MNQ1! trade ideas

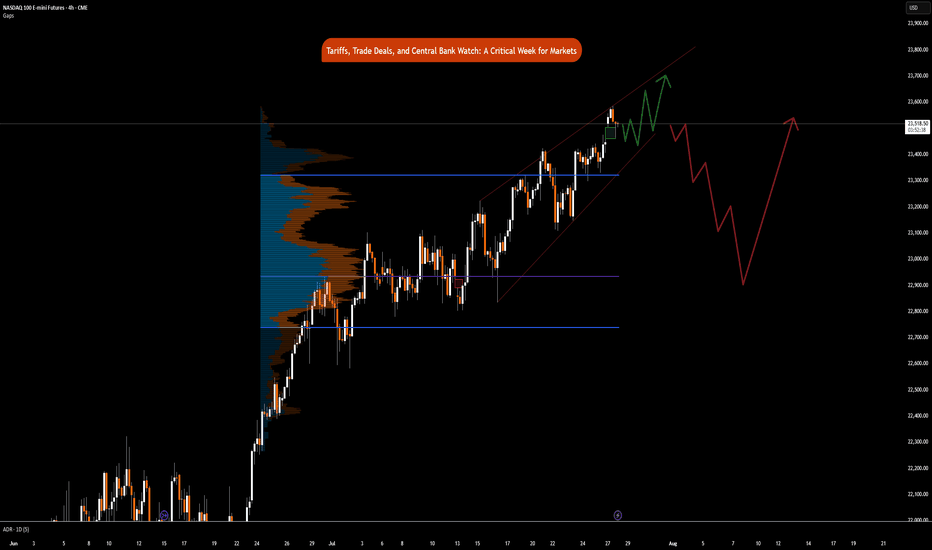

Tariffs, Trade Deals, & Central Bank Watch: Key Week in MarketsCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1!

This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy developments, we have a key week which may shape how the rest of the year unfolds.

Below is a consolidated summary of the latest trade negotiations, scheduled economic releases, and policy outlooks.

US - EU Trade Deal:

• US–EU Tariffs: The US will impose a 15% tariff on most EU goods, including cars, semiconductors, and pharmaceuticals, but retain a 50% tariff on steel and aluminium with a new quota system.

• Exemptions: Zero-for-zero tariffs agreed for agriculture, aircraft parts, and chemicals; aircraft exports are temporarily exempt.

• EU Commitments: The EU will invest $600 billion in the US and purchase $750 billion in US energy, mainly LNG.

• Agriculture: The EU will lower tariffs on many US agricultural goods, though not comprehensively.

• Political Reactions: EU leaders are mixed, Germany and the Netherlands praised the deal, France called it unbalanced, and Hungary viewed it unfavorably.

• The deal is not final until it is ratified by all EU national parliaments and the EU Parliament.

China Talks: US and China expected to extend their trade truce by 90 days. US-China meeting expected in Stockholm on Monday and Tuesday. Trump to freeze export controls to secure a deal. A group of US executives will visit China for trade discussions, organized by the US-China Business Council.

South Korea Trade Talks: Korea proposes a shipbuilding partnership with the US and is preparing a trade package.

UK–US Relations: PM Starmer and Trump to meet in Scotland to discuss the UK–US trade deal implementation, Middle East ceasefire, and pressure on Russia.

Thus far, the US has announced trade deals with the UK, Vietnam, Philippines, Indonesia, Japan and The EU. Trade delegations are working to finalize deals with China, Mexico, Canada

Key Economic Data Releases:

Monday: Treasury refunding financing estimates.

Supply: 2-Year and 5-Year Note Auction, 3 & 6-Month Bill Auction

Tuesday: US Advance Goods Trade Balance, Wholesale Inventories Advance, CB Consumer Confidence, JOLTS Job Opening (Jun), Atlanta Fed GDPNow, Australian CPI Q2

Supply: 7-Year Note Auction

Wednesday: German GDP Q2, EUR GDP Q2, US ADP Non-farm Employment, US GDP Q2, Crude Oil Inventories, Chinese Manufacturing PMI

Canada: BoC Interest Rate Decision, Rate Statement, Monterey Policy Report, BoC Press Conference

US: Fed Interest Rate Decision,FOMC Statement, Fed Press Conference.

