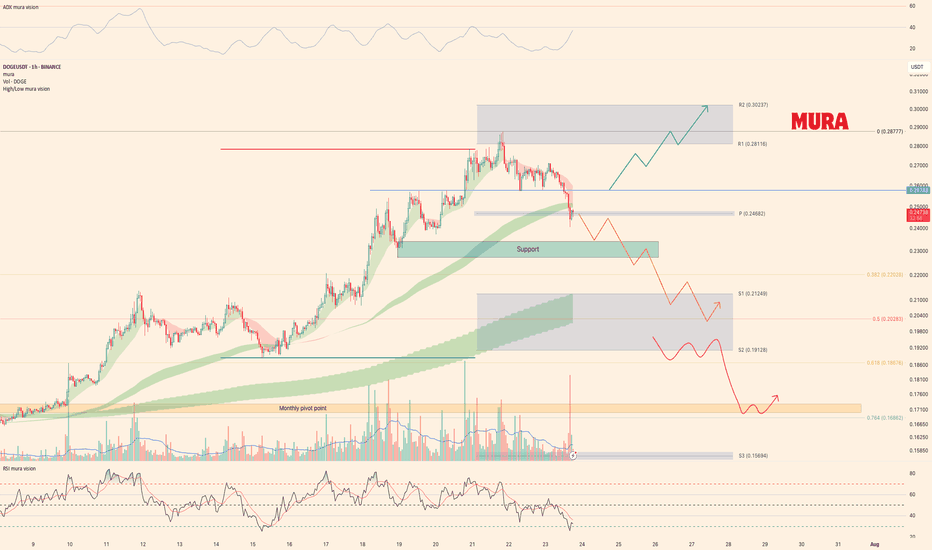

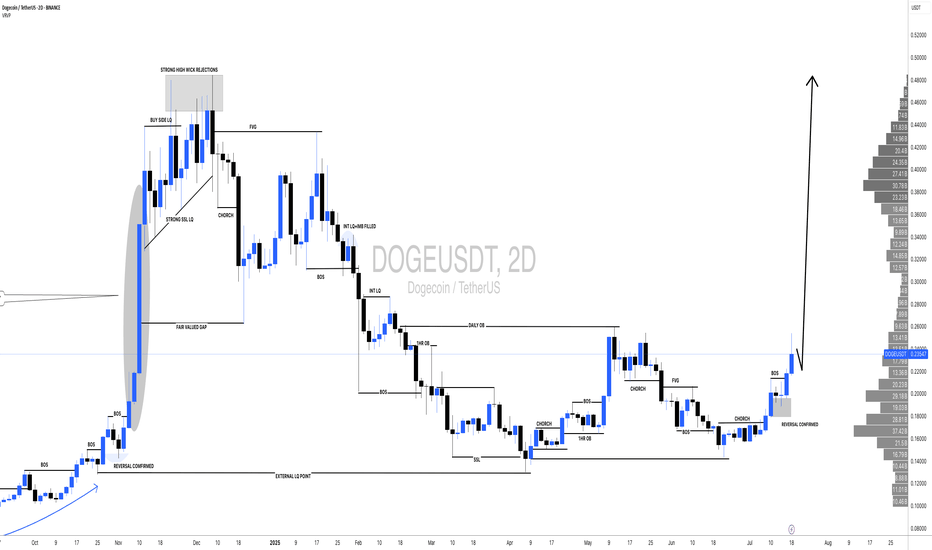

#DOGE Update #2 – July 27, 2025#DOGE Update #2 – July 27, 2025

I previously made two purchases in Doge, and closed one of them with approximately a 10% profit. You can see this in earlier posts as well. After that profit-taking, I opened another position in Doge. However, this time Doge chose to make a correction.

I’m still holding the position and haven’t averaged down yet. My entry level is currently around the $0.262 zone. Unless I see a sharp drop or a clear breakout signal, I find it more reasonable to hold onto the cash in my account rather than averaging down.

At the moment, along with XRP, I’m experiencing around a 10% drawdown from the current level. However, I will continue to wait. I don't think it's reasonable to make a new purchase from this level.

If I decide to average down, I plan to do it near the $0.18 zone. There's also a slight chance I may add at the $0.21 level, but I'm not certain yet. From its current position, I expect approximately a 14% profit. I will continue holding this position.

