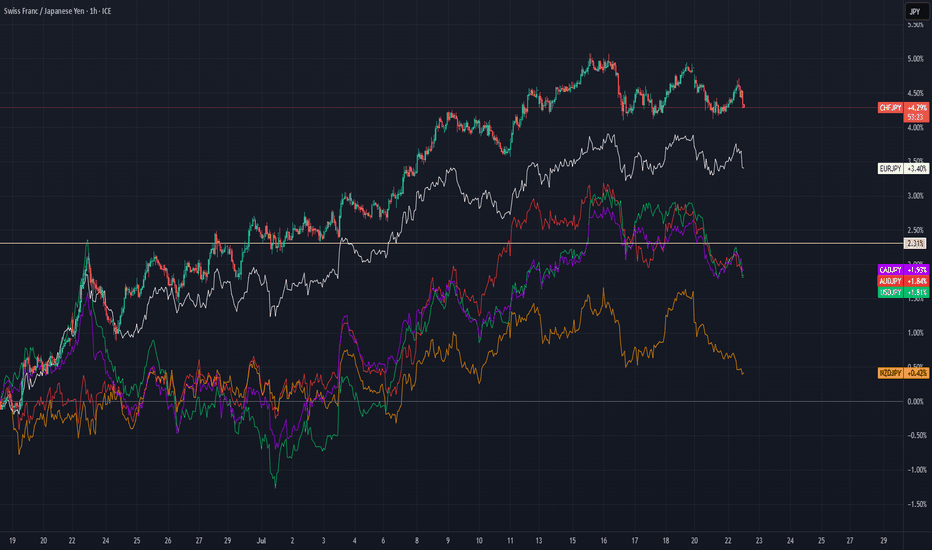

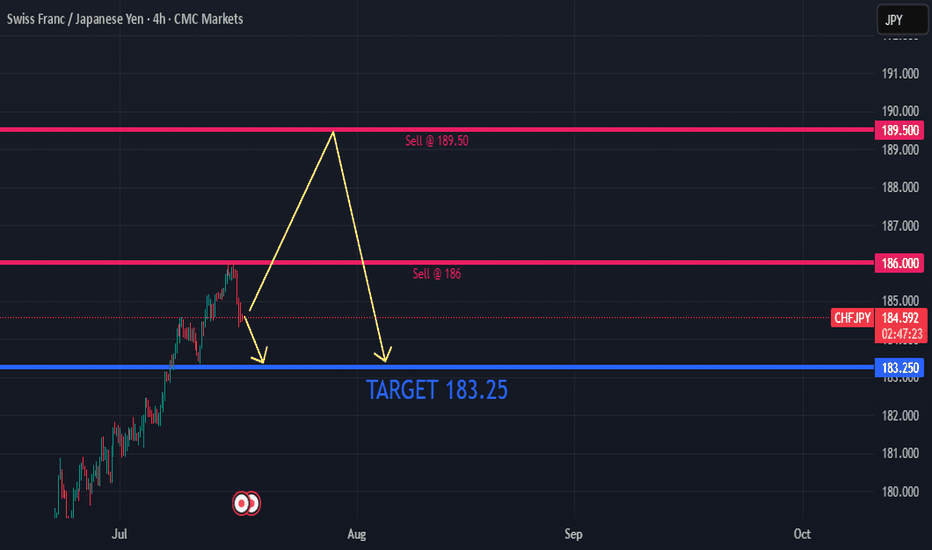

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

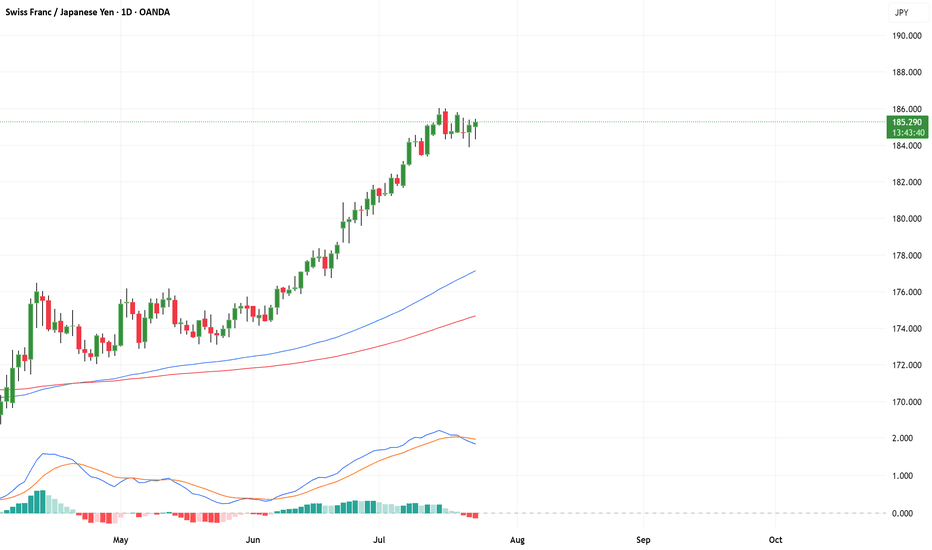

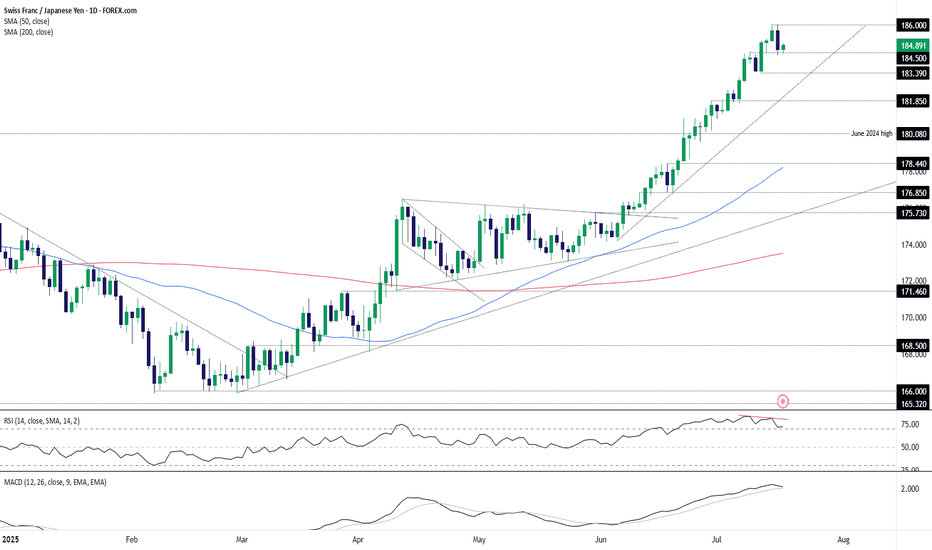

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