Japan: BoJ Interest Rate Decision, Monetary Policy Statement

Thursday: EU Unemployment (Jun), US PCE & Core PCE Price Index (Jun)

Japan: BoJ Press Conference

Friday: EU CPI, US NFP, Unemployment Rate, Average Hourly Earnings, ISM Manufacturing PMI, Michigan 1-Year & 5-Year Inflation Expectations.

It is also a busy earnings week. See here for a complete earnings schedule .

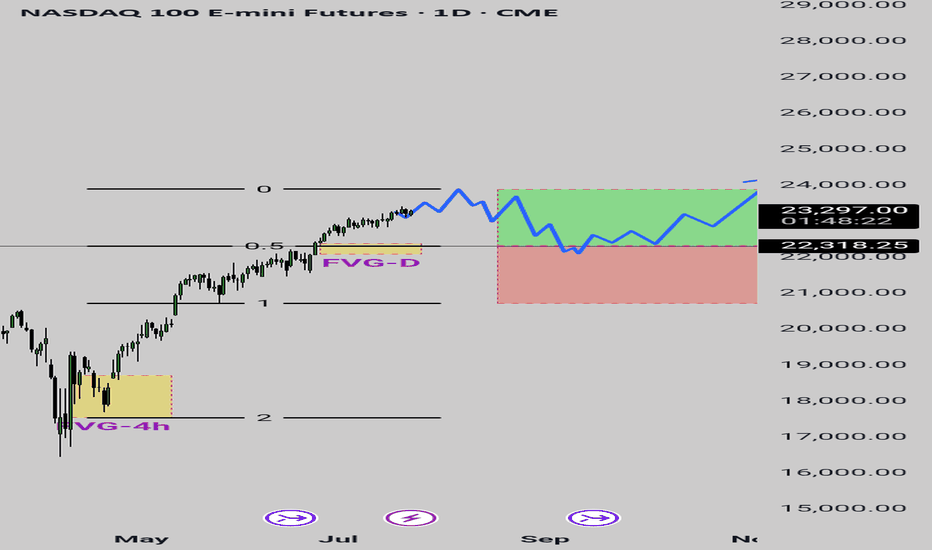

Markets are interpreting trade deals as positive news thus far. The dollar is strengthening.

As we previously mentioned, we anticipate no rate cuts this year as economic data proves to be resilient and inflation largely under control. WSJ also posted an article stating that most tariffs costs are being absorbed by companies due to weaker pricing power. We previously wrote about this on our blog: “ In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies must start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.”

In our view, the US dollar has a higher probability to rally in the short-term i.e., Q3 as markets re-align FX rate differentials. Bond yields stabilize, Equities continue pushing higher, while Gold retraces as previously mentioned. This in our view, is what investors and participants refer to as the Goldilocks scenario. If this plays out as expected we anticipate continued strength with AI, tech, energy and defense sectors outperforming into mid- 2026.

Institutional View: Morgan Stanley

Morgan Stanley also sees no rate cuts in 2025, despite market pricing for two 25 bps cuts. They forecast more aggressive cuts in 2026 due to:

• Tariff-related inflation emerging before labor market deterioration

• Slowing US growth, as fiscal support fades

• Impact of tighter immigration policy and global trade realignment

That said, MS continues to cite longer-term risks to the dollar, including:

• Twin deficits (fiscal + current account)

• Ongoing debate around USD’s safe haven status

• USD hedging activity picking up by international investors

• Strained credibility of the Fed due to tension between Fed Chair and the US Administration

How Fed policy evolves in Q4 2025 and Q1 2026 will depend heavily on the incoming Fed Chair nominee, who is expected to replace Jerome Powell in May 2026. This nomination could significantly influence future policy direction around growth and inflation targets.

NQ & ES Key Levels 28-07As long as the price is above the purple line (Equilibrium) I am bearish... Below the purple line there are these key levels where the price can react aggressively and start to rise, seeing a reversal. It will either rise to a point and continue to fall or it will start a rally to the ΑΤΗ.

