CHFGBP trade ideas

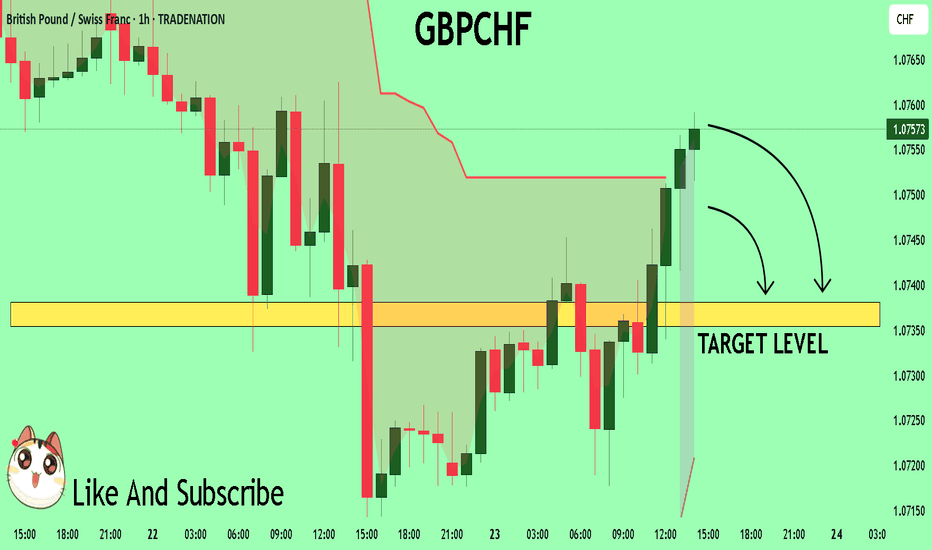

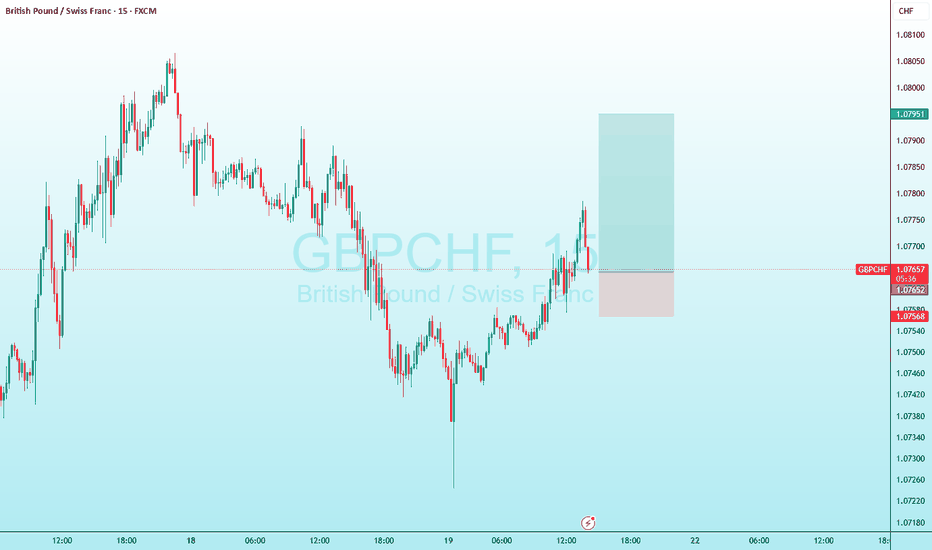

GBPCHF My Opinion! SELL!

