SWISS FRANC / BRITISH POUND forum

Data Breakdown

Factor Score Explanation

COT Positioning -2 Institutional sentiment favors CHF over GBP. Hedge funds appear to be rotating out of GBP.

Retail Sentiment -1 Retail traders are heavily long GBPCHF — contrarian signal to go short.

Seasonality -1 August has historically not been favorable for GBPCHF, especially when CHF gains on risk-off sentiment.

Trend Reading -2 Strong bearish momentum across multiple timeframes. Weekly trend is clearly down.

GDP Differential -2 UK’s GDP is stagnating while Switzerland’s economy remains relatively stable.

PMI Scores (m/s) -4 Both manufacturing and services PMIs are weak in the UK — contraction territory.

Inflation Metrics -3 UK inflation slowing, lowering BoE pressure to hike. Swiss inflation remains well-anchored.

Labor Market -1 UK employment weakening; not supportive of GBP strength.

Interest Rates -1 BoE nearing peak; SNB has hawkish tilt, narrowing the rate differential.

🧨 That’s 14 out of 15 inputs either neutral or negative for GBPCHF — this is rare alignment. This isn’t just a weak currency pair — it’s statistically and fundamentally fragile.

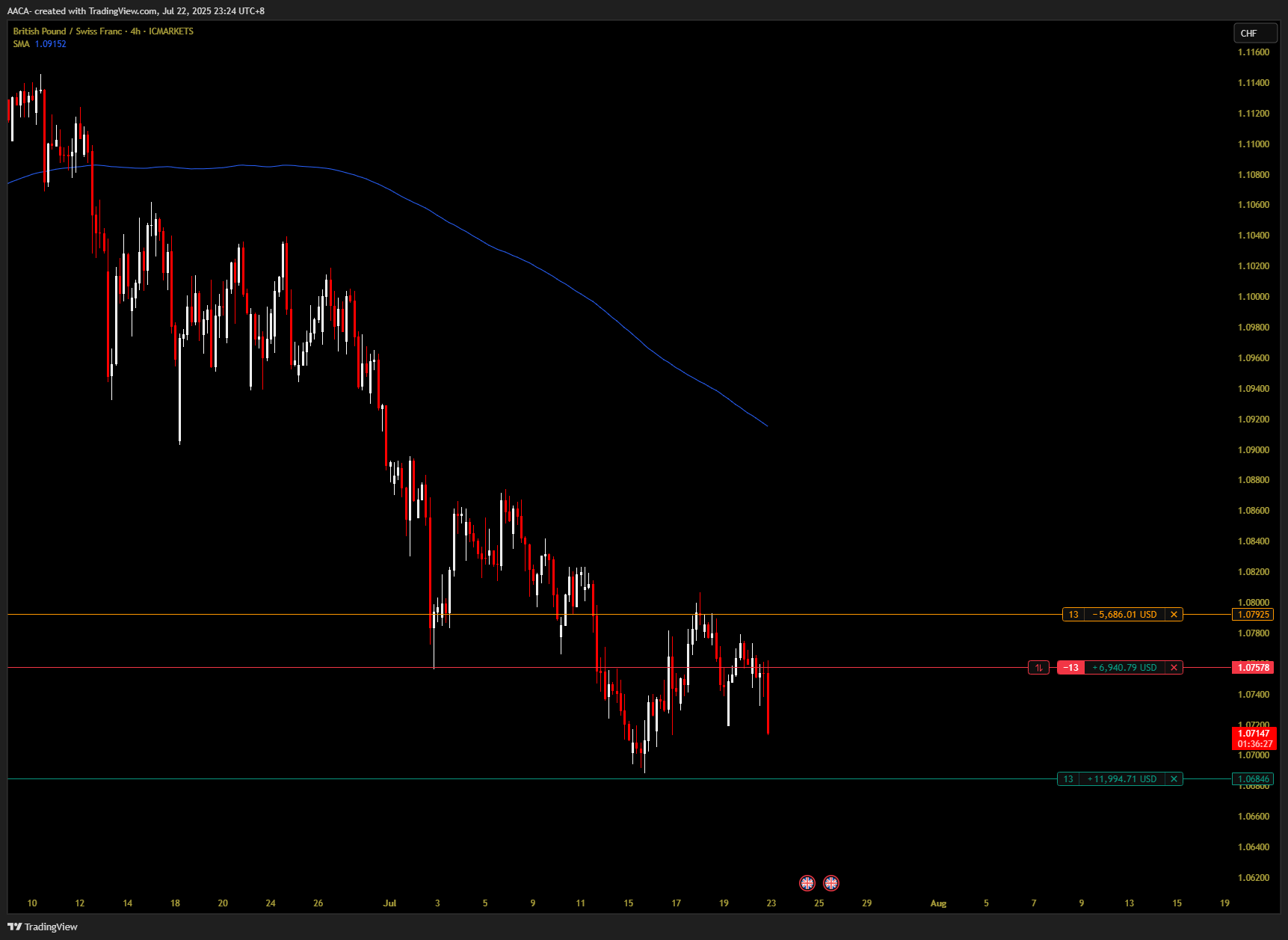

🔔 Why I Like This Setup

GBPCHF is aligned across fundamental, sentiment, and technical dimensions for a bearish continuation. With a clean invalidation level and strong downside potential, this is one of the clearest risk-defined setups on the board.

📌 “Bias + Price Action + Fundamentals + Confluence = Confidence.”

🔍 What the Data Tells Us

GBPCHF stands out this week as one of the strongest bearish setups on my watchlist. The pair earns a Very Bearish rating (-17 — the lowest score among all major pairs I’m tracking.

🧩 Macro context:

UK macro data remains weak: GDP, PMI, and employment metrics are declining

Switzerland continues to benefit from safe-haven flows and SNB’s hawkish tone

Retail crowd still buying GBPCHF — a contrarian bearish signal

Idea link above ^^^

GBPCHF currently has the strongest bearish bias, reflecting widespread weakness across economic, sentiment, and trend-based indicators.

From a sentiment standpoint, institutional traders are reducing exposure to the British pound, while retail traders are predominantly long — which often precedes downside moves. Seasonality doesn’t favor GBP in August either, adding weight to the bearish pressure.

The UK's fundamental backdrop is deteriorating: recent data points to slowing GDP, weak retail sales, and significant declines in both manufacturing and services PMI readings. Labor market strength is fading, and inflation is easing, which could force the Bank of England to pivot toward rate cuts or, at the very least, a pause in hikes.

In contrast, the Swiss economy remains relatively stable. Inflation is under control, and the Swiss Franc continues to attract capital due to its safe-haven reputation, especially during periods of global uncertainty. With the SNB showing no urgency to adjust rates and the UK outlook worsening, policy divergence is increasingly favoring CHF strength over GBP.

ripe n ready

shorted @ 1.0748