CHFUSD trade ideas

Earthquake in Myanmar and Safe Haven Currencies

Hello, my name is Andrea Russo and I am a Forex Trader. Today I want to talk to you about the impact of catastrophic events, such as the recent earthquake in Myanmar, on the Forex market, with a particular focus on the role of safe haven currencies. During global crises or unpredictable events, investors tend to seek safety for their capital, moving it towards assets and currencies considered stable. This phenomenon, known as "flight to safety," occurs because markets become highly volatile and uncertain, and the risk of losses increases.

Flight to safety and the importance of safe haven currencies

When dramatic events such as the earthquake in Myanmar occur, global investors prefer to protect their portfolios. This often leads to a strengthening of so-called safe haven currencies, i.e. those currencies perceived as safe and stable. The reason is that these currencies tend to maintain their value or even strengthen in times of crisis, acting as anchors of stability for financial markets.

Top Safe Haven Currencies

Common safe haven currencies include:

Swiss Franc (CHF): Switzerland is known for its economic and political stability. The Swiss Franc is often seen as a “safe haven” during times of instability.

US Dollar (USD): The dollar is considered a safe haven currency due to the strength of the American economy and its status as the global reserve currency.

Japanese Yen (JPY): Despite Japan having a high level of public debt, the yen is seen as a safe haven currency due to the country’s internal stability.

Gold and Other Safe Haven Assets: Although gold and some other commodities are not currencies, they are often considered safe havens and their value indirectly influences currency markets.

Impact of Earthquakes on Currencies and Forex

An event like the Myanmar earthquake tends to cause capital to move into these safe haven currencies for the following reasons:

Local Currency Depreciation: Myanmar’s currency, the Kyat, is coming under pressure due to economic instability and the need for large amounts of capital for reconstruction.

Safe Haven Currencies Rise: As uncertainty increases, currencies like the CHF, USD and JPY strengthen as investors seek refuge.

Market Volatility: Catastrophic events often lead to sudden price movements in major currency pairs, increasing risk while also providing opportunities for experienced Forex traders.

Commodity Impact: If the disaster area is rich in natural resources, commodities may experience price fluctuations, significantly impacting related currencies like the AUD and CAD.

Conclusion

Natural events, like the Myanmar earthquake, are a reminder of how volatile the Forex market can be during times of crisis. Closely monitoring these dynamics is essential to adapt trading strategies and protect your investments. Understanding the role of safe haven currencies in these moments allows you to identify opportunities, reduce risks and maintain portfolio stability.

I hope this article has provided you with a useful overview. If you have any questions or would like further information, do not hesitate to contact me.

USDCHF .. will the weakness continue ??I really don't see any reason for a change unless of course Mr .. causes another upheaval. For now, check out your charts and note that:

Monthly - bearish

Weekly - bearish

Daily - bearish

Intraday - all bearish.

We will hit and break a few S/R levels, but IMO, we should eventually get down to 0.8400.

This is not a trade recommendation, merely my own analysis. Trading carries a high level of risk, so only trade with money you can afford to lose and carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

CHF/USD Weekly Forecast: Falling Wedge Breakout Towards TargetMarket Overview: Bullish Reversal in CHF/USD

The Swiss Franc (CHF) / U.S. Dollar (USD) currency pair has recently broken out of a Falling Wedge pattern, signaling a bullish trend reversal. This breakout is significant as it suggests the end of a prolonged downtrend and the beginning of a new upward momentum. Traders who capitalize on this pattern could benefit from potential long opportunities.

This analysis will cover the chart pattern, key levels, trading setup, risk management, and market sentiment, providing a comprehensive professional breakdown of the CHF/USD price action.

1. Chart Pattern: Falling Wedge – Bullish Breakout

A Falling Wedge is a well-known bullish reversal pattern that forms when price action creates lower highs and lower lows, but the slope of the highs is steeper than the lows. This leads to a narrowing structure that suggests sellers are losing strength, paving the way for a bullish breakout.

Pattern Characteristics:

✔ Prior Downtrend: The CHF/USD pair was in a sustained bearish trend before forming the wedge.

✔ Converging Trendlines: Price action squeezed into a wedge formation, showing decreasing volatility.

✔ Breakout Confirmation: The price successfully broke above the wedge resistance, signaling a shift in market sentiment.

✔ Retest Possibility: Price may revisit the breakout zone before continuing its uptrend.

A breakout from a falling wedge typically leads to a sharp bullish rally, making this a high-probability trading opportunity.

2. Key Technical Levels: Support & Resistance

Support Zones (Buying Interest):

🔵 1.0835 – 1.1000: This zone has acted as strong support where buyers stepped in aggressively.

