Dow Jones Trend Analysis (Elliott Wave + AO + Volume)📊 Dow Jones Intermediate Trend Analysis (Elliott Wave + AO + Volume)

🌀 Elliott Wave Interpretation

The chart reflects a clear Elliott Wave count from the post-COVID low:

Wave I and Wave II are well-established.

Wave III is now completed, accompanied by a peak in AO — which aligns with classical Elliott theory where AO typically peaks during the 3rd wave, showing strong momentum.

Wave IV is currently unfolding.

📉 Wave IV Characteristics (Ongoing Phase)

Wave IV is expected to be complex — commonly forming:

Triangles (contracting or expanding),

Flats,

Double/triple threes.

It is likely to consume time and generate sideways or choppy price action.

Volumes, interestingly, are peaking again, which often occurs toward the end of Wave IV due to emotional volatility and retail panic activity.

🔮 Two Probable Scenarios for Wave IV Completion:

Scenario 1 (Shallow Correction):

Target Zone: ~37,400

This zone coincides with the 0.382–0.5 Fibonacci retracement levels from Wave III.

Would reflect a simple flat or sharp zigzag structure.

Scenario 2 (Deeper Correction):

Target Zone: ~34,100

Corresponds to the lower support band with possible spike to 32,988 (FINAL FIB Support).

May occur if external macroeconomic or geopolitical triggers cause extended selling.

📈 Post Wave IV – Projection for Wave V

Once Wave IV completes:

Wave V is expected to resume the larger bullish cycle.

Price target: New all-time highs, possibly towards the upper blue resistance trendline (~46,000+).

Watch for bullish confirmation with AO flipping and price breaking above Wave IV consolidation highs. before completing 4th wave it always create complex patterns. we need to watch the patterns and it is getting completing before move to 5th wave.

🔍 AO (Awesome Oscillator) Insights

AO peak confirms Wave III completion.

Negative divergence between AO and price also supports Wave V capping out, indicating exhaustion of upward momentum.

AO is now retracing — likely bottoming during the end of Wave IV.

🔊 Volume Behavior

Volume peaked at the end of Wave III — a common occurrence.

Now rising again near Wave IV completion – this suggests:

Panic selling,

Possible final shakeout before market stabilizes for Wave V.

Monitor for volume drop-off during Wave V's beginning – a classic signature of reduced fear and return of trend stability.

🔒 Critical Support & Resistance Levels

Level Description

37,400 Scenario 1 target / shallow correction

34,100 Scenario 2 deeper correction target

32,988 Final strong support (Fib extension)

46,000+ Potential Wave V high / upper trendline

📌 Conclusion

The intermediate trend is corrective, within a larger bullish framework.

Wave IV is currently playing out and might end soon.

Watch key support zones (37,400 and 34,100) for potential reversal setups.

Once confirmed, Wave V rally could offer significant upside opportunities.

Remain cautious during this volatile consolidation and validate reversal signs before positioning.

📜 Disclaimer

⚠️ This analysis is for educational and informational purposes only. It is based on technical chart interpretation (Elliott Wave Theory, volume, AO) and does not constitute investment advice. Trading and investing in financial markets involves significant risk, including the risk of losing your capital. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

WALLSTREETCFD trade ideas

US30 4H - Weekly UpdateDow Jones Analysis

The overall trend on Dow Jones remains bearish.

Although a short-term correction toward 39,840 may occur at the market open, this is not my primary scenario.

Main Scenario:

◾ Continuation of the downtrend toward 36,880

◾ A corrective move back to the 39,460 area

◾ Further decline toward the final target at 35,050

Note:

The trend has been studied with high precision and will be updated as needed based on market behavior.

Accurate analysis, remarkable results!

The Dow Jones 100 Year Rising WedgePeople lie. The news lies. But the CHARTS DON"T LIE.

This is a 100 year rising wedge pattern that is occurring on the DJI.

Maybe not today, maybe not tomorrow, maybe not for another 50 years,

but this pattern will break to the downside.

As of now, a return to the original trendline is HIGHLY LIKELY.

NO FEAR, THIS IS OUT OF LOVE.

EYES OPEN.

US30 will drop by another 10% in next 4 weeks📊 My Macro Analysis Breakdown

Covid Crash:

Sharp -25% collapse.

V-shaped recovery, before another -10%

Inflation Explosion (2022):

-21% drop due to Fed rate hikes.

Choppy sideways market after.

Inflation Cooled (Nov-Dec 23):

Big +22% rally when markets priced in rate cuts.

Trump Re-Election (Nov 2024):

Stocks rallied ~8%.

US Tariffs "Lib Day" (April 2025):

Current Phase: Huge initial crash of -10%.

Projection: I am forecasting another -10% to -12% downside toward 32,352 area.

🧠 Why My Prediction Makes Sense:

Markets always overshoot after a major policy shock (tariffs are no small thing — this is bigger than inflation).

Fed won't act yet (cut rates) until serious economic data deterioration happens.

Global slowdown fears are increasing (China, Europe showing signs too).

Corporate earnings for Q1 2025 are about to be revised down = next catalyst for more selling.

Technical structure resembles past correction patterns (Covid, Inflation explosion).

📅 Timing (based on past crashes I charted):

Covid crash: 5-6 weeks.

Inflation crash: 2-3 months.

This one: Likely 4-8 weeks of choppy downside.

⚡ Conclusion:

✅ A prediction of another ~10% drop is totally aligned with both macro fundamentals and technical history.

✅ Expect violent bear market rallies (sharp 2-5% spikes) inside the downtrend — that's normal.

