NQ1! trade ideas

$NQ Supply and Demand Zones 7/18/25 This is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart only, not as many supply zones with the limited timeframes I can use for TradingView free plan. This is my chart coming into next week.

However, we have so far found rejection from new ATH and making our way to retest the imbalances and previous resistance-now support levels of past supply zones.

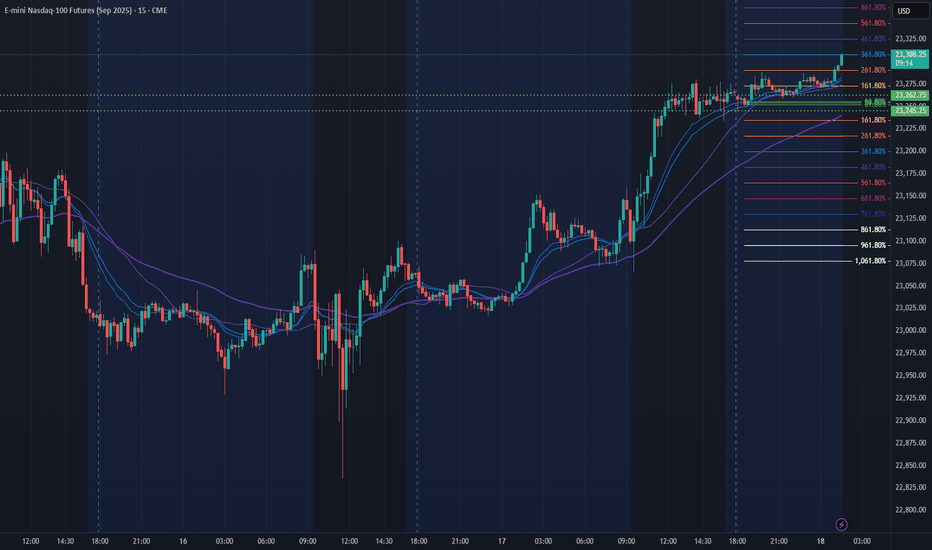

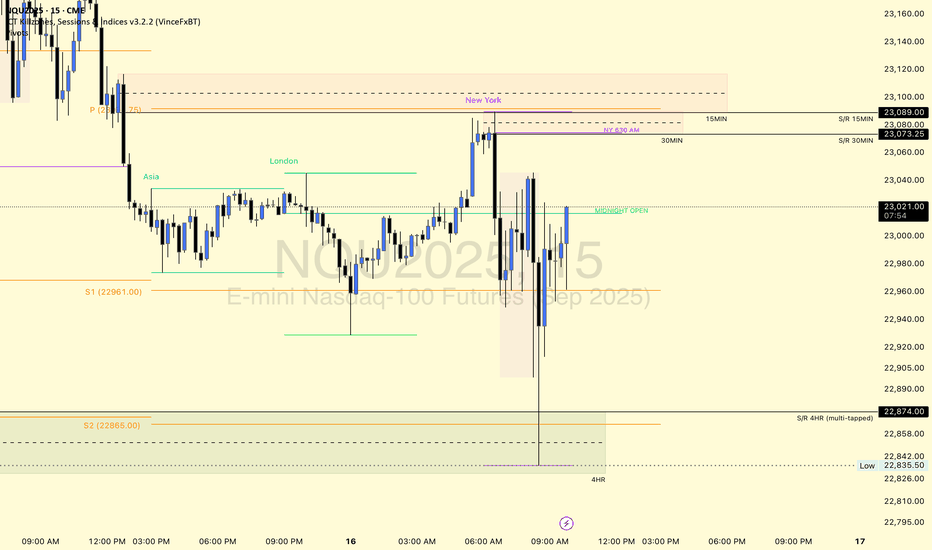

NQ Power Range Report with FIB Ext - 7/18/2025 SessionCME_MINI:NQU2025

- PR High: 23262.75

- PR Low: 23245.25

- NZ Spread: 39.0

No key scheduled economic events

Pushing ATH through overnight hours

Session Open Stats (As of 1:15 AM 7/18)