DOGEUSDT trade ideas

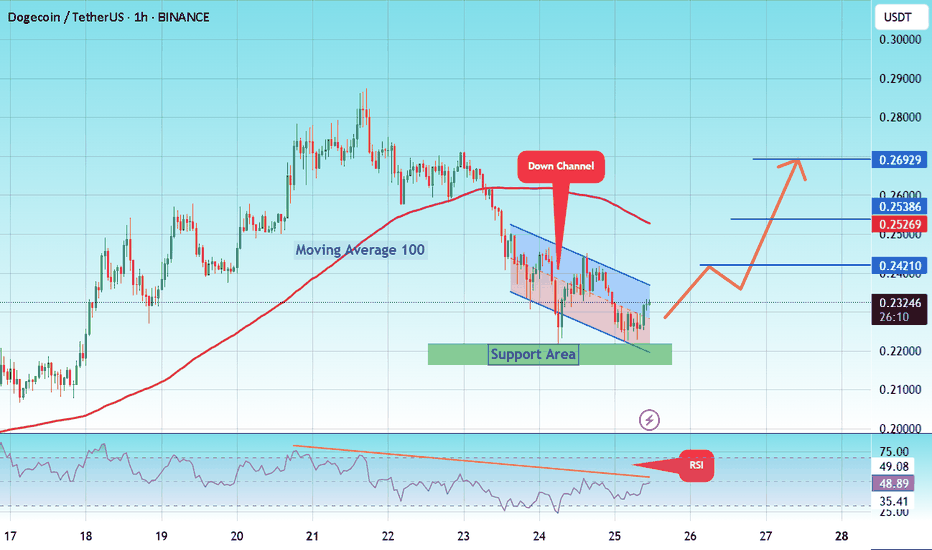

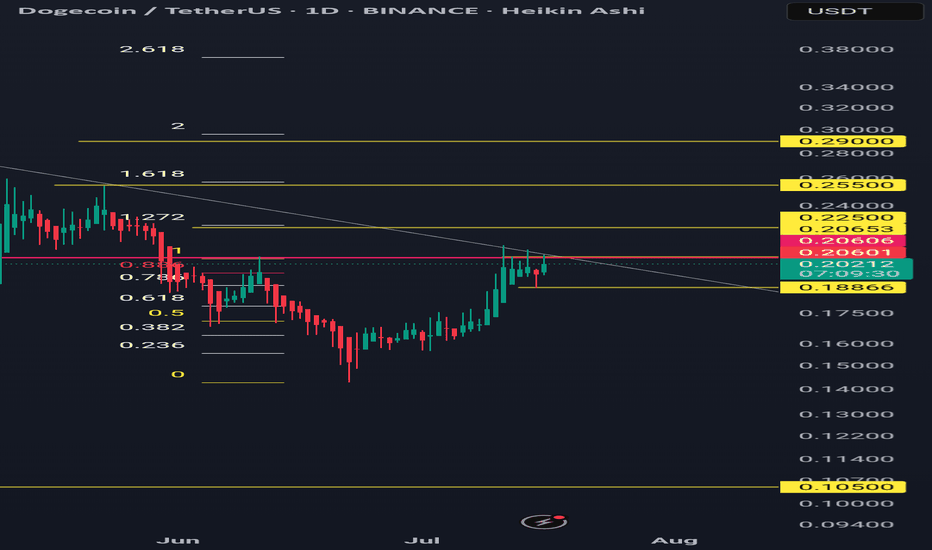

#DOGE/USDT falling wedge#DOGE

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.22270, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.21777.

