ES1! trade ideas

Combined US Indexes - Lower High Lower Low checked; What next...As previously expected, a lower low has been achieved.

What was not expected was the speed, magnitude and extent of the fallout.

Next up, since it is about 3.5 Standard Deviations out, we can start looking for a consolidation, although there might be slightly more downside and we need a higher low in the expected range within box. Having said that, it is possible to see it overextend downwards briefly.

There is a long term support, Fibonacci downside target zone just below.

So expecting a short term bounce between Monday to Wednesday at the earliest, and following that a consolidation area formation.

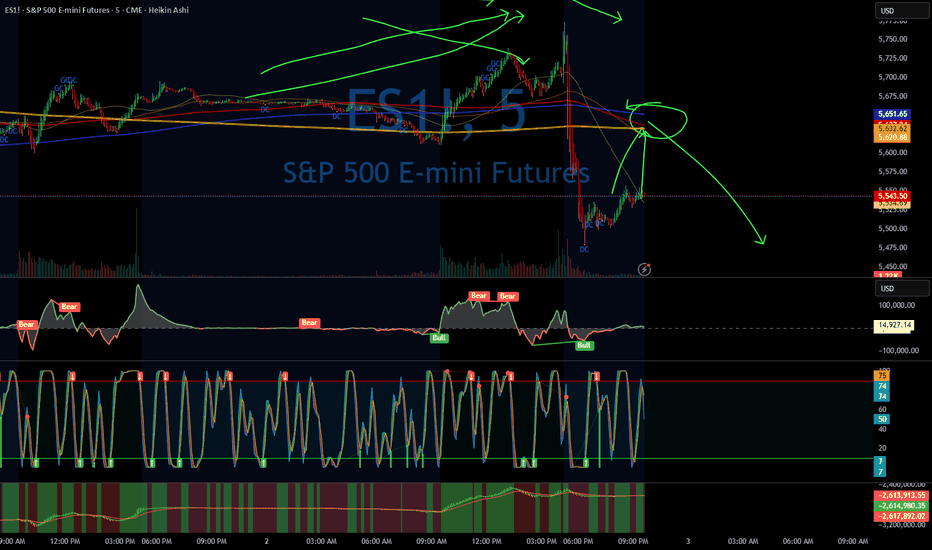

ES and the Trade War, We are still short here.Current Market Context:

Downtrend Continuation: The ongoing trade tensions between the U.S. and China have led to significant sell-offs, pushing the ES further down. The recent sharp decline in major indices, including the S&P 500, highlights the market's instability and investor anxiety.

Bearish Sentiment: The market's bearish sentiment is evident, with the Nasdaq entering a bear market and the S&P 500 experiencing its largest weekly decline since 2020.

Criteria for Reversal:

Trend Line Break: A break above the current downtrend line on a higher time frame, such as the 15-minute chart, would be a strong indicator of a potential reversal.

Mitigation of Bearish Fair Value Gap: Observing a mitigation of the bearish fair value gap would suggest that sellers are losing control, paving the way for buyers to step in.

Formation of Bullish Fair Value Gap: The emergence of a bullish fair value gap would indicate a shift in market sentiment, signaling the potential for an uptrend.

Projections for ES Price:

Short-Term Outlook: If the above criteria are met, we could see a reversal in the ES price, with potential targets at key resistance levels. Look for a break above the recent highs on the 15-minute chart to confirm the uptrend.

Medium-Term Outlook: Should the reversal gain momentum, the ES could aim for higher resistance levels, potentially retracing some of the recent losses. Key levels to watch include previous support turned resistance zones.

Long-Term Outlook: In the event of sustained bullish momentum, driven by positive economic indicators or easing trade tensions, the ES could recover further, targeting higher time frame resistance levels.

Strategic Considerations:

Cautious Approach: Given the current volatility, it's crucial to remain cautious and wait for clear confirmation of a trend reversal before entering long positions.

Sector Opportunities: Consider focusing on sectors like utilities, consumer staples, and healthcare, which may offer more stability during this downturn.