- Session Open ATR: 272.56

- Volume: 18K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

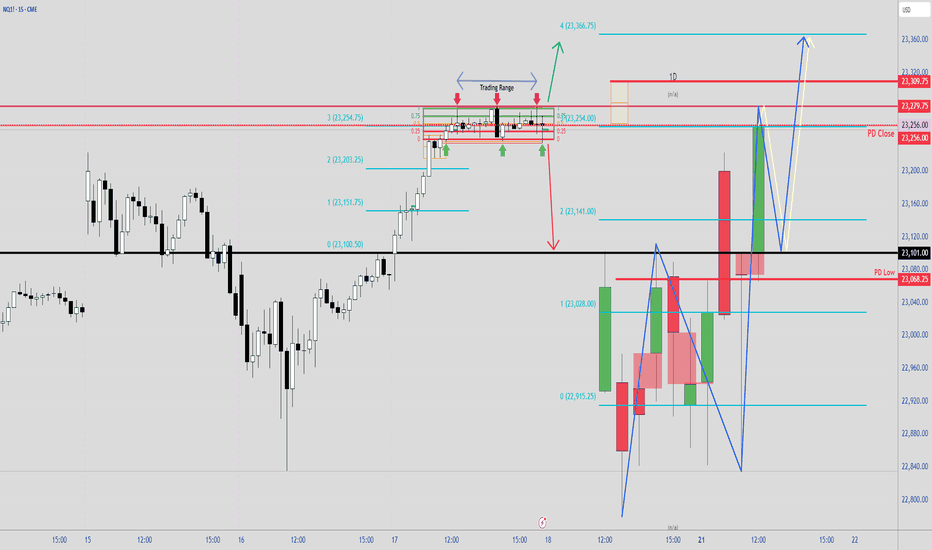

$NQ Supply and Demand Zones - All Time High! 7/17/25This chart is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ only.

We recently hit ATH this AM session and now price is accumulating and we are waiting to see what it wants to do next. Continue to hold support at ATH before we breakout higher, or break below and close below ATH support for a retest lower?

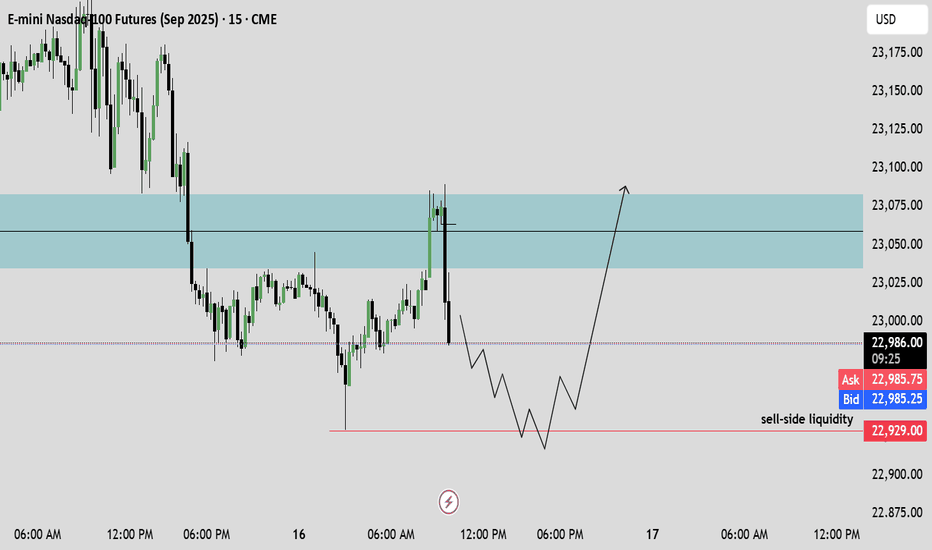

Eyes on the Gap – Discipline Over FOMO NQ📌 Waiting for High-Probability Levels to Engage

Right now, price has been stuck in a multi-week range, coiling just beneath major resistance and above strong demand. I’m not forcing trades — I’m waiting for price to reach the key gap zone and confirmed strong support near 22,781.75.

