ES Morning Update March 18thYesterday, the plan for ES was straightforward: rally to ~5755 (adjusted for the June contract, previously 5703 on March) to back-test the 3-month megaphone breakdown from last Monday. The market followed through with an 88-point rally to that level before selling off.

As of now:

• 5720 (reclaimed) and 5698 are key supports

• Holding above keeps 5739 and a second test of 5754 in play

• If 5698 fails, look for selling pressure toward 5668

ES1! trade ideas

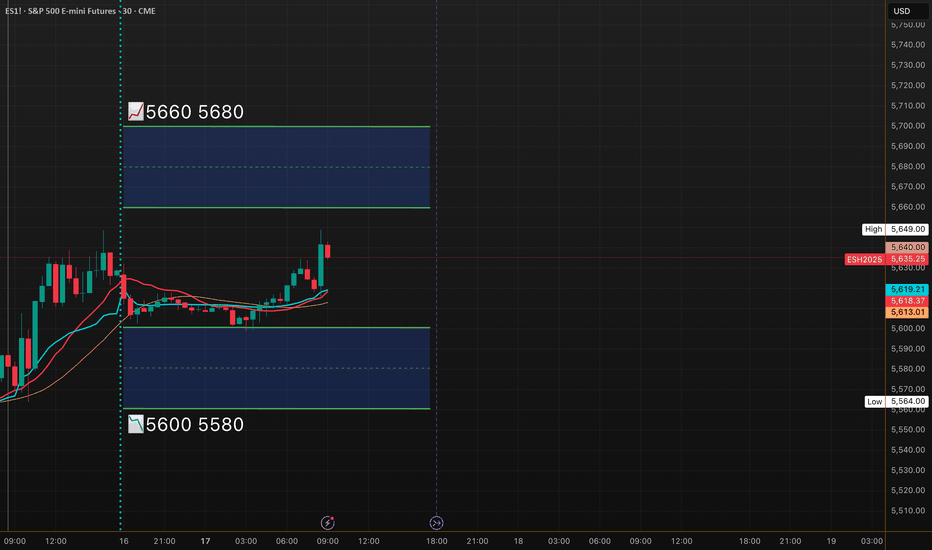

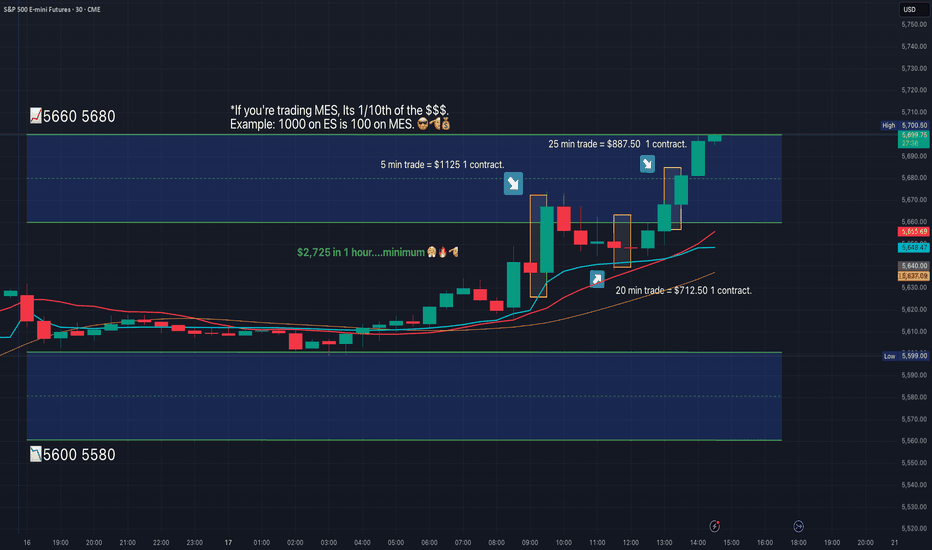

MES!/ES1! Day Trade Plan for 03/17/2025MES!/ES1! Day Trade Plan for 03/17/2025

📈5660. 5680

📉5600. 5580

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

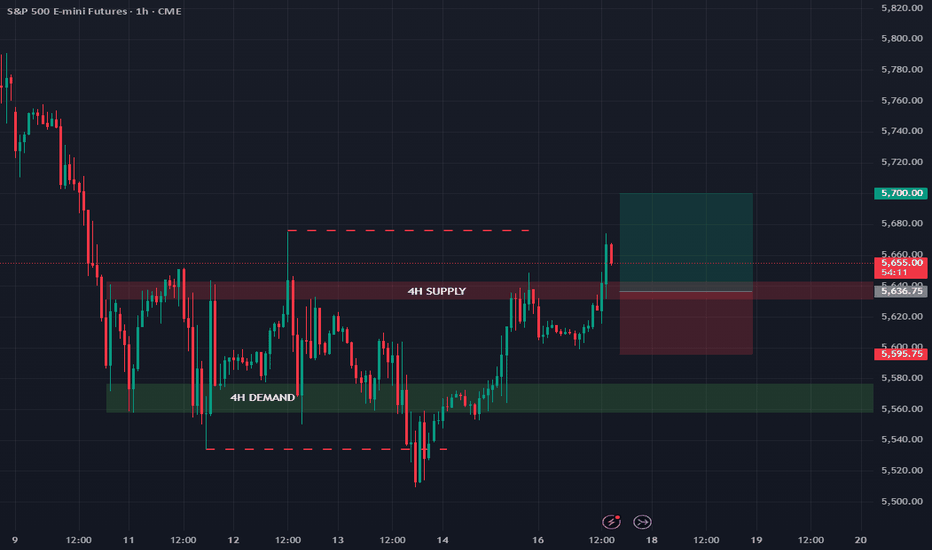

ES futures update 17/03/'25Last week, I mapped out some trading zones that are still valid and unchanged.

The 4H supply zone has broken out, so I will be looking for a long position after a retest of this broken supply zone, which should now act as support.

My last trade was a short from this zone, resulting in a small profit since market closing prevented reaching the full take-profit target.

Let's see if the bullish momentum can hold during the retest entry.

As always, follow for more market updates.

OTEUM EXPERT CALL: SP500 Intraweek Pre-FED Bounce?Here comes the pre-FED volatility—price is dipping into that “value area” and OTEUM is looking to ride it higher 🤜💥. But watch out: Trump is back on tweet mode 🦅, which could rattle the market at any moment. Go small, manage your risk like a pro, and let’s see if we can ride this bounce 🚀!