ES 3hr Update1) I told everyone not to go long until congress decides to rescind all of the tariffs

2) I said the futures gap might not fill for an extended period of time, but all gaps will fill. This one will not happen until the tariffs are rescinded by congress or the next president, lol.

3) I said like COVID, this drop will probably break a lot of rules. So far it's broken the gap rule, 3hr indicator, double index gap (SPX daily index doesn't usually throw gaps 2 days in a row, and if it does it fills them them within days).

4) I assume it will break daily and weekly indicators as well, so I'm not even gonna post plots.

5) The algos are on, but broken. You can see that the market zig zagged multiple times today as the algos tried to pump the market, but there were way too many retail investors that sold. EOD (end of day) selling indicates people going cash in their 401k. Extremely rare for the market to drop EOD on Fridays like that. Usually there's at least some bounce.

Anyways, you can see 3hr indicators flatlined at the bottom, the same can happen with daily and weekly indicators. We were close to circuit breaker level today. We may hit it next week if congress doesn't do something. That's the unknown factor that kept me from shorting the market over the weekend. If not, we may see yet another futures gap Sunday night and the circuit breaker. Remember we hit it multiple times during COVID bottom.

ES Monthly chart for some of you youngstersIf you think the market can't go any lower, you're mistaken. It's been a while since it's happened (housing bubble crash), but monthly indicators can go oversold. We're not there yet.

If congress doesn't step in and rescind the tariffs, the stock market will get cut in half like it did back then. It's gonna be nearly impossible for corporations to match even preCOVID level profits with such huge tariffs.

I do not recommend going long on anything until congress steps in. That may happen as early as this weekend, or they can wait until the market tanks 50%, lol..... who knows.

SPX scenarios in weekly chartHello

These 2 scenarios for S&P is more probable ones and as you elliotticians know there is a doubt in wave (4). In scenario 1 wave (4) is acceptable due to Alternation and in scenario 2 it made a Running Flat. In both scenarios there is one strategy for today market which is another correction starting from here.

In smaller time frames you need to find a bearish impulse wave to get in this correction.

S&P 500 - Elliott Wave Bearish BreakdownThis S&P 500 E-mini Futures (ES) daily chart highlights a potential bearish Elliott Wave structure following rejection from a key resistance zone.

- The market encountered strong resistance near the 5,600 level, leading to a sharp decline.

- A five-wave impulsive bearish structure appears to be forming, with Waves (1) and (2) already completed.

- If this pattern continues, Waves (3), (4), and (5) could drive prices lower, targeting key support levels in the coming weeks.

Traders should watch for confirmation of Wave (3) acceleration, as it is typically the strongest wave in an impulse. A break below recent lows could confirm further downside, while a strong bounce from lower levels may indicate a correction or trend reversal.

Risk management remains crucial, as volatility can increase during corrective and impulsive waves. Keep an eye on macroeconomic factors and technical confluences for additional confirmation.

Combined US Indexes - Lower High checked; Lower Low next...As expected from previous analysis, there is a lower high likely as the TD Sell Setup is Perfected. This just missed the target but has the TD Bear Trend intact

Following, a Bearish Engulfing pattern plus a Gap Down occurred yesterday.

Breaking back into Extension Zone box... and likely to protrude out the other side.

MACD is turning down in the bearish zone too.

So, looking for a lower low now...

April 3rd Daily Trade Recap EOD accountability report: +$161.25

Sleep: 6 hour, Overall health: not good at all.

**Daily Trade Recap based on VX Algo System **

9:42 AM Market Structure flipped bullish on VX Algo X3!

10:30 AM Market Structure flipped bearish on VX Algo X3!

11:11 AM VXAlgo ES 10M Buy signal (double signal)

12:04 pm Market Structure flipped bullish on VX Algo X3!

1:31pm Market Structure flipped bearish on VX Algo X3!

1:40 PMVXAlgo NQ 10M Buy Signal double signal

Another wild day, market went extremely bearish and has been rejecting the 5 min resistance and playing out as expected.