🔵 1.1071 – 1.1095: A short-term support level that aligns with recent price action, making it a critical stop-loss area.

Resistance Zones (Profit Targets):

🔴 1.1483 – 1.1550 (Primary Resistance): Price has struggled at this level previously, making it the first target for a bullish move.

🔴 1.1600 (Major Resistance): If the uptrend continues, this level will act as the next major challenge.

🔴 1.1909 (Extended Target): A long-term resistance level where price has historically reversed.

3. Trading Strategy & Entry Setup

Now that we have identified the breakout and key levels, let’s design a strategic trading plan.

📌 Entry Points for Long Trades:

✅ Aggressive Entry: Buy at the current price after the breakout, expecting continuation.

✅ Conservative Entry: Wait for a retest of the wedge breakout zone or support near 1.1071 – 1.1095 before entering long.

📌 Stop-Loss Placement (Risk Management):

❌ Stop below 1.1071: This level is a strong support area, and a break below it may invalidate the bullish setup.

❌ Alternative Stop below 1.1000: A safer option for long-term traders to avoid stop-hunting.

📌 Take-Profit Levels:

🎯 Target 1: 1.1483 – 1.1550 (Primary Resistance Zone)

🎯 Target 2: 1.1600 (Stronger resistance where partial profits can be booked)

🎯 Target 3 (Extended): 1.1909 (For swing traders holding positions longer)

📌 Risk-Reward Ratio:

A proper Risk-to-Reward (R:R) ratio of at least 1:2 should be followed for efficient trade management. This means:

Risking 50 pips to gain 100 pips (or more) for profitable trading.

4. Market Sentiment & Confirmation Signals

✔ RSI (Relative Strength Index):

Above 50? Bullish confirmation.

Near 70? Overbought zone, potential pullback.

✔ MACD (Moving Average Convergence Divergence):

Bullish Crossover? Strengthens buy signal.

Divergence? Confirms price momentum.

✔ Volume Analysis:

High volume on breakout? Confirms strong buying interest.

Low volume? Beware of false breakout.

✔ Fundamental Factors:

Swiss National Bank (SNB) Policy: If SNB maintains dovish policies, CHF could weaken, pushing CHF/USD higher.

US Federal Reserve Stance: A strong USD could slow CHF/USD gains.

5. Conclusion & Trading Plan

🔹 Summary of Trade Setup:

✅ Bullish breakout from Falling Wedge – high-probability long trade

✅ Retest of breakout zone may offer better entry

✅ Major support at 1.1000 – 1.1071

✅ Targeting 1.1550 – 1.1909 range

🚀 Final Trading Plan:

📌 Buy CHF/USD above 1.1100 – 1.1150

📌 Stop-loss below 1.1071

📌 Take Profit 1: 1.1550

📌 Take Profit 2: 1.1600

📌 Take Profit 3 (Swing Trade): 1.1909

📢 Pro Tip:

Always confirm breakout volume before entering.

Monitor economic events affecting CHF & USD.

Use proper risk management (1-2% of account per trade).

📊 Final Verdict:

🔥 CHF/USD is in a bullish setup after breaking out from a Falling Wedge. Traders should look for buy opportunities on pullbacks while targeting resistance levels. 🚀

Double Bottom on USD/CHF @ W1This double bottom pattern has formed on the weekly chart of the USD/CHF currency pair following a downtrend that had been active since October 2022. It can be used as an upside breakout setup. The two bottoms are marked with the lower yellow line; the neckline is marked with the upper yellow line. My potential entry level is at the cyan line (10% of the pattern's height above the neckline). My potential take-profit level is at the green line (100% of the pattern's height above the neckline). My potential stop-loss is not shown on the chart and will be set to the low of the breakout candle or to the low of the preceding candle if the breakout one trades mostly outside the pattern's borders. I won't be trading a bearish breakout from this trend-reversal pattern.

A BIGGER PICTURE OF USDCHF Price one more reacts at a historic pullback resistance of 0.92001 what next do we expect from market participant this time? Are we likely to see further drop in price as usual or we’d see a complete change in market trend. If price falls lower to 0.85000 a longterm bear trend emerges. But until then, we may experience complete reversal in price.

