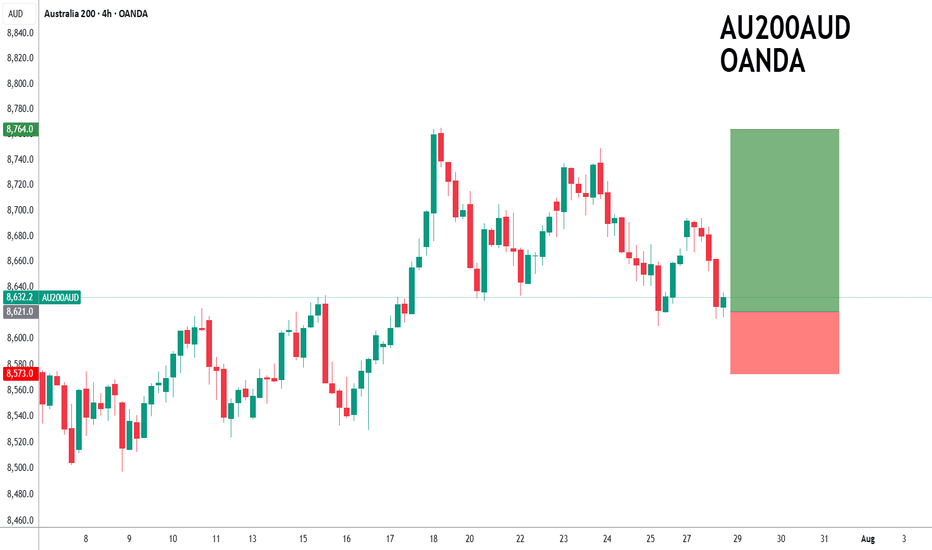

ASX200 to find support at current market price?ASX200 - 24h expiry

The primary trend remains bullish.

Price action continues to trade around the all-time highs.

20 1day EMA is at 8619.

Offers ample risk/reward to buy at the market.

Our outlook is bullish.

We look to Buy at 8621 (stop at 8573)

Our profit targets will be 8764 and 8794

Resistance: 8670 / 8694 / 8749

Support: 8610 / 8570 / 8524

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUSTRALIA200CFD trade ideas

AUS200/ASX200 - ANOTHER OPPORTUNITY TO SHORT AUS200Team, today, good data came out from the AUS200

The market has given some steroids

Time to put an end to this

SHORTING AUS200 at 8761 toward 8772 with stop loss at 8810

Target 1 at 8732-8726 - take 50% volume and bring stop loss to BE

TARGET 2 at 8712-8696

ENJOY YOUR DAY!

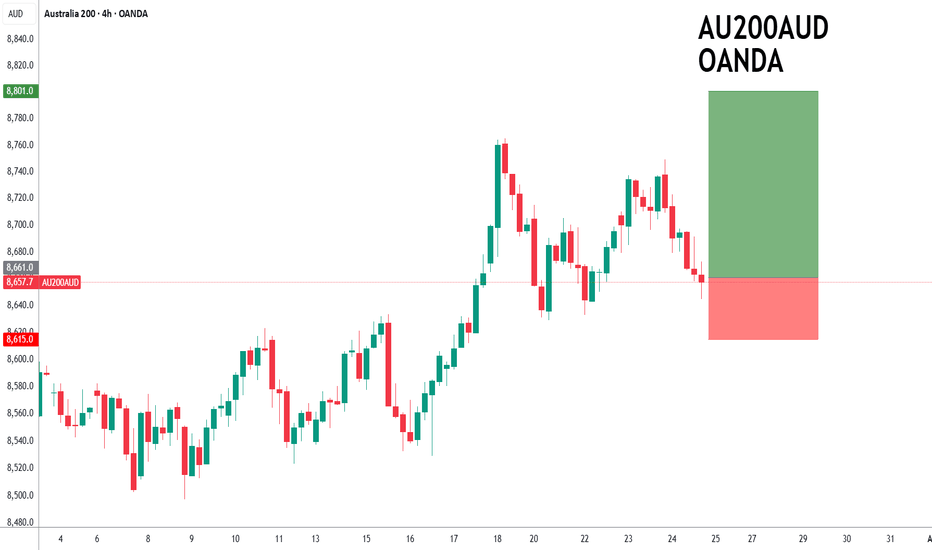

ASX200 to find buyers at current market price?ASX200 - 24h expiry

Price action resulted in a new all-time high at 8765.

