Contract highlights

GOLD & SILVER Weekly Market Forecast: Wait For Buys!In this video, we will analyze the GOLD & Silver Futures. We'll determine the bias for the upcoming week of April 14-18th, and look for the best potential setups.

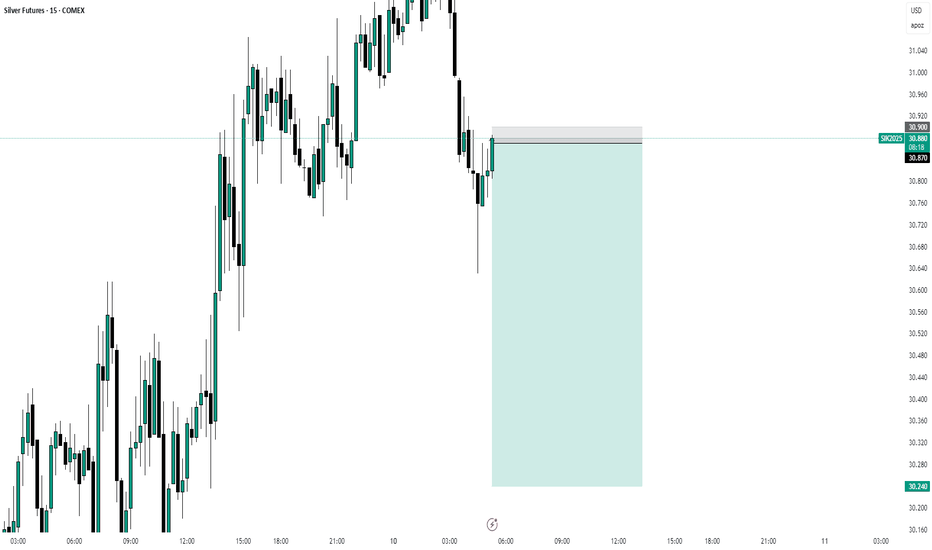

Gold is still bullish, making new ATH's. Silver is not as strong, but had a very strong previous week after sweeping the range lows.

I

I would keep my eye on the gold it looks like it might break hig July 14th early morning. I reviewed the gold and the silver and the dollar the markets trading to the patterns that I use and there's a good chance that the dollar might break higher and if it does there's a chance that it could trade significantly higher and I show that on the video. which could b

Silver Strategy: Short Positions Above Resistance Levels for Nex- Key Insights: Silver remains highly volatile and is currently underperforming

gold, making it a preferred asset for short trades. Key resistance levels at

$33.85 and $35.40 present opportunities to initiate bearish positions, while

support zones near $31.12 and $32.00 provide important areas

Silver next week?doing a top down analysis, from weekly to 30m, it looks like silver has tapped a major SSL zone after the massive drop of ~8%, which I have never seen in my 5 years of trading!

There has got to be some bounce expected over the coming week as this week has created huge imbalance in the price of silv

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Related commodities

Frequently Asked Questions

The current price of Silver Futures (Apr 2025) is 32.225 USD / APZ — it has risen 0.42% in the past 24 hours. Watch Silver Futures (Apr 2025) price in more detail on the chart.

The volume of Silver Futures (Apr 2025) is 45.00. Track more important stats on the Silver Futures (Apr 2025) chart.

The nearest expiration date for Silver Futures (Apr 2025) is Apr 28, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Apr 2025) before Apr 28, 2025.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Silver Futures (Apr 2025) this number is 130.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Silver Futures (Apr 2025) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver Futures (Apr 2025). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver Futures (Apr 2025) technicals for a more comprehensive analysis.