Implied volatility, one more tool in our arsenalWHAT IS IMPLIED VOLATILITY?

Implied volatility (IV) refers to the market’s expectations of future volatility for a given asset, derived from option prices. Unlike historical volatility, which measures past price fluctuations, IV is forward-looking and reflects what traders believe will happen in t

Related futures

Tactical Short Setup on EURThe September 2025 Euro FX futures contract (E6U25) is currently trading around 1.1440 after topping out near 1.19 the 1st of July. This decline reflects a broader market repricing, driven by evolving expectations around monetary policy from the Federal Reserve and the European Central Bank, softeni

Euro to Rise as Trade Tensions DefusedCME: Micro Euro/USD Futures ( CME_MINI:M6E1! ), #microfutures

On July 27th, U.S. President Donald Trump and European Commission President Ursula von der Leyen announced the U.S. has reached a trade deal with the European Union.

• President Trump said that the deal imposes a 15% tariff on most Europ

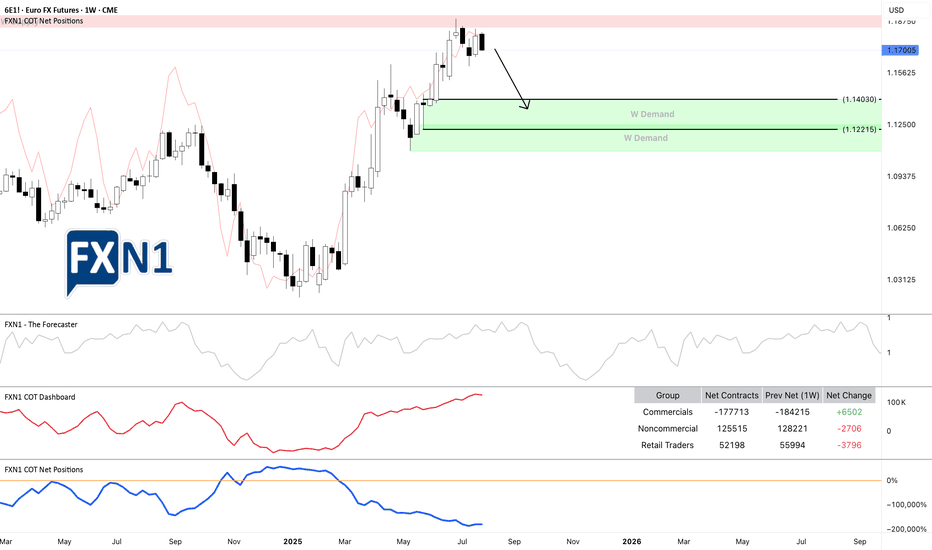

6E1!: Rebound at Weekly Supply Sparks Potential ReversalThe EURUSD (6E1! futures) experienced a rebound from a weekly supply zone * and now appears to be approaching a potential reversal toward a demand area. The overall picture is clear: we already capitalized on the rebound off the previous weekly supply zone, and at this point, we're simply observing

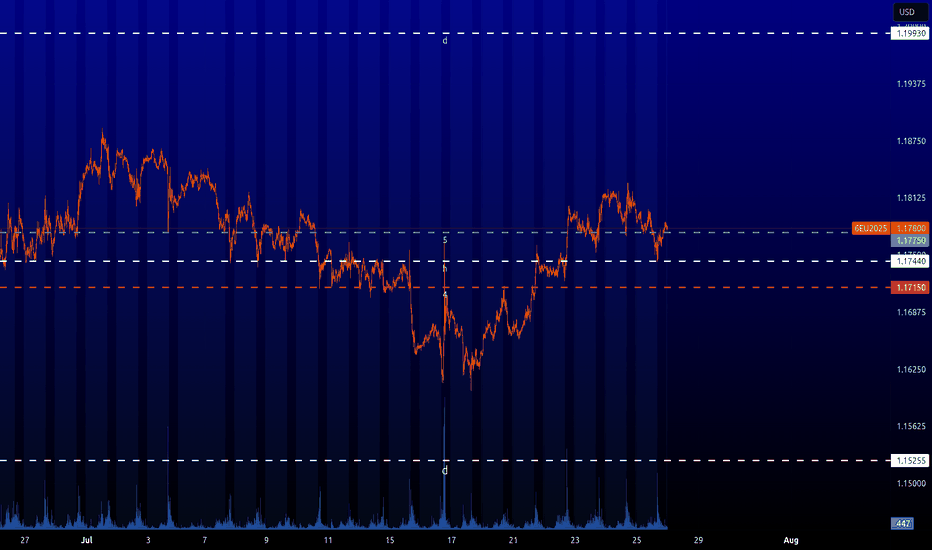

6E : Key levelsHere are the key levels for this instrument.

