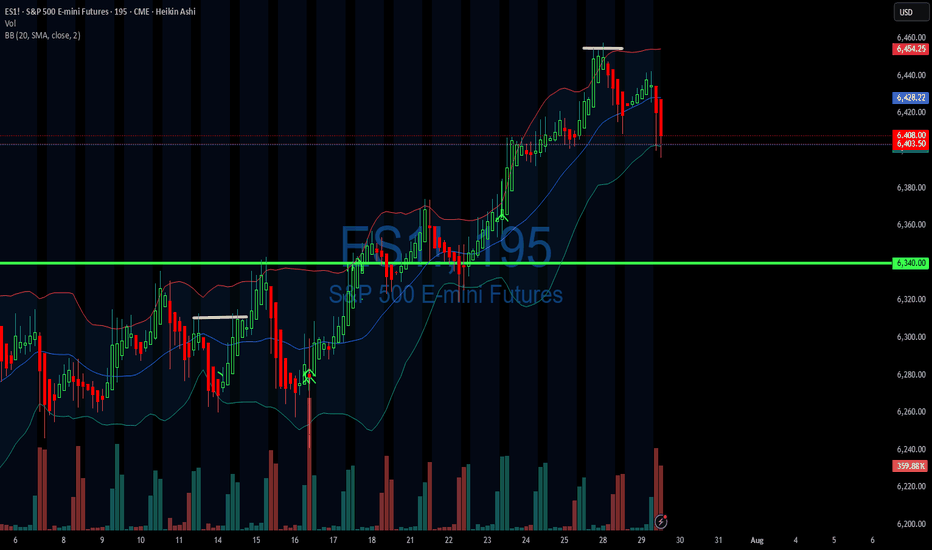

S&P 500 (ES1): Post FOMC, Buyers Pushing Back To The Highs!In this video, we will analyze the following FX market for July 31 - Aug 1st.

S&P 500 (ES1!)

In the Weekly Forecast for the S&P 500, we highlighted:

- price is bullish, and expected to go higher. It did move to ATH before pulling back.

- the sell side liquidity under the ascending lows would dr

Related futures

This is a focus the Index marketIt's Sunday and you might want to look at the S&P when the Market opens later tonight. For 2 days the S&P went lower and I think you can categorize this as an expanding Market and it's very tradable. You can even miss the trade on Thursday and still make a good return on Friday. Also I would call th

07/29/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +734

Sleep: 5 hours

Overall health: Been struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:00 AM Market Structure flipped bearish✅

— 9:30 AM VXAlgo NQ X3 Buy Signal✅

— 9:36 AM Market Structure flipped bullish on VX Algo X3! ❌

Corrective Dip or New Downtrend on the S&P 500 Futures?🟣 1. Impulses vs. Corrections – The Classical View

When price trends, it doesn't move in a straight line. Instead, it alternates between directional movements called impulses and counter-directional pauses or retracements known as corrections. Most analysts define an impulse as a sharp, dominant m

Time to catch its breathAfter the break to lower prices in the daily S&P 500 chart, the expectation for Monday is for the market to stop and catch its breath which means are not looking for a big day down on Monday but rather a sideways so only slightly lower move without new fundamental information to stimulate the market

Approachable Contracts for Trading Around Fed DecisionsCME Group E-Mini S&P Options ( CME_MINI:ES1! ) and Micro S&P Futures ( CME_MINI:MES1! ), #microfutures

On July 30th, the Federal Open Market Committee (FOMC) decided to keep the Fed Funds rate unchanged at the 4.25-4.50% target range. Investors now turn their focus on whether the Fed will cut rates

Understanding SMT Divergence In Trading1. Definition and Importance

SMT (Smart Money Technique) Divergence refers to a trading concept that involves identifying discrepancies between the price movement of correlated markets or instruments.

These discrepancies can signal potential market reversals or price manipulation. Specifically, it

Friday's support clearly shown This is why I use the Accurate Swing Trading System (Ceyhun). Look at it in default configuration on this daily MES1! chart. I drew the red horizontal lines where the indicator line is "flat". That is what I am trying to show you. An "Emergent Quality" of the indicator. I note the line at 6,241

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of E-mini S&P 500 Futures (Mar 2030) is 7,320.00 USD — it has fallen −0.42% in the past 24 hours. Watch E-mini S&P 500 Futures (Mar 2030) price in more detail on the chart.

Track more important stats on the E-mini S&P 500 Futures (Mar 2030) chart.

The nearest expiration date for E-mini S&P 500 Futures (Mar 2030) is Mar 15, 2030.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini S&P 500 Futures (Mar 2030) before Mar 15, 2030.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini S&P 500 Futures (Mar 2030). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini S&P 500 Futures (Mar 2030) technicals for a more comprehensive analysis.