#202514 - priceactiontds - weekly update - nasdaq e-mini futures

Good Evening and I hope you are well.

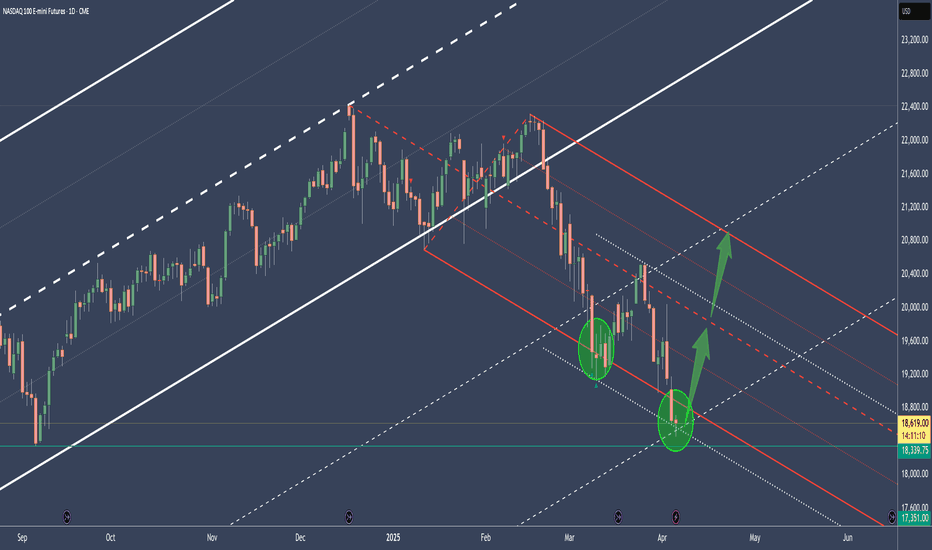

comment: W3 has likely concluded and I expect the same price action as for W2. Market is respecting technicals precisely. Look at the chart and the obvious numbers and lines. We can always do an over- or undershoot but for now I don’t think looking for shorts after two days of crashing make any sense.

current market cycle: strong bear trend

key levels: 16000 - 19600

bull case: Bulls still running for the exits but we have fallen too much too fast and we are getting into value territory for bigger players to buy the dip. Almost nothing is ever as bad as these extreme market reactions want to trap you into. Not to the downside and certainly not to the upside but to the upside everyone is busy pounding their chest because they are such a genius for making money in a bull market. Bulls want a squeeze up to 19000, that’s about it. Bear trend line around 18800-19000 will most likely get hit over the next 2 weeks.

Invalidation is below 17000.

bear case: Same reasoning as for dax. Bears want the big bull trend line around 16500 but they won’t get there in a straight line. W4 is likely around the corner. If we stay below 18800, that would once again leave another gap open and be another show of big strength by the bears.

Invalidation is above 19100.

short term: W3 has likely concluded, shorting below 18000 is really really not a good trade unless it’s a momentum scalp. Looking to scalp some longs on the squeeze up.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. Clear W1 of this bear trend. Market now has to close below 19000 to confirm W3. Depending on how deep W3 goes, W5 will either reach only around 17500 or the bull trend line around 16000.

current swing trade: None

chart update: Made the bear trend clear and my expectation for W4 and W5. As always, it’s a guess.

MNQ1! trade ideas

Market Update: NASDAQ 100 Analysis📈 The NASDAQ 100 is currently trading at 18,075.00, which represents a -22.6% decline from the all-time high of 22,425.75 . This marks a significant drop from its peak, entering into what could be classified as a bear market by traditional standards.

📊The previous decline from the high of 16,800.00 in November 2021 saw a decline of 37.47% , eventually bottoming out at the 61.8% Fibonacci retracement level (10,514.25), from which it staged a significant recovery to reach the all-time high of 22,425.75.

📊Current Demand Zones & Fibonacci Levels:

These zones represent potential reversal areas where buyers could regain control. The Fibonacci retracement levels align well with historical price action, reinforcing their significance as support zones.