CHFJPY trade ideas

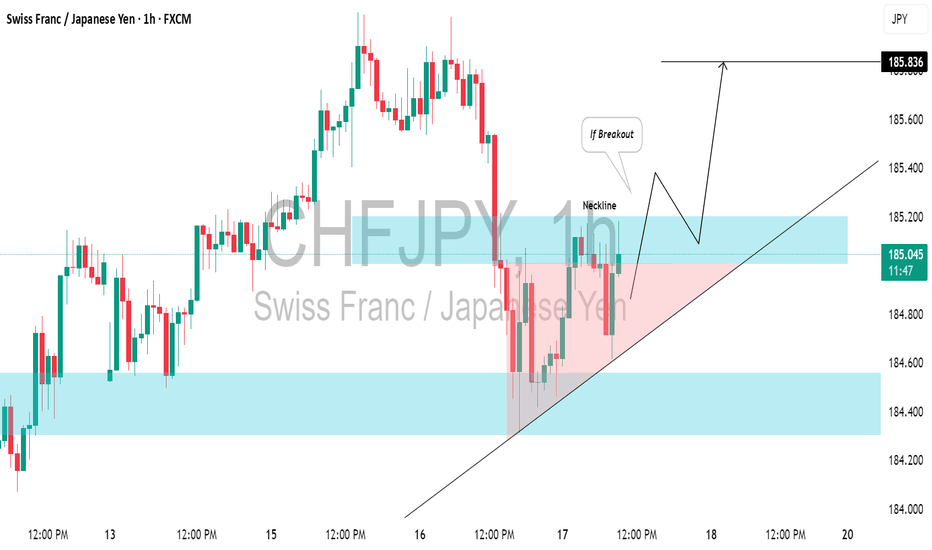

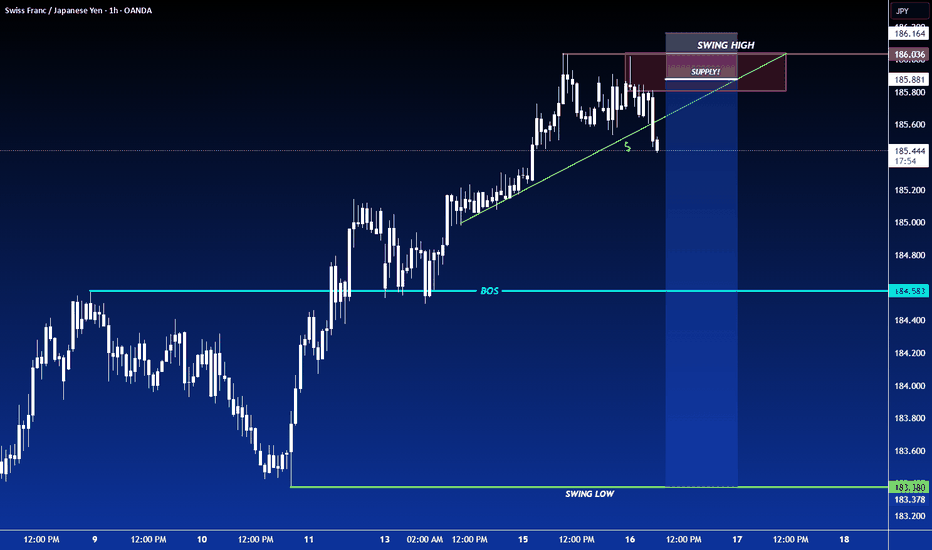

CHFJPY: Your Trading Plan For Today⚠️CHFJPY is currently testing a recently breached key daily/intraday resistance level, which is likely to have become support.

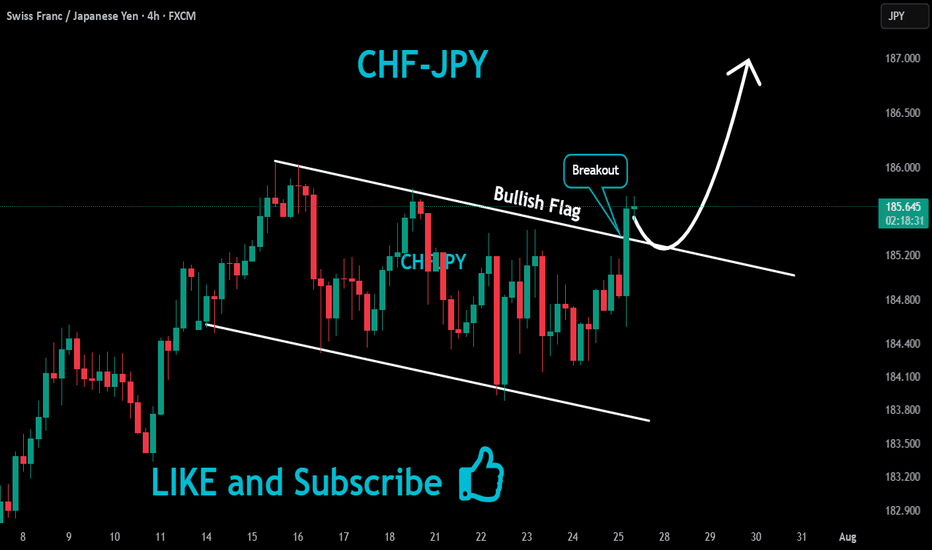

We will look for a confirmation to buy when there is a bullish breakout above the neckline of an ascending triangle pattern on the 1-hour chart.

A close above 185.20 will validate this breakout, and we anticipate a bullish continuation towards at least 185.83.

