LONG Investment Opportunity on GBP/DKK 4H

Hello everyone, I am Trader Andrea Russo, and today I want to share with you a LONG investment opportunity on GBP/DKK. With the help of the SwipeUP Reversal Radar Multi-Timeframe Alerts indicator, we have managed to identify a setup that deserves attention for its bullish potential.

Here is the Investment Setup:

Entry Price: 8,714

Target Price (TP): 8,818, corresponding to an estimated profit of 1.20%.

Stop Loss (SL): 8,679, corresponding to a risk of 0.40%.

This setup is based on bullish pressure signals, with technical confirmations that show a potential reversal to the upside. The break of the Dynamic Resistance on the 4-hour (4H) chart supports the idea of a possible bullish movement.

As always, I encourage you to check the chart and apply proper risk management to ensure informed trading. Don't forget to use a strategic plan to capitalize on this setup. Happy trading everyone! 📈

DKKGBP trade ideas

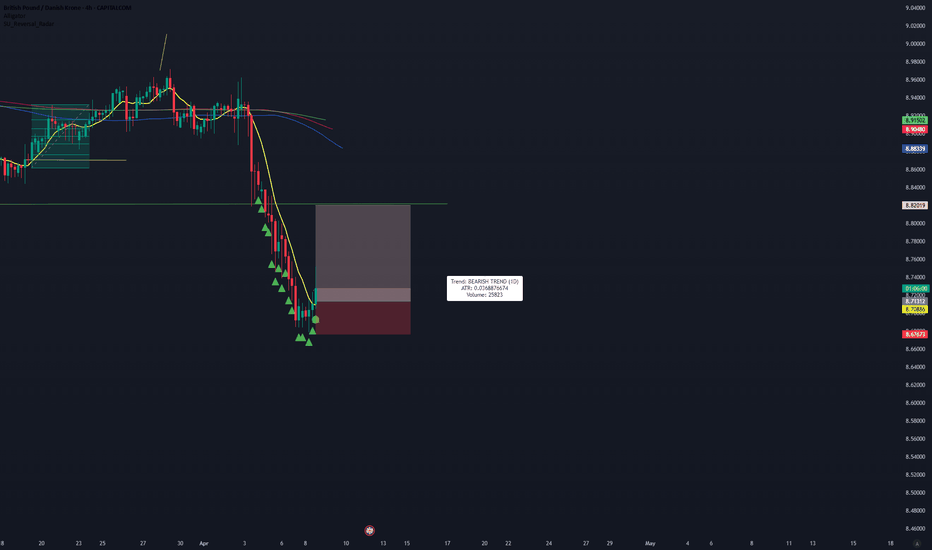

Trading Signal for GBPDKK: SellAttention traders,

We have identified a SELL opportunity for the currency pair GBPDKK, based on our analysis using the EASY Quantum Ai strategy.

Entry Price: 8.85281

Take Profit: 8.83847

Stop Loss: 8.86746

Our analysis indicates a bearish trend for GBPDKK. Here are the key factors that have influenced our prediction:

1. Technical Analysis: The price movements and chart patterns point towards a downward trend. Indicators such as moving averages and Fibonacci retracements suggest a high probability of further decline in the pair.

2. Market Sentiment: Recent market sentiment analysis reveals that traders and investors are favoring the Danish Krone over the British Pound due to prevailing economic conditions and monetary policies. This sentiment is likely to continue putting pressure on GBPDKK.

3. Economic Indicators: Key economic data from the UK, such as lower-than-expected GDP growth and higher inflation rates, negatively impact the Pound. Conversely, stable economic performance and favorable interest rate expectations for Denmark make the Krone a stronger currency in this pairing.

4. Geopolitical Factors: Current geopolitical events and uncertainties in the UK, including issues related to post-Brexit economic adjustments and political uncertainty, contribute to the Pound's weakness against the Krone.

Please ensure your risk management strategies are in place before entering this trade. This signal is a recommendation based on our strategy and current analysis, and market conditions can change rapidly.

Happy trading,

EASY Quantum Ai Strategy Team

Trade Signal for GBPDKK Pair: SellDear Traders,

We have identified a trading opportunity for the GBPDKK currency pair using our EASY Quantum Ai strategy.

