CHFUSD trade ideas

USDCHF and back down to the zone around 0.84000USDCHF continues its bearish trend since mid-January and all indications are that we will see a return back down to the zone around 0.84000. The pair failed to break above the EMA 200 weekly moving average, which further increased the pressure on the dollar.

USDCHF: Forecast & Trading Plan

The analysis of the USDCHF chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USD/CHF Bearish Trade Setup – Supply Zone Rejection🔹 CHoCH (Change of Character) – 📉 A key shift in market structure indicating bearish momentum.

🔹 SBR + DBD Zone (Support Becomes Resistance & Drop Base Drop) – 🚧 This blue zone is a strong resistance area where sellers are likely to step in.

🔹 Stop Loss (🚨) – Positioned above 0.84742, marking a risk level if price moves against the trade.

🔹 Entry Zone (🔵) – Inside the resistance zone, where price is expected to reject and continue downward.

🔹 Target Zone (🎯) – 0.82553, indicating a potential profit of around 2.01% downward movement (-169.7 pips).

🔹 Bearish Confirmation (🔻) – Price already reacted to the zone, showing rejection.

This chart suggests a short-selling opportunity, expecting the price to drop further after rejecting resistance. 📊🔥

USD/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

USD/CHF pair is in the downtrend because previous week’s candle is red, while the price is obviously rising on the 2H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 0.846 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDCHF Tests 0.8350: Break or Bounce?USDCHF is testing the critical 0.8350 support level amid rising safe haven demand. Yesterday’s chaos in the bond market highlighted how few places investors have to park their money. One of the most widely accepted safe haven assets is the Swiss franc, and current demand for CHF is clearly strong. But is it strong enough?

There hasn't been a weekly close below 0.8350 since 2011, and this level has held firm through several sharp market moves since then. Now, this major support is being tested once again.

Whether it breaks or holds, a significant swing trading opportunity could be on the horizon, especially given the heightened uncertainty surrounding the global trade environment.

USD/CHF Short Trade Setup: Resistance Rejection Analysis🔵 Resistance Area (Blue Box)

🟥 Stop Loss: 0.86283 🔴 (Red dot at the top)

🔹 Entry Point: 0.85993 🔵 (Blue dot in the middle)

🟢 Target Point: 0.84518 ✅ (Green dot at the bottom)

📉 Trade Plan:

📌 Short Entry at 0.85993 (Expecting rejection from resistance)

🚨 Stop Loss at 0.86283 (Above resistance to protect against breakout)

🎯 Target at 0.84518 (Potential downside move)

📊 Market Structure:

📉 Prior Downtrend: Strong bearish move before consolidation

🔄 Sideways Price Action: Price struggling in resistance

⚡ Possible Breakdown: Expecting a fall if price holds below resistance

Market Analysis: USD/CHF DivesMarket Analysis: USD/CHF Dives

USD/CHF declined and is now struggling below the 0.8615 resistance.

Important Takeaways for USD/CHF Analysis Today

- USD/CHF declined below the 0.8675 and 0.8615 support levels.

- There is a short-term bearish trend line forming with resistance near 0.8550 on the hourly chart at FXOpen.

USD/CHF Technical Analysis

On the hourly chart of USD/CHF at FXOpen, the pair started a fresh decline from well above the 0.8800 zone. The US Dollar dropped below the 0.8675 support to move into a negative zone against the Swiss Franc.

The bears pushed the pair below the 50-hour simple moving average and 0.8615. Finally, the bulls appeared near the 0.8420 level. A low was formed near 0.8421 and the pair is now consolidating losses.

On the upside, the pair could face resistance near the 0.8480 level. It is near the 23.6% Fib retracement level of the downward move from the 0.8674 swing high to the 0.8421 low. The next major resistance is near the 0.8550 level.

There is also a short-term bearish trend line forming with resistance near 0.8550. It coincides with the 50% Fib retracement level of the downward move from the 0.8674 swing high to the 0.8421 low, above which the pair could test the 0.8615 level.

If there is a clear break above the 0.8615 resistance zone, the pair could start another increase. In the stated case, it could even surpass 0.8675.

On the downside, immediate support on the USD/CHF chart is 0.8420. The first major support is near the 0.8400 level. The next major support is near 0.8350. Any more losses may possibly open the doors for a move toward the 0.8220 level in the coming days.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDCHF Intraday Swing Idea 09/04/2025USDCHF Update – Swing Setup in Play

After a massive 150+ pip move to the downside yesterday, USDCHF is now retesting the 0.84482 zone. This level will be key for the next leg:

Sell Opportunity if 0.84482 holds as resistance

Break of 0.83981 confirms continuation to the downside

Target: 0.83366 (90+ pips from confirmation)

⚠️ A break back above 0.84482 could invalidate short-term sells, opening room for a pullback to 0.85082 before the next bearish wave.

Bias: Bearish, unless structure breaks above key levels.

