EUR/CHFKey Observations:

Support Area:

A brown-highlighted support zone indicates a potential area where price has historically found buyers.

Price recently touched this area and is showing signs of reaction.

Order Blocks (OB):

A Bullish OB is present below the current price, which suggests a potential demand zone.

Bearish OBs are present above, indicating potential resistance.

Fair Value Gaps (FVG):

Several FVG zones are highlighted, suggesting inefficiencies in price that could be revisited before continuing the trend.

Trade Setup:

A long position (buy trade) appears to be placed, targeting 0.97085 with a stop-loss around 0.94465.

This suggests a bullish bias, expecting price to move upwards after rejecting the support.

Bullish Scenario:

If price holds above the support area and fills the nearby FVGs, it could aim for the 0.96000-0.97000 range.

Breaking above the Bearish OBs would confirm further upside.

Bearish Scenario:

If price fails to hold the support and breaks below 0.95000, it could continue downward to 0.94465 or lower.

Rejection at the Fair Value Gap above could push price back down.

CHFEUR trade ideas

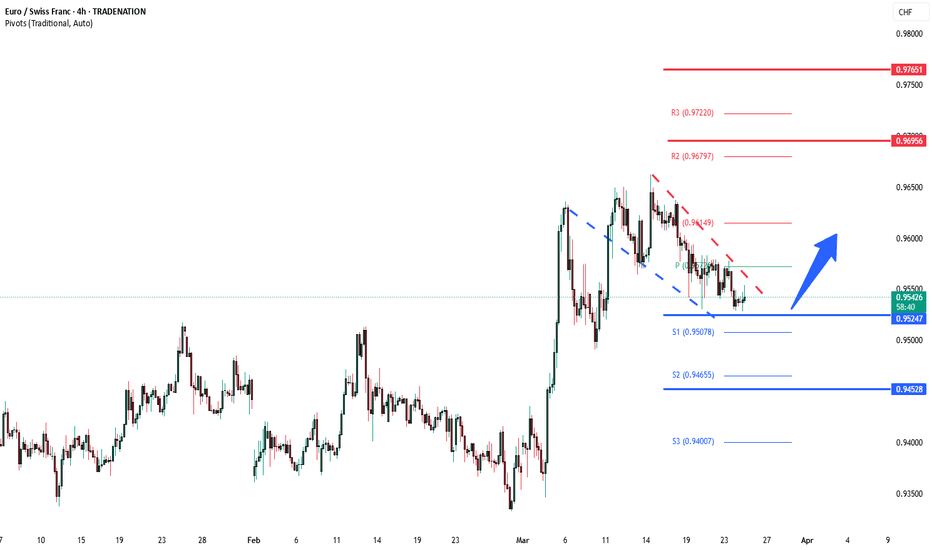

EURCHF My Opinion! BUY!

My dear friends,

EURCHF looks like it will make a good move, and here are the details:

The market is trading on 0.9524 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal -0.9565

Recommended Stop Loss - 0.9499

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF support retest at 0.9530The EUR/CHF currency pair is showing a bullish sentiment, supported by the prevailing long-term uptrend. Recent intraday price action indicates a bullish breakout from a sideways consolidation phase, with the previous resistance now acting as a new support zone.

Key Support and Resistance Levels:

Support Zone: The critical support level to watch is 0.9530, representing the previous consolidation price range. A corrective pullback toward this level, followed by a bullish rebound, would confirm the continuation of the uptrend.

Upside Targets: If the pair sustains a bounce from 0.9530, it may aim for the next resistance at 0.9640, followed by 0.9665 and 0.9690 over the longer timeframe.

Bearish Scenario: A confirmed break and daily close below 0.9530 would negate the bullish outlook and increase the likelihood of further retracement. In this scenario, the pair could retest the 0.9500 support level, with further downside potential toward 0.9450.