My dear followers,

I analysed this chart on GBPCHFand concluded the following:

The market is trading on 1.0756 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0738

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

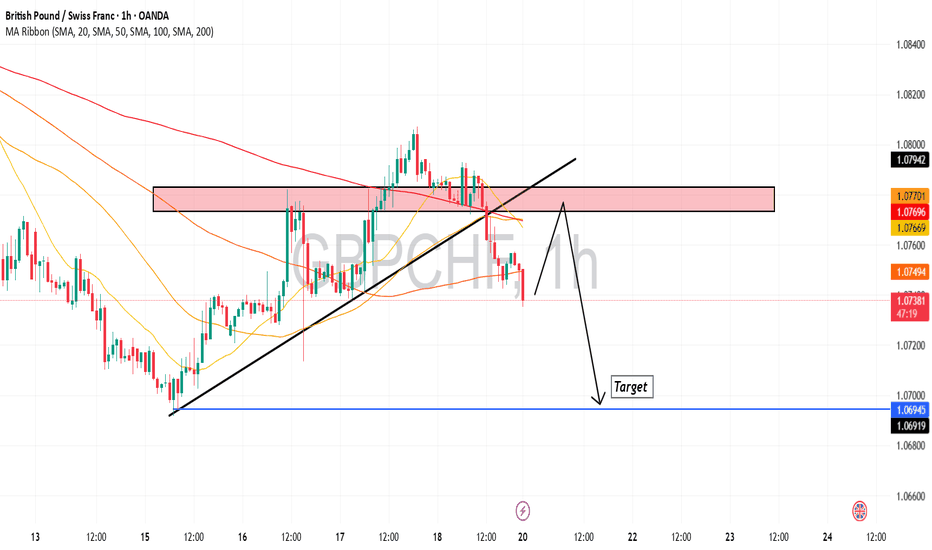

GBPCHFGBPCHF is currently in a downtrend, confirmed by a series of lower highs and lower lows.

The pair has recently formed a bearish engulfing candle below the minor resistance zone near 1.07400, signaling renewed bearish pressure.

Price rejection from the 50 EMA suggests sellers are still in control.

RSI is trending downward, staying below 50, indicating bearish momentum without being oversold.

GBPCHF is in the Selling from ResistanceHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

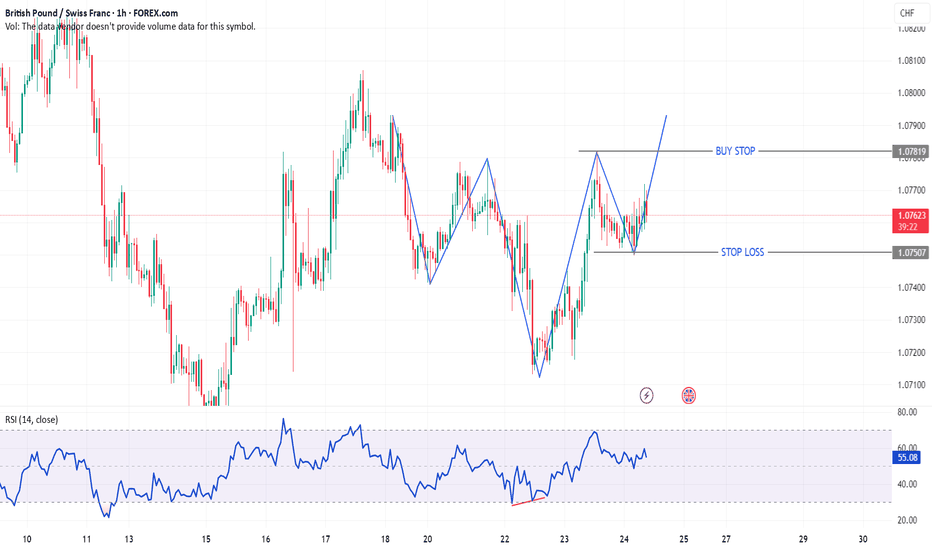

GBPCHF Trading Opportunity! BUY!