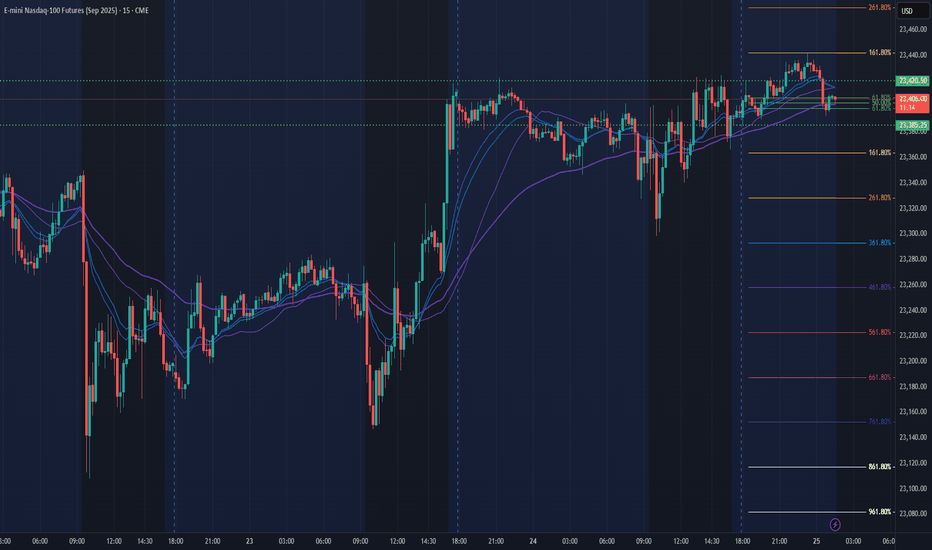

NQ Power Range Report with FIB Ext - 7/28/2025 SessionCME_MINI:NQU2025

- PR High: 23558.25

- PR Low: 23504.00

- NZ Spread: 121.25

No key scheduled economic events

Weekend gap up of 0.37% into new ATH

Session Open Stats (As of 12:25 AM 7/28)