The nearest interesting level is at 1.17750. It is too early to buy it. The price needs to grow a little more and then it will be possible to buy this level with a limit order.

The other levels are still far away, but they will be interesting for the mar

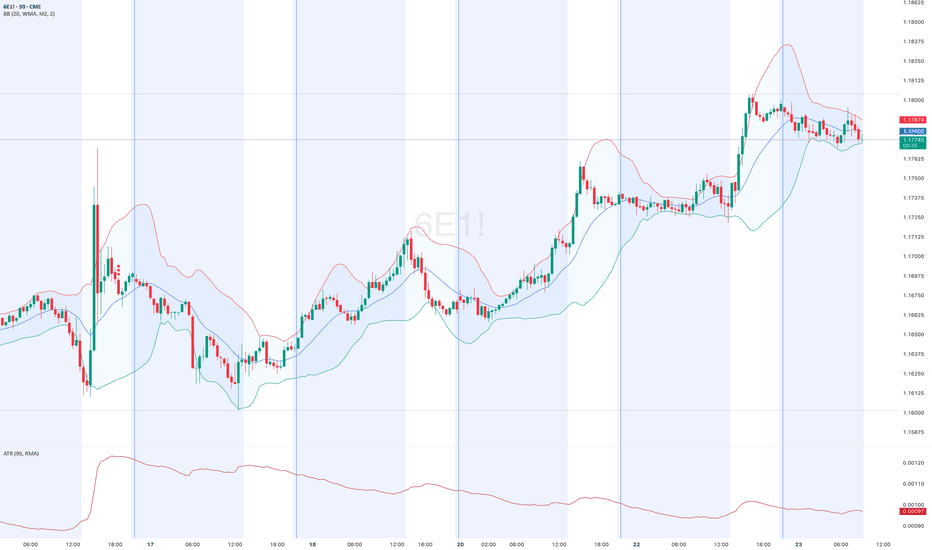

Euro Futures (6E) – Bearish Drift Below ResistanceEuro Futures (6E) appears to be grinding lower showing clear signs of fading bullish momentum.

After a bounce off 1.16160 support on July 17, Euro Futures (6E) made a failed push into 1.17995 resistance on Tuesday, July 22, a level that’s acted as a firm ceiling since June 26.

Since then, price ac

EUR/USD Futures – Key Decision ZonePrice is consolidating between 1.1430 and 1.1485, forming a range near previous value areas.

A breakout is likely imminent. Watching for:

📈 Bullish scenario: Break and retest of 1.1490 → targeting 1.1570 supply zone.

📉 Bearish scenario: Sweep of 1.1430 lows with strong volume → targeting 1.1370 dem

EURUSDEURUSD - Still has potential either now or in the future to go up to 1.3726.

Off futures has potential to go below 0.95 based on analysis only.

Confluence:

Futures Analysis - Can go both ways based on todays price action.

Forex Analysis: Still in a downtrend based on the longer term perspective,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of E-mini Euro FX Futures (Sep 2025) is 1.1641 USD — it has risen 0.14% in the past 24 hours. Watch E-mini Euro FX Futures (Sep 2025) price in more detail on the chart.

The volume of E-mini Euro FX Futures (Sep 2025) is 1.46 K. Track more important stats on the E-mini Euro FX Futures (Sep 2025) chart.

The nearest expiration date for E-mini Euro FX Futures (Sep 2025) is Sep 15, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini Euro FX Futures (Sep 2025) before Sep 15, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini Euro FX Futures (Sep 2025) this number is 8.91 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini Euro FX Futures (Sep 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini Euro FX Futures (Sep 2025). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini Euro FX Futures (Sep 2025) technicals for a more comprehensive analysis.