My dear followers,

This is my opinion on the GBPCHF next move:

The asset is approaching an important pivot point 1.0737

Bias - Bullish

Safe Stop Loss - 1.0728

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.0756

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

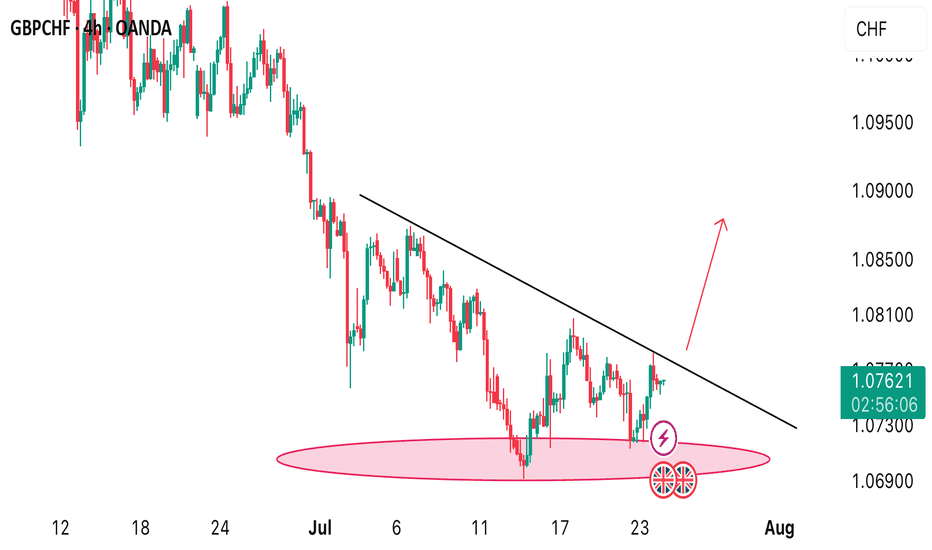

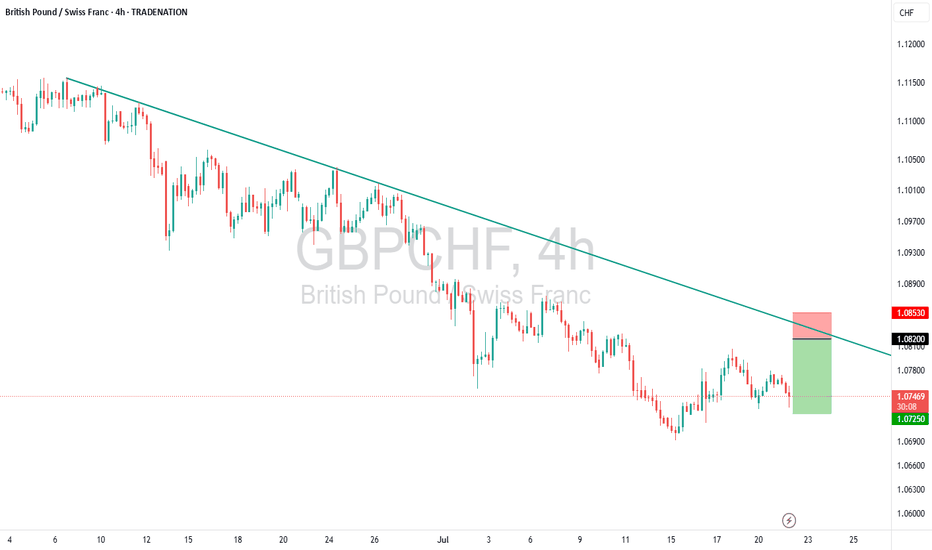

GBPCHF oversold bounce backs capped at 1.0826The GBPCHF pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the falling resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 1.0826, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 1.0826 could confirm the resumption of the downtrend, targeting the next support levels at 1.0653, followed by 1.0607 and 1.0545 over a longer timeframe.