Price action continues to trade around the all-time highs.

The bullish engulfing candle on the 4 hour chart the positive for sentiment.

50 4hour EMA is at 8658.

We look for a temporary move lower.

We look to Buy at 8661 (stop at 8615)

Our profit targets will be 8801 and 8831

Resistance: 8700 / 8749 / 8765

Support: 8658 / 8629 / 8600

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

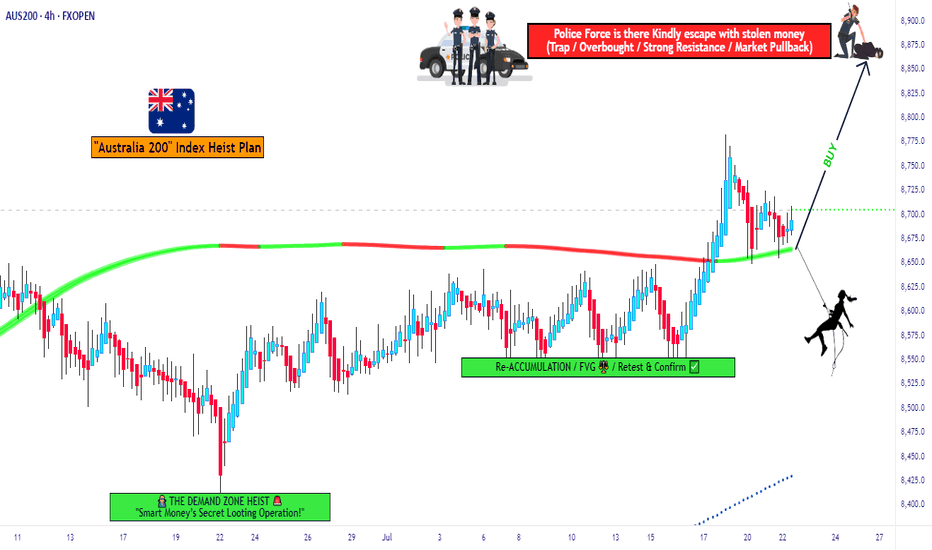

ASX200 Heist Blueprint – Entry, Exit, Escape Mapped Out!💼💣 The ASX200 Heist Blueprint: Bullish Loot Incoming! 🔥💰

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 👋

Welcome back, Money Makers & Market Robbers! 🤑💸✈️

It's time for another high-stakes heist, this time targeting the ASX200 / AUS200 “Australia 200” Index. Get your trading toolkit ready – we're planning a strategic, stealthy bullish operation based on Thief Trader’s signature blend of technical setups + macro fundamental analysis.

💹 ENTRY STRATEGY – "The Vault Is Open!"

The bullish loot is ripe for the taking. Watch for pullbacks on the 15M to 30M charts – layer in limit buy orders near recent swing lows or key levels.

🧠 Use DCA-style (Dollar Cost Averaging) layering to maximize your position like a smart thief scaling walls.

Every entry counts – but precision matters. Time your move, rob the dip, and don’t get caught by the bears. 🐂💥

🛡 STOP LOSS – "Don’t Trip the Alarm!"

Protect your capital like it’s the last stack of bills in the vault.

📉 Suggested SL: Near 4H swing low/high (e.g., 8620.0)

Always adjust based on:

Your risk tolerance

Position size

Number of open entries

Risk smart. The getaway must be clean. 🚁💨

🎯 TARGET – "8880.0 & Beyond!"