DZ-1 (17,539.00-16,334.85): Approximately the 50% Fibonacci retracement of the recent bull rally

DZ-2 (16,334.85-15,384.25): Approximately the 61.8% Fibonacci retracement - Historically a strong support level

DZ-3 (15,384.25-14,557.00): Critical structural level with prior buyer interest

DZ-4 (14,557.00-14,140.25): Deep support level - key psychological zone

📈 Recovery Potential

To regain the all-time high of 22,425.7 5, the market would need to achieve the following percentage gains from each demand zone:

From DZ-1 (Top: 17,539.00, Base: 16,334.85): 📈 +37.3% to all-time high

From DZ-2 (Top: 16,334.85, Base: 15,384.25): 📈 +45.8% to all-time high

From DZ-3 (Top: 15,384.25, Base: 14,557.00): 📈 +54.0% to all-time high

From DZ-4 (Top: 14,557.00, Base: 14,140.25): 📈 +58.6% to all-time high

The DZ-2 to DZ-3 range provides the most likely region for a significant reversal based on confluence between historical support levels and Fibonacci retracements. While DZ-4 aligns with the 37% historical decline.

🔑 Key Takeaways

The NASDAQ 100 s is in a significant correction phase, down -22.6% from its peak.

Price is approaching critical Demand/support zones (DZ-1 to DZ-4), which may act as reversal points.

A return to all-time highs would require substantial gains, particularly if the market reaches the deeper demand zones.

Investors should closely monitor price action around the DZ-2 to DZ-3 range (15,384.25 - 14,557.00) for signs of a potential reversal.

Additionally, staying updated on developments related to the new tariffs is essential, as they may heavily influence market dynamics in the coming months.

Nasdaq Approaches Bear Territory Amid Escalating Trade TensionsMarket Decline: The Nasdaq Composite has fallen 20% from its December record high, approaching bear market territory. The S&P 500 and Dow Jones Industrial Average have also experienced significant drops, marking their steepest weekly declines since March 2020.

Trade Tensions: The downturn is largely attributed to escalating trade tensions. The U.S. imposed a 10% tariff on most imports, prompting China to retaliate with a 34% tariff on all U.S. goods, effective April 10. This escalation has heightened fears of a global trade war.

Recession Concerns: In response to these developments, J.P. Morgan has increased the probability of a global recession to 60%, up from 40% previously.

Market Movements:

Support Levels and Potential Retracement: The Nasdaq's 20% decline suggests it's testing critical support levels. While technical analysis might indicate a potential for a short-term retracement or consolidation at these levels, the prevailing market sentiment, driven by ongoing trade disputes and recession fears, could limit any substantial recovery.

Outlook: Given the current geopolitical and economic climate, a continued downward trend is plausible. However, markets are inherently volatile, and any developments in trade negotiations or economic policies could influence future movements.

Disclaimer: Please remember that market predictions are speculative. It's essential to conduct thorough research and consult with financial advisors before making investment decisions.

2022 NQ Bear Market Fractal scenarios Index has declined more than 20% and we've failed RSI 40 on weekly, indicating a bear market has started. Best case scenario, I could see it bottoming around 16,666/15000 and recovering very quickly with a blow-off top +100% in less than a year, similar to 2000, topping around 30k-33k.

Bear markets typically last 3M-3Y, with most ending in a year or less. This one topped mid Q1, so mid Q2, Mid-May, might be a great time to buy, if only for a few weeks. Bottoming there after 3M would fit close to orange pattern, or stretch it 3M to bottom mid Q3, October.

Green pattern is the only 1:1 with 2022 top to present, with a bottom around 1Yr and then blue and green are steeper variation bottoming a little later, mid 3Y.

Pink is more of a 2000 top with 3Y bear market, but would just be a recession.

Red is worst case scenario; great depression followed by rapid hyperinflation that sends markets screaming with exponential gains just to outrun inflation.

You can stretch the scales on idea to zoom in and out and see the patterns better, or try drawing your own.

Linked are my ideas from 2022 top. There is more confirming TA, but removed for clarity on an already busy chart.

Possible greatest shift in history for wealth! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Nasdaq futures , printed a cash signal on close of march candle.So I am cash in my trading accounts with exception of my SPY price action trading which works in any condition .