Entry price: 0.2320

First target: 0.24210

Second target: 0.25380

Third target: 0.26920

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

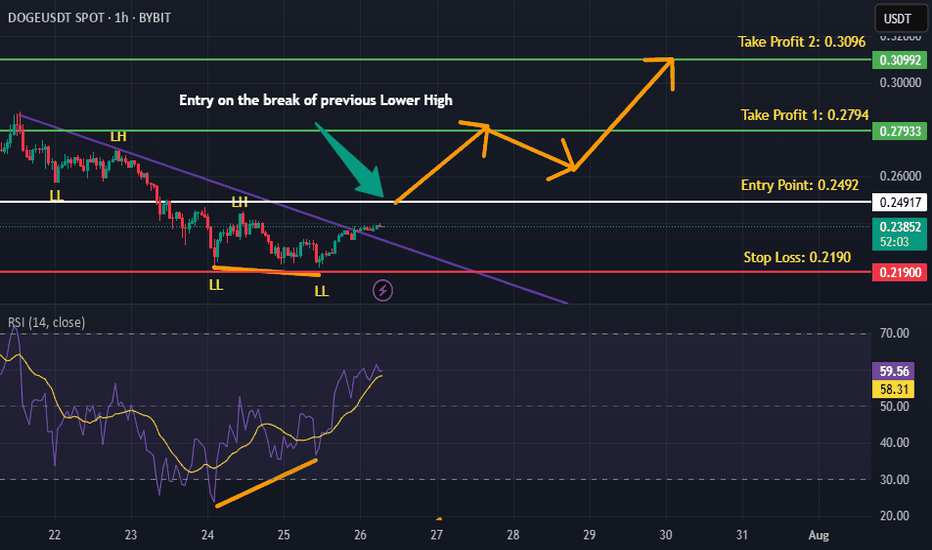

DOGEUSDT is BullishPrice went down for a small retracement on hourly timeframe, however the double bottom formation coupled with bullish divergence and breaking of descending trendline hints that bulls are assuming control of the price action. This sentiment would be validated with the break of previous lower high, according to Dow theory. Targets are mentioned on the chart.