- Session Open ATR: 245.44

- Volume: 23K

- Open Int: 276K

- Trend Grade: Long

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

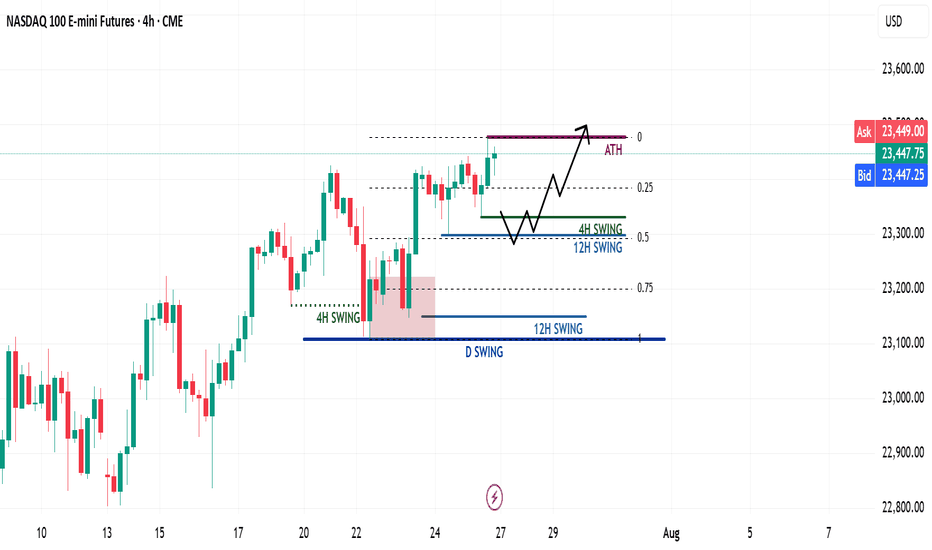

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

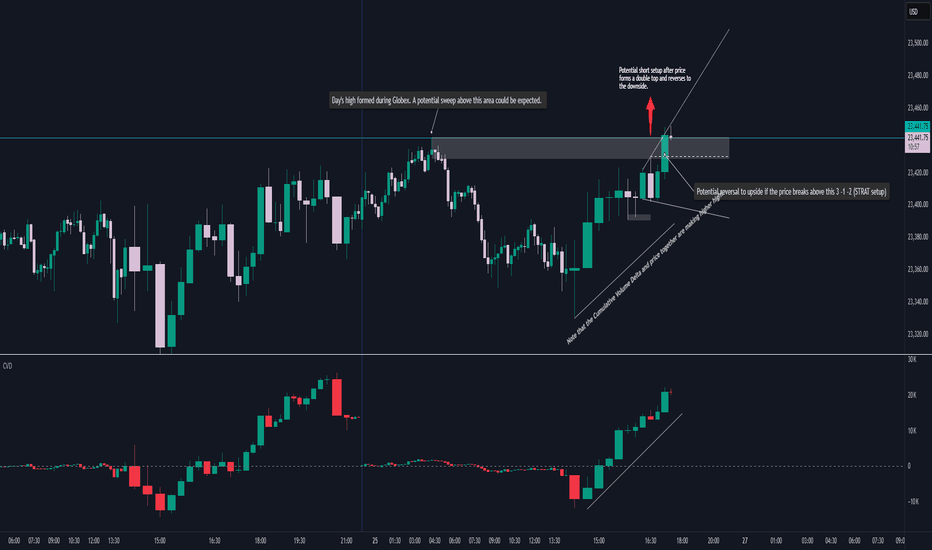

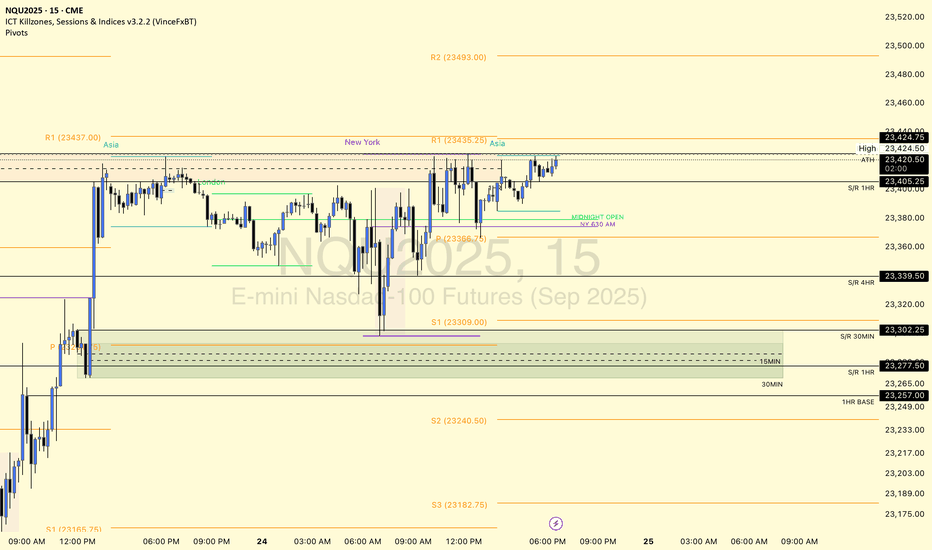

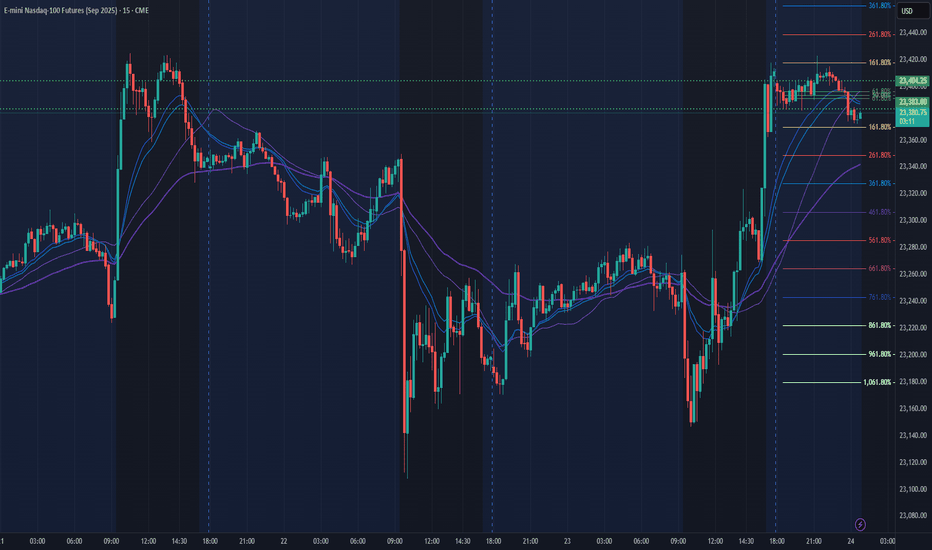

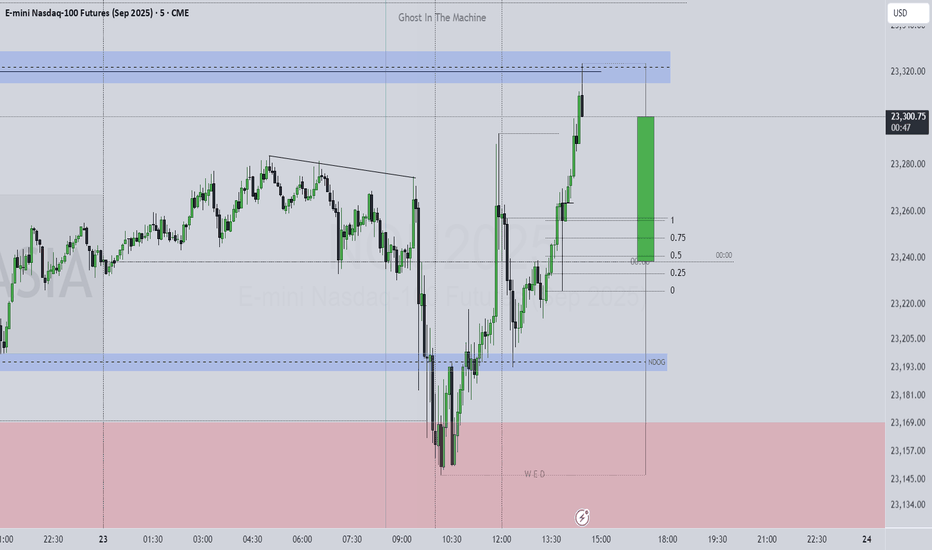

NQ potential short setupGlobex High Sweep Setup : Price tagged the overnight high. Liquidity hunt likely before rejection.

Double Top Reversal : Classic short trigger with weakening momentum.

CVD and price: Price and CVD making higher highs — bullish pressure?

STRAT 3-1-2 Setup : Breakout above internal bar range could flip bias long.