That’s the main exit point for our current job.

Expect tough resistance ahead – the police barricade zone where supply, exhaustion, and reversal pressure builds.

Book profits and treat yourself like a boss – your hustle deserves celebration! 💪🎉🍾

📊 Market Condition Overview

The ASX200 is currently in a bullish trend, supported by:

Risk-on sentiment globally 🌐

Aussie economic data strength 📈

Global indices correlation 🧩

Technical confirmations from Thief Trader tools 🔧

📌 Important Note – Stay Informed!

📢 Fundamentals Matter!

Tap into macro analysis, COT reports, geopolitical news, sentiment indicators, and intermarket flows. These are the real gears behind the charts.

📡 Always stay sharp and analyze what’s behind the candles.

⚠️ NEWS TRAP WARNING

🚨 Big news = big volatility. Don’t get caught during releases.

✔️ Avoid opening new positions around high-impact events

✔️ Use trailing SLs to protect open profits

✔️ Manage leverage like a pro thief manages their escape route

💖 Support the Thief Gang!

If this heist plan helped you, hit that Boost 💥 & Follow – it fuels our mission to help more traders rob the market cleanly and smartly.

Together we earn. Together we learn.

🧠💼 Stay tuned for more heist blueprints and tactical break-ins into global markets with the Thief Trading Style™.

🔥 Until next time, rob responsibly. 🕶💸🎯

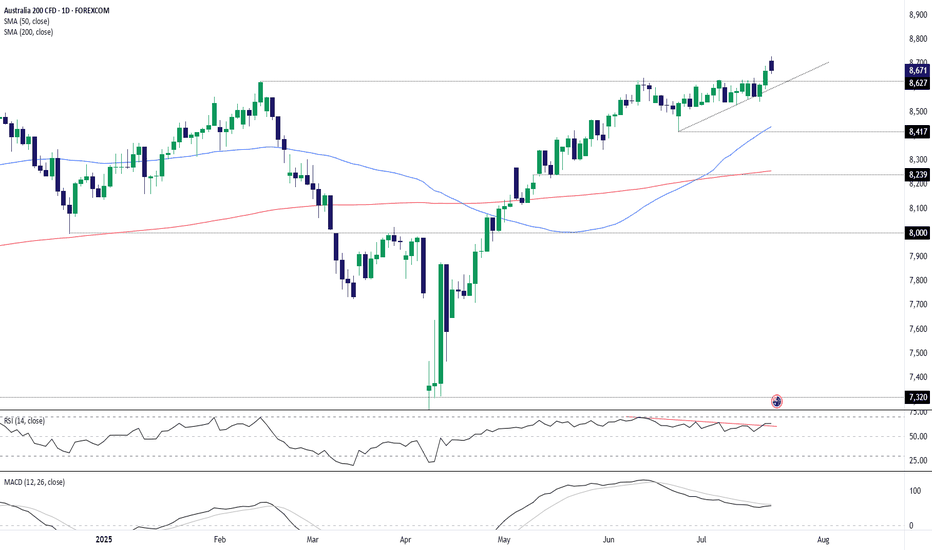

Australia 200: Pullback Presents Second Chance for LongsThe Australia 200 contract continues to trade above former horizontal resistance at 8627, with Monday’s pullback offering an improved entry level for longs looking to buy the breakout.

Bullish positions could be established ahead of 8627, with a stop beneath for protection. The session high of 8727 looms as an initial test for longs, with a push above that level opening the door for further upside.

While some like to use extension targets, the preference would be to wait for a clear topping pattern before exiting the trade. Others may prefer to adopt a target based on the desired risk–reward of the trade.

Bullish price momentum is showing signs of picking up again, favouring a similar bias. Iron ore futures are also flying in Asia, likely assisting gains across the underlying materials sector.