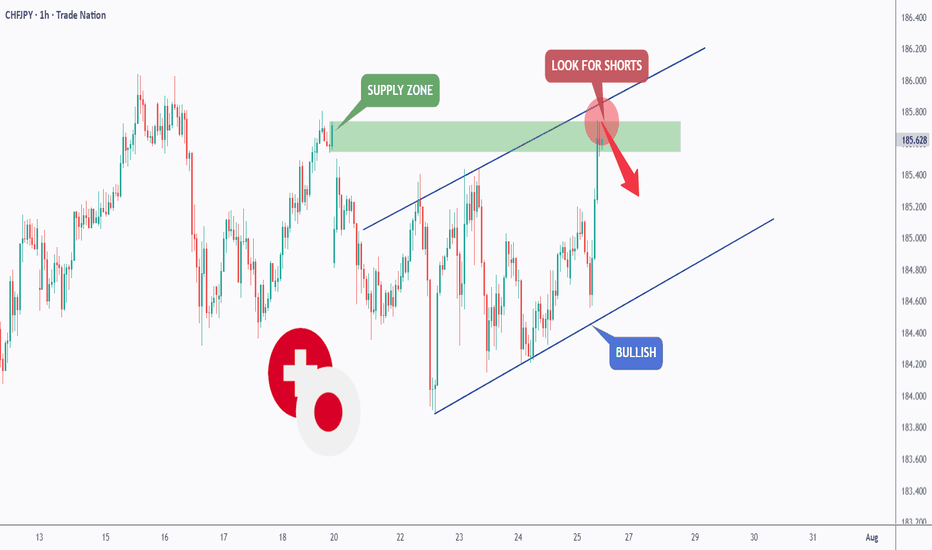

CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green supply.

📚 As per my trading style:

As #CHFJPY is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHFJPY: It's getting the value of a toilet paperCHFJPY: It's getting the value of a toilet paper

The all-time high for CHFJPY was reached on July 10, 2024 and has been moving lower ever since.

However, over the past month for no apparent reason, CHFJPY broke above the top of this area, reaching a new all-time high for the time being at 186, pushing the price up by almost +600 pips above the previous high.

The only reason is that the SNB continues to manipulate the Forex market by keeping the CHF stronger for no reason. The big trade has to fall and it will fall one day, but it definitely won’t fall unless the SNB stops this crazy manipulation.

All eyes are on the SNB to change its monetary policy approach and also on the BOJ to stop manipulating the yen’s weakness because they want to increase their exports. So both banks are playing a dirty game and it is unclear when the downtrend might start, but even the bullish move is highly overvalued. It is very dangerous both ways.

However, the big trade must fall as it is becoming like toilet paper.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

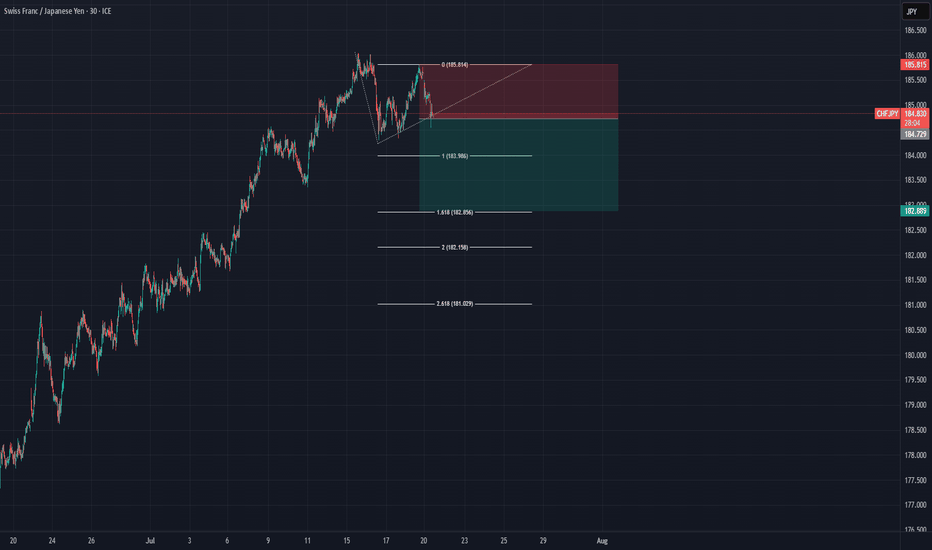

CHFJPY SELL TRADE PLAN🔥 CHFJPY TRADE PLAN 🔥

📅 Date: 22 July 2025

📋 Trade Plan Overview

Type Direction Confidence R:R Status

Swing Sell ⭐⭐⭐⭐ (82%) 4.0:1 Awaiting Confirmation

Guidance: Focus on Scenario A Primary Plan – high confluence bearish rejection zone after extended bullish run. Scenario B remains tactical, lower probability unless impulsive breakdown.

Total risk: 1.2% (standard swing).

Primary Trade Plan: Swing Sell

📈 Market Bias & Trade Type

Bias: Bearish

Trade Type: Reversal - Post-Parabolic Exhaustion

🔰 Confidence Level

⭐⭐⭐⭐ (82%)

Reason:

D1 parabolic exhaustion + rejection wicks.