No reason to act until the market gives me a clear setup.

The real move will come from the edges — not the middle.

🔹 Support Confluence: Gap fill zone + Strong Support label

🔹 Range Context: Price capped under ATH & recycling between session highs/lows

🔹 Bias: Bullish only after sweep or confirmed hold of the lower zone

💬 Discipline is waiting when others get chopped up in the middle. Let the trap spring — then strike.

#PlaymakerTrading #GapZone #SmartMoneyLevels #NQFutures #MarketStructure #SupportAndResistance

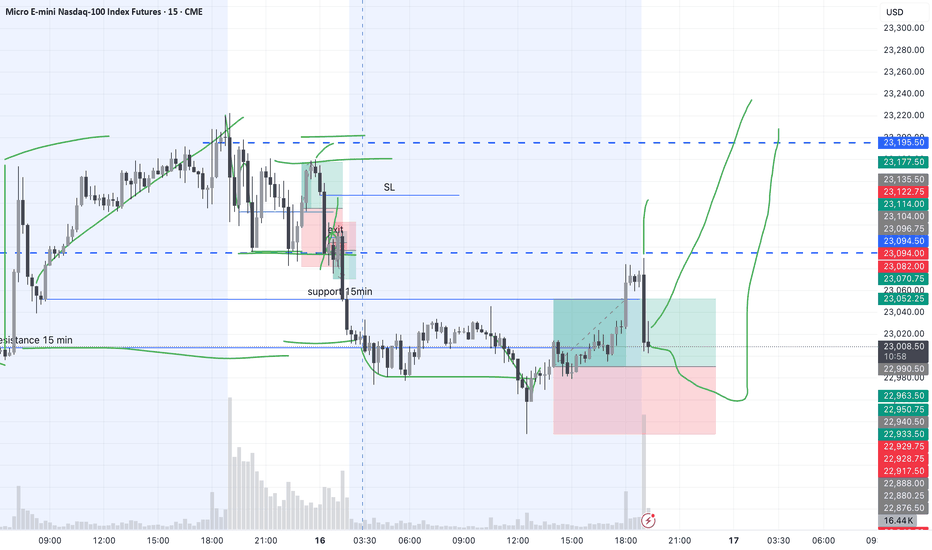

MNQ LONGHere we go again with confusing charts.

So to begin with, iam bullish until the orange trendline is broken, if its not broken and the price is still reacting positively to it as its doing so far, then iam very much bullish.

Also you should be aware that there is divergence started to show up on the daily and it looks massive on the 4h tf, also price swept last high and moved lower, even though the trend is still intact, it still shows some weakness.

my confidence in this setup is 7 out of 10

Since the price action is bearish for now, then if you want you can take some short until 22840, then go long from here.