Direction: Sell

Enter Price: 8.88001

Take Profit: 8.86185333

Stop Loss: 8.89550333

Justification for Forecast:

1. Technical Analysis: Our EASY Quantum Ai strategy has detected bearish momentum in the GBPDKK pair. Technical indicators, such as moving average convergence and trend oscillators, confirm downward pressure.

2. Market Sentiment: Current market sentiment shows increased bearish sentiment due to recent economic data favoring the Danish Krone over the British Pound. This has been reflected in the latest market movements.

3. Economic Indicators: Recent macroeconomic reports indicate stronger economic performance and stability in Denmark compared to the UK. This disparity is likely to drive the GBPDKK pair lower.

Remember to monitor your trades closely and adjust your risk management settings as necessary. Wishing you successful trading!

Best regards,

EASY Quantum Ai Strategy Team

Trade Signal for GBPDKK: BuyDirection: Buy

Enter Price: 8.85034

Take Profit: 8.86776

Stop Loss: 8.81885

Attention traders! Based on a thorough analysis, we're issuing a BUY signal for the GBPDKK currency pair.

Our recommendation is to enter at the price of 8.85034. Set your Take Profit level at 8.86776 and your Stop Loss at 8.81885. This trade signal has been generated using the EASY Quantum Ai strategy, known for its robust analytical capabilities and high accuracy.

Reasoning:

1. Technical Indicators: The relative strength index and moving average convergence divergence are showing bullish trends, indicating strong upward momentum.

2. Economic Indicators: Recent economic data from the UK shows positive signs, strengthening the GBP. Concurrently, the Danish economy is facing some headwinds which could weaken the DKK.

3. Market Sentiment: Positive investor sentiment towards GBP due to political stability can push the currency pair higher.

4. Volume Analysis: An increase in buying volume suggests that more traders are taking long positions, which usually precedes a price increase.

Act now to capitalize on this opportunity! Check your positions and ensure your risk management parameters align with your trading strategy. Happy trading!

GBPDKK Sideways Trading Strategy! 📈 GBPDKK Sideways Trading Strategy! 📉

Hello traders! 📊 Today, I'd like to present a compelling trading opportunity in the GBPDKK currency pair. The 1-hour chart indicates a sideways market, with no clear bearish or bullish trend. To make the most of this situation, I have devised two trade plans using buy stop and sell stop orders, targeting potential support and resistance levels.

📉 Trade Plan 1 - Sell Stop 📉

🎯 Entry: Below S2 at 8.6742

🛡️ Stop Loss: Above S1 at 8.6852

🎯 Take Profit: 1:1 at 8.6632

In this plan, we are looking to capitalize on potential downside movement from the current sideways range. The entry point below S2 suggests a bearish continuation, while the stop loss above S1 provides a safety net in case of a reversal. The take profit is set at 1:1, aiming for a reasonable target within the range.

📈 Trade Plan 2 - Buy Stop 📈

🎯 Entry: Above R2 at 8.7212

🛡️ Stop Loss: Below R1 at 8.7161

🎯 Take Profit: 1:1 at 8.7263

In this plan, we are seeking to profit from potential upward movement. The entry above R2 implies a bullish breakout, while the stop loss below R1 mitigates risk if the price retraces. The take profit is set at 1:1, providing a balanced reward-to-risk ratio.

It's important to note that trading in a sideways market carries inherent risks, and caution should be exercised. As always, I advise using appropriate risk management techniques and not risking more than you can afford to lose.

Good luck! 🍀 Happy trading! 📈💹

#GBPDKK #Forex #TradingStrategy #TechnicalAnalysis #SidewaysMarket

ExoticGood morning starts with a good trade, wolves🔥

One more formation. So get ready

There was a slight and confident bullish trend before consolidation.

The price multiple times bounced from support and resistance level.

Then there was a bullish breakout.

Possible retest of the level is expected.

Follow the chart and look for the best price to enter carefully.

_____________________________________________________

If you enjoy my FREE Technical Analysis , support the idea with a big LIKE👍 and don't forget to SUBSCRIBE my channel, you won't miss anything!

Feel free to leave comments✉️

And always remember: "we don't predict, we react".

GBPDKK mine thought reflexion

GBPDKK mine own perspective so what's your consideration on the price movement please comment in the below section ?

I believe that. So what is your expectations in comment below.

So guys Let's look at it 😍😍😍🥰😍😍😍😍 with #hasanat_hussain_al_ahmed_hasan

Learn forex then thought to does earn

Stay With me

Stay With trading

Stay With idea

Stay on trend