Conclusion:

The bullish sentiment for EUR/CHF remains intact as long as the 0.9530 support holds. Traders should monitor the price action at this key level to assess potential buying opportunities. A successful bullish bounce from 0.9530 would favor long positions aiming for the specified upside targets. However, a break below 0.9530 would signal caution and increase the risk of a deeper pullback.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

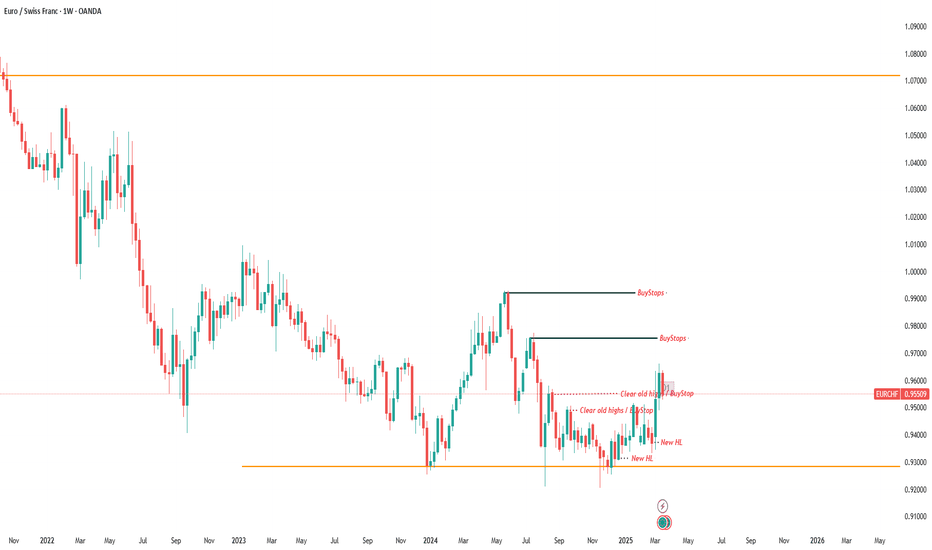

Possible Long EURCHF Set but DATE: 17/03/2025The HTF charts, specifically the M1 and W1 charts, indicate that this pair has been on a long-term downward trend. However, the W1 chart has begun to show signs of change over the past few weeks in December, with the trend now producing new higher highs and higher lows. Considering the highs from the last downswing, the pair is still trading at a discount.

Next, we will look at the D1 and H4 charts. The Fair Value Gap (FVG) that was created yesterday was nearly filled today, making this price area of interest for potential long entries, as depicted in the charts.

Let's wait for the for fundamentals, and the DXY, to confirm our trade

EURCHF POTENTIAL LONG SWING TRADEHello hello TradingView community! Hope you guys are doing fantastic! Just wanted to come on here and make a post for a potential opportunity I see for potential buying opportunities on EURCHF currency pair! So let's dive right in

OK so first things first. The reason I am looking at this currency pair as an opportunity to trade is the huge influx of buyer volume and interest that came in around 0.93500 price handle which sent prices over 300 pips to the upside. Which is a large move for the EURCHF pair. With that in mind and considering as retail traders we do not move the markets this displayed to me large player interest in buying the EURO vs the SWISS FRANC and put this on high alert for me.

So how do we get involved? Well for me I like to keep it simple...WAIT FOR A DISCOUNT. So for me I am waiting for prices to potentially pullback to the 0.94100-0.94200 price region before looking for buys.

Confluences I am seeing are a Fibonacci retracement alignment, demand zone, & potentially if we can get oversold conditions on the RSI as well that would be great.

OK guys hope this brings some value to you and to all my currency traders out there please boost this post and follow my page for more accurate analysis and setups!

Cheers!

EURCHF Strong Retracements 0327SGT 23032025Price shown that they retraced strongly based on previous price actions.

Also, price is currently oversold, I am expecting price to reverse back strongly.

That will be a good area to sell from.

0328SGT 23032025

Not saying I would be selling. Just saying what I want to record.