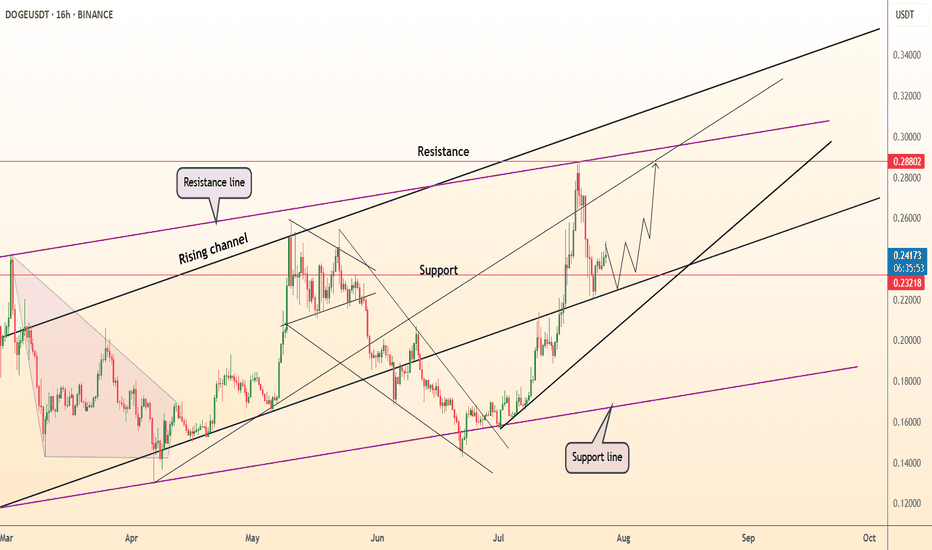

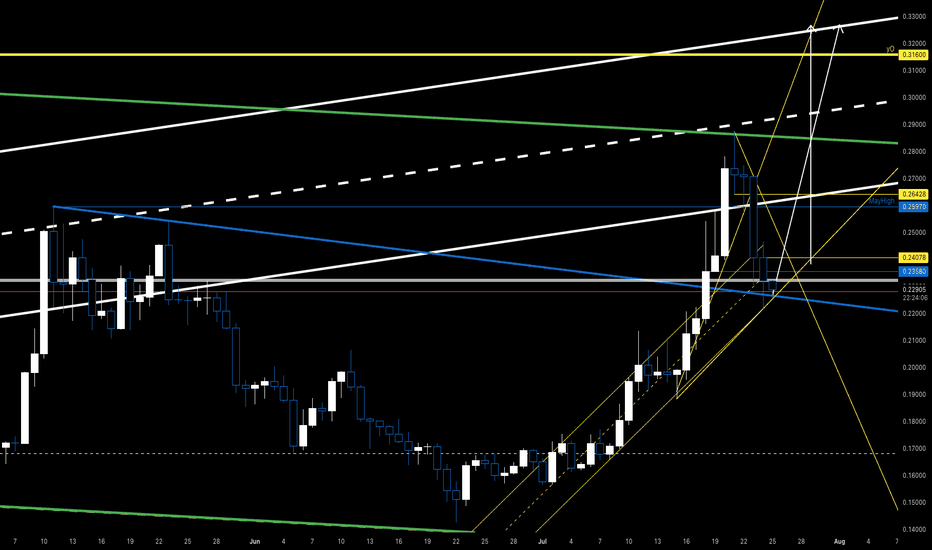

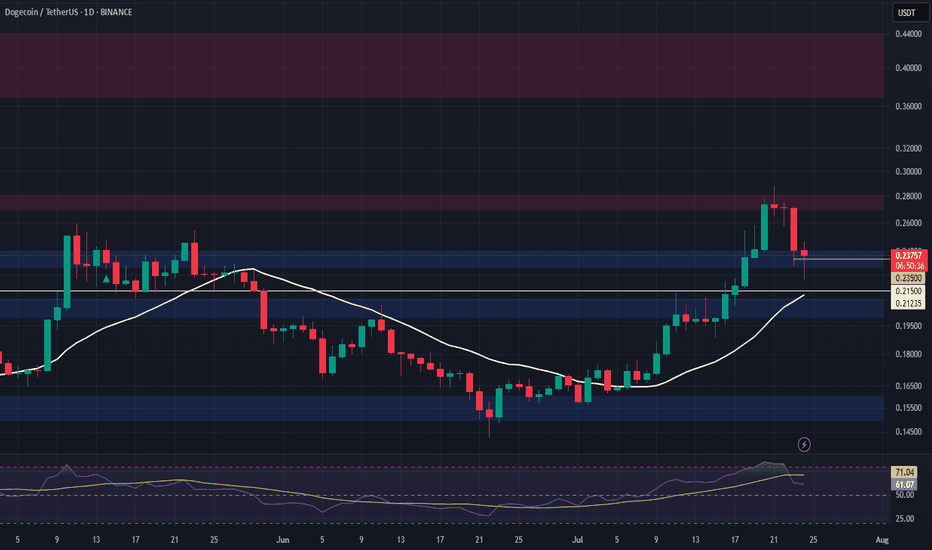

DeGRAM | DOGEUSD above the support level📊 Technical Analysis

● DOGE keeps printing higher swing-lows inside the 5-month rising channel; the latest pull-back bounced precisely at the mid-band/0.232 support, turning May’s flag roof into demand.

● A fresh micro bull-flag is unfolding above that rail; its pole height and channel geometry project follow-through toward the upper red supply 0.288-0.300 where the purple macro cap meets the channel crest.

💡 Fundamental Analysis

● Binance confirmed its late-July quarterly burn will include >150 M DOGE trading-fee tokens, trimming float, while reports of X testing DOGE micro-payments boosted social volume this week.

✨ Summary

Long 0.232-0.245; hold above 0.232 targets 0.272 → 0.288. Invalidate on a 16 h close below 0.214.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

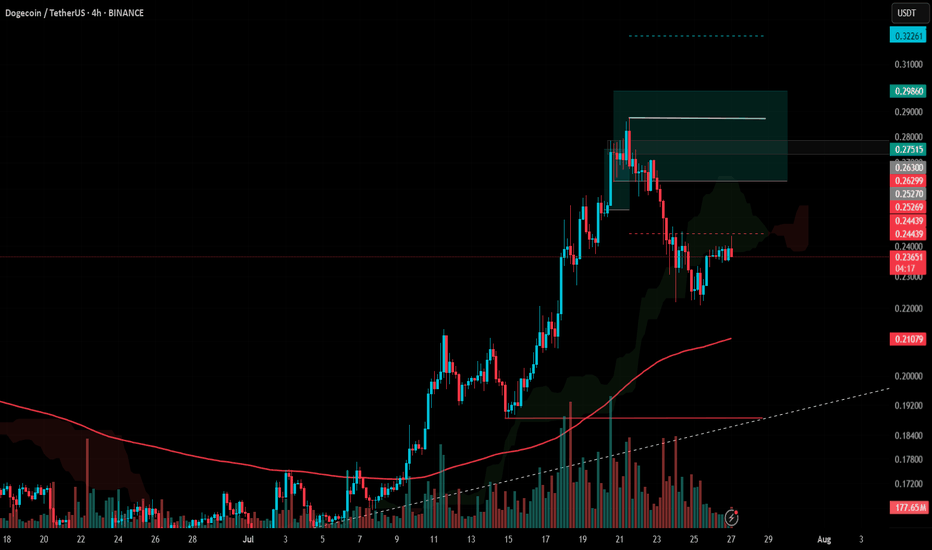

Trading plan for DOGELast week, BINANCE:DOGEUSDT rode the market wave with solid gains. Now we're in a correction phase, sitting right at the weekly pivot point. Here's the breakdown:

Upside potential: Needs to cleanly break and hold above $0.257 to target new local highs

Current reality: While below the weekly pivot, odds favor more downside toward $0.20

Trade the reality until the market proves otherwise. Watch those levels and let price lead the way.

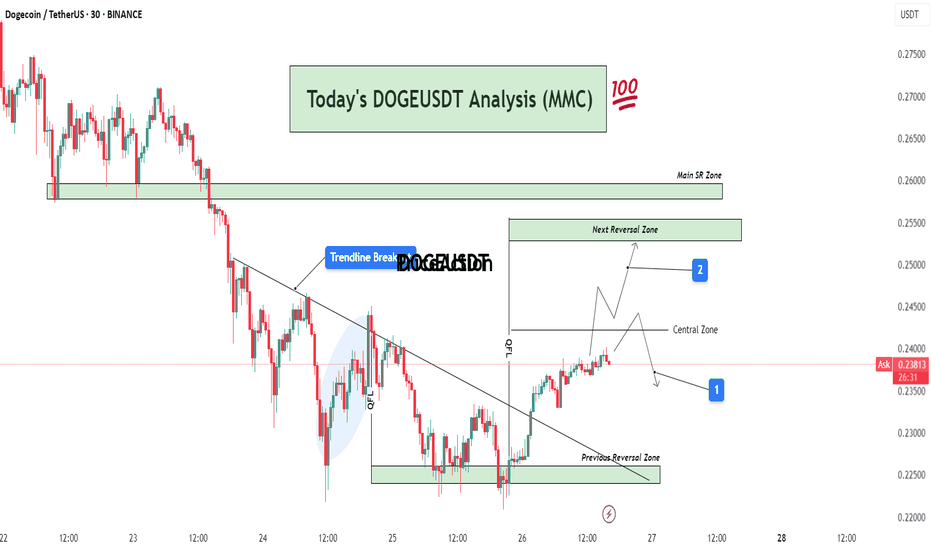

DOGEUSDT Analysis : Bullish Breakout, Reversal Zones + Target📊 Full Technical Analysis:

This chart presents a structured and precise MMC-based analysis of DOGE/USDT on the 30-minute timeframe, integrating key price action zones, trendline structure, and potential market scenarios.

🧩 1. Downtrend Phase and Trendline Formation

DOGE was in a continuous downtrend, creating lower highs and lower lows. A bearish trendline had been acting as dynamic resistance for multiple sessions. Price consistently respected this trendline, indicating strong seller dominance.

However, after repeated taps on the trendline and rejection from lower support, price finally broke above the trendline — marking a potential trend reversal or corrective phase.

🔄 2. Previous Reversal Zone – Demand Zone (0.225–0.228)

This zone acted as the major turning point where buyers aggressively stepped in. The demand was previously tested and respected, indicating strong accumulation here.

From this zone, a bullish reversal was initiated, leading to the current price rally.

This area can now be considered a structural support base – ideal for watching future re-tests or consolidation.

🔁 3. Central Zone – Decision Area (0.238–0.240)

This is a critical intraday resistance zone acting as a central decision-making area for traders.

Two Key Scenarios Could Play Out from Here:

Scenario 1 (Marked by Blue Box 1):

Price could face rejection from this zone and fall back slightly toward minor support levels for a retest or liquidity grab. If bullish pressure sustains, a higher low may form before continuation upward.

Scenario 2 (Marked by Blue Box 2):

If price breaks above the central zone with strong volume, momentum can push it toward the Next Reversal Zone between 0.250–0.255.

In either case, watching price behavior and candle structure near the central zone is critical for confirmation of the next move.

🔼 4. Next Reversal Zone – Supply/Resistance (0.250–0.255)

This zone marks a historical resistance area where DOGE faced heavy selling pressure before.

If price reaches this zone, expect:

Either profit-taking and short-term selling from intraday traders.

Or a possible breakout continuation if broader market sentiment remains bullish.

This zone will act as a key test of DOGE's strength and market conviction.

📌 5. Main SR Zone – Strong Structure (0.258–0.260)

Beyond the Next Reversal Zone lies the Main SR (Support-Resistance) Zone, where price has reacted strongly in the past.

If DOGE manages to break and hold above the 0.255 range, this zone will likely become the next upside target and strong resistance zone.

🔍 Additional Market Context:

Breakout Volume: The trendline breakout was accompanied by rising volume, which suggests stronger conviction behind the move.

QFL Zone: Price structure also aligned with a QFL (Quick Flip Level) bounce within the shaded region before breakout, further validating the bullish pressure.

Psychological Levels: 0.240 and 0.250 are psychological levels, which often act as magnet points and temporary resistance/support.

🧠 Mirror Market Concepts (MMC) Insight:

This analysis is rooted in Mirror Market Concepts, where the market tends to reflect past behavioral zones. Each marked zone (Demand, Central, Reversal, SR) is based on previous reaction points that guide current sentiment.

The market is now in a mirror reaction phase, moving from the previous demand zone toward historical supply zones. If the symmetry continues, the pattern supports a gradual bullish continuation with measured pullbacks.

✅ Trading Plan (Educational Purpose Only – Not Financial Advice):

Entry Zone 1: Breakout traders may have entered after the trendline breakout near 0.233–0.235.

Entry Zone 2: Conservative traders can look for retest confