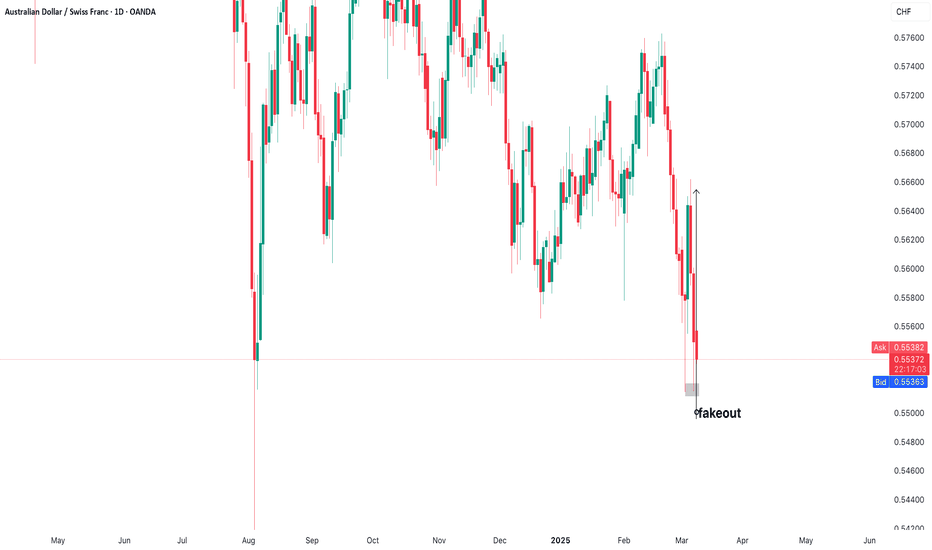

Bullish bounce?AUD/CHF is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 0.55517

1st Support: 0.55053

1st Resistance: 0.56177

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CHFAUD trade ideas

POTENTIAL LONG TRADE SET UP FOR AUDCHFAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

The price has approached the lower bound of a bullish continuation structure on the higher time frame (HTF) with a descending structure on the Mid time frame (MTF). We will now monitor for a bullish impulse and continuation structure to identify a potential entry point for the trade.

Expectation: A upward move is expected, targeting the upper bound of the HTF bullish continuation structure.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!

AUD/CHF 1-Hour & 4-Hour Bullish Divergence (Potential Reversal)AUD/CHF is signaling a potential bullish reversal on the 1-hour and 4-hour charts, with a double timeframe bullish divergence between price action and momentum oscillators (RSI and MACD). This setup indicates weakening bearish momentum and a possible upward correction.

Key Observations

4-Hour Chart:

Price Action: Lower lows (LL) in the downtrend.

RSI (14): Higher lows (HL), forming a clear bullish divergence.

MACD: Histogram shows declining bearish pressure; signal line approaching a bullish crossover.

1-Hour Chart:

Price Action: Lower lows (LL) aligning with the broader 4H trend.

RSI (14): Consecutive higher lows (HL), reinforcing divergence on the shorter timeframe.

Support Zone: Price consolidating near a historical support area.

Technical Analysis

Bullish Divergence Confluence:

Divergences on both timeframes strengthen the reversal case. The 4H divergence suggests a larger trend shift, while the 1H chart offers a precise entry trigger.

Price Structure:

A breakout above the descending trendline (connecting recent highs) would validate bullish momentum.

MACD Confirmation:

A bullish crossover on the MACD (4H) would add further conviction.

Trade Setup

Entry Trigger:

Confirm a close above the 1-hour descending trendline (drawn from recent swing highs).

Look for bullish candlestick patterns (e.g., hammer, bullish engulfing) near support.

Targets:

TP1: First major resistance level (e.g., previous swing high).

TP2: Higher-timeframe Fibonacci retracement level (e.g., 61.8% of the recent downtrend).

Stop Loss:

Place SL below the recent swing low to protect against downside volatility.

Risk Management

Limit risk to 1-2% of trading capital.

