CHFJPY: Pullback Trade From Key LevelAnother pair that appears attractive for buying at a key support level is 📈CHFJPY.

Following a test of an important intraday structure, the price has formed a cup & handle pattern.

A bullish breakout above its neckline serves as a solid bullish confirmation.

It is likely that the pair will continue to climb and reach the 170.24 level in the near future.

CHFJPY trade ideas

CHFJPY is in a Bearish Structure after Breaking the SupportHello Traders

In This Chart CHFJPY HOURLY Forex Forecast By FOREX PLANET

today CHFJPY analysis 👆

🟢This Chart includes_ (CHFJPY market update)

🟢What is The Next Opportunity on CHFJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

CHFJPY sell opportunity setting upHello,

A potential selling opportunity is setting up on the CHFJPY pair on the 45-minute chart. The pair is currently forming a corrective pattern, as shown in the analysis, and is approaching the moving average—signaling a potential continuation of the downtrend.

Additionally, the MACD indicator has just registered a zero-line crossover, further strengthening the bearish outlook.

For risk management, consider placing a stop loss just above the previous correction level, around 169.62, to mitigate potential reversals.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Good luck!

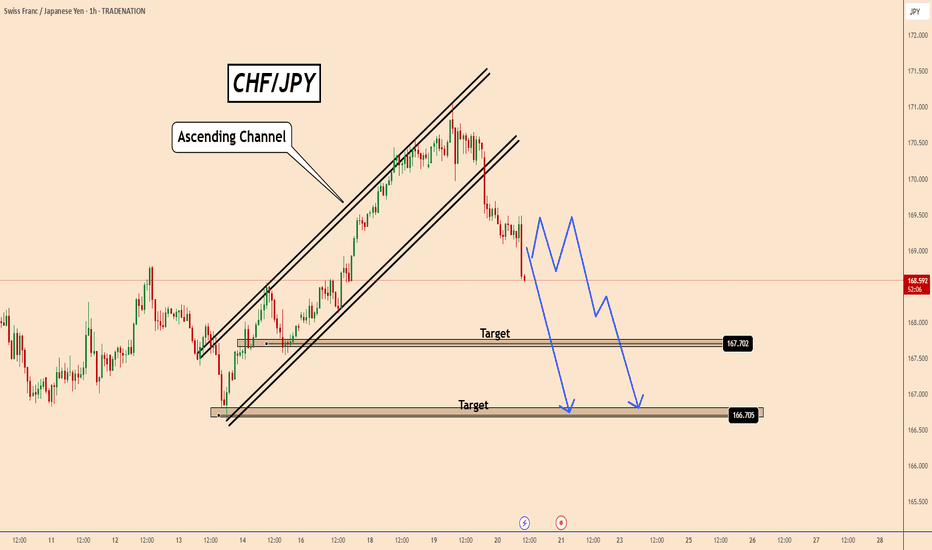

CHFJPY: Trend Channel Collapse Signals Bearish ShiftTrend Channel Breakdown: The chart clearly shows a previously established upward trend channel that has been decisively broken to the downside. This indicates a potential shift in momentum from bullish to bearish.

Key Levels:

The 169.328 level has been breached, suggesting it may now act as resistance.

Potential support levels are identified at 167.656 and the low of 166.607.

Bearish Momentum: The sharp downward movement following the trendline break suggests strong bearish momentum.

Timeframe: The 1-hour timeframe focuses on short-term price action.

CHFJPY Bearish Momentum: Technical and Fundamental InsightsCHFJPY Bearish Momentum: Technical and Fundamental Insights"

Technical Analysis:

CHFJPY has entered a strong bearish phase following the breakout from an aggressive Ascending Channel Pattern. This breakout signals the potential for further price declines. After any minor corrections, CHFJPY is likely to continue its downward trajectory. Key target levels to watch in the coming days are 167.70 and 166.70, as the bearish momentum remains robust and aggressive.

Fundamental Analysis:

Yesterday, the Bank of Japan (BoJ) maintained its interest rates at 0.5%. Meanwhile, today, the Swiss National Bank (SNB) announced a rate cut of 25 basis points, bringing its rates down to 0.25%.