Update after posting the chart: As this is a contrarian trade, please wait for short entry confirmation. The market is quite bullish, and a move down might be quite bumpy, with expected stop runs. Market has already run past the double top with huge bullish movement. The market has already run past the double top with a bullish moment.

The next point of reversal could be at the daily pivot R1 at 23,435.25.

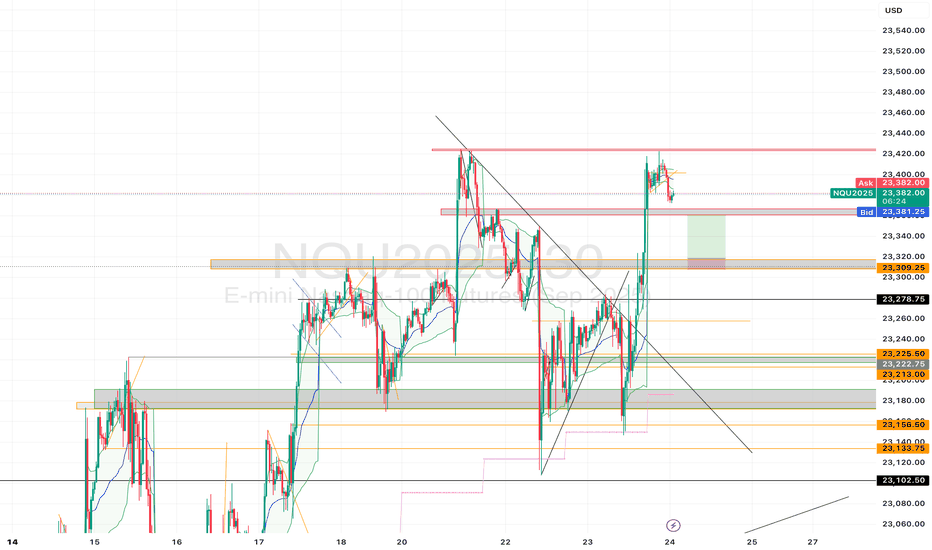

NQ Range (07-23-25)The O/N slight lift back to Mid Level of range. The big Tweet regarding Japan, did show up after the close. Now we need to see how the Open Drive & Reg Session move today, may be snail lift higher 1st. The next bullish move would be F-M Long play. The selling just does not have much force or is part of the head fake prior to a decent drop test. Still Scalp Shorts to KL's and wait on some conviction selling to eventually show up.