Conversely, a decisive breakout and daily close above 1.0826 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 1.0870, then 1.0936.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 1.0826 Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

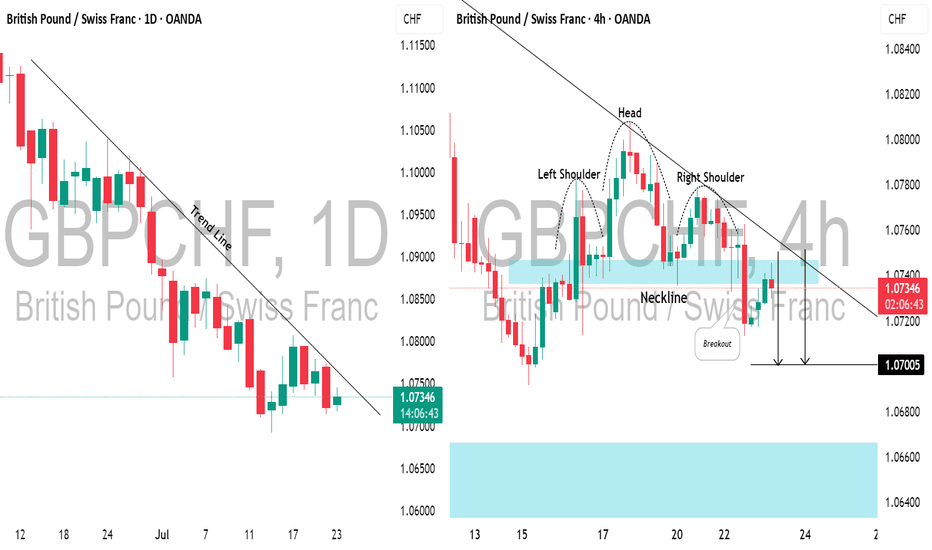

GBPCHF: Bearish Move From Trend LineI spotted a strong descending trend line on 📉GBPCHF, with the price rising to that last week on a daily.

As it tested this level, the pair formed an inverted head and shoulders pattern on a 4-hour time frame.

The neckline has recently been broken and retested.

I anticipate a bearish move towards the 1.0700 level now.

GBPCHF – Fade the Rally Ahead of ResistanceTrade Idea

Type: Sell Limit

Entry: 1.0820

Target: 1.0725

Stop Loss: 1.0853

Duration: Intraday

Expires: 23/07/2025 06:00

Technical Overview

Although price action suggests a short-term bottom, the broader bias remains bearish.

A corrective bounce is expected to stall at the weekly pivot (1.0820) — a key resistance level.

With gains likely to be limited, the preferred strategy is to sell into strength with a tight stop just above.

If momentum turns lower from 1.0820, the path toward the support target of 1.0725 offers attractive potential.

BoE Governor Bailey’s speech today (22/07 at 10:15 BST) could introduce volatility, potentially triggering the setup or stop.