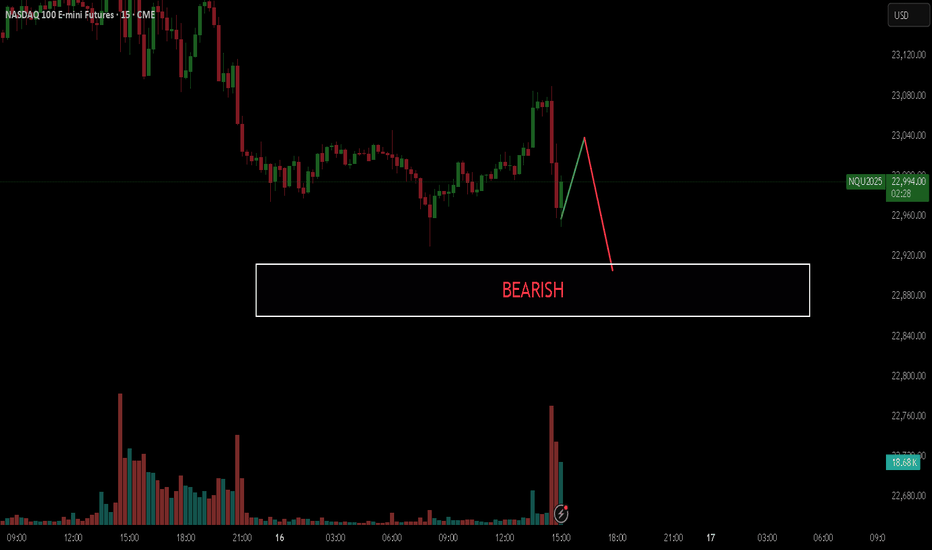

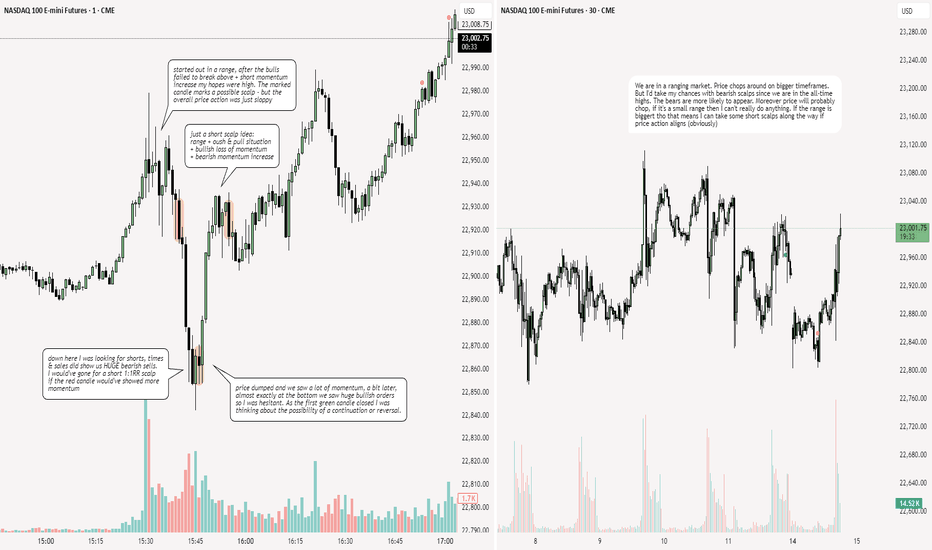

2025-07-14 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

nasdaq e-mini futures

comment:

The biggest surprise for next week would be a huge gap down Sunday futures open and having that gap stay open. If bears could actually do something like that and trap all bulls who bought above 22600, that would be amazing.

Spoiler: Bears could not. Another gap down and bear trap. It’s sad but the reality. Don’t expect strong bears all of the sudden.

current market cycle: bull trend

key levels: 22000 - 23100

bull case: Bulls defended 22800 which is still as bullish as it gets. Don’t make it more complicated than it is. We are going sideways under the ath, can print a new one any given day. Since I don’t have any targets above 23100ish, I won’t make stuff up here. I only wait for the profit taking to begin to look for shorts.

Invalidation is below 22700.

bear case: Bears are sad. Need a daily close below 22700. If they prevent bulls from printing a new ath above 23111, I would be surprised. No need to write more here until we see much much bigger selling pressure.

Invalidation is above 23500.

short term: Neutral. Bears not doing enough and bulls going sideways under ath. No interest in buying, so I am neutral until big bears come around.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Long the double bottom above 22800 or the retest on US open around 22830. Bears failed to print consecutive good looking 30m/1h bear bars, so a reversal was the most likely outcome after the double bottom.