Good luck!

DS

AUS200 Breakout or Fakeout? I Say Breakout – Here's Why🔍 Technical Overview:

After monitoring the recent movement in AUS200, I believe we are in the early phase of a bullish breakout continuation rather than a fakeout.

Uptrend Structure: Price has been consistently respecting higher lows and trending above the green trendline.

Break of Descending Resistance: The downtrend line has now been pierced with momentum candles — a bullish sign.

Buy Condition Set:

Next 1-hour/s candle should close above the intersection (highlighted zone).

Candle should be green, and preferably no wick on the top (indicating strength).

Volume analysis to be considered on confirmation.

✅ Trade Plan:

Buy Zone marked.

Stop Loss Zone clearly defined – I plan to exit the trade if price closes back below the shaded red/gray zone.

Upside Potential: Initial target around 8,820–8,840, with extension toward 8,900+ if momentum sustains.

Risk/Reward ratio looks favorable based on current structure.

📰 Fundamentals:

I have not yet identified any bearish macro or news catalyst that contradicts the current technical picture. If you know of any relevant developments (e.g., RBA policy, earnings, CPI releases), feel free to comment.

🔄 Validation Request:

Would love the community’s take:

Do you see this as a valid breakout?

Any hidden divergence or bearish signals I might have missed?

Let me know if you're tracking the same structure or see something different.

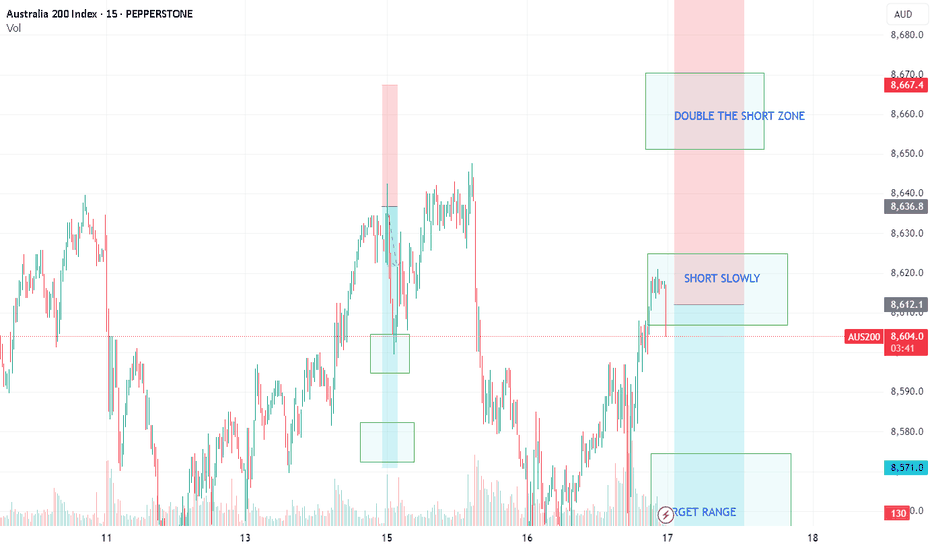

AUS200/ASX200 - ANOTHER DAY TO MAKE THEM PAYTeam, we have successfully SHORT AUS200 last week and kill them with our ACTIVE TRADER COMMUNITY.

Time to have another short at this current price level 8609-8626 ranges

DO NOT FEAR - DOUBLE THE SHORT AT 8642-56 - KILL them

Our first target range at 8586-72 - take 60% profit and bring stop loss to BE

2nd target at 8562-45

NOTE: Next week, we expect the market to be volatile, so be careful with your trade.

ASX200- Swing Trade Plan - SELLThe ASX200 has reached last year's high, and bulls have attempted to push the price higher, and we have seen a failure for demand on the weekly for the last two weekly candles.

Seasonality - Risk off.

Price is reached MM3 pivot.