H4 strong bearish engulfing.

H1 impulsive breakdown from 185.40 zone.

Volume spike on H1 selling.

Fib 61.8% rejection.

Sentiment stretched overbought JPY weakness.

Breakdown:

Price Structure: 30%

Candlestick Patterns: 20%

Volume / Fib / RSI: 22%

Macro / Sentiment: 10%

📌 Status

Awaiting Confirmation

📍 Entry Zones

🟥 Primary Sell Zone:

184.45 – 184.75 (H4 bearish order block + imbalance + prior rejection)

👉 Status: Waiting for rejection wick / bearish engulfing / LTF breakdown.

🟧 Secondary Sell Zone:

185.20 – 185.45 (H4 final supply zone; riskier short).

❗ Stop Loss

185.65 (above secondary zone wick + structure + 1.2x ATR).

🎯 Take Profit Targets

🥇 TP1: 183.10 (H1 imbalance fill; 125 pips; ~2.0:1 R:R)

🥈 TP2: 182.20 (liquidity pool, structure target; 210 pips; ~3.5:1 R:R)

🥉 TP3: 180.90 (deeper swing pullback; H4 demand zone; ~4.8:1 R:R) – Optional trail.

📏 Risk:Reward

TP1: 2.0:1

TP2: 3.5:1

TP3: 4.8:1

🧠 Management Strategy

Risk 1.2% of $ ($ , lots).

Move SL to breakeven after TP1 hit.

Close 60% at TP1, 30% at TP2, leave 10% runner for TP3 (trail SL).

If impulsive bullish reclaim above 185.00, exit manually.

Portfolio Risk capped at 3% max open trades.

⚠️ Confirmation Checklist

H1 bearish engulfing OR rejection wick in primary zone.

H1/H4 volume spike during London or NY session.

RSI divergence (optional).

No major JPY risk events upcoming.

⏳ Validity

H4 Swing: Valid for 2–4 days (expires 26 July 2025).

❌ Invalidation

4H candle close above 185.65

Bullish BOS on H1 beyond secondary zone.

🌐 Fundamental & Sentiment Snapshot

COT: CHF neutral / JPY oversold.

DXY: Rangebound.

Retail: 77% buyers CHFJPY (contrarian bearish bias).

Cross-Pair: EURJPY and AUDJPY showing topping signs.

Cross-Market: Risk sentiment fragile (SP500 fading).

Macro: No major CHF/JPY news.

Sentiment Score: +7/10 bearish CHFJPY.

📋 Final Trade Summary

Sell CHFJPY targeting reversal after extended bullish run.

Focus is on rejection from 184.45–184.75 with strict SL above 185.65.

Patience mandatory for confirmation candlesticks.

Aggressive scaling only if H1 breaks down from current price.