NQ Power Range Report with FIB Ext - 7/25/2025 SessionCME_MINI:NQU2025

- PR High: 23420.50

- PR Low: 23385.00

- NZ Spread: 79.5

Key scheduled economic events:

08:30 | Durable Goods Orders

Session open ATH break and retrace

Session Open Stats (As of 12:45 AM 7/25)

- Session Open ATR: 248.86

- Volume: 20K

- Open Int: 274K

- Trend Grade: Long

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

$NQ SUPPLY AND DEMAND ZONES 7/24/25www.tradingview.com

This is SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart for my YouTube community.

Intrigued to see if we sweep for a new ATH or a rejection to test demand levels below.

With a new ATH, gotta wait for more S/D S/R levels to be created.

Will resort to imbalance playbook or S/R play until then.

NQ Power Range Report with FIB Ext - 7/24/2025 SessionCME_MINI:NQU2025

- PR High: 23404.25

- PR Low: 23383.00

- NZ Spread: 47.75

Key scheduled economic events:

08:30 | Initial Jobless Claims

09:45 | S&P Global Manufacturing PMI

- S&P Global Services PMI

10:00 | New Home Sales

Front run ATH, advertising breakout potential

Session Open Stats (As of 12:15 AM 7/24)

- Session Open ATR: 258.10

- Volume: 18K

- Open Int: 271K

- Trend Grade: Neutral

- From BA ATH: -0.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Intro to what I call Algo TradingAlgorithmic training can mean different things to different people what I mean when I say the term algorithmic trading is just things that happen automatically.

Some guys have like these really complex formulas and based on like all this really advanced mathematics. If I'm being 100% honest i'm essentially looking at pictures on a chart and looking at the patterns.

But the pictures on the chart themselves are based on really advanced mathematical formulas or they can be at least or a combination of multiple mathematical formulas that then that the result of our represented by a picture on a chart.

So I look at the pictures on the chart I analyzed them really carefully and if it looks good I use artificial intelligence to code the idea so it happens automatically based on the rules that I set.

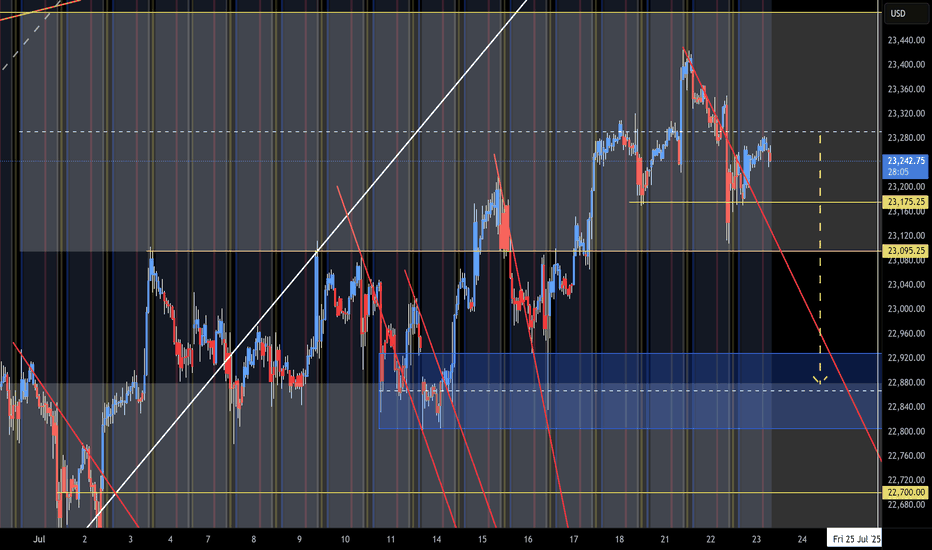

2025-07-23 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Very tight channel up from 23142 but only 1 bear bar since then and in the absence of bear bars, we can only assume sideways to up movement.

current market cycle: bull trend

key levels: 23000 - 24000

bull case: Bulls want to print more higher highs. We are in this bull channel for the whole July now without breaking it and bulls now confirmed the breakout above 23100ish - 3 times. That is the 50% retracement of the last big leg up and very important. A measured move for this leg gives us 24000. Bears have tried with two decent legs to get down to 23000 and failed. I think many will give up on this after hours buying and we can have more meltup into the weekend. Anything bearish would be a big surprise.