If support is breached on the hourly -8592 and the hourly candle closes, and the next candle restest this area then the trade plan is to short.

Targeting - WKM1 - 8506.

AUS200/ASX200 - LETS MAKE MILLIONYesterday, we hope you all enjoyed SHORT UK100 AND AUS200, we did it twice in our channel

Today we are reshorting AUS200 at 8600-8226 ranges

Target at 8572-8561

Yesterday, while doing REAL LIVE TRADING every day, we killed the NAS AND DOW on a long trade.

Bring us 6 out of 6 trades successful for the day.

SHORT AUS200/ASX200 - TIME TO SHORT THE AUSSIETeam, over the last few days, we have been successfully SHORT BOTH UK100/AUS200, but I did not post the chart

Today is a good time to post.

Ensure you understand your RISK - can always discuss with us in the room

Let's SHORT UK100/FTSE100, I still expect the market to be volatile even though the US expect a rate cut. on the 9th JULY, there will be a tariff announcement, and it could also extend towards September

We are SHORTING AUS200 at 8586 toward 8616 - SLOWLY

with target at 8562-47

DOUBLE THE SHORT AT 8632-56

Target at 8608-8592

AUS200/ASX200 - MASTERMIND FOR SUCCESS STRATEGY Team, last night we did another successful trade on DOW/US30 AND NAS30

If you have time, watch my video how i made 1.5k turn into 20k per month and expect 6 months to hit 100k

so far 2 and half month reached 80k

We are shorting slowly at 8572-8586 range

With target at 8545-36

Now, this is another READY set up order if AUS200 hit above 8618-36 - This is where we kill them with DOUBLE UP the volume as per chart

With the target at 8586 -67

LET'S GO.

ASX200 short term bias has turned negative.ASX200 - 24h expiry

Short term bias has turned negative.

A shooting star has been posted on the weekly charts.

Bearish divergence is expected to cap gains.

Previous resistance located at 8550.

50 4hour EMA is at 8528.

We look to Sell at 8529 (stop at 8581)

Our profit targets will be 8375 and 8355

Resistance: 8543 / 8574 / 8594

Support: 8476 / 8400 / 8335

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUS200 Potential Sell SetupSellers Missing, But Structure Is Alarming ⚠️

Weekly Overview:

Price is currently at a major resistance zone and formed a clear bearish pin bar last week, hinting potential downside pressure. This level has historically acted as a ceiling, so it's worth paying attention.

Daily Chart Insight:

Despite the bearish weekly signal, the daily timeframe hasn't confirmed seller presence yet. No strong bearish price action or momentum shift is visible at the moment.

4H Chart Setup:

Price is trading below the 50EMA, which is often the early sign of a possible trend change. However, we still haven’t seen solid selling pressure—no trendline break or bearish structure yet.

Plan:

🔹 Bias: Bearish

🔹 Entry: Wait for confirmation – look for 4H bearish structure break or trendline break below recent support.

🔹 Targets:

‣ First target: Near-term 4H support zone

‣ Second target: Daily support zone aligned with previous swing low

🔹 Invalidation: A clear break and close above last week's high will invalidate the setup.

📌 Patience is key – weekly shows intent, but daily and 4H need to confirm. No rush until sellers truly step in.

ASX200 forming a top?ASX200 - 24h expiry

Price action looks to be forming a top. A shooting star has been posted on the weekly charts.

Bearish divergence is expected to cap gains.

Previous resistance located at 8550.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

We look to Sell at 8549 (stop at 8601)

Our profit targets will be 8395 and 8365

Resistance: 8552 / 8594 / 8629

Support: 8504 / 8450 / 8400

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUS 200 on track to 9,163Whether the trade analysis does well or not, we need to update accordingly.

That's the life of traders and how we all weather through the markets, whether just starting out or whether you're highly experienced.

We don't Take losses personally but instead see them as strikes and data points.

In this case the AUD200 is moving up nicely towards the medium term target of 9,163.