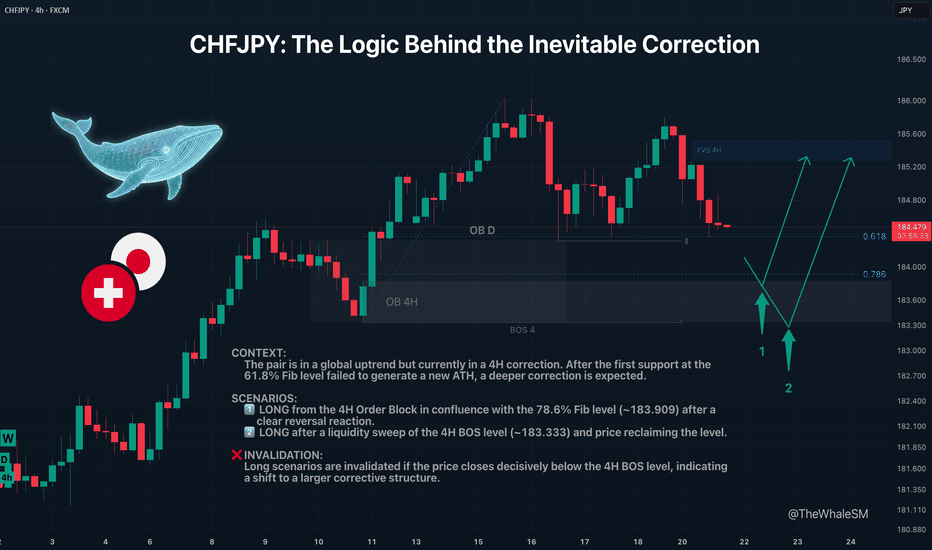

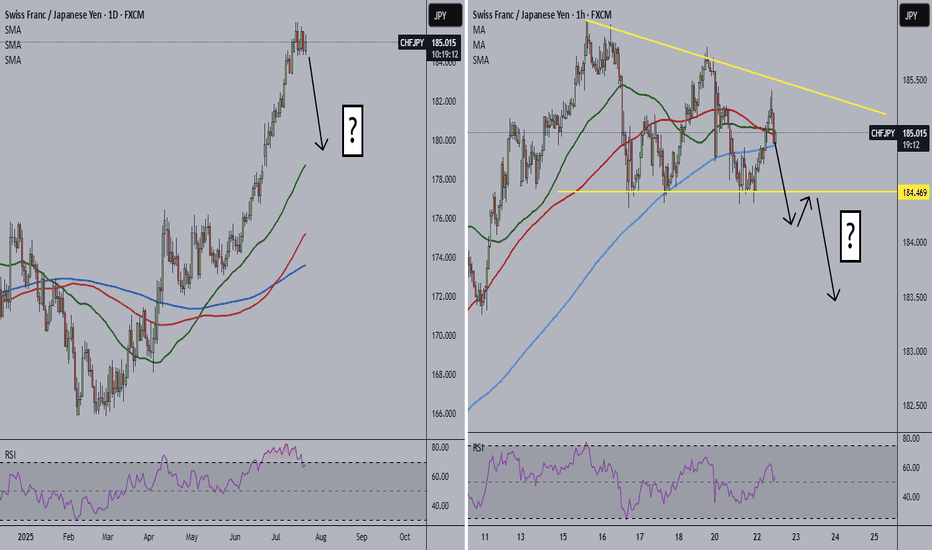

CHFJPY: The Logic Behind the Inevitable CorrectionCHFJPY recently bounced from what seemed like a perfect support level. Many likely saw this as a buy signal. But when the price failed to make a new high, it sent a clear warning: the correction isn't over yet.

This analysis dives into why that first bounce was a trap and where the next institutional levels are waiting below—the ones with the real fuel for the next major move up.

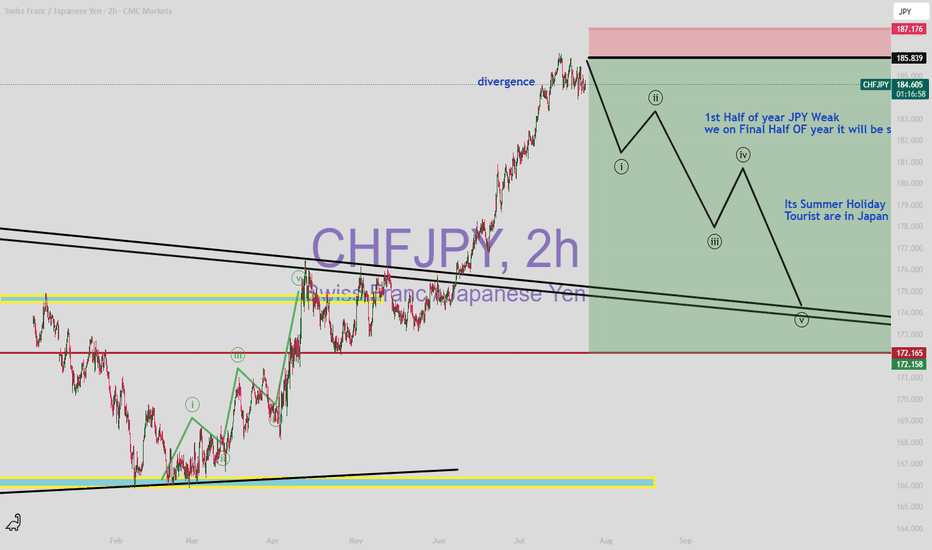

The CHFJPY pair continues its long and strong global uptrend . However, the market cannot move in one direction indefinitely without pullbacks; sooner or later, corrections occur. Large capital, or "Whales," who are the most important market participants, need to refuel with liquidity to continue their advance and to shake off piggybacking competitors. Right now, CHFJPY is in a 4H structure correction .

The first target for this correction was the 61.8% Fib level and a daily order block. The price did show a reversal reaction from them, but it lacked enough liquidity to create a new ATH, and the price continued its corrective movement. The next target for the correction will be the 78.6% Fibonacci retracement level at ~183.909, in conjunction with a 4H order block . This move will also sweep liquidity from the low of July 16th.