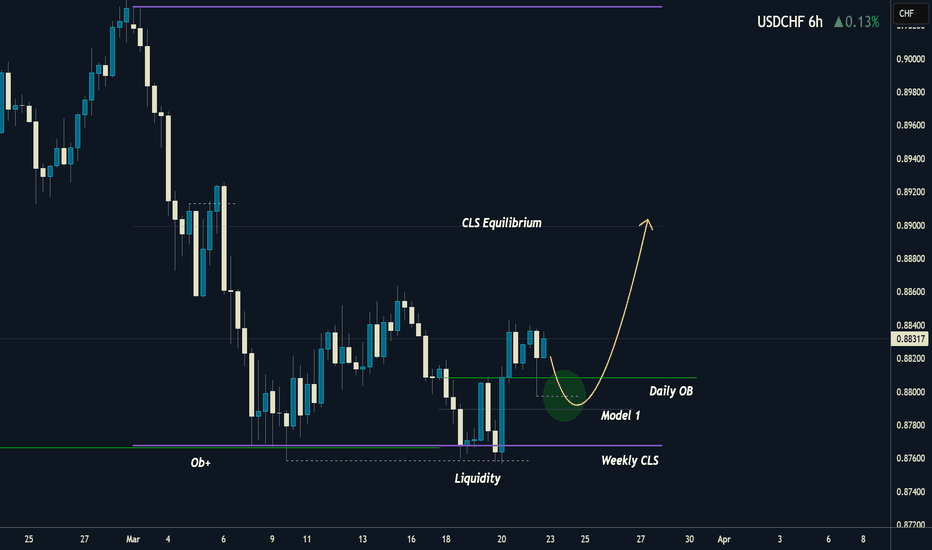

USDCHF I Weekly CLS I Daily OB, Model 1, CLS 50% TargetHey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Hit the like if you like trading !!

David Perk ⚔

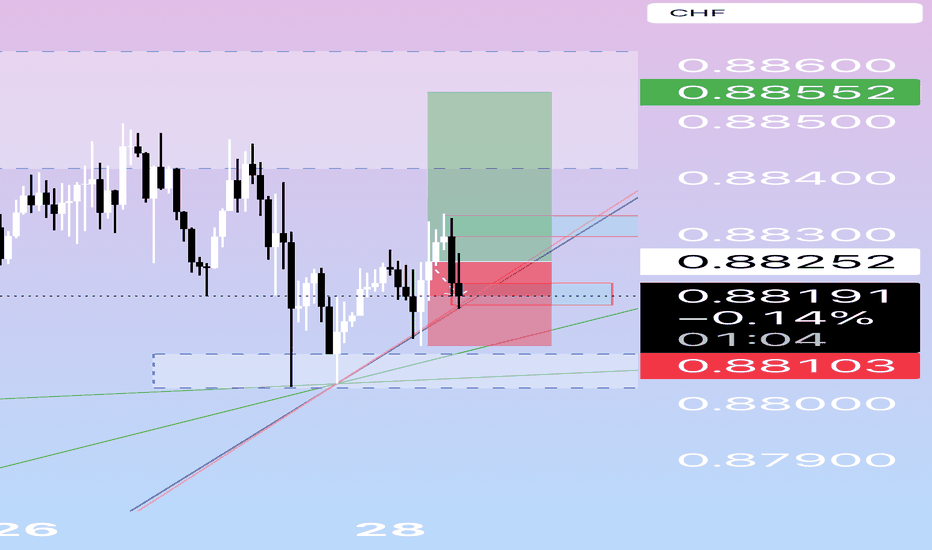

USDCHF Short Bias ! The pair is in a clear downtrend, trading below the moving averages and facing strong resistance around 0.8859. The price attempted to break this level but failed, reinforcing the likelihood of continued downside movement.

Expected Scenario: Further bearish continuation after this rejection, targeting 0.8660 as a potential support zone.

Bearish Confirmation Factors:

Price staying below key resistance.

Moving averages acting as dynamic resistance.

Overall bearish market structure.

Price action at its finest !!!!!!!Up until one fathoms particular concepts of a pairs currency maneuvers; the goal of achieving financial liberation in the forex market is downright toilet water! 💩

Do all right for yourself and probe PRICE ACTION with the aim of mastering its constituents unreservedly.

As in the present case

Candlesticks Anatomy

Candlestick patterns

The Market structure

Time frames and top down analysis

Trading strategies and tactics

Money management

Stay connected🤞

Bullish play

CHF/USD – Rising Wedge Breakdown | Bearish Setup The CHF/USD (Swiss Franc to US Dollar) 15-minute chart is currently displaying a classic Rising Wedge Pattern, which is widely recognized as a bearish reversal pattern. This setup signals weakening bullish momentum and an increased probability of a price breakdown. The chart provides a clear sell trade setup, with key levels including entry, stop loss, and target, making it a structured and well-defined opportunity for traders.

🔹 Key Technical Elements on the Chart

1️⃣ Resistance Level (Sell Zone)

📌 Location: Near 1.1350 – 1.1360

📌 Significance:

This level represents a strong supply zone, meaning sellers have consistently pushed prices down from this area.