For the first time in three years, a significant gap has emerged between the interest rates of these two safe-haven currencies. This divergence could further weigh on CHFJPY. If the SNB refrains from intervening in the forex market, we may see continued downward pressure on the pair.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

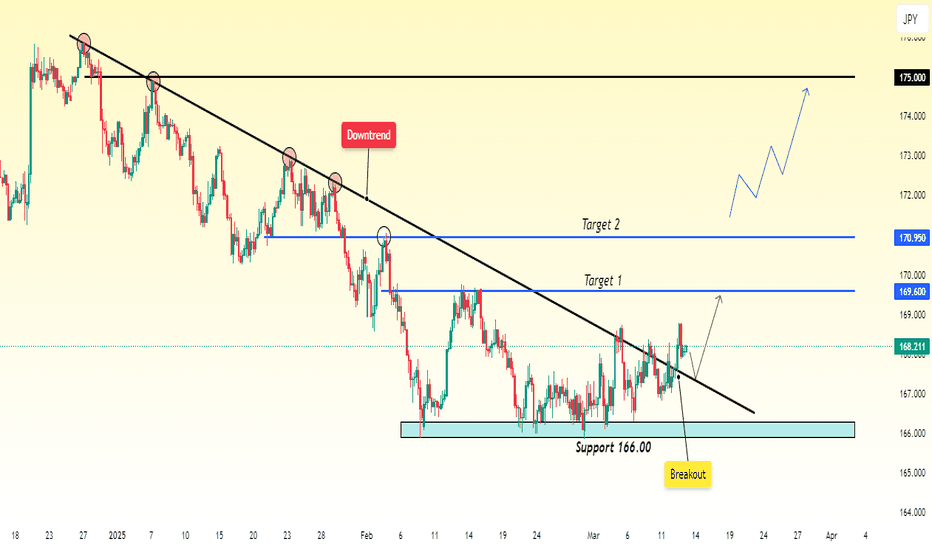

CHF/JPY Trend Shift? More Upside AheadCHF/JPY was in a downtrend for a long time, continuously moving lower. But when it hit support at 166.00, the price stopped falling, and buyers stepped in, pushing it back up. This level became a key turning point, preventing further drops.

After bouncing from 166.00, CHF/JPY started showing signs of going up and even broke above the trendline that was holding it down. This breakout is a sign that the market may be changing from a downtrend to an uptrend, meaning the price could keep rising.

With this breakout, our first target is 169.60, which is a resistance level where the price might slow down or take a break before moving higher. If buyers stay strong, our second target is 170.95, another important level where the price could face some resistance.

CHFJPY Wave Analysis – 18 March 2025

- CHFJPY broke resistance zone

- Likely to rise to resistance level 172.00

CHFJPY currency pair recently broke the resistance zone lying at the intersection of the resistance level 169.50 (former upward correction top from February) and the 38.2% Fibonacci correction of the sharp downward impulse from December.

The breakout of this resistance zone accelerated the active upward correction from the major support level 166.70.

CHFJPY currency pair can be expected to rise to the next resistance level 172.00 (which reversed the pair at the end of January).

CHFJPY Buyers In Panic! SELL!

My dear friends,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 167.58 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 166.87

Recommended Stop Loss - 167.97

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

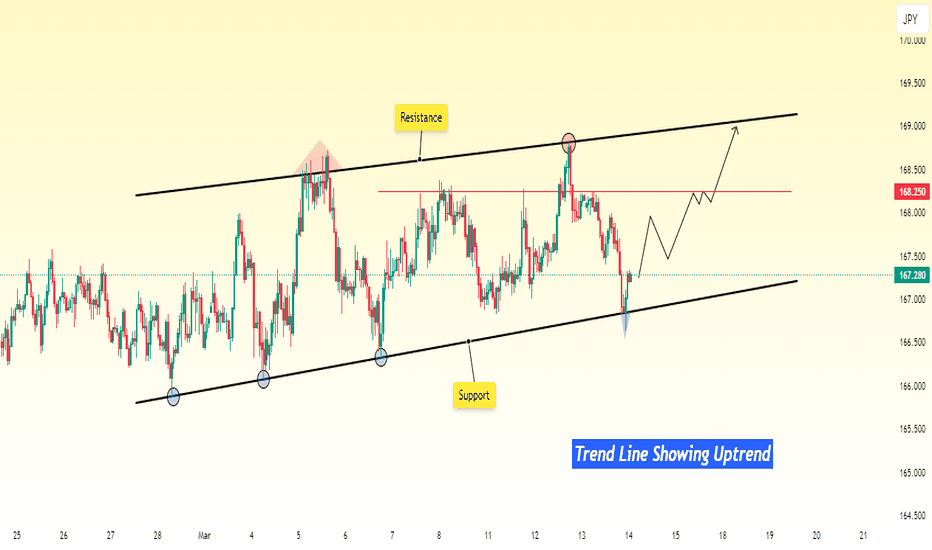

CHF/JPY Bullish Outlook & TargetsCHF/JPY appears to be in a strong bullish trend, making higher highs and higher lows. The price is respecting the trend and continuing upward. If this momentum holds, we can expect further upside movement.