Two Potential Long Scenarios

SCENARIO 1: Entry from the 78.6% Fib Level & 4H Order Block

The first long entry scenario will be triggered by a clear reversal reaction from this support confluence.

► Setup Condition: Price must reach this zone, mitigate the order block, and close decisively above the 78.6% level, showing strength. An entry will require LTF confirmation (a BOS or the beginning of LTF order flow).

► Invalidation: If the 78.6% level is broken and the price closes below it, this scenario is invalid. In this case, the 4H order block itself will act as liquidity, and an attack on the 4H structure's break level (BOS 4) will likely occur.

SCENARIO 2: Entry After a Deeper Liquidity Sweep

This path becomes active if the first scenario fails.

► Setup Condition: A liquidity sweep with a candle wick below the 4H BOS level (183.333), with the price then closing back above this level. The final confirmation would be the start of a new order flow on a lower timeframe.

► Invalidation: A decisive close below the 4H BOS level will invalidate all long scenarios and will signal that the correction is shifting to a higher timeframe structure.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this wonderful, advanced TV community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always use a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

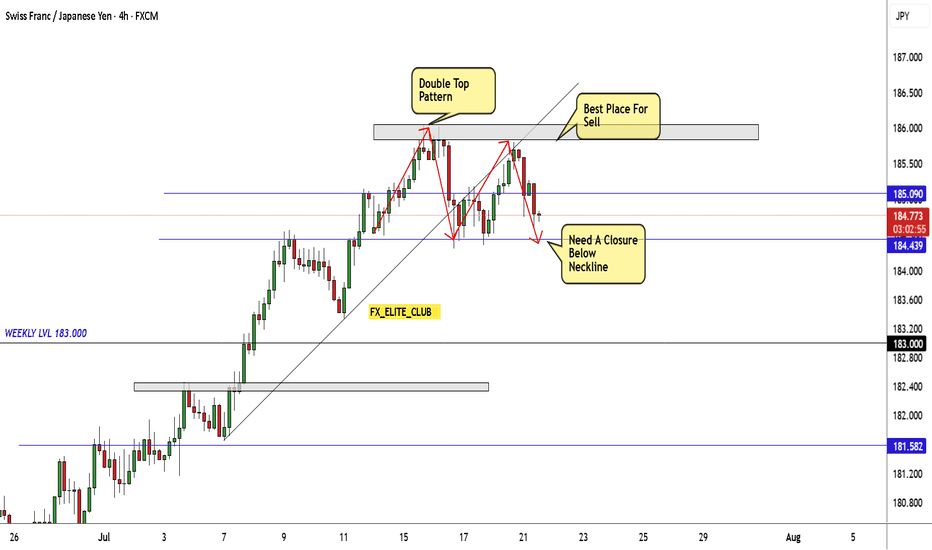

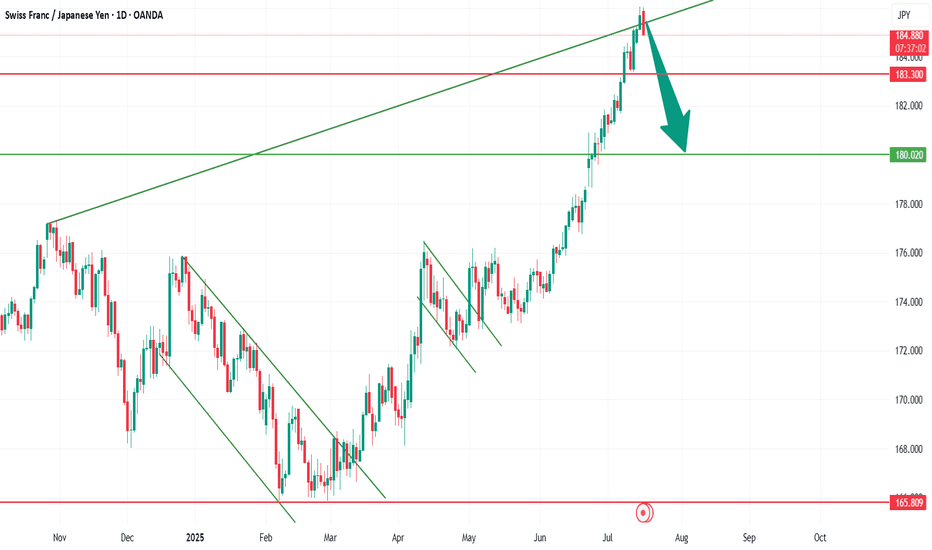

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

CHF/JPY Reversal brewing?Is the high-flying CHF/JPY cross about to hit an air pocket? Having printed a bearish engulfing candle on Wednesday, and with bearish divergence between RSI (14) and price while still in overbought territory, the risk of a pullback appears to be growing. MACD is also curling over towards the signal line, hinting that bullish momentum is waning.