The market Nasdaq futures market has closed under the monthly 20 period ema , I have tested the Dow jones on this logic to 1897 for over 100 years of results and when the market makes closes below I go to cash and wait for a H2 monthly close to get back in . I personally think that this is a very easy way to trade as there is very little user interference its very black and white and if you traded this way on Dow jones from 1987 to now it would have even outperformed buy and hold from 1897 to 2015 (and maybe we will be outperforming soon again too with what the market seems to be threatening ).

The 2X Nasdaq , QLD which from 2023s buy signal to end of last months cash signal yielded 78% return. ( that's what my strat uses instead of QQQ for these signals , note however that TQQQ has too much decay to work well imo)

It's not hard to make money this way , but there is lots of inaction and us humans don't do so well with that . In any case we have a cash signal and now the game is to wait .... possibly quite a while .

Also the Dow , SPY , QQQ and MES , have not quite yet printed sell cash signals so you could argue that they should do this before going to cash but they are all below their sell signals and the market is flashing pretty notable warning signals , So I am cash .

I do plan on continuing my price action trades when I have time it can work in all markets but that is a tiny account in comparison to my monthly signals capital . I mostly do it for fun and experience building and often don't have the time .

Take care and good luck out there .

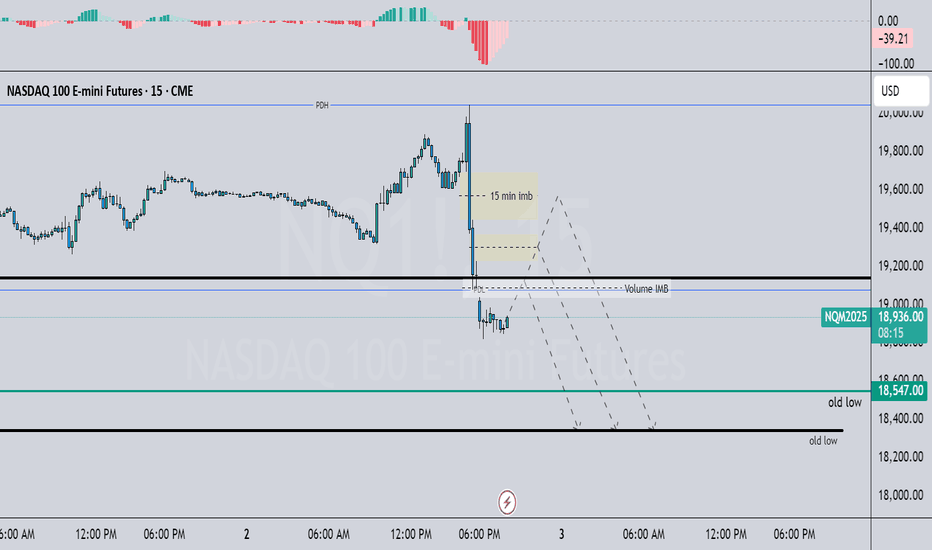

The gap is nearly filled , what next today with Fed and earningsThe gap we have from the weekend and the announcement from Deepseek , we have nearly rebalanced the imbalance.

Today with Fed decision (No rate changed widely expected) but tech heavy earning after the close , today will be the start from something pivotal be prepared.

Understanding the ICT Venom ModelIn this video I break down the ICT Venom Model as recently described by the man himself on his YouTube channel. I am sure he has more details on the model he has not released, but I basically attempt to give my two cents on NQ and the model itself.

I hope you find the video useful in your endeavours regarding learning ICT concepts as well as trading in general.