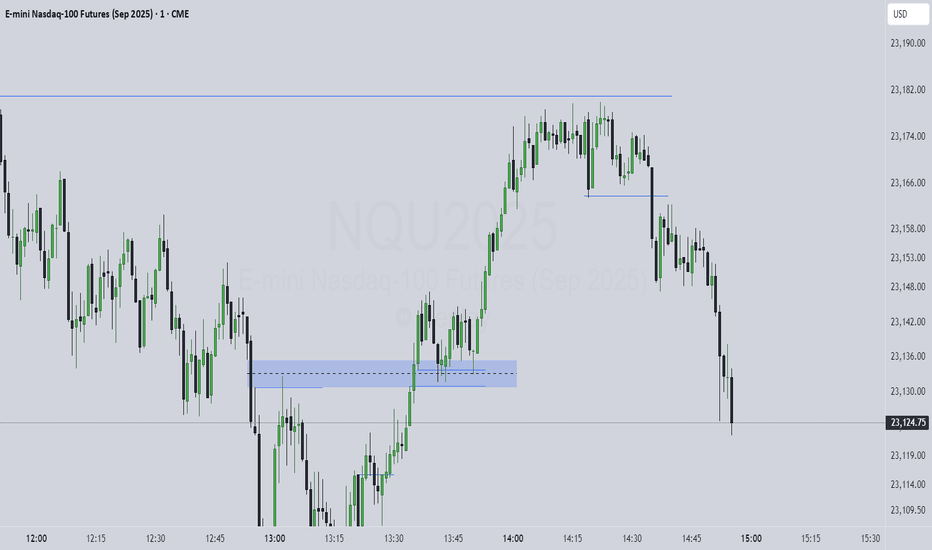

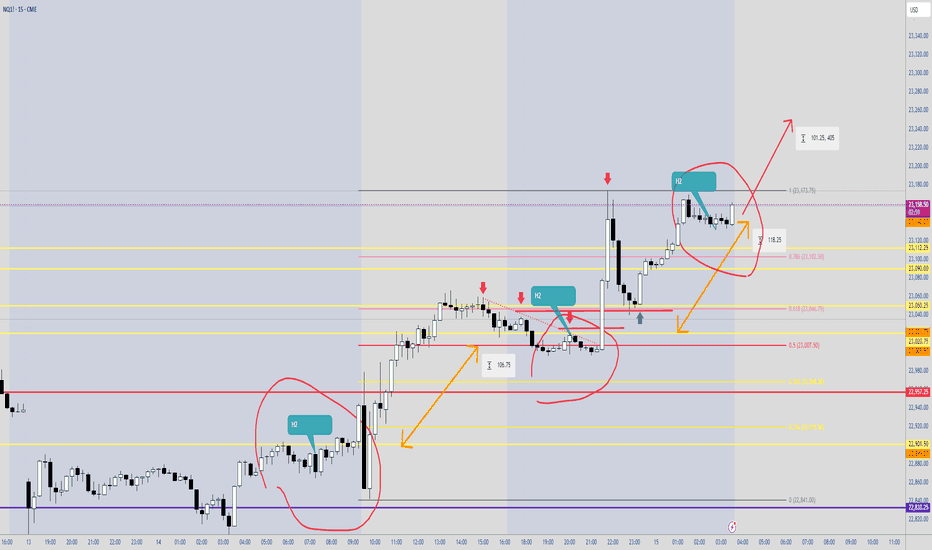

07/14 Nasdaq TradeThis time I had to wait for the red candle to create the wick for me to enter. I just needed that because we already had enough volume. Nasdaq is dangerous with this type of time frames. So review

Yellow Part: Variation

Blue Part: The wick that the red candle was creating for me to enter mroe confidently and using the wick as a stop loss.