#SP500 #ExpertCall #PreFED #Volatility #TrumpTweets

Gamma Exposure on SPXToday marks the first day in a long time where we can observe some green, bullish levels on gamma exposure. The daily GexView indicator displays thin green lines, which represent the gamma exposure of zero-days-to-expire contracts. The thick lines, on the other hand, represent the total gamma exposure across all expiration contracts. This is a promising first step, especially if these lines persist over the next few days and continue to develop further.

ES Futures Market Outlook & Key LevelsCME_MINI:ES1!

As we discussed in last week’s TradingView blog, the ES futures are currently undergoing a 10% correction. You can access the full context through the link here.

Rollover Notice:

Today marks the rollover of ES futures to the June 2025 contract. The rollover adjustment using Friday’s settlement prices for ESH2025 and ESM2025 is +52.25. To map out the new levels for ESM2025, simply add +52.25 to the levels on ESH2025.

Note: TradingView will roll over the continuous ES1! chart on Tuesday, March 18, 2025.

Key Events This Week: This week, all eyes will be on the FOMC rate decision , FOMC press conference , and the Summary of Economic Projections (SEP ), which includes the Fed’s dot plot, inflation expectations, and growth forecasts for the next two years. This release will set the tone for market movements, at least until the clarity of the looming reciprocal tariffs deadline on April 2, 2025.

