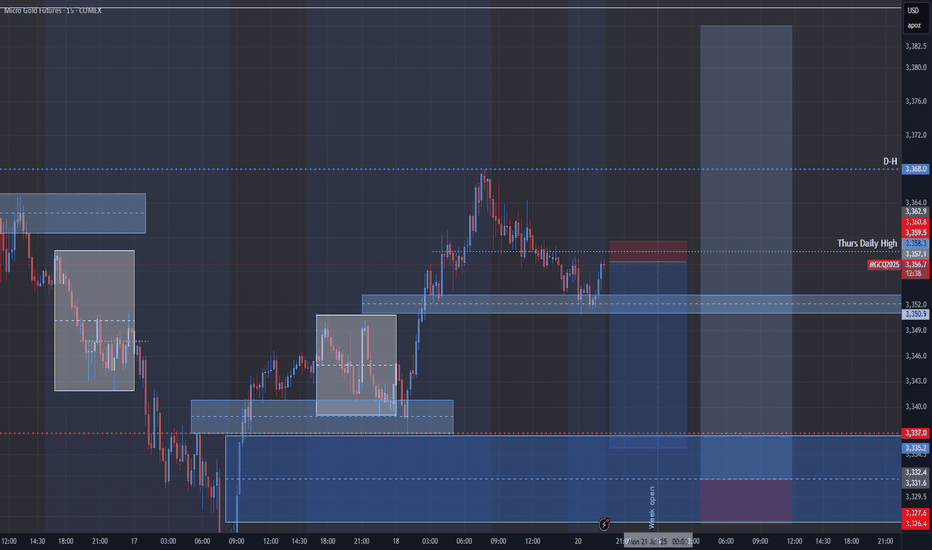

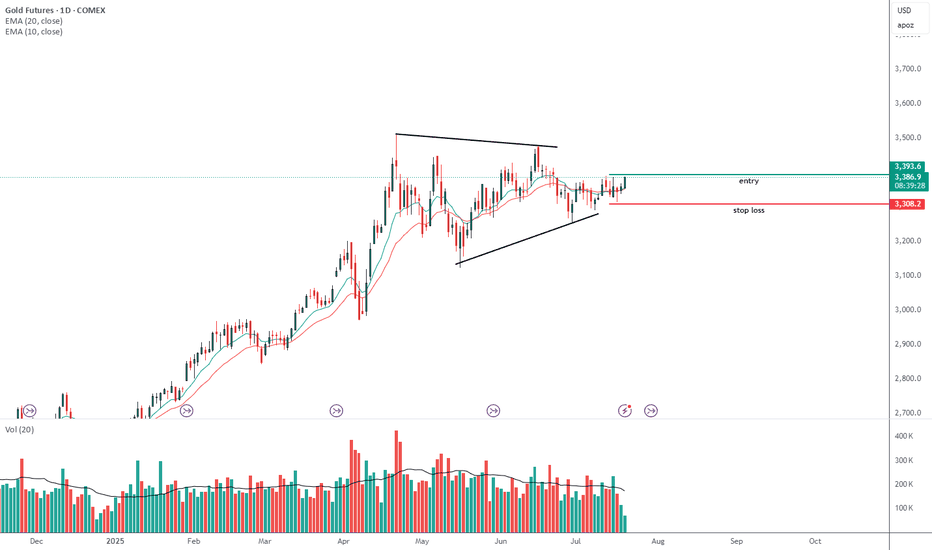

Gold will make a Low for the Week before Pushing BullishOn my previous Update I mention that we should have support off this H4 Gap. My problem with it s it immediately reacted to it when the market opened back up. well before the killzone. So I feel like this is a fake out to go short for now. they will make a low for the week then we will see it set up

Contract highlights

Related commodities

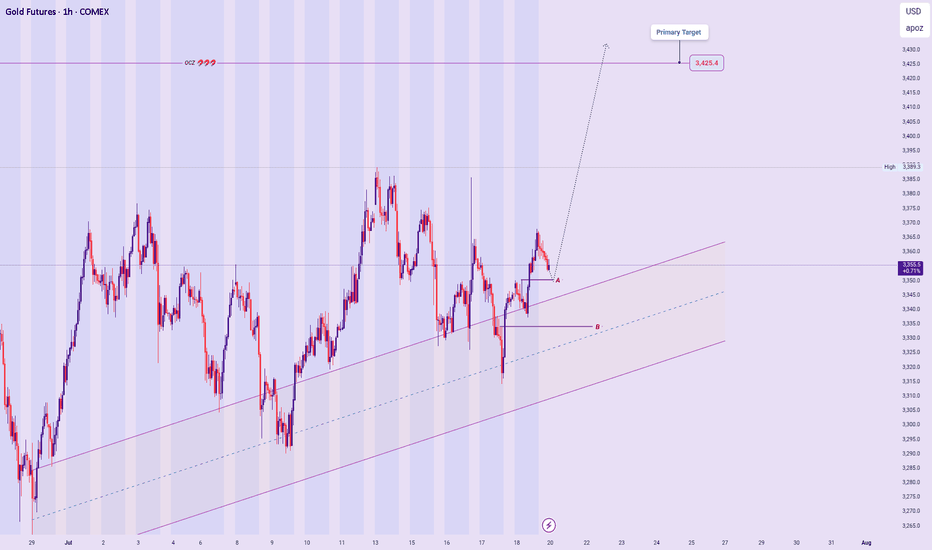

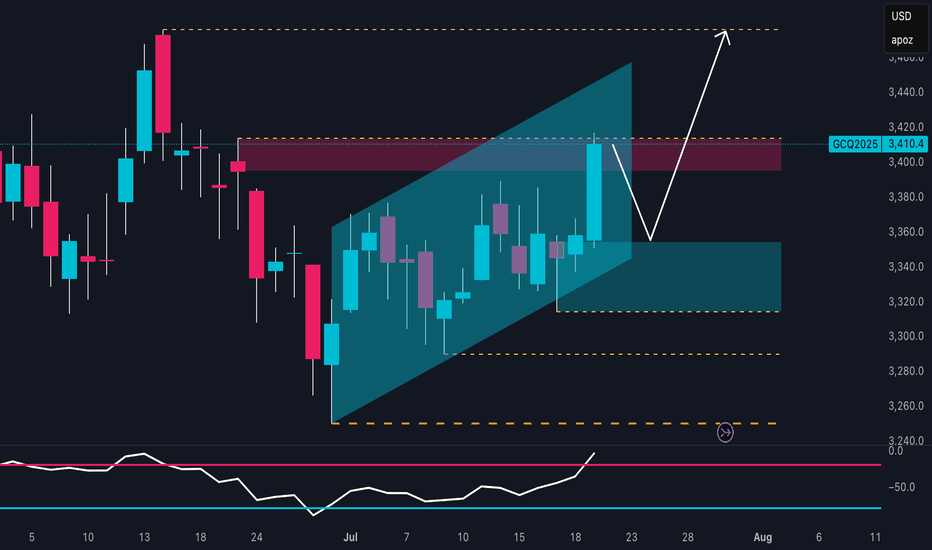

XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deep

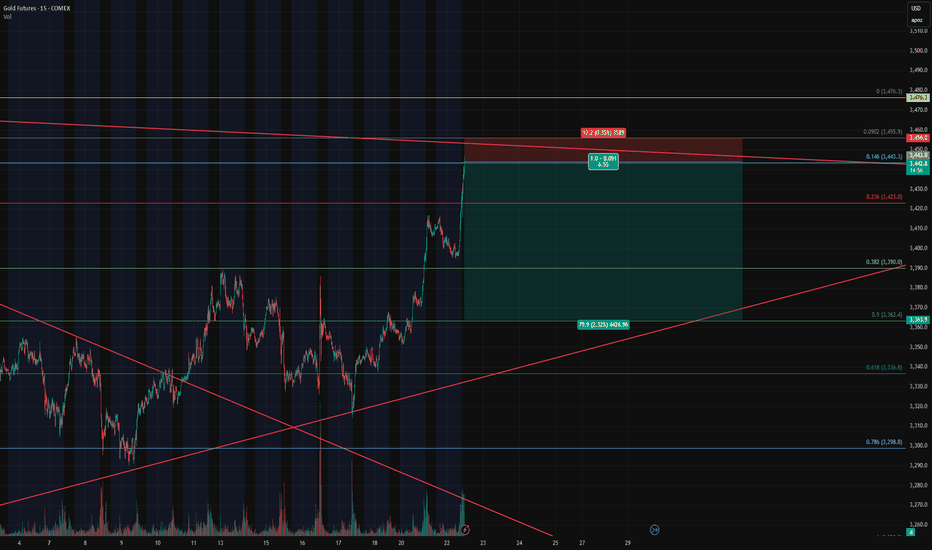

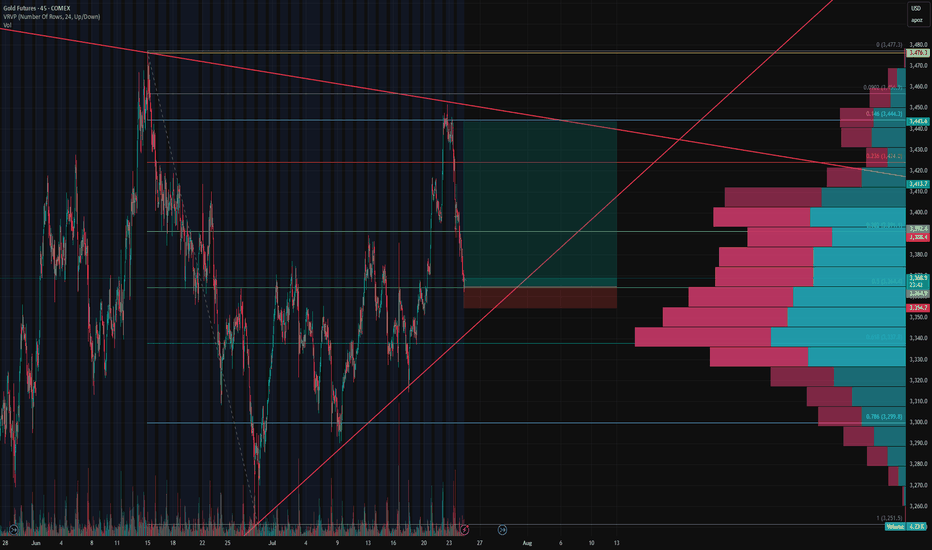

Gold Futures – Closing Longs and Flipping Short at Key Fib🔴 Gold Futures – Closing Longs and Flipping Short at Key Fib Confluence

Instrument : Gold Futures – COMEX ( COMEX:GC1! )

Timeframe : 15-Minute

New Position : Short

Entry Zone : ~3442

Target : ~3362

Stop Loss : ~3458

Risk/Reward : Approx. 6.5+

Setup Type : Reversal from Overextension / Fi

Gold Buyers Barely Holding. Sellers Licking Their Lips.The move on gold over the last two sessions has been clean, aggressive, and very telling. Price rallied hard into a well-defined supply zone between 3452 and 3460, which has acted as a sell-side magnet for the past three rotations.

