DENTUSDT trade ideas

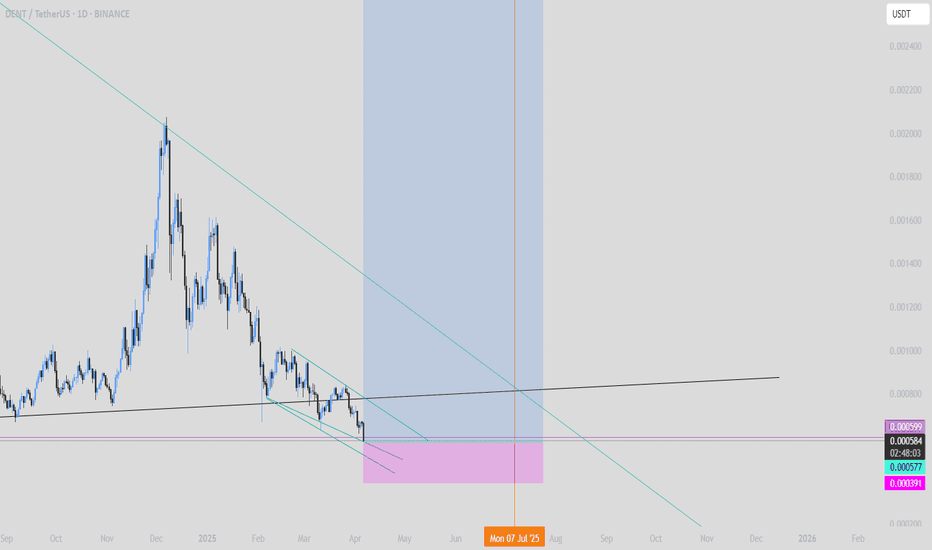

DENT at Strong Support – Bounce Ahead?DENTUSDT is trading at a strong support level on the weekly chart. This same area has been tested several times in the past, and each time the price bounced back up. Once again, the price has reached this support zone and is starting to show signs of a possible bounce.

As long as the price stays above this support area (around 0.00050–0.00060 USDT), there's a good chance we could see a bounce or even a trend reversal. But if the price breaks below this level, it could drop further. Right now, this is an important level to watch for a possible move up.

DENT - Potential Price Reversal at Golden Pocket and FVG ZoneIn this TradingView chart for the DENT/USDT perpetual contract on the 4-hour timeframe, the current price action is being analyzed with a focus on key Fibonacci and market structure levels that indicate potential price movement. Below is an extensive description of the setup:

1. Golden Pocket Support Zone:

- Highlighted in yellow, this area represents the golden pocket derived from a significant upward trend. The golden pocket, located between the 0.618 and 0.65 Fibonacci retracement levels, is known as a high-probability reversal zone.

- The price recently reacted off this level, signaling potential bullish interest in the zone.

2. Fair Value Gap (FVG):

- The blue zone above current price action highlights an unfilled Fair Value Gap (FVG) left behind during the prior downtrend. This area, located near 0.00078, may act as a potential liquidity target if the price begins to retrace upward.

- The Fibonacci retracement is also drawn, intersecting with this zone, reinforcing its significance as a key resistance area.

3. Potential Scenarios:

- Bullish Retracement: The green path anticipates a short-term upward move where the price may climb toward the FVG resistance zone. This move could align with traders looking to target the imbalance created by previous price action.

- Bearish Continuation: The red arrow outlines the scenario where price, after testing the FVG, resumes its downward trajectory, breaking through the golden pocket and continuing its bearish trend.

4. Technical Overview:

- The chart shows clear evidence of a prior bearish trend, with current price action suggesting a temporary pause or reversal. Traders should monitor price behavior around the golden pocket and FVG zones for confirmation of either scenario.

- Breakdowns below the golden pocket could indicate further downside momentum, while breakouts above the FVG might suggest a shift in market sentiment.

This setup provides a roadmap for potential price action and highlights critical levels for traders to watch for entry, exit, and risk management.

Is this pattern on Dent repeating?Look at the chart above. The bars pattern looks EXACTLY like the one from 2020/2021, but is a bit extended (which is in line with lengthening cycles).

Target: 0.08$ (which is about a 100x from here)

Stoploss: 0.0007$

Is this the one for you for altseason 2025?

Rustle

DENT short targetWhat Is Dent (DENT)?

Launched in 2017, Dent is a revolutionary digital mobile operator offering eSIM cards, mobile data plans, call minutes top-ups and a roaming-free experience. According to the company website, Dent employs blockchain technology’s powers to create a global marketplace for mobile data liberalization.

Dent has an ambitious roadmap ahead, with plans to expand its services to new markets by the end of 2021. The company has already attracted more than twenty-five million mobile device users, and Dent services are available in more than 140 countries. Enterprise partnerships for Dent include Samsung Blockchain, The Enterprise Ethereum Alliance and Telecom Infra.

Holders: 85.61K

Total supply: 99.99B DENT

Max. supply: 100B DENT

Circulating supply: 99.99B DENT

DENT short target 0.001 usdt.

We continue downwards, 0.0008-0.0006 usdt area.

This is only my idea guys.

This is not financial advice !

Please do your analysis and consider investing !! Thanks for supp.

DENTUSDT - Ready for Bull Rally on Retest or BreakotAs per my analysis, BINANCE:DENTUSDT is ready for a bull rally after the retest of the zone or breakout of the trend as shown on the chart...

Do your own research before entering in the crypto trading as we are not responsible for your loss and this is just for educational purposes...

Thanks for your support as always...

DENT has some huge upward Potential

Launched in 2017, Dent is a revolutionary digital mobile operator offering eSIM cards, mobile data plans, call minutes top-ups and a roaming-free experience. According to the company website, Dent employs blockchain technology’s powers to create a global marketplace for mobile data liberalization.

Dent LongNot the prices we wanted from alts, but this is crypto, she does whatever she wants.

Trying to catch a long from 0.00098$ to 0.001$.

I will use 5x leverage .

Risk-reward is more than decent.

I think dent can pull a 2 cents at least in this cycle even though this cycle has been rubbish so far for most of the altcoins.

DENTDENT is in a downtrend, and as long as it does not break out of its descending trendline, there is still the potential for further correction in this token. Additionally, the first support level is around the price of $0.0012, which is crucial to maintain.

Good luck! This analysis reflects only my personal opinion, and you are responsible for your own trades. Please share your thoughts with me.

DENT/USDTKey Level Zone : 0.001460 - 0.001500

HMT v4.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

More Results <3 🔥 PremiumTraders AI Indicator - DENT/USDT 1H Results 🔥

📉 SHORT WIN: -35.76% gains locked in!

📈 LONG RALLIES:

+137.25% profits secured!

+23.73% additional win!

🔍 Performance Metrics:

Winning Trades: 61/72

Our AI-powered indicator continues to dominate, capturing multiple opportunities with precision, whether it's shorting or riding strong long trends. 💰

👉 Take your trading strategy to the next level. Join the winning team today! 🚀

#PremiumTraders #CryptoSignals #AITrading #DENTUSDT #TradingView