- R2F Trading

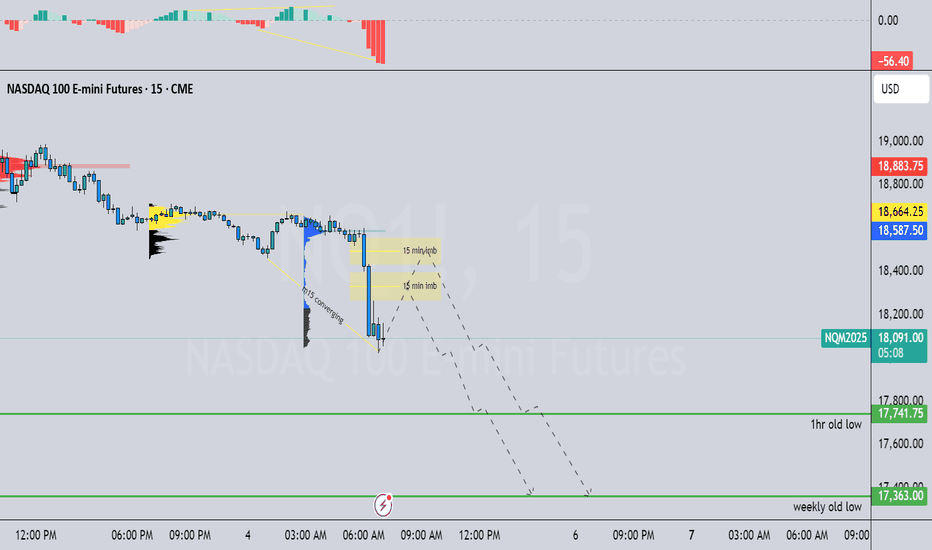

we might continue dropping daily hidden divergence, price might want to continue seeking sell side liquidity

4hr is making a new low and taking out old lows (sell side liquidity) to the left MACD is not converging as of yet

1hr hbrsh-div price is dropping ahead of red news this Friday, could head to 1hr old low or weekly low, waiting to see how price reacts to news

m15 price is below POC of previous NY session POC, as well as overnight Asian and London session converging nicely ahead of news I would favor price reacting short-term from m15 bearish imbalance before reaching the lows around the NY open after news but we will see

NQ! Short Idea (MXMM, Quarterly Theory)Dear Traders,

today I present you once again my current idea on the Nasdaq. We have swept a High Liquidity Area marked as my lower HTF PDA. Because of that we might see a stronger Pullback as shown on my Chart.

However, I will still keep my eyes open and wait for the 9:30 (UTC-4) Manipulation to look for a Market Maker Sell Model which I will only consider a after a Pullback into my Key Areas and Price Action showing interests of a bearish continuation.

(09:30 Manipulation, Liquidity Sweep + SMT Divergence, Break Of Structure, Any PD-Array)

Praise be to God

-T-

Bearish PotentialBias: Bearish (Pending Confirmation Post-News)

Higher Timeframe Context (Daily) Wednesday closed bearish –

4H made a lower high, and a bearish engulfing candle after sweeping the previous day high, and MACD turned from bullish momentum after making a higher high showing hidden bearish divergence

Lower Timeframe Breakdown

1hr made a market structure shift after making a higher

MACD made a lower high (bearish divergence), the price closed below Wednesday NY session POC

15M made a lower low + MACD lower low( convergence)

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed sharply lower due to the aftermath of tariff impositions. Following a significant gap-down, the index broke below the lower Bollinger Band, intensifying selling pressure. Yesterday’s bearish candlestick confirmed a sell signal, leading to an expanded third wave of selling. The index has now reached the previous support zone near 18,500, with additional volatility expected due to today’s Non-Farm Payrolls (NFP) report and Fed Chair Powell’s speech.

On the monthly chart, the Nasdaq is forming a lower shadow around the 20-month moving average. Given the sharp decline, if further selling occurs, oversold conditions may trigger a strong rebound, making it risky to chase shorts at this stage. The 240-minute chart also shows a sell signal, with heavy selling pressure continuing. However, this is a risky zone to enter new short positions, so it's advisable to monitor short-term price movements before making a move.

Regardless of whether you take long or short positions, due to high volatility, make sure to set stop-loss levels and adjust leverage to a manageable risk level.

Additionally, the VIX surged, forming a large bullish candle and reaching its March 11 high. With the VIX in an uptrend and a buy signal appearing, further volatility expansion is likely. However, since it has reached a key resistance zone, a short-term pullback in the VIX could allow for a Nasdaq rebound. For the VIX to break above its previous high, a period of consolidation may be necessary. Given the strong buying momentum on both the weekly and monthly charts, this should be taken into consideration when forming a trading strategy.

Crude Oil

Crude oil plunged following the OPEC meeting, where supply increases became a key issue. While oversupply concerns are a factor, the economic slowdown fears from tariffs have also played a major role in the decline. Previously, $68 was considered a strong support level, but oil collapsed from $72 in a steep decline. The final key support lies around $66.