Key Technical Levels

Resistance: 1.0820 / 1.0905 / 1.1030

Support: 1.0740 / 1.0610 / 1.0535

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

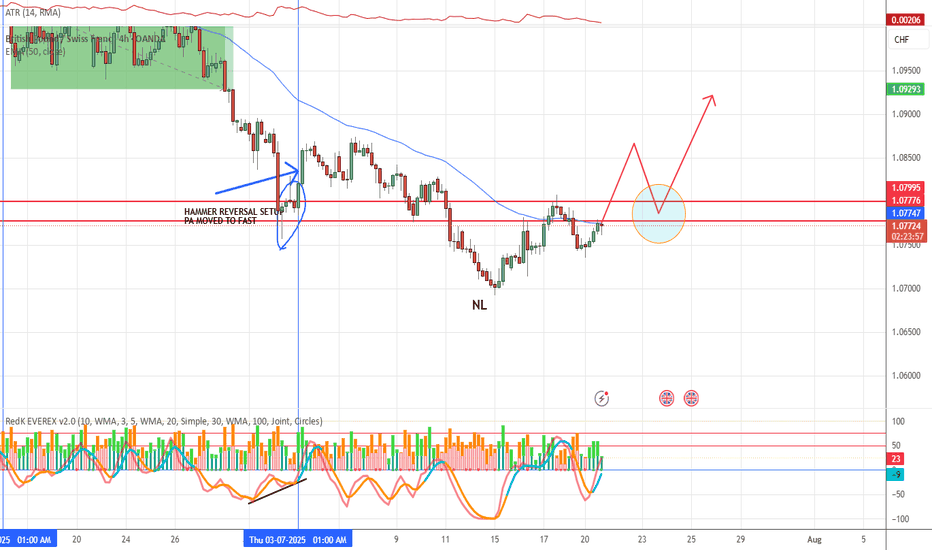

GBP/CHF POSSIBLE SETUPWatching for Pullback + V/M Alignment

We’re watching this market to see if price will break above current resistance then pull back into the key support/resistance zone.

What we want to see:

✅ Volume increasing in the direction of the trend

✅ Momentum aligning — ideally rising and then hooking back in trade direction

✅ A clean engulfing candle at or near the 50EMA

✅ Pullback must reach the recent broken high/low (structure matters)

This is classic VMS strategy setup behavior — no need to predict, just prepare.

📌 Discipline is waiting. The setup either shows up or it doesn’t.

We’ll keep watching.

GBPCHF is Ready for a breakthroughHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