Price attempted to break through this zone multiple times but was rejected, reinforcing the bearish outlook.

It serves as the upper boundary of the rising wedge, confirming its role in restricting upward movement.

Traders should be cautious of any false breakouts above this level before confirming a bearish move.

2️⃣ Support Level (Demand Zone)

📌 Location: Near 1.1295 – 1.1305

📌 Significance:

This level has historically acted as a demand zone, where buyers stepped in to push prices back up.

However, the formation of the rising wedge suggests weakening demand at this level.

Once the price breaks below this support zone, it confirms a bearish trend continuation.

3️⃣ Rising Wedge Pattern (Bearish Setup)

📌 Pattern Characteristics:

The rising wedge is a bearish continuation pattern that typically signals an upcoming sell-off.

Price moves inside a narrowing upward-sloping range, where buyers lose strength while sellers gradually gain control.

The lower trendline (dotted black line) has been providing support, but as price struggles near resistance, a breakdown becomes likely.

Once price breaks below the wedge, the pattern confirms a strong bearish move.

📌 Why Is This Important?

This pattern indicates that buyers are losing momentum, and a shift toward bearish control is taking place.

The expected move is a sharp downward breakout, leading to lower price levels.

4️⃣ Trendline Support (Breakdown Confirmation)

📌 Location: The dashed black line below price action

📌 Significance:

This trendline acted as a rising support, keeping price within the wedge.

A clean break below this trendline confirms the bearish breakout.

The breakdown is expected to be followed by increased selling pressure and higher trading volume.

📉 Bearish Trade Setup (Short Position Strategy)

Based on the rising wedge breakdown, traders can consider the following sell trade setup:

✅ Entry Point: Sell below 1.1325 (Confirm breakdown with volume)

✅ Stop Loss: Above 1.1356 (To avoid false breakouts)

✅ Target 1: 1.1295 (First support level)

✅ Target 2: 1.1275 (Deeper downside potential if momentum continues)

🛠 Trade Rationale (Why Take This Trade?)

🔸 Bearish Price Action → Price is rejecting resistance and forming a lower high, signaling weakness in the uptrend.

🔸 Pattern Confirmation → The rising wedge has a high probability of breaking downward, leading to a sharp decline.

🔸 Risk-Reward Ratio → The setup provides a favorable risk-to-reward ratio, as traders can manage risk efficiently by placing a stop loss above resistance.

🔸 Volume Analysis → If selling volume increases upon breakout, the move becomes more reliable.

📊 Market Outlook & Final Thoughts

🔹 Bearish Scenario:

If price breaks below 1.1325, expect a strong decline toward 1.1295 and potentially lower.

A sharp move downward could accelerate selling pressure, targeting 1.1275 in an extended move.

🔹 Bullish Reversal Risk:

If price closes back above 1.1356, the bearish setup is invalidated.

Traders should exit shorts if price reclaims the resistance level.

🚨 Final Verdict: Bearish Breakdown Expected!

📉 Short Setup Activated – Targeting 1.1295 🚀

📊 Watch for Volume Confirmation Before Entering!

Bullish bounce?The Swissie (USD/CHF) has bounced off the pivot which is a pullback support and could rise to the 1st resistance which lines up with the 138.2% Fibonacci extension.

Pivot: 0.8797

1st Support: 0.8759

1st Resistance: 0.8911

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

USD/CHF NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

USDCHF Is Very Bearish! Sell!

Please, check our technical outlook for USDCHF.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.883.

Considering the today's price action, probabilities will be high to see a movement to 0.865.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USD/CHF Market Analysis – Potential Bullish ReversalThe USD/CHF pair is currently in a downtrend, as indicated by the overall bearish price action. However, the chart suggests a potential reversal scenario.

Price is approaching a key H4 demand zone, which previously acted as strong support. If this level holds, a bullish move could be anticipated. The projected market structure indicates a possible pullback before a continuation upwards, aligning with the larger trend shift.

Traders should monitor price reaction within the demand zone, as a break below could indicate further downside continuation, while a strong rejection may confirm a bullish reversal.

USD-CHF Local Short Form Resistance! Sell!

Hello,Traders!

USD-CHF is trading in a

Kind of range consolidating

For a next big move but

Right now we can use the

Moment to trade the local

Range and to short the pair

From the horizontal resistance

Of 0.8855

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

UC UpdateBoth the USD and CHF are safe-haven currencies, but their behavior depends on global conditions. If uncertainties (e.g., trade issues or economic slowdowns) rise, demand for the CHF could increase, lowering the pair. On the flip side, strong U.S. economic data could lift the USD and the pair

For now let's wait for data to be released