✅ Bias: Sell the rallies, buy safe havens (gold after the dip, bonds).

"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJ30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (42200) Thief SL placed at the nearest / swing high level Using the 3H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 40200

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJI "Dow Jones" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (42200) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (41400) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 43100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

dow jones down 15% -Some time ago, I identified a strong resistance zone near the 45,000 level on the Dow Jones Industrial Average chart, based on historical price action and technical indicators. Since then, the index has experienced a notable correction, declining to approximately 38,314 as of the most recent close — representing a drawdown of nearly 15% from the identified resistance level. This move reinforces the significance of that resistance area and suggests heightened market sensitivity around those levels

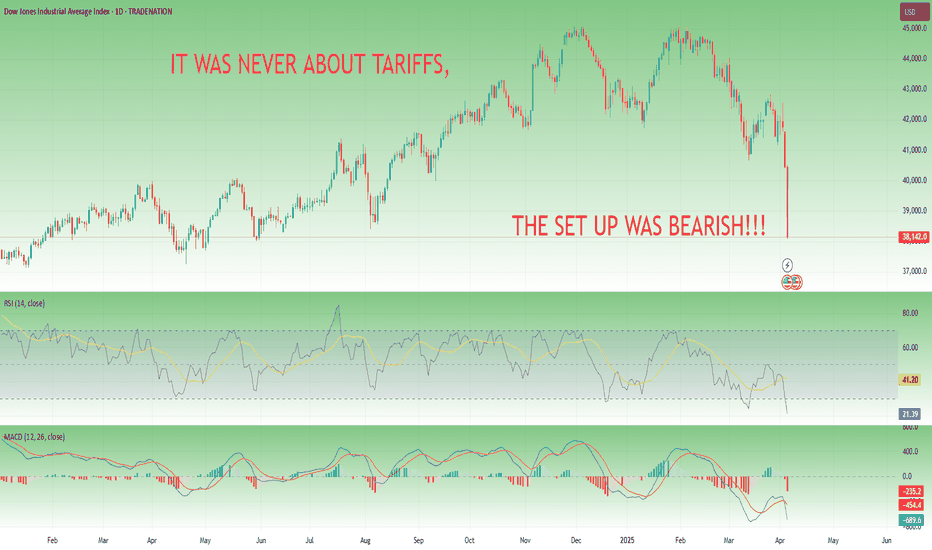

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.

As soon as the wedge broke on NAS100 and SPX broke the double top's neck line the path was clear — risk off.

________________________________________

📉 I Was Calling This Since Q1

The targets were public:

SPX = 5,200. NAS100 = 17,500.

And the logic was simple:

• Overextension in AI-led tech

• Complacent VIX environment

• Crowded long positioning

• Bearish divergences and fading momentum

Double Top and Rising Wedge on SPX and Nas100

We didn’t need a reason to drop. The market had been levitating without support. All we needed was a trigger — and we got one.

________________________________________

🧭 Lesson: Trade the Structure, Not the Story

Here’s what I hope you take away:

✅ Setups come first. News comes later.

✅ If it wasn’t tariffs, it would’ve been CPI, earnings, Fed minutes, or a bird on a wire

✅ Don’t chase headlines. Anticipate setups.

The best trades aren’t reactive. They’re built on structure, sentiment, and timing — not waiting for CNBC to tell them what’s happening.

________________________________________

🔚 Conclusion: It Was Never About Tariffs

Tariffs were the match.

But the market was already soaked in gasoline.

This correction was technical, predictable, and clean.

📝 Post Scriptum — The Setup Shapes the Narrative

Let me be clear:

I’m not a Trump fan. Hoho — not by far.

But I’ll swear this on any chart:

If the setup had been the opposite — double bottom, falling wedge, positive divergences, and improving momentum — these exact same tariffs would’ve been interpreted as “bold leadership,” “pro-growth protectionism,” or “markets pricing in a stronger America.”

That’s how it works.

Price action leads. Narrative follows.

When structure is bullish, traders celebrate even bad news.

When structure is bearish, even good news becomes a reason to sell.

So no — it wasn’t about Trump. It never is. It’s about where the market wants to go. The rest is storytelling.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Dow Jones INTRADAY key trading levels ahead of US employmentKey Support and Resistance Levels

Resistance Level 1: 40540

Resistance Level 2: 41000

Resistance Level 3: 42000

Support Level 1: 38940

Support Level 2: 38175

Support Level 3: 37320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Wall Street - Printing a very Dangerous Move!The Dow Jones (US30) is currently testing a critical level within its long-term ascending channel. The next move depends on whether the price holds or breaks this structure.

🔹 Possible Scenarios:

1️⃣ Bullish Bounce (Channel Holds) ✅

If price finds support within the 38,000 - 36,000 zone, we could see a strong rebound.

A bounce from this level may lead to a retest of 42,000 - 44,000, with potential for another attempt at the upper channel near 46,000+.

Confirmation: Look for bullish price action like long wicks or a bullish engulfing candle.

2️⃣ Bearish Breakdown (Channel Breaks) ❌

If the price breaks below the channel and closes under 36,000, this could signal a trend shift.

A breakdown may accelerate selling, leading to further downside targets at 32,000, then 28,000.

Confirmation: A strong weekly close below support with increased volume and no immediate recovery.

📌 Key Takeaway:

Channel intact → Buy dips for potential continuation.

Channel break → Expect deeper correction towards long-term supports.

Let me know your thoughts! Are you bullish or bearish on US30? 🚀📉

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.