Key Levels to Watch:

• Bullish LIS / Yearly Open 2025: 5,949.25

• Key Level to Reclaim: 5,795 - 5,805

• Resistance Zone: 5,704.50 - 5,719.75

• Bearish LIS / Mid Range 2024: 5,574.50

• 2024-YTD mCVAL: 5,449.25

• 2022 CVAH: 5,280.25

Market Scenarios:

Scenario 1: Fed Support ("Fed Put")

The Fed is widely expected to hold rates steady this week. However, markets are forward-looking, so the key focus will be on the updated SEP forecast and the Fed’s press conference. A dovish stance and flexibility to support the US economy, including rate cut expectations moving to the May/June meetings, will drive sentiment. This would imply markets pricing in more rate cuts throughout 2025. The CME Fedwatch tool is a useful resource for tracking Fed fund probabilities and comparing these with the dot plot projections.

Scenario 2: Trade War 2.0

If the Fed remains in a "wait and see" mode, maintaining a restrictive stance while uncertainties surrounding Trade War 2.0 persist, markets may face heightened volatility. The combination of a restrictive Fed policy and geopolitical tensions could act as a double whammy for markets.

ES Morning Update March 17thOn Thursday, ES reclaimed 5558, triggering a long setup that led to a rare green day. The 5645 target was hit on Friday after a strong trend day. With that momentum, today is likely to be more complex—hold runners.

As of now:

• 5599, 5615 are key supports

• Tests of 5599 and recoveries of 5615 are actionable setups

• Holding above keeps 5644, 5666+ in play

• If 5599 fails, expect selling pressure to increase

ES, Mar 17, 2025 CME_MINI:ES1! swept September’s low, clearing major sell-side liquidity before starting to reverse. I’m anticipating a push through the 4H FVG, inverting it, and then a retracement into it early this week (March 17th/18th). If price holds above, we could see continuation higher, but failure to hold the FVG as support may lead to another leg lower.

The Weekly FVG remains a key resistance — multiple taps could weaken it for a potential breakout later in March.

ES1! Intraday levels for 16-17 March Oh no!

Here are the levels for ES1! tonight/tomorrow.

Sorry for the poor graphics, it seems Tradingview has uh, prevented publishing ideas with "private" indicators overlaid.

Unfortunately my levels are exported from secondary software for overlay on Tradingview via pinescript so it really makes sharing ideas much more difficult.

I understand the reason but for the rare person like me who uses Pine just for plotting functions its a real hassle, so I beg you Tradingview to reconsider! haha

Okay, anyway now that that is out of the way, I am very neutral for the session tonight/tomorrow.

I expect moves in both directions, and keep in mind we have FOMC on Wednesday.

The probability metrics favour the downside targets but don't think its unreasonable to expect both upside and downside targets.

Looking for it to snag either resistance of support first before taking a position this evening.

Good luck everyone! Safe trades!!! 🚀

S&P 500 (March Contract) - Stock Market Loses $5 Trillion!The S&P 500′s rapid 10% decline from a record high into correction territory has wiped out trillions of dollars in market value.

The market value of the S&P 500 at its Feb. 19 peak was $52.06 trillion, according to FactSet. Thursday’s decline put the index’s market value down to $46.78 trillion.

That makes for a total loss of about $5.28 trillion in about three weeks.

Will the rate announcements cause S&P 500 to sink lower into the abyss??

Reference: www.cnbc.com

Weekly Market Analysis - 16th March 2025 (DXY, NZD, ES, BTC)This is weekly market analysis of a few pairs (DXY, NZD, ES, BTC).

I haven't done one of these in a while, but here it is!

I would have done more pairs but the video was already 30 minutes long and I went into more teaching rather than pure analysis.

I hope you found it insightful to your own trading, because what I teach is the truth of the market regardless of whatever specific strategy you use for trading.

Anything can make money in the markets, but of course, risk management and discipline rule all.

- R2F Trading

Why DCA Does Not Work For Short-Term TradersIn this video I go through why DCA (Dollar Cost Averaging) does not work for short-term traders and is more suitable for investors. I go through the pitfalls than come through such techniques, as well as explain how trading should really be approached. Which at it's cost should be based on having a positive edge and using the power of compounding to grow your wealth.

I hope this video was insightful, and gives hope to those trying to make it as a trader. Believe me, it's possible.