Trail stops to breakeven once price reaches TP1.

Monitor macroeconomic factors (e.g., SNB policy, AUD risk sentiment).

Conclusion

The alignment of bullish divergences on 1H and 4H timeframes, combined with a key support zone, hints at a potential AUD/CHF reversal. Always wait for price confirmation (e.g., trendline breakout) before entering. Manage risk tightly, as divergences can fail if broader trends persist.

Update charts and set alerts for technical triggers!

Indicator Settings: RSI (14), MACD (12,26,9).

Timeframe Strategy: Use 4H for trend context, 1H for entry precision.

Remember: Divergence signals require confirmation. Trade with discipline! 🚀

aud recovery and risk on quant zones trackingalready with bull flow

Check out our socials for some nice insights.

Let us know if there're any pair you like to see or if this is something you like.

Do ask if you have any question

Not as refined as our direct trade setups. More for advanced active traders.

information created and published doesn't constitute investment advice!

NOT financial advice

AUDCHF Short: Trade Closed| +240 Pips | 8RAUDCHF Short: Trade Closed ✅ | +240 Pips | 8R

This trade was built on a strong confluence of factors:

📉 Trend Analysis – Downtrend confirmed a sell bias

📊 Overbought Conditions – A prime reversal setup

🔻 Sell Story – Price action aligned with short positions

📈 COT Data

CHF: Bullish positioning from institutional traders

AUD: Bearish positioning, reinforcing downside momentum

🛑 Sentiment – Bearish AUD, Bullish CHF

🔍 Technical Factors:

No VIX Fix – No volatility spike signaling reversal

.382 Daily Level – Key Fibonacci resistance zone

Mean Reversion – Price returned to equilibrium

Executed, managed, and secured the move for a +240 pip gain at an 8R reward. Another lesson in patience and execution. 🎯

📊 On to the next setup! #Forex #AUDCHF #PriceAction #COT #FXTrading

AUD/CHF Bullish retracementBased on higher time frames, we are prepared for buying rather than selling. At the support zone, be cautious of potential false breakouts. False breakouts almost always occur at important levels due to the placement of stop loss orders above or below the level. To avoid triggering stop losses, it is best to wait for a false breakout and then enter in the opposite direction.

AUD-CHF Local Long! Buy!

Hello,Traders!

AUD-CHF went down and

The pair made a retest of the

Horizontal support level

Of 0.5514 from where

We are already seeing a

Bullish rebound and we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

POTENTIAL SHORT TRADE SET UP FOR AUDCHFAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price has reached the upper boundary of a higher time frame (HTF) bearish continuation structure, approaching this zone with an ascending channel on the mid time frame (MTF). On the lower time frame (LTF), a bearish impulse has developed, and we will be watching for a continuation pattern to pinpoint a potential entry point for the trade.

Expectation: A downward move is anticipated, targeting the lower boundary of the HTF bearish continuation structure.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!

AUD/CHF BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/CHF pair is in the downtrend because previous week’s candle is red, while the price is clearly falling on the 1H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 0.557 because the pair oversold due to its proximity to the lower BB band and a bullish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅

Bullish rise?AUD/CHF has reacted off the pivot which acts as a pullback resistance and could potentially rise to the 1st resistance which has been identified as an overlap resistance.

Pivot: 0.5618

1st Support: 0.5577

1st Resistance: 0.5680

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish rise?AUD/CHF has reacted off the resistance level level which is a pullback resistance and could rise from this level to our take profit.

Entry: 0.5616

Why we like it:

There is a pullback resistance level.

Stop loss: 0.5581

Why we like it:

There os a pullback support level.

Take profit: 0.5679

Why we like it:

There is an overlap resistance level that is slightly above the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDCHF SELL OPPORTUNITY AUDCHF provides a sell opportunity as price retraced to a pullback resistance which aligns with 23.6% Fibonacci retracement level a sell opportunity is envisaged from the current market price. The stop loss is placed at 0.56370 (50% fibo retracement ) and take profit is at the low price of 0.54905