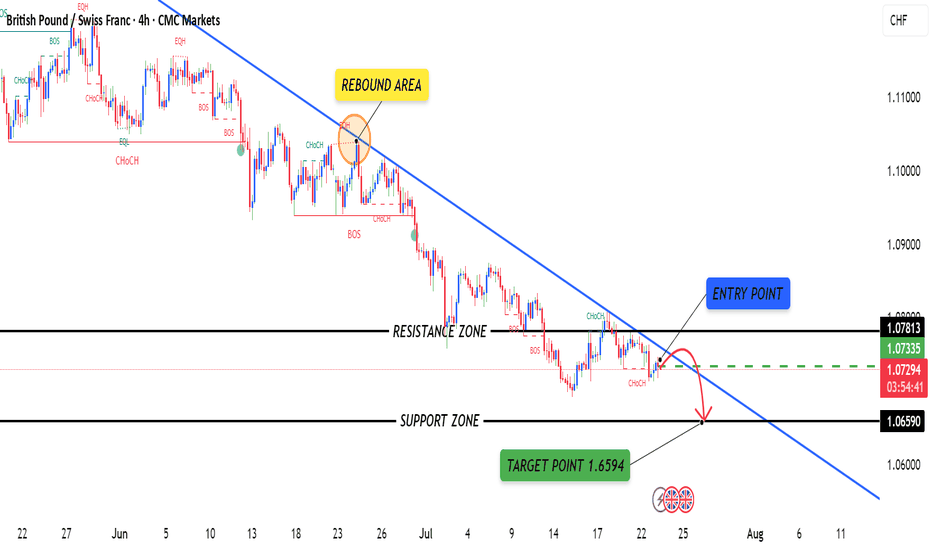

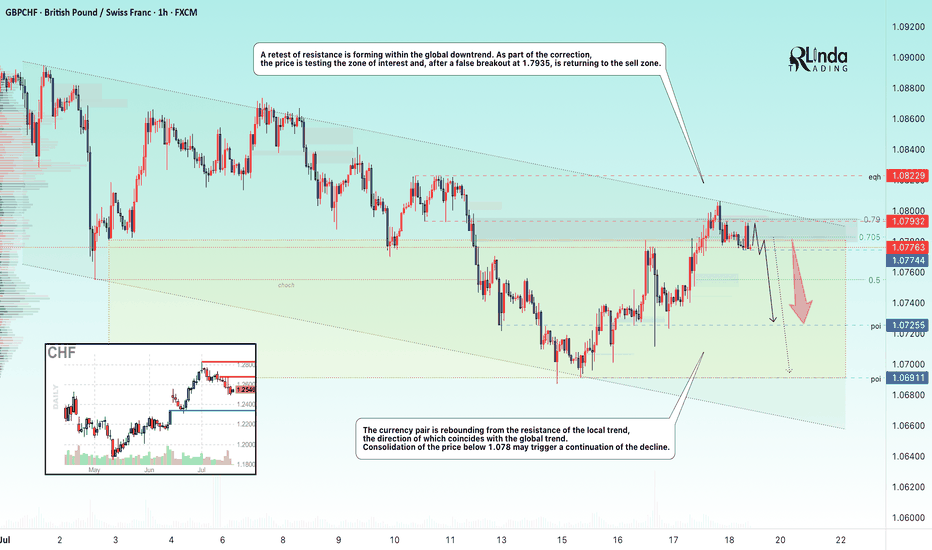

GBPCHF → Retest of resistance to the global downtrendFX:GBPCHF is facing resistance from the local trend, which is aligned with the global bearish trend. The trend may continue...

A retest of resistance is forming within the global downtrend. As part of the correction, the price is testing the zone of interest and, after a false breakout of 1.7935, is returning to the selling zone.

The currency pair is rebounding from the resistance of the local trend, which coincides with the global trend. Consolidation of the price below 1.078 may trigger a continuation of the decline

Resistance levels: 1.07932, 1.0823

Support levels: 1.07744, 1.07255

Price consolidation in the selling zone followed by a break of the local structure could strengthen the bearish sentiment, which could trigger a further decline overall.

Best regards, R. Linda!

GBPCHF may bounce back from 1.0750 support areaGBPCHF may bounce back from 1.0750 support area

GBPCHF reached a low of 1.0687 for the time being and resumed an upward move.

The price rose above a strong support area, indicating increasing momentum. If GBPCHF manages to hold around this area, the chances of further growth will increase.

Key target areas: 1.0800; 1.0820 and 1.0865

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Could the price bounce from here?The GBP/CHF is falling towards the pivot and could bounce to the 1st resistance, which serves as a pullback resistance.