On the daily chart, the MACD and signal line are converging near the zero line, suggesting that once a new wave begins, it could lead to a strong trend movement. Depending on today's session and Monday’s market, oil could see an aggressive breakout in either direction. Current candlestick patterns indicate that the weekly chart remains bearish, meaning holding long positions over the weekend carries significant risk.

The 240-minute chart also confirms a strong sell signal, with MACD plummeting. Oil may form a temporary sideways range near the $66 support, but if this level breaks, selling pressure could intensify. Ensure you manage stop-loss risks carefully in case of further downside.

Gold

Gold declined, reacting to fluctuations in the U.S. dollar's value. The price failed to hold above $3,200 and dropped below the 5-day moving average. Gold has been in a one-way trend, so a bullish approach remains valid unless it breaks below the 10-day MA. However, it has now entered a range-bound phase, and MACD on the daily chart is nearing the signal line, suggesting potential downside risks. The MACD failed to break its February highs, increasing the likelihood of divergence, which could trigger a strong correction if selling intensifies. With rising market volatility and today's NFP release, further wild swings in gold prices are expected.

The 240-minute chart has shown a sell signal, leading to a sharp decline. However, the price has found support near a key resistance-turned-support zone. Since the MACD and signal line remain above the zero line, gold may continue trading within a range in the short term. On shorter timeframes, candlestick volatility is high, so reducing leverage and widening stop ranges would be a prudent strategy.

During periods of extreme market volatility, technical analysis may become less effective, as market sentiment often overrides chart patterns. As always, trade only within your manageable volatility range. The market is always open, so even if you incur losses, there will always be opportunities to recover. Manage risk wisely, and best of luck with your trades today!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

KEEP TRADING SIMPLE - NDX/NQ1Good Morning,

We did it - We sat patiently waiting for this beauty to drop. I am still holding my SSSQ but will exit shortly. Currently I am waiting for confirmation off the support to start accumulating more stocks from across various sectors.

This in theory is motive wave two. We will have to revisit at the next resistance area.

Thank you !

NQ - Nasdaq's potential to reboundThe Median or Centerline:

The Median (Centerline) Line is the central element of the Pitchfork and acts as the equilibrium point. Price tends to oscillate around this line, and it often serves as a strong reference for potential reversals or price targets. A price move back toward the Median Line is common after significant moves away from it.

Pitchfork (Red):

The red Pitchfork, drawn through significant price points, provides the overall trend direction and shows the potential path to the downside. The red line indicates a bearish bias in the current setup, as it has been guiding the price lower.

Green Circles and Arrows:

These represent key areas of support.

The lower green circle and green arrows indicate price has found solid support in this region. The price has been bouncing from this support level, showing that it is reacting to the [ower boundary of the Pitchfork. This behavior aligns with the rule that the price tends to respect these boundaries, creating a foundation for a potential move back toward the Median Line.

Price Action Analysis:

The price recently tested the lower green circle and green arrows, bouncing off this support level, which is a typical reaction in a Pitchfork setup.

According to the Median Line theory , when the price moves too far away from the Median Line, it often returns toward it. Therefore, the bounce off the lower boundary suggests that price may now be setting up for a bullish reversal toward the RED Median Line .

Bottom Line:

The price action is following the general Pitchfork playbook . The bounce from the lower green circle suggests that the price is setting up for a potential bullish reversal toward the RED Median Line .

The next major test will be the upper resistance in the red Pitchfork , after the break of the Centerline. If the price can break through this resistance, a strong move higher is likely.

Keep an eye on this critical point!

NQ Power Range Report with FIB Ext - 4/4/2025 SessionCME_MINI:NQM2025

- PR High: 18698.00

- PR Low: 18588.25

- NZ Spread: 245.25

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

11:25 | Fed Chair Powell Speaks

AMP margins remains increased but lowered to 25%

- Value decline continues, dipping into 18400s inventory

- Auction holding just below previous session low

Session Open Stats (As of 12:55 AM 4/4)

- Session Open ATR: 482.31

- Volume: 48K

- Open Int: 261K

- Trend Grade: Bear

- From BA ATH: -18.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 20954

- Mid: 19814

- Short: 18106

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone