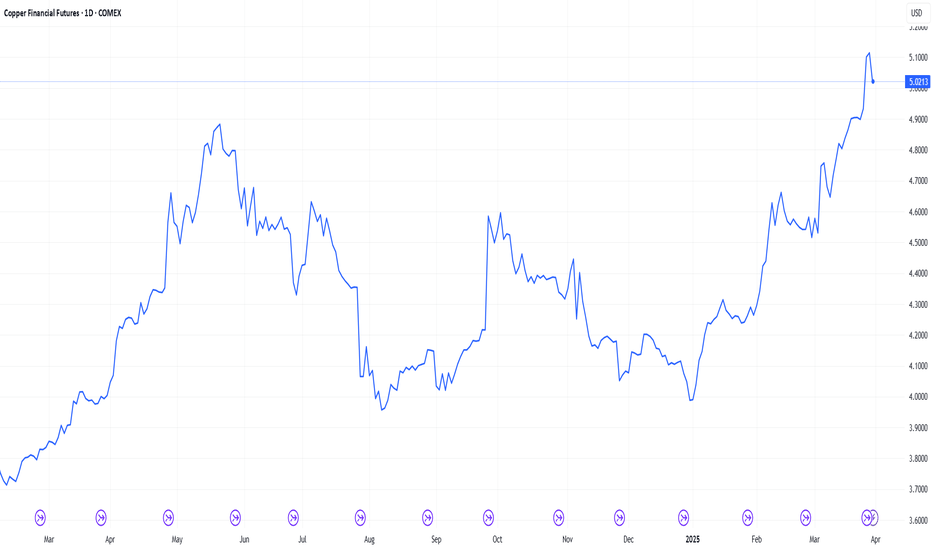

MR. COPPER GOES FUN. WITH DONALD TRUMP — IT IS A BULL RUNCopper prices in 2025 are up about 27 percent year-to-date, driven by a complex interplay of technical and fundamental factors, with geopolitical events such as the Trump administration's tariff policies and the escalation of geopolitical tensions in the Middle East having a significant impact.

Fundamental Outlook:

The main driver of copper prices in 2025 is the ongoing global surge in demand driven by the transition to clean energy. Copper is essential for electric vehicles (EVs), renewable energy infrastructure, and grid upgrades, all of which require extensive use of copper due to its superior electrical conductivity.

For example, EVs use about 2-4 times more copper than traditional vehicles, and renewable installations such as wind turbines contain several tons of copper each. This structural growth in demand underpins the optimistic outlook for copper in the medium to long term.

On the supply side, however, copper production is growing. The International Copper Study Group (ICSG) forecasts a global copper surplus of 289,000 tonnes in 2025, more than double the 2024 surplus. This surplus is driven by rising production, particularly from new or expanded operations in the Democratic Republic of Congo, Mongolia, Russia and elsewhere.

Capacity increases in these regions, coupled with smelter growth, could contribute to a supply glut despite strong demand.

Conversely, geopolitical tensions in the Middle East could disrupt bauxite and alumina supply chains, a region that is a strategically important supplier of raw materials.

Impact of Trump Tariffs:

The Trump administration’s threats and actions to impose tariffs on U.S. copper imports have added volatility and complexity to the market. The tariff announcement triggered a sharp sell-off in early April 2025 as concerns about the impact on US manufactured demand and global trade flows grew. London Metal Exchange (LME) copper prices fell to one-month lows following China’s retaliatory tariffs, before partially recovering after some tariff exemptions and reductions were announced.

The tariffs also distorted physical supply chains. Traders rushed to deliver copper to the US ahead of the tariffs, reducing copper availability in other regions such as China. This arbitrage resulted in a significant widening of the price differential between US CME copper contracts and LME copper prices, with US prices trading at a premium of over 10% to London. This premium reflects the tariff risk embedded in the US copper price and expectations of temporary domestic market tensions.

Technical Outlook:

Technically, copper prices have shown resilience despite the tariff shocks. Copper prices sold off after peaking in late March 2025 before the tariffs were announced, but have since begun to recover.

Long-term trendlines and moving averages remain supportive, with the 100-week and 200-week moving averages trending higher and forming a bullish crossover earlier in the year.

Long-term copper prices are once again attacking the 18-year resistance around $4.50/lb ($10/kg) that capped the upside in 2008 and again in the 2010s and first half of the 2020s, with a 1.5x rally in the next 1 to 3 years.

The technical main chart of the COMEX December 2025 copper futures contract COMEX:HGZ2025

points to the possibility of an upside move, all the way to the $7 mark (around $15/kg) as early as H2 2025.

Conclusion

Going forward, copper prices are expected to remain volatile but supported by long-term structural demand growth, with the impact of tariffs likely to cause episodic disruptions rather than a sustained suppression of increasingly hot prices.

--

Best wishes,

@PandorraResearch Team😎

HGK2030 trade ideas

Copper LongsBullish Bias for copper. Looking for daily BPR target, then possibly relative equal highs.

Ideally would like to pair a bullish weekly profile with longs. If the week opens lower first and delivers to a key level, thats favoring longs. So looking for Monday, Tuesday or Wednesday to create the low of the week.

I see a daily MMBM in play. Price expanded off the breaker block. If bsl is the dol, price should expand hard of EQ of the range.

Long Setup: Micro Copper Futures (Jul 2025)While U.S. equity markets are closed in observance of Juneteenth, traders in the futures markets still have opportunities to position ahead of broader market moves. One such opportunity is forming in Micro Copper Futures (MHGN2025), which continues to consolidate in a tight range near key technical levels. The current structure suggests a potential breakout to the upside with a favorable risk-reward setup.

Technically, price action remains compressed between approximately 4.70 and 4.90, coiling just above the Ichimoku Cloud and holding support above the mid-April range. This zone has acted as a critical demand area multiple times since April, and the market has rejected any meaningful downside continuation, signaling underlying strength.

A long position is being considered based on the following:

Entry Zone: Around 4.81, above the flat Kijun-sen and within the current range high.

Stop Level: Set at 4.7080, just below the support band and Ichimoku base, providing technical invalidation if broken.

Target: 5.10, aligning with previous resistance and psychological round number. This would complete a 6.8% upside move from current levels.

Risk/Reward Ratio: 2.64, indicating strong asymmetry favoring the long bias.

The MACD histogram remains positive despite flattening out in recent sessions, while the signal line crossover earlier in June continues to support the bullish case. Although momentum has paused, it has not turned negative, which may point to a consolidation phase before the next leg.

The broader copper narrative also lends support to this setup. With persistent demand from renewable infrastructure, data centers, and EVs, copper remains a fundamentally supported commodity despite near-term volatility driven by macro factors and central bank policy. Any fresh economic stimulus out of China or signs of rate stabilization globally could provide the catalyst for a bullish breakout in base metals.

Traders should monitor volume and any breakout beyond the 4.89–4.90 zone, which could trigger further buying. A daily close above 4.90 on increased volume would confirm the breakout and improve the probability of reaching the 5.10 target.

While today’s market holiday may reduce liquidity temporarily, it also offers a less crowded environment for early positioning. As always, risk management is paramount, and trade sizing should reflect the volatility and leverage of commodity futures.

This setup remains active and will be reassessed if price fails to hold above the key support zone or if macroeconomic conditions materially shift in the near term.

Copper1! at Best Support !!This is the 2 chart of Copper1! .

Chart 1 Analysis:

The stock is trading near a parallel channel support zone in the 880–890 range. This zone also aligns with the monthly pivot and weekly pivot support around 882–880. Additionally, the percentage fall is nearly complete near 885, further strengthening this level as a potential support zone.

Chart 2 Analysis:

On the monthly Heikin Ashi chart, support is observed near 864, while the weekly Heikin Ashi support lies around 880.6. By connecting key levels, it indicates that Copper may find support in the 880–885 zone.

Thank You !!

Bullish Reversal Builds in Copper: Eyes on $5.20 Resistance

The current price has closed above the Bollinger Band middle line (20-day SMA), indicating short-term upward momentum.

A sustained close above 4.90–4.95 could open the way to challenge the psychological level of 5.00 and possibly 5.20.

Immediate resistance: 4.95 → 5.00 → 5.20

Support zones: 4.75 (middle band) → 4.60 (recent low) → 4.45 (lower band)

Copper Nears Annual HighCopper Nears Annual High, Driven by Trade Optimism and Falling Inventories

By Ion Jauregui – ActivTrades Analyst

The copper market is once again in the spotlight. The metal is currently trading at around USD 9,756 per tonne on COMEX futures at the London Metal Exchange (LME), approaching its annual high reached at the end of March, near USD 10,000. This rally is supported by a combination of macroeconomic drivers and market-specific factors.

China–U.S. Dialogue Boosts Demand Outlook

One of the key catalysts behind this upward move has been the recent diplomatic thaw between China and the United States, which has improved the global trade climate. Trade negotiations held in London have renewed optimism about global economic growth, which naturally strengthens the projected demand for industrial metals like copper—widely used in construction, energy, and technology sectors.

LME Inventories at Lows Add Upward Pressure

Adding to this context is a significant decline in inventories recorded at the LME. This drawdown reflects both an increase in physical consumption and speculative positioning amid potential new tariff policies that could follow the current trade truce. This relative scarcity in physical supply has become another driver of price gains.

Technical Analysis of Copper (USD/lb)

As of early trading hours, copper is quoted at approximately USD 476.5 per pound, according to ActivTrades data. The asset has shown strong upward momentum from July 2023 through May 2024, with a brief correction down to USD 399.70, a key technical support level for the ongoing rally that began in mid-April. The Point of Control (POC) for volume is located around USD 467, holding above an intermediate support level at USD 449.13, reinforcing the short-term bullish structure.

As for resistance levels, USD 505.32 stands out as the main ceiling to overcome. Currently, the price is fluctuating within a technical range between USD 494.22 and USD 442.61, suggesting a consolidation phase ahead of a potential breakout.

Conclusion

Copper remains one of the most dynamic industrial metals in today’s macroeconomic landscape. Renewed trade optimism between the world’s two largest economies, combined with a sharp drop in LME inventories, has created a solid set of fundamentals justifying the approach toward annual highs. Technically, the bullish structure remains intact as long as key support levels hold, and a sustained close above USD 494/lb could pave the way for fresh short-term highs. In this context, copper not only reflects the pulse of global industry but also embodies the economic growth expectations in a time of geopolitical and energy transition.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Chart Pattern Analysis Of Copper.

There are 4 candles close upon the neckline of a potential bullish triangle pattern,

It seems that another bull run will start here.

I am expecting an accelerate motive wave to touch or break up the target line.

On the other hand,

If K4 couldn’t close upon K1 to verify the strong bullish momentum,

It is also possible that a short-term consolidation will carry on from K1.

If the following candles successfully resets the resistance,

It is also a good place to buy it then.

Long-875/Stop-870/Target-920

Long-881/Stop-870/Target-920

Price correction and re-increase in copper prices1.Growing Global Demand: Rising infrastructure projects and renewable energy initiatives (like EVs and energy storage systems) are boosting copper demand.

2.Supply Constraints: Declining reserves in major mines, production disruptions in key producers (e.g., Chile, Peru), and limited new investments are tightening supply.

3.Weaker USD: If the Fed cuts interest rates, a weaker US dollar (as copper is dollar-denominated) could push prices higher.

4.China’s Recovery: Economic stimulus in China (the world’s top copper consumer) is expected to drive stronger demand.

5.Inflation Hedge: Copper is seen as a hedge against inflation, attracting more investor inflows if global inflation persists.

Strong demand, tight supply, and supportive macro trends could drive copper prices upward in the coming months.

Sasha Charkhchian

DR COPPER vs GOLD as a Safe HavenAn enlightening ratio provides additional proof that 2026 is set to be a remarkable year of economic growth, propelling us into the upcoming peak of the #AI cycle.

A key indicator of the AI peak is the initial public offering (IPO) of Open AI on the stock market. This is a definitive signal to capitalise and harvest as much economic energy as possible during the euphoric frenzy, and establish Open AI as a new Tech Titan for the next decade.

How can I be late to the copper bull era?How can I be late to the copper bull era when the party hasn’t even started?

The rocket-ship moments for copper lie ahead—not behind us.

There’s no need to front-run anything.

No pressure. No rush. Just readiness.

Wait.. where did I read something similar before... Mmm

Copper to Pump soon, W formation and small cap rumblingsIf you look closely there's a beautiful W formation that has been tested numerous times and has passed. This is high time frame and inconsideration of goals massive run, market makers are going to be looking into smaller cap assets this time of year. Small cap accumulation will last about 2 years. The precious metals like copper which are akin to small caps are going to eat as well. Looks like it's going to double or triple in value notice the parallel Channel as well. Measured moves off the W show the targets.

Candlestick Reversals vs. IndicatorsA simple question to think about. Do indicators make charts too confusing, have mixed success, and ultimately fall victim to whipsaw with an occasional big winner?

Would it be better to use an indicator free daily chart and just observe the buyer and seller psychology that candlesticks offer?

Candlestick patterns are powerful. Especially when you observe them around areas of price congestion, support or resistance.

I would love to hear some opinions on these questions. For and against my thoughts.

Morningstar Candlestick Pattern Forming at the monthly PivotThis 3 candle pattern is a good indicator that a bullish reversal is underway. Price was driven lower on day 1. On day 2 price was initially driven lower but buyers stepped in to take control. And they took control at the monthly pivot which adds even more significance to the move. Finally, on day 3 price moved up which means buyers are in control and bears are losing control. This is likely headline driven and economic outlook driven but the momentum shift at the monthly pivot is an important point to note.

Elliott Wave: Copper (HG) Impulsive Rally Signals More UpsideCopper ( NYSE:HG ) has been displaying a strong bullish trend, with the rally from the July 11, 2022 low unfolding in a Elliott Wave diagonal. This rally is structured as a 5-swing pattern, which is characteristic of a motive wave. This suggests that the broader trend favors further upside. As of the latest price action, the metal has completed a significant corrective phase and is now positioned for additional gains.

The recent pullback to the 4.03 low on April 7, 2025, marked the completion of wave ((4)). It is a corrective wave within the larger 5-wave diagonal structure. Following this low, copper has turned higher, initiating wave ((5)). This wave ((5)) is the final leg of the motive sequence. Within wave ((5)), the short-term rally from the wave ((4)) low at 4.03 appears to be unfolding in an impulsive manner, indicating strong upward momentum. Wave 1 ended at 4.465 and pullback in wave 2 ended at 4.038. The metal then rallied higher in wave 3 towards 4.748 and wave 4 dips ended at 4.564.

Expect cycle from April 7, 2025 low to end soon with wave 5 of (1) and the metal to see a 3 waves pullback. However, as long as pullbacks remain above the 4.03 low, copper is expected to see more upside. The Elliott Wave framework continues to support a bullish bias for NYSE:HG in the near term.

Daily HG analysisDaily HG analysis

A long position with the target and stop loss as shown in the chart

The trend is up, we may see more upside

All the best, I hope for your participation in the analysis, and for any inquiries, please send in the comments.

He gave a signal from the strongest areas of entry, special recommendations, with a success rate of 95%, for any inquiry or request for analysis, contact me

COPPER The 1D MA50 is the key.Last time we looked at Copper (HG1!) was on January 24 (see chart below) giving a buy signal that easily hit our 4.6550 Target:

This time the market is in front of a critical moment. The 2025 pattern has been a Channel Up, which last Wednesday reached the top (Higher Highs trend-line) of the 1-year Channel Up. As long as the 2025 pattern holds, the recent pull-back is a buy opportunity targeting 5.3745.

If the 1D MA50 (blue trend-line) breaks however, we expect a quick dive, rebound re-test and rejection, similar to July 05 2024. In that case, we will target the bottom of the 1-year Channel Up at 4.150.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.