And if the analysis changes, we will let you know.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUS200 UNDER ATTACK: TRADERS RAID THE TREND!🔥 Australia 200 HEIST: STEAL THE TREND LIKE A MARKET BANDIT! 🚨💰

Locked & loaded for the AUS200 (Australia200 Index) heist? This slick blueprint cracks the code to loot profits—blending killer technicals with macro intel. Ride the bullish wave, but dodge traps near the Overbought Zone. Bears lurk, so secure your bag before the reversal hits! 🐻💨

🎯 ENTRY: STRIKE LIKE A PRO THIEF

Long the breakout near 8430.00.

Set stealth alerts to catch moves in real-time. 🕶️🔔

🛡️ STOP LOSS: ESCAPE ALIVE

Hide stops under the last 2H swing low/wick—no reckless bets!

Adjust for your risk—survivors play smart. ⚡

💸 TAKE PROFIT: VANISH WITH THE LOOT

Main Target: 8650.00 (or bail early if momentum fades).

Scalpers: Trail stops & ghost out with quick wins. 🏃♂️💨

📡 WHY THIS HEIST WORKS

Australia 200’s on fire: Fundamentals + COT data + macro tides align.

Sentiment’s bullish, but stay sharp—links below for the full intel. 🔍🌐

⚠️ WARNING: NEWS = POLICE SIRENS

Avoid new trades during high-impact news. 📢

Lock profits with trailing stops if you’re already in. 🔐

🤝 JOIN THE TRADING MAFIA

Smash LIKE, drop a comment, & let’s dominate the AUS200 (Australia200)! �

Ready for the next big move? Stay tuned. 👀

Happy hunting, chart pirates! 🏴☠️📉

AUS200/ASX200 - TIME FOR A KILLTeam, another successful trading at ActiveTraderCommunity - we have hit 4/4 trades again today with target hit.

AUS200/ASX200 has been one of my favorite, but it moves like a snail. However I have all the time in the world to be patience and that what I am good at when it comes in term of trading. Be patience until the PRICE IS RIGHT

Please carefully look at two TARGET price ranges

Target 1 at 8478-8473 - please take 70% profit once it hit here and bring stop loss to BE

Target 2 at 8467-8458 - close our chapter

PLEASE NOTE: These two prices are also taking into consideration base on my statistic and probability of highly chance the target will hit.

Make sure you follow my channel for further trade. As we have not losing a trade for a very long long time. Also click on video above and you will see all my trade are accurate.

AUS200 - Bullish Continuation Using 3 Bar Reversals, Fibs, AB=CDAfter a recent violation of a previous structure high, the AUS200 shown signs of relief with a pullback into the previous level of structure resistance which we would now look to act as present structure support.

At this level price has also given us a 3-Bar Reversal which can be used as a reason for entry.

Targets are protected at a previous level of structure highs on the daily, also being supported by a Fibonacci extension level and an AB=CD pattern projection.

If you have any questions, comments, or just want to share your ideas, please do so below. A please show your support by hitting that LIKE button before you go.

Akil

ASX short term bias remains positive.ASX200 - 24h expiry

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Buying continued from the 78.6% pullback level of 8321.

We look to buy dips.

50 4hour EMA is at 8331.

We look to Buy at 8330 (stop at 8275)

Our profit targets will be 8495 and 8545

Resistance: 8386 / 8426 / 8500

Support: 8343 / 8300 / 8249

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUS200 - SET UP AND PREPARATION Team, lets kill the BEAST today

last minutes the MOODY fake downgrade on the US economy, the market dump back a little

We want to see if the AUS200 OPENING in another 30 minutes will pull back to our buyer zone.

Then we will buy.

Tomorrow RATE cut, it would give us some incentive bullish, and the following day.

So lets hope we catch the right entry and get ready to make millions

Remembers always take 30-40% profit when the position profit then the rest can wait for target.