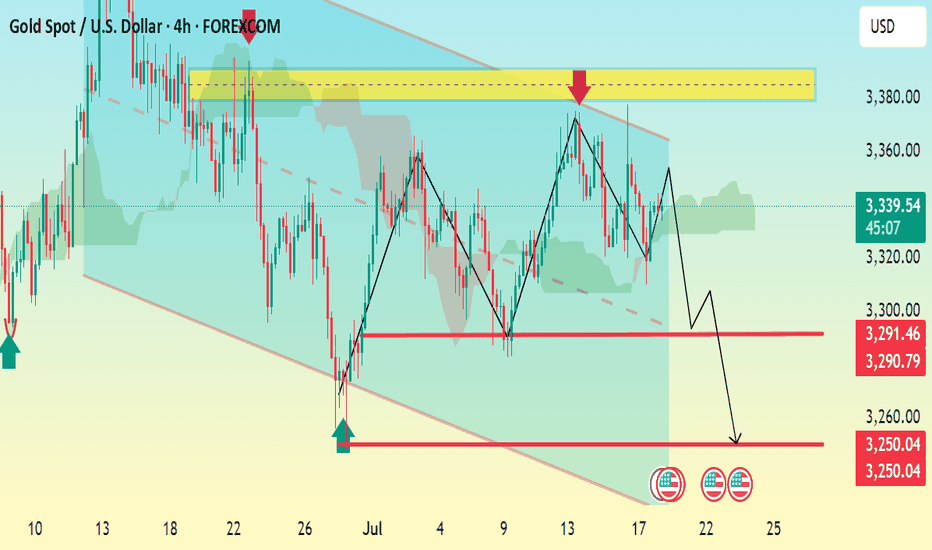

XAU/USD 4H Bearish Continuation Setup Analysis:Price recently rejected from the key resistance zone around 3,370–3,380 (highlighted in yellow).

A double top pattern is evident, indicating bearish pressure.

Price broke the rising trendline support and is forming lower highs.

Immediate support levels lie at:

3,291.46

3,290.79

A confirmed break below this support could send price toward the next major support at 3,250.04, which aligns with the projected move.

Bearish Bias:

As long as price remains below 3,344, the structure favors further downside.

Watch for a break and retest of the 3,291–3,290 zone for confirmation.

📉 TP Zones:

TP1: 3,291

TP2: 3,250

🛑 Invalid if price breaks above: 3,344