ID: 2025 - 0073.18.2025

Trade #7 of 2025 executed. So simple, yet far from easy...

Trade entry at 30 DTE (days to expiration).

This trade has a little more hot sauce and fire built into it.

Unbalanced butterfly, close to expiration, will adjust the wing widths as the market adjusts either up or down. Goal is to be out of this trade in under two weeks before GAMMA really begins kicking in.

The reason I like going in closer to expiration after big market moves, is the volatility is better, and fills are quicker, and spreads are tighter. The downside of playing super long DTE strategies is that when the market gets spooked or turbulent, the bid/ask spreads become a mile wide.

Happy Trading!

-kevin

be careful from this market makers playIts a very straight forward approach.

make it look like we have a double bottom and rugpull:

fomo pump to vwap

clean the funky high

then nuke toplongers on trump news

I hope this wont get many views, i know you're watching market maker.

dont worry im not going viral so you keep doing you.

green rectangle is a gap thats why its my target.

i wont short this without oscilators data

ES UpdateGap is still open but market is cycling down. RSI is not oversold yet. Probably a bounce when RSI hits oversold, but I don't expect a big one until the daily gets oversold.

Market took such a big shit that firms had to sell gold futures for to cover losses and margin calls. So gold is red now as well. SO that play also appears to be done. Too bad I didn;t just short something before close like XLF or AAPL.

Gaps are so huge, I have no idea how to play this. I don;t recommend going long today though, unless its just a day trade.

Understanding MACD In TradingThe Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that measures the relationship between two moving averages of an asset’s price. Developed by Gerald Appel in the late 1970s, MACD is designed to provide insights into both trend strength and momentum.

Unlike simple moving averages, which merely smooth price data over a specific period, MACD goes a step further by identifying when short-term momentum is shifting in relation to the long-term trend. This makes it a valuable tool for traders looking to enter or exit positions at optimal points.

1. Why is MACD important in trading?

Trend Confirmation: Identifies whether an asset is in an uptrend or downtrend.

Momentum Strength: Measures how strong a price movement is.

Reversal Signals: Detects potential changes in trend direction.

Entry and Exit Points: Helps traders determine when to buy and sell.

2. MACD Components

The MACD Line: Identifies whether an asset is in an uptrend or downtrend.

This line is derived by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.

When the MACD Line is positive, it indicates bullish momentum; when negative, it suggests bearish momentum.

The Signal Line: Measures how strong a price movement is.

A 9-period EMA of the MACD Line.

It smooths out MACD fluctuations, making it easier to identify crossovers.

The Histogram: Detects potential changes in trend direction.

The difference between the MACD Line and the Signal Line.

A positive histogram suggests increasing bullish momentum, while a negative histogram suggests growing bearish momentum.

3. MACD Formula

The Moving Average Convergence Divergence (MACD) is one of the most widely used technical indicators in trading. It helps traders identify trends, momentum shifts, and potential buy or sell opportunities by analyzing the relationship between two moving averages.

By calculating the difference between a short-term and long-term exponential moving average (EMA), MACD provides insight into market direction and strength.

//@version=6

indicator("MACD Indicator", overlay=false)

// MACD parameters

shortLength = 12

longLength = 26

signalLength = 9

// Calculate MACD

macdLine = ta.ema(close, shortLength) - ta.ema(close, longLength)

signalLine = ta.ema(macdLine, signalLength)

histogram = macdLine - signalLine

// Plot MACD components

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.red, title="Signal Line")

plot(histogram, color=color.green, style=plot.style_columns, title="Histogram")

Explanation:

Short EMA (12-period) and Long EMA (26-period) are calculated.

The MACD Line is the difference between these EMAs.

A Signal Line (9-period EMA of MACD Line) is calculated.

The Histogram represents the difference between the MACD Line and the Signal Line.

4. Interpreting MACD signals

MACD Crossovers

A crossover occurs when the MACD Line and Signal Line intersect:

Bullish Crossover: When the MACD Line crosses above the Signal Line, it signals a potential uptrend and a buying opportunity.