Should the price break and hold beneath 184.50, shorts could be established with a tight stop above the level for protection. 183.39 screens as an initial target, coinciding with the low struck on July 11. If it gives way, it could open the door to a deeper unwind towards 181.85, a level that acted as both support and resistance in recent months.

If the price resumes its uptrend and takes out the current record high above 186.00, it would invalidate the near-term bearish bias.

Good luck!

DS

CHFJPY Alert!

🚨 CHFJPY Alert 🚨

Don't catch a falling knife... 🔪 However, price always returns to moving averages, and CHFJPY could be starting its descent.

Personally, I think price may form one last bullish move up and then come crashing down. However, the 1-hour is forming a descending triangle. A break below the triangle could be the start of the daily retracement.

Thoughts?

CMCMARKETS:CHFJPY

CHF/JPY: Poised for a Short-Term CorrectionThe CHF/JPY pair has experienced an impressive and sustained bullish run, gaining approximately 1000 pips in under two months. Such rapid and significant upward movements often lead to a healthy market correction as buyers exhaust their momentum and profit-taking ensues.

Based on this strong bullish run, and likely factoring in overbought conditions that often follow such moves, the pair appears ready for a short-term correction. The level of 180.000 stands out as a critical psychological and technical target for this potential pullback.

Considering the exhaustion of the recent rally, a short-term sell trade targeting 180.000 appears to be a viable strategy. My sell trade is currently on 10 pips gain and its not too late to join the rally.

Stay safe!

CHFJPY – Possible Trend Reversal (Sell Setup)Reasons for Potential Reversal:

1-Bearish Divergence:

Clear bearish divergence is forming between price and RSI

2-Market Sentiment:

Approximately 94% of traders are currently holding sell positions

3-Break of Last HL:

Wait for a clear break of the most recent Higher Low (HL). This will confirm a shift from bullish to bearish and provide a safer sell entry point.

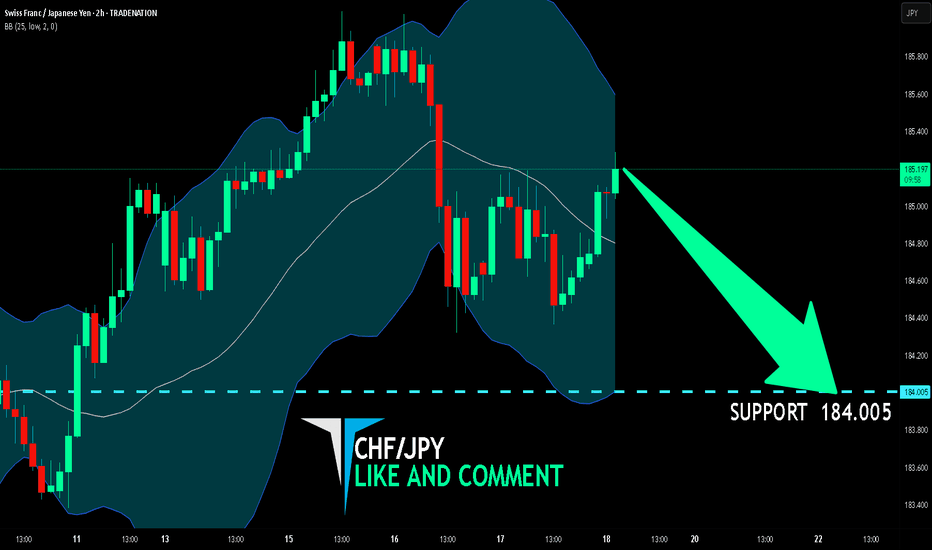

CHF/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

CHF/JPY pair is in the uptrend because previous week’s candle is green, while the price is evidently rising on the 2H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 184.005 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CHFJPYCHFJPY price is in a very bullish trend. At the current price, there may be short-term selling. Therefore, if the price cannot break through 185.34, it is expected that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!