Key Levels & Trade Plan:

First Target: 168.25

This is the immediate resistance level where price may face some reaction.

If CHF/JPY struggles to break 168.25, we could see a pullback before another push higher.

If price breaks and closes above 168.25 on a strong candle, it confirms bullish strength.

Breakout Confirmation & Next Target: If CHF/JPY breaks above 168.25 with strong momentum, we look toward the next major resistance.

Next Target:

Upper Trendline (which depends on the slope of the trendline but could be near 169.00+).

A break and retest of 168.25 could be an ideal buying opportunity for further continuation.

CHFJPY: Bearish Forecast & Bearish Scenario

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the CHFJPY pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

Previous week’s green candle means that for us the CHF/JPY pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 166.301.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CHFJPY Massive Short! SELL!

My dear subscribers,

This is my opinion on the CHFJPY next move:

The instrument tests an important psychological level 168.56

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 167.79

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

SWISS JPY sell ideawhy u may ask: buy side has been taken and a mss which broke structure. A correction is required which has happened but due to my discipline which i still struggle with due to the fact i am learning to trade london session, since i reside there. I know deep down i wont miss anything since this isnt my session yet i will wait for NY session then use any FVG i will find that suggest lower pricing. I won t be on the screen so i can ignore the noise

maybe market will sweep my ob take out the high before offering lower pricing. I dont care until we get into a particular time of day.

how ever it may be u make sure u trade carefully as todayis the end of the week and price needs to settle for mondays reversal then tuesday may present something better for us all

GOOD LUCK

#CHFJPY 4HCHFJPY (4H Timeframe) Analysis

Market Structure:

The price has successfully broken out of the downtrend resistance line, indicating a potential shift in market sentiment from bearish to bullish. This breakout suggests that buyers are gaining strength and may push the price higher.

Forecast:

A buy opportunity is anticipated following the breakout. It is advisable to watch for a potential retest of the broken resistance line, which could now act as support, for additional confirmation.

Key Levels to Watch:

- Entry Zone: Consider buying after a confirmed breakout and potential retest of the previous resistance turned support.

- Risk Management:

- Stop Loss: Placed below the retest level or recent swing low to manage risk.

- Take Profit: Target the next key resistance levels for potential upside gains.

Market Sentiment:

The breakout from the downtrend resistance signals bullish sentiment. Confirmation through price action or candlestick patterns will strengthen the probability of an upward move.

"Swiss Franc vs. Japanese Yen: Why CHF Holds the Upper Hand"After the accumulation phase, the Swiss Franc (CHF) has shown significant strength against the Japanese Yen (JPY), maintaining its upper hand in the market. The breakout, followed by a pullback, suggests a potential bullish continuation, indicating that buyers are still in control. If this momentum persists, we could see further upward movement, reinforcing the bullish outlook for CHF. Traders and investors may find this setup favorable, as the price action aligns with a classic trend continuation pattern, signaling potential opportunity.

CHFJPY is gaining momentum to reverse the trendThe drawn support level looks quite good. The price tried a couple of times to break it but could not and is getting bounced instead. Buy stop order can be placed at 168.688 level or you can also wait for the price to move upwards and then wait for the retracement in this way it will be a confluence of the bullish trend. I am aiming at 1:2 RR; let’s see where it goes

CHFJPY My Opinion! SELL!

My dear subscribers,

My technical analysis for CHFJPY is below:

The price is coiling around a solid key level - 168.11

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 167.35

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

Lingrid | CHFJPY primed for a DOWNSIDE Breakout. ShortThe price perfectly fulfilled my previous idea. It reached the target. The price has pulled back from the resistance level after forming a false breakout of the consolidation zone. On the daily timeframe, we can observe a choppy market with price moving sideways. The market is still trading within the weekly range formed in the second week of February. I believe the price may fall below the trendline and potentially retest the recent lower low level. Looking at the price action, we can see that it is forming a large triangle pattern, which seems to be poised for a downward movement. Moreover, the current price squeeze is likely to result in a breakout, and I expect the market to move lower since we have a round number at 168.000 above and the downward trendline. My goal is support zone around 165.100

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