Bearish Crossover: When the MACD Line crosses below the Signal Line, it suggests a potential downtrend and a selling opportunity.

MACD Divergences

Divergences occur when MACD moves in the opposite direction of the price, signaling a potential reversal:

Bullish Divergence: If price makes lower lows, but MACD makes higher lows, it suggests weakening downward momentum and a possible bullish reversal.

Bearish Divergence: If price makes higher highs, but MACD makes lower highs, it signals weakening upward momentum and a potential bearish reversal.

Histogram Interpretation

The MACD histogram visually represents momentum shifts:

When bars are increasing in height, momentum is strengthening.

When bars shrink, it suggests momentum is weakening.

Zero Line Crossings

The MACD crossing the zero line indicates momentum shifts:

MACD crossing above zero → Bullish trend initiation.

MACD crossing below zero → Bearish trend initiation.

5. Trend & Momentum Analysis

Traders use MACD to confirm trends and analyze market momentum:

If MACD Line is above the Signal Line, an uptrend is in place.

If MACD Line is below the Signal Line, a downtrend is dominant.

A widening histogram confirms strong momentum in the trend’s direction.

A narrowing histogram warns of potential trend weakening.

MACD works best in trending markets and should be used cautiously in sideways markets.

6. MACD Based Trading Strategies

Entry Strategies

Buy when MACD Line crosses above the Signal Line in an uptrend.

Sell when MACD Line crosses below the Signal Line in a downtrend.

Exit Strategies

Exit long trades when a bearish crossover occurs.

Close short positions when a bullish crossover occurs.

Position Management

If the histogram is expanding, traders can hold positions.

If the histogram is contracting, it may signal weakening momentum.

7. Limitations of MACD

While MACD is a powerful tool, traders must consider:

It lags behind price movements (since it is based on moving averages).

It can generate false signals in choppy markets.

Customization is required to suit different trading styles.

8. Optimization

Optimizing MACD for Different Market Conditions

Day Traders & Scalpers: Use faster settings like (5, 13, 6) for quick signals.

Swing Traders: Stick with the default (12, 26, 9) setting for balanced signals.

Long-Term Investors: Use slower settings like (24, 52, 18) for a broader market perspective.

9. Key Takeaways

MACD is a momentum and trend-following indicator that helps traders identify market direction, strength, and potential reversals.

Since MACD is a lagging indicator, it may generate false signals, especially in sideways markets.

Combining MACD with RSI, moving averages, and volume indicators improves accuracy and reduces risk.

MACD should be used alongside risk management strategies and other confirmation tools for best results.

MACD remains one of the most effective technical indicators, widely used across different markets. It helps traders identify trends, confirm momentum, and optimize trade entries and exits. However, it should always be used with additional tools to minimize false signals.

Stay sharp, stay ahead, and let’s make those moves. Until next time, happy trading!

Daily Trade Recap based on VX Algo System EOD accountability report: +$2,337.50

Sleep: 5 hour, Overall health: not gud

**

Daily Trade Recap based on VX Algo System **

9:36 AM VXAlgo NQ 48M Buy Signal,

9:44 AM Market Structure flipped bullish on VX Algo X3!

11:13 AM VXAlgo ES 10M Sell Signal (lost $525 on this play)

1:21 PM VXAlgo ES 10M Sell Signal

2:05 PM VXAlgo NQ 48M Sell Signal

2:40 PM VXAlgo ES 10M Buy signal (triple signal)

Overall a pretty wild day, I'm extremely glad that we have a system that works and reads the MM very well.

The only thing we need to do is be extremely disciplined and pull the trigger without hesitation.

ES Open Gap AlerrtKinda expected that there will be an open gap after the break. Algos are trying desperately to bring futures back up, and much like I told you the other day, they're selling gold futures to do it. So much gold future that it's not tracking spot price, lol. I don't think I've ever seen that aside from when oil futures went negative during COVID.

Probably gonna just stick with gold, RSI is not oversold yet, so it may drop further before rebounding to fill teh gap.