The W1DOW maker is looming. BEAR MARKET watch.

Look at that August Monthly hammer candle after the Yen carry trade wobble.

The Global Dow jones index is at an all time new high

This rise is BASED on a wall of #FIAT capital that has been clicked and borrowed into existence.

And speculation of an AI revolution

But Money creation is not wealth creation.

An general AI will be deflationary, as more decisions outsourced from Humans to the "mainframe" :0

Most of my idea's I have shared on assets have been to the upside even after bearish down moves. Stocks, Gold & Crypto. Right Back in 2020 I shared a thesis of a Roaring 20's echo meltup and here we are melting up ...

Yet the party must end sometime

so we watch and have one foot in and foot out from this point.

Secular Bull markets have a lifespan of 15-18 years ...

and this one has required multiple rounds of QE (liquidity injections) to achieve this run.

So we will are looking for #BTC hit $100k the Russell 2000 to make new high's, before setting the stage for a bear market that could be quite extraordinary.

W1DOW trade ideas

Global Recession / Depression of 2022-2023Bears and Bulls await for the "Great Reset" (or as the Fed might state: "financial accident") that will lead to the Fed Pivot.

The question is where (and when) will the pivot occur?

"Watch your step while peering into the abyss. The cliff edge is crumbling faster and is closer than we realize..."

Global Market Indices Topping Out

Nothing stays bullish forever... Global markets cannot keep this rate of growth healthily.. A pullback from here would be the best case scenario in the long term, even if it meant a period of economic downturn..

Having a look at 3 of the major global indices, both individually & combined together, shows that from a simple TA point of view, we are nearing the end of this cycle of market growth & hinting at a major global economic downturn.

From the chart I'd be expecting a rejection from that Res.1 level (or a fakeout above then down) towards the pivot point & support levels below.

The ticker I used was (DJ:W1DOW+NASDAQ:NQGM+NASDAQ:NQGI)/3 :

- W1DOW

- NQGM

- NQGI

^The average of the 3 global market indices was taken to produce the chart

W1DOW: ( www.spglobal.com )

The Dow Jones Global Index aims to provide 95% market capitalization coverage of stocks globally, including developed and emerging regions.

NQGI: ( indexes.nasdaqomx.com )

The NASDAQ Global Index is a float adjusted market capitalization-weighted index designed to track the performance of global equities covering over 98% of the entire listed market capitalization of the global equity space.

NQGM ( www.nasdaq.com )

The NASDAQ Global Market Composite consists of 1,450 stocks that meet NASDAQ’s strict financial and liquidity requirements, and corporate governance

standards. The Global Market Composite is less exclusive than the Global Select Market Composite.

^The above provide a broad selection of the major worldwide markets & when combined and averaged provide a nice benchmark of the global market's current performance.

^A look at the bearish divergence on daily chart when you combine all 3 of the above global indices.

Here is a look at the quarterly chart of the NASDAQ Global Market Composite. The chart is hinting towards some major bullish exhaustion & possible major pullback

- RSI exhaustion

- Stochastic RSI bearish div. and pointing down

- CCI overbought & local downtrend

- MacD exhaustion signs

- VMC B bearish sommi diamond + exhaustion signs.

All indicators mentioned are pointing towards a heavy downswing on the 3-month chart quite soon.

NQGI:

(Daily)

Showing extensive bearish divergence on MacD for the Nasdaq global index

NQGI on the weekly chart also bearish with multiple bearish divergences inside a rising channel

W1DOW:

Weekly Global Dow is in an ascending channel with some major bearish divergences

^Could extend a bit higher first before retracing

SPX: Included out of interest

SPX 2-weekly bullish exhaustion with Bearish divergence on multiple indicators.

Bearish div. within an ascending wedge pointing to a severe correction on the way.

Overall you can see that the majority of markets around the globe are ready for a major pullback or slowing of growth.

*Symbol tags*

DJCFD:W1DOW NASDAQ:NQGI NASDAQ:NQGM TVC:SPX

DOWNJONES Global BullishGood luck for your trades.

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market.

But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

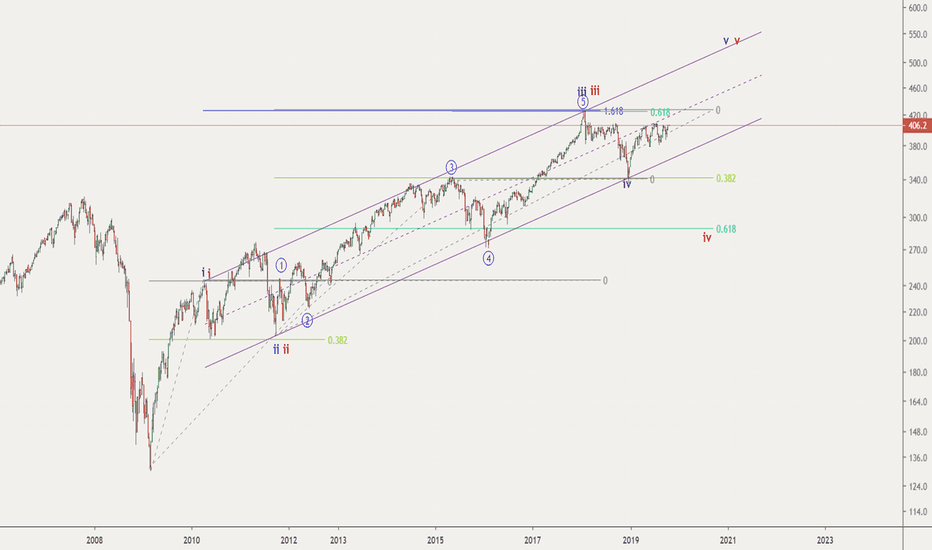

Global Dow - trend to new lows continuesGlobal Dow continues on its way down to new lows. In the shorter term view, it seems to have finished, or nearly so, minor counter-trend wave 2. The next move should be minor 3, where the most probable target is is below 370. If prices crosses up 418, this analysis should be reviewed. FOLLOW SKYLINEPRO TO GET UPDATES.

W1DOW - reached the target range and reversed, as predictedW1DOW as reached the target range forecasted in our post of May 31 and reversed as predicted. It seems to have finished the minor corrective wave 2 and should soon be tracing minor wave 3 down with strong momentum. The probable target for the end of minor wave 3 should be below 370. If price crosses up 418, this analysis should be reviewed. FOLLOW SKYLINEPRO TO GET UPDATES.

Global Dow - end stage of counter-trend rallyAs forecasted in the April 7 post, Global Dow surpassed the target at 377 and just crossed the 0.618 retracement, typical of second waves. Intermediate wave C is tracing minute wave 3 up, therefore we may see a probable additional growth of 5% before the trend reverse in direction to new lows. A possible target is at around 410. If the index cross down 354.80 the probable scenario is that the trend already reversed. FOLLOW SKYLINEPRO TO GETUPDATES.

The Dow Global Index Respects its Trendlines...Just adding a long term view - this index very much "respects" its trendlines. In other words, it shows classic signs of resistance, bouncing, etc off its important long term trends. This is important because it just broke below the 10 year support line after the GFC. This is potentially indicative of a new bear starting globally.

Global Dow testing break of long-term trendThe Dow Jones Global Index just broke below the post GFC lower trendline. Note that it hit it's all time high and went lower in February when hitting the upper trendline. Could have very bearish implications.

Like many breakouts, it may test this line a bit or perform a false breakout and retest. Will be interesting to watch what happens, but definitely a precarious position to be in.