0328SGT 23032025

EURCHF Strong Retracements 0327SGT 23032025

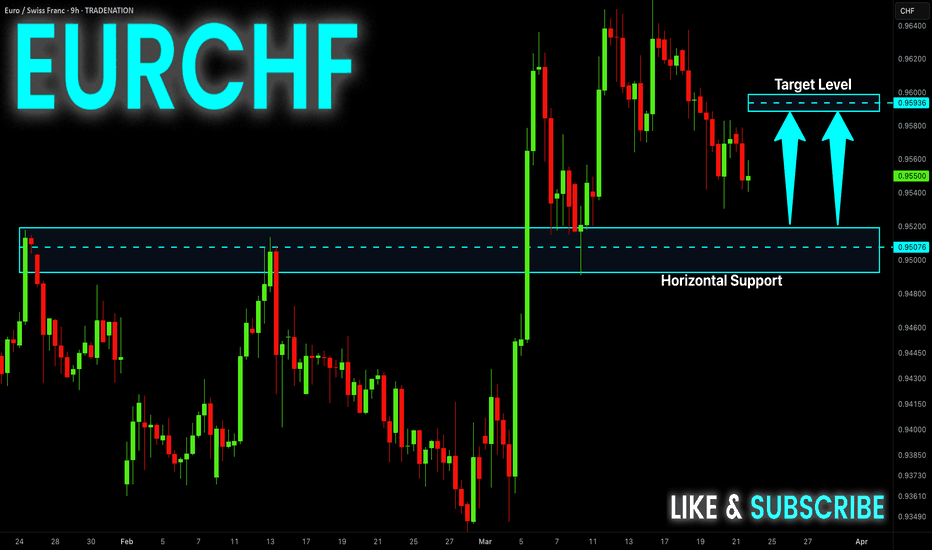

EUR-CHF First Down, Then UP! Buy!

Hello,Traders!

EUR-CHF keeps falling down

After making it through the

Local structure of 0.9580

So we think that the pair will

First fall further down to

Retest the horizontal support

Of 0.9507 and after that

We will see a rebound and

A new wave of growth

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF: Expecting Bullish Continuation! Here is Why

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURCHF pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/CHF BUYERS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

EUR/CHF is trending up which is clear from the green colour of the previous weekly candle. However, the price has locally plunged into the oversold territory. Which can be told from its proximity to the BB lower band. Which presents a great trend following opportunity for a long trade from the support line below towards the supply level of 0.963.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR_CHF SUPPORT AHEAD|LONG|

✅EUR_CHF will be retesting a support level of 0.9500 soon

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

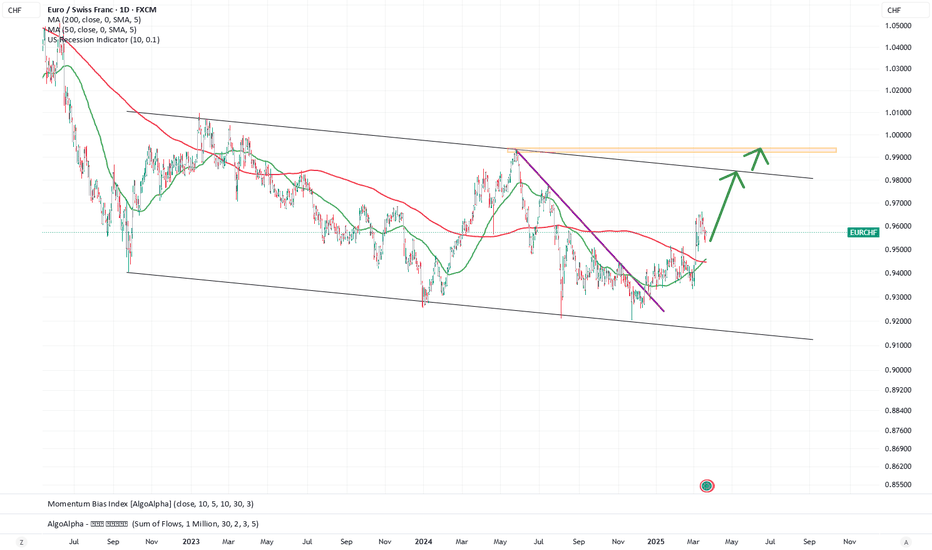

Long EURCHFGood morning traders,

EURCHF is above 200 MA, higher lows and higher highs after bottom at 0.92 . I´m expecting a bullish leg till 0.98 area

Scenario will be cancelled below 0.94 on a daily basis

6 Trading Rules :

1. Never add to a losing position .

2. Don´t be the first to buy low and sell high ., and don´t be the last one to exit

3. Think like a fundamentalist, trade like a technician .

4. Keep your analysis simple

5. Start small and increase exposure when trend is confirming your analysis

6. The hard trade is the right trade

Have a great weekend

Plan your trade ahead of time to avoid impulsive decisions All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade then this is how you will gain consistency in you trading and build confidence

www.tradingview.com

EURCHF LongHi Everyone,

Hope you are all well and enjoyed my gold signal that hit all TP's

Here is our EURCHF Signal. wait for the 15 minute candle to close above the entry, and then for price to respect the entry, then we can enter. Here are the numbers.

EURCHF Buy

📊Entry: 0.95727

⚠️Sl: 0.95176

✔️TP1: 0.96349

✔️TP2: 0.97141

✔️TP3: 0.98148

Stick to the rules

Hope you all earn lots of profit.

Best wishes,

Sarah