USDOLLAR trade ideas

USDOLLAR INDEX (DOW JONES) ANALYSIS OF TODAYCHECK THE YESTERDAR"S USDOLLAR ANALYSIS.

________________________________________________________________________________________________________________

**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

US DOLLAR INDEX LONG TRADEUSD Dollar Index broke upper limit of bullish pennant pattern at level 12537

Price is based above HVN at level 12449 which indicates that dollar index is in accumulation phase

Above SMA 100 on H1 frame

MACD shows start of bullish momentum

It's expected more buying to level 12859

as a target of pennant pattern

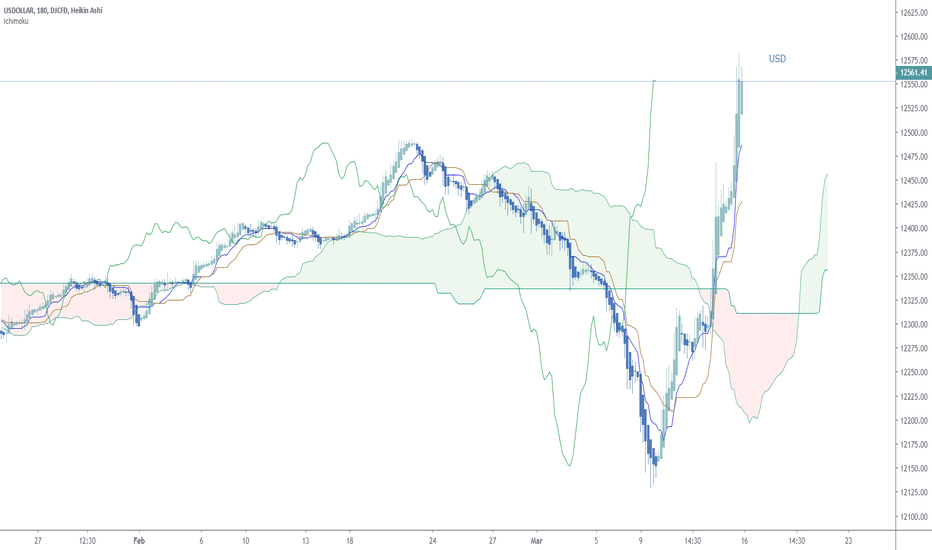

USDOLLAR H4 Timeframe Showing Signs of StrengthFXCM's USDOLLAR index is bouncing on the H4 time frame. It's green 5-hour EMA is looking to cross above its orange 10-hour EMA (green ellipse) and its RSI is looking to move above 50 (blue rectangle). If these chart than it will be considered as bullish developments. However, we need to be wary of a a correction in a larger impulse move down. to This end, if the EMAs do cross and develop angle and separation and the RSI crosses above and moves away from 50, it it may be signalling that an underlying bullish momentum is present in the near-term.

Dow Jones Dollar Index | Losing Support TrendlinePlease support this idea with LIKE if you find it useful.

Price might lose a support trendline and also Ichi Cloud support zone. On a confirmed breakout we can initiate short position.

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

The USDOLLAR Heads for its Worst Week of the YearThe USDOLLAR is having a brutal week after Tuesday’s emergency rate cut by the Federal Reserve – with markets expecting another 50 basis points cut on the bank's March 18th meeting.

Carry trades unwind and the index breaks below 12.250, which exposes last month lows (12.200), closely followed by December’s low (12.181).

Technically speaking these levels appear distant as it trades to extremely oversold territory. As such it could react back towards 12.271, but a massive catalyst would be required in order to challenge today’s high (12.300).

USDOLLAR Slides to 61.8% Fibonacci LevelFurther to yesterday's article , the USDOLLAR has continued to decline. It now finds itself at the 61.8% Fibonacci level of its previous impulse move. This level overlaps with price support (green shaded horizontal) around the 12,290 level. The rotation of capital into bonds as well as short term notes is putting pressure on yields. This is the the catalyst for the lower USD. We note the positive correlation between the 2 Yr Treasury Bill and the USDOLLAR (red rectangle areas). However, we again reiterate that the RSI for the T-Bill is oversold (blue rectangle) and that it will need to normalize soon. This is likely to provide support for the greenback, which may provide a floor to further greenback weakness in the near term.

USDOLLAR Drops to 50% Fibonacci Retracment on DailyFXCM's USDOLLAR index has pulled back to the 50% retracement of its previous impulse move up. This area overlaps with price support around the 12,337 level. It will be interesting to see if this is a level that the greenback bulls are targeting. Pressure has been exerted on the USDOLLAR by the declining yields on the shorter end of the yield curve. Above we show the US 2-Yr treasury note, noting the drop in yields (blue rectangle). This area corresponds with a deeply oversold RSI (green rectangle) and a bounce in the short-term yields in the near term is a possibility, as the oscillator normalizes. If this happens, it is likely to support the USDOLLAR. It will be interesting to note if this happens at current levels.

USDOLLAR Pulls Back To Support AreaThe USDOLLAR has pulled back to the 38.2% Fibonacci retracement of the last impulse move up. This level coincides with a resistance turned support area (green shaded horizontal). The G7 finance ministers and central bankers will hold a teleconference today to discuss measures to deal with the economic impact of the coronavirus outbreak. The formal statement may create market volatility and it will be interesting to see if the support level holds. If the green 5-day EMA closes above the orange 10-day EMA and the RSI moves above 50, it will be regarded as bullish developments and may be a signal that the greenback has commenced its next advance. If this does happen, the catalyst is most likely to be market disappointment in the communicated monetary response i.e.a dovish stance by the Fed has already been priced in.

Dow Jones Dollar Index | Almost a Decade of UptrendPlease support this idea with LIKE if you find it useful.

Highly recommend to watch the Support trendline, because it was not broken for almost a decade.

At current we have an Ascending Triangle formed and if the resistance zone is past the Uptrend will continue.

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

USDOLLAR Momentum Down As Yields DeclineThe momentum of the USDOLLAR has declined over the course of the week. We can see this by the convergence of the green 5-day EMA towards the orange 10 day EMA (green ellipse). Moreover, the RSI has moved closer to 50 (red rectangle). As markets capitulated this week we note the bottom chart of the US 2-Yr note i.e. the yield has dropped markedly (blue rectangle). This reflects a renewed expectation by the market that the Fed will be forced to cut rates in 2020 more aggressively than initially forecast. Cuts are now expected in April, June and December. However, the greenback is showing some resilience. Today's candle (still to complete) looks like a bullish hammer (green arrow). As such we continue to monitor and if the green 5-day EMA crosses below the orange 10-day EMA and the RSI drops below 50, these will be considered as bearish developments.