We got five separate stabs into that zone, all failing to close wi

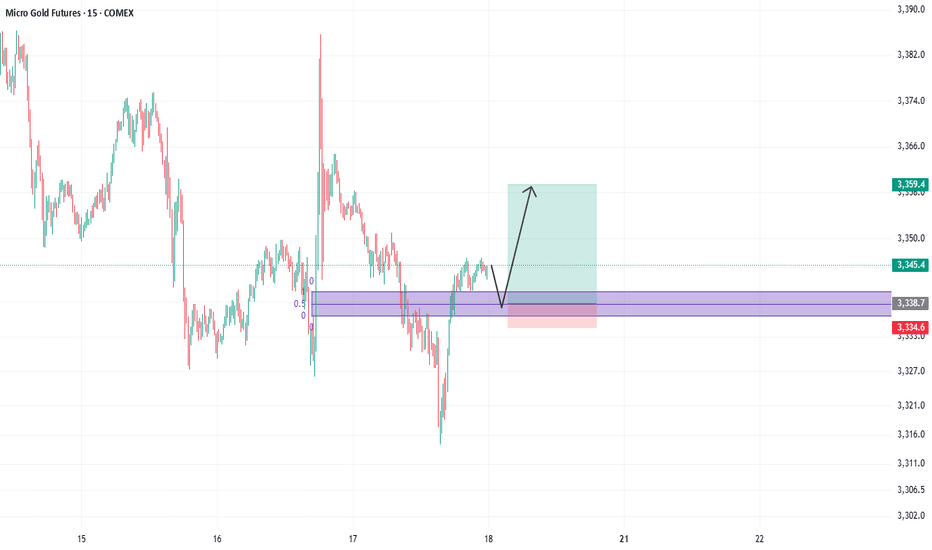

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on t

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area

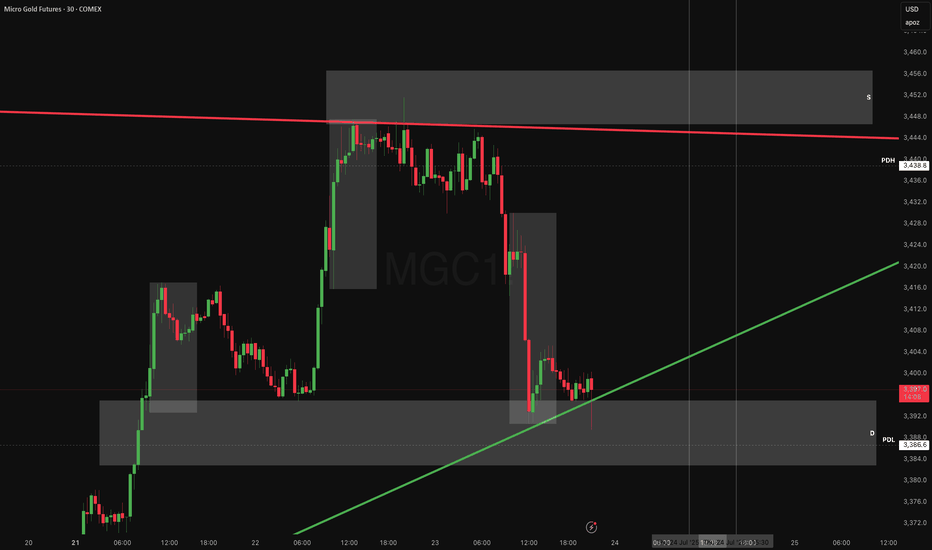

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click o

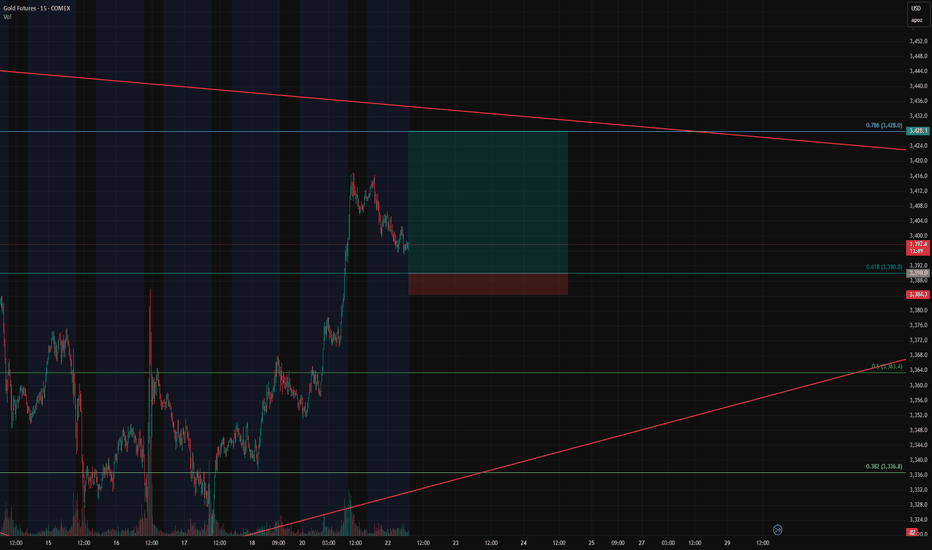

Gold Futures Long Setup – Breakout Continuation off the 0.618 FiGold Futures Long Setup – Breakout Continuation off the 0.618 Fib

Instrument: Gold Futures – COMEX ( COMEX:GC1! )

Timeframe: 15-Minute

Trade Type: Long – Breakout Continuation

Entry Zone: 3390 (0.618 Fibonacci retracement)

Take Profit: 3428 (0.786 Fib)

Stop Loss: 3384

Risk/Reward Ratio: 6.68

Setup:

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Gold Futures (Jul 2026) is 3,478.9 USD / APZ — it has fallen −0.65% in the past 24 hours. Watch Gold Futures (Jul 2026) price in more detail on the chart.

Track more important stats on the Gold Futures (Jul 2026) chart.

The nearest expiration date for Gold Futures (Jul 2026) is Jul 29, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Gold Futures (Jul 2026) before Jul 29, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Gold Futures (Jul 2026) this number is 1.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Gold Futures (Jul 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Gold Futures (Jul 2026). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Gold Futures (Jul 2026) technicals for a more comprehensive analysis.