Pivot: 1.0777

1st Support: 1.0739

1st Resistance: 1.0837

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

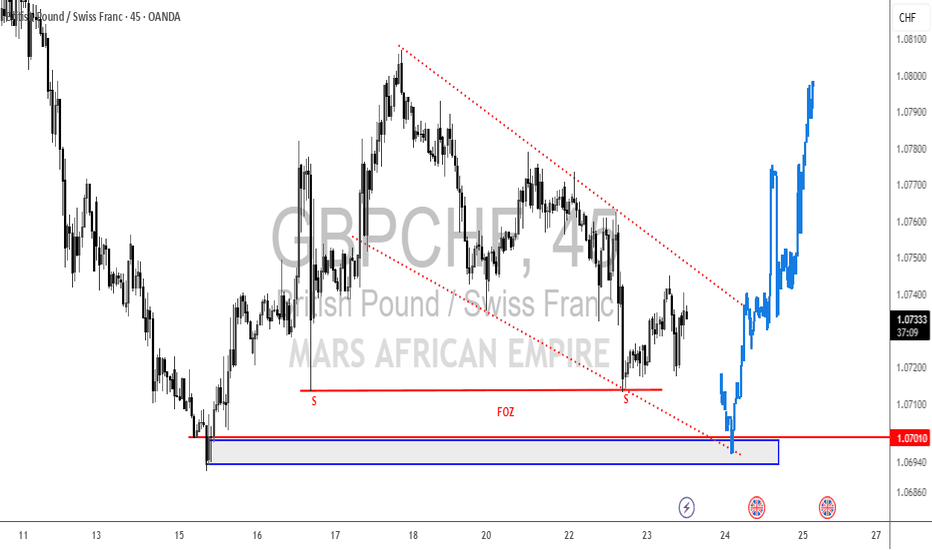

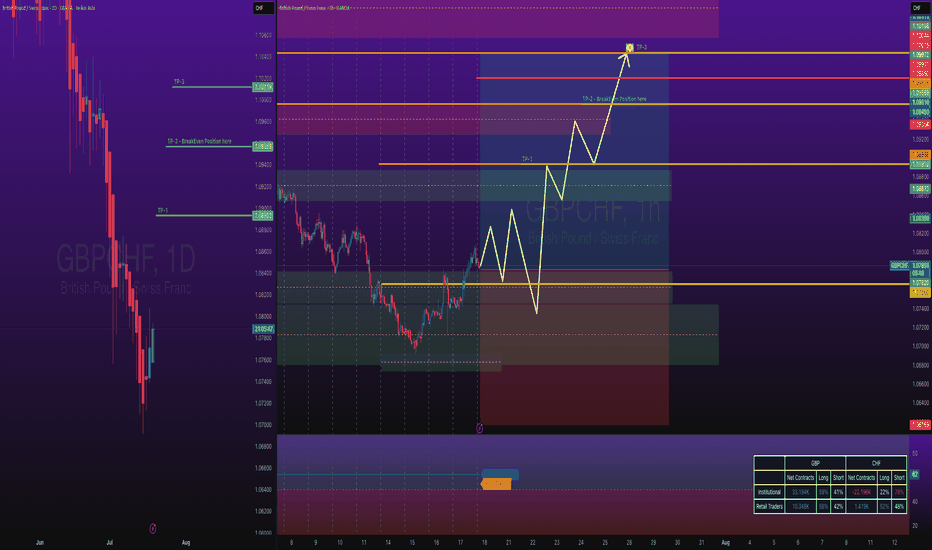

GBPCHF Long Swing Trade - Time to go Long with HedgeFundsOANDA:GBPCHF Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

This is second time I getting into Long of GBPCHF, hedgefunds, banks have already started buying, lets see how much buying pressure we have.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

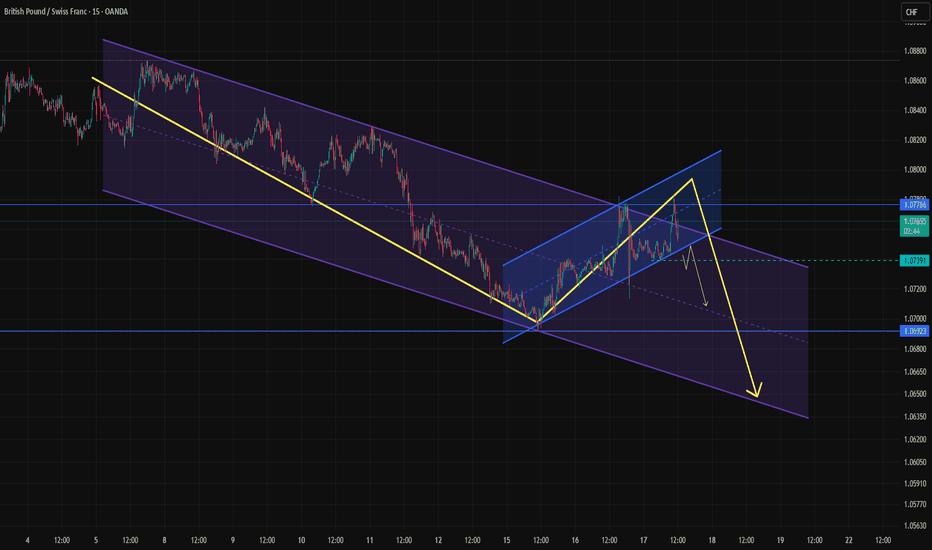

Analysis based on a channel within two cyclesWe have a large descending channel, which appears to be forming a smaller ascending channel as part of a correction.

Once the correction is confirmed and completed, it could provide a good opportunity for a short position.

However, if the lower boundary isn't broken and the price moves higher, we’ll hold off and wait for a new structure to form.