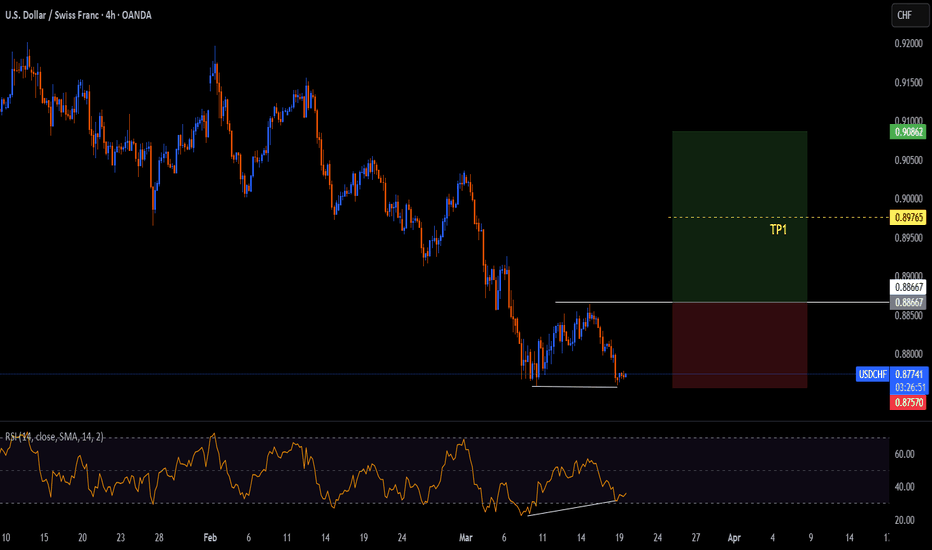

USD/CHF Analysis Week 10 - Master-ShortKey Target: 0.83000 / 0.83500 (Master-Short Target)

Exciting week ahead! The analysis shows a clear downtrend – the target of 0.8300 remains in focus.

Market Situation & Structure

USD/CHF is currently at 0.88625, reflecting a decline of -0.37%.

The price has repeatedly gone through cyclical highs and lows, with the last high around 0.91500, followed by a downward movement.

The long-term structure indicates a possible continuation of the downtrend.

Buyer has coming to USDCHFThe daily timeframe shows a candle rejection, indicating that buyers have entered the market. On the 15-minute timeframe, there is a change in the main structure from bearish to bullish. Waiting for a pullback to the entry zone, with the first target at 0.86258 and the final target at 0.87664

USDCHF Forecast: Short Opportunity Detected by EASY Trading AIThe USDCHF shows a clear bearish signal according to EASY Trading AI strategy. A short entry recommendation is confirmed at the price level of 0.84681. Target for take profit is precisely set at 0.84135667 with a protective stop loss placed at 0.85635667.The EASY Trading AI system detected selling pressure building due to weakening bullish momentum, confirmed by recent resistance failures and bearish price patterns visible on shorter timeframes. Current market sentiment also aligns with selling USDCHF, supporting a likely downward move.Focus on disciplined trading, strictly respecting recommended entry, take profit, and stop loss levels.

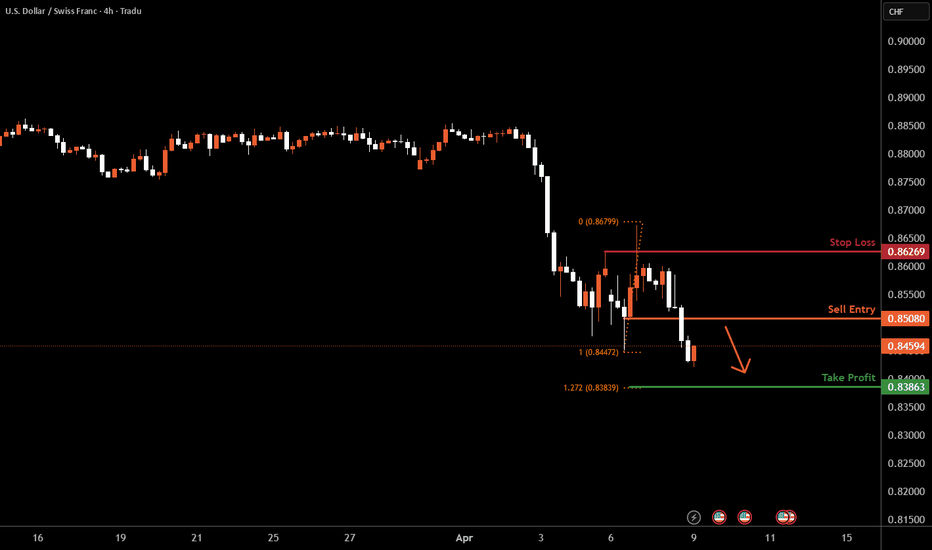

USDCHF H4 | Bearish Continuation Based on the H4 chart, the price is approaching our sell entry level at 0.8508, a pullback resistance.

Our take profit is set at 0.8386, which aligns with the 127.2% Fibo extension

The stop loss is set at 0.8626, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Falling towards pullback support?The Swissie (USD/CHF) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which is a pullback resistance.

Pivot: 0.8391

1st Support: 0.8188

1st Resistance: 0.8628

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.