Invalidation is below 23250ish.

bear case: Bears tried and failed again. Everything is bought. 1h close below 23250 would certainly stop the max bullishness but bears are really not doing much. We are almost printing daily new ath. Focus on longing pullbacks until the bull channel is broken.

Invalidation is above 24000.

short term: Bullish on any pullback until it stops working.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Long 23200 has been profitable since Friday.

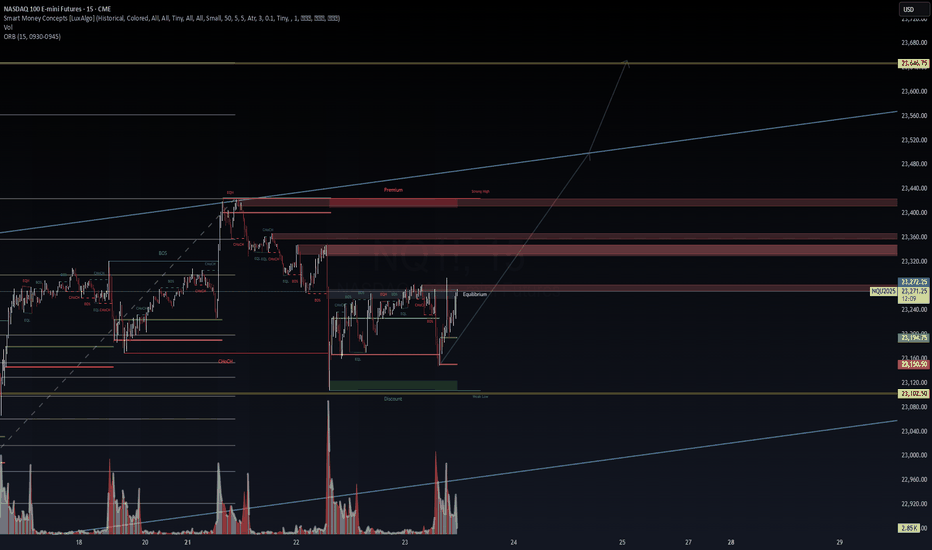

NQ1! | VolanX SMC Playbook | July 23, 2025🧠 NQ1! | VolanX SMC Playbook | July 23, 2025

📈 Chart Thesis:

Price has reclaimed equilibrium after engineering liquidity below the weekly low and rebalancing from the discount zone. We now sit above internal BOS (Break of Structure) with signs of continuation toward premium inefficiencies.

🔍 SMC Read:

ChCh (Change of Character) and BOS clusters confirm internal accumulation.

Liquidity sweep at the EQD (Equal Low/Discount) and reclaim of the OB signals strength.

Volume shows commitment on upward drive—aligns with algorithmic intent.

📊 Key Zones:

Support (Reclaim Confirmed):

23,150.50 (ORB Low)

23,102.50 (Weekly Low - Discount Level)

Resistance / Target Clusters:

23,360–23,440: Supply + SMC Breaker Zone

23,646.75: Extended target (Premium High / Measured Move Completion)

🚀 Trade Idea:

Bias: Bullish

Entry Zone: Retest near 23,195–23,220

Stop: Below 23,140

Target 1: 23,360

Target 2: 23,646.75

Risk-to-reward: ~1:3.5+ | Confirmation preferred via retest and OB hold

⚙️ VolanX Protocol Overlay:

DSS Signal Score: ★★★★☆

Catalyst Monitor: Watch upcoming earnings, FOMC minutes preview leaks, and AI sector flows

Narrative Control: Tech resilience + dovish repricing fuel continuation setups

📢 Disclaimer: This post is for informational and educational purposes only. It does not constitute financial advice.

#NASDAQ100 #Futures #SMC #VolanX #WaverVanir #DSS #LiquidityTheory #VolumeProfile #MacroAI #NQ1! #AlgoTrading

$NQ Supply and Demand Zones 7/23/25www.tradingview.com

This SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart is posted for my YouTube community.

The 1HR S/R level is holding price down well for now and we have tapped into the 4HR supply 2x so far. We have built up support that can use as potential bounce levels if* respected, but price needs to reclaim the S/R level and show higher lows. If not, a continuous close at lower lows with rejecting support at demand can show price dropping to 22830-23000 zones. The 4HR demand below has also been tapped into multiple times, so it's only a matter of time before it can no longer hold up (it's pretty much invalidated at this point lol).