- R2F Trading

SPY shortsThe chart displays the S&P 500 E-mini Futures (4-hour timeframe) with technical analysis indicators. Key features include:

Current Price: 5,628.25 (SELL) and 5,629.25 (BUY).

Recent Movement: The price recently bounced from a low and is projected to reach 5,676.00 by March 17, 2025, before potentially dropping to 5,392.50 by March 24, 2025, reflecting a decline of -283.50 points (-4.99%) in 7 days.

Fibonacci Levels:

0.5 retracement levels at 5,836.25 and 5,641.75.

Extension levels indicate potential further declines below 5,352.00 and 5,253.75.

Pivot Points: Marked at multiple levels (e.g., 5,935.50 and 6,166.50) for resistance and support.

Volume: 410.25K with a daily gain of +112.50 points (+2.04%).

Projection: The blue arrow suggests a bearish outlook after a short-term rise, with a significant price drop expected.

This chart is likely part of a trading strategy based on Fibonacci retracements, pivots, and projected price movements.

Full recovery on the way? Perhaps...As I stated in my last observation, the "bottom" held and the S&P e-mini's began to move up reaching a .236 retracement at 5639. Considering the damage from the last few weeks, it was a welcome and much needed recovery. Looking forward, I expect a continuation of the market to chop higher heading to the next important level of 5709, or a .382 retracement. There was so much damage to so many stocks that it would be hard to expect much more than this, but given the highly emotional way people sold into this down move, there should be an equally emotional move higher as FOMO kicks in and investors reluctantly buying many of the same companies they

recently sold: wash sale rules be damned.

A look at the ES1!What's up traders,

Havent posted in a while.

Heres my take and outlook for next week, using the MES1! (SP500)

Current Outlook

Technical Look:

Momentum Bearish -323.25 (looks weak)

MACD Bearish, possibly inflecting

RSI 36.72, off lows and crossing MA (oversold)

200D SMA at 5775.75 (Below the 50 Day)

50D SMA at 5967.43 (Above the 200 Day) Trending towards a Death Cross

Price Action

Bullish Engulfing Candle on the March 14 bounce.

Price successfully crossed the 5600 Psychological Level

We bounced at ~5500

Experiencing resistance in the 5640-5620 Range (expected)

Sentiment

Canada showed promise as heading towards a (take your best guess at the details) resolution to the tariff fight with the united states.

Tariffs remain a major drag on the stock market pricing.

Government shut down at time of this post, is apparently narrowly avoided.

Gold Set a new high.

Outlook for Next Week

Economic Reports

Monday - Retail Sales 830AM

Tuesday - Building Permits, Housing Starts 830AM

Wednesday - Fed Int Rate Decision 2PM, JPOW Speech 230PM

Thursday - Existing home sales 10AM

Notable Earnings Reports

Micron

Nike

Fed Ex

General Mills

Carinval Cruise

NIO

Tencent

I viewed the Firday bounce as a sort of 'relief rally'. My belief is that we could go higher on the back of it. The market has majorly 'oversold' by the numbers - and the probability of a bounce became increasingly likely. Upside resistance to remain mercurial on the rapidly changing sentiment narrative.

A possible outcome: retest the underside of the 200DMA.

I do not expect a notable price recovery towards ATH's until the tariff effects are known, which means: I expect higher than normal volatility for several months

Earnings projections (in the coming earnings season) will shed the required light on reality.

I have been adding long term holds - such as:

GDX

DAX

META

GOOG

AMZN

BABA

UNH

C

CRWD

IBIT

NVO

CMG

INDA

AVGO

I remain ~90% cash at ~3.7% yield.

Resistance possibly at:

5672 August 2024 Resistance, September 2024 Support

5724 July 2024 Resistance and later Support

5775 (200 Day SMA)

ES futures update 14/03/'25The key trading zones from yesterday's analysis remain unchanged.

Yesterday's plan was to short at the demand zone retest after the breakdown, but the trade was cancelled since price never reached my entry point.

Today, I'll be watching for either a short opportunity at the 4H supply zone or a long position after a breakout and retest of the supply zone.

Follow me for more trading updates.