Red Part: Execute the volume is on your side

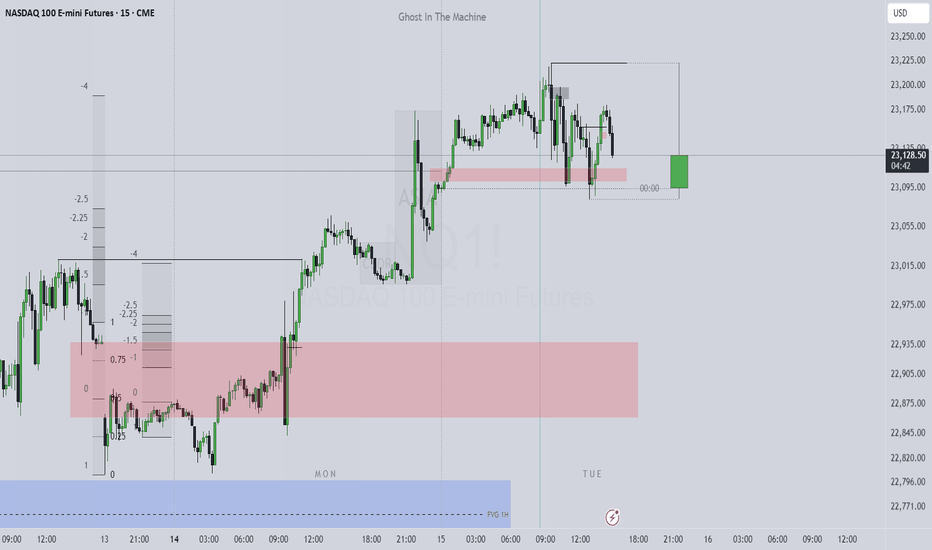

NQ: 217th trading session - recapI'm back after a week and it feels great. I do think I really needed a break. I'm back with a new mindset, with optimism and a redifined plan. Here are some questions I will need to answer for myself:

- bullish times & sales increase - Watch out for it?

- breakeven for short scalps?

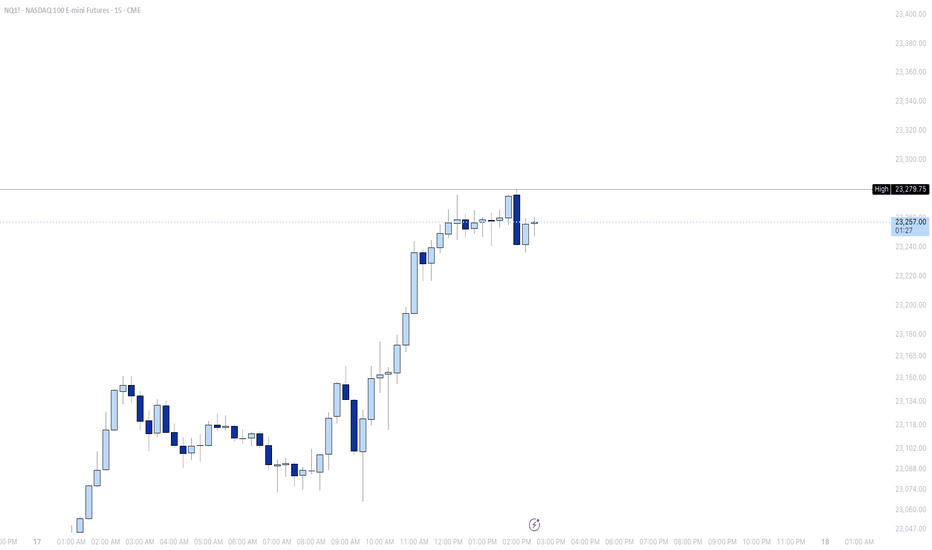

NQ Power Range Report with FIB Ext - 7/14/2025 SessionCME_MINI:NQU2025

- PR High: 22890.50

- PR Low: 22803.00

- NZ Spread: 195.0

No key scheduled economic events

0.33% weekend gap to previous week low, unfilled

Session Open Stats (As of 1:15 AM 7/14)

- Session Open ATR: 289.88

- Volume: 36K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -1.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NASDAQ TRADING IDEA FOR 14-18 JULY 2025The price of NASDAQ is ranging between daily supply zone (23100) and daily demand (22830) and respecting trendline to find next liquidity control at h1 base at 22904 or H4/H1 liquidity control at 22864. I am looking for long opportunities at that area depend on how the price action for and wait confirmation before taking long position.

The price will continue to rise if daily supply breakout and form a new higher high at daily timeframe.

The market will shift direction if the daily demand breakout and I’m focusing to find opportunity taking short position at important key level/zone.

NQ Range (07-08-25)White arrow is stall/drop zone and yellow is strong short. The O/N continues to reset any drops that happen in most Reg Sessions. It appears to me that a weak/fake Euphoric Stage is being played out. The idea of chasing the NAZ (after the O/N redirect) is the game, no chase and the game will end. The O/N has been redirecting for about 2 years (can continue). Again, the recent 25% drop was erased with a Tweet & news release (10 min 2,000 point) move and a few O/N's. Just feels like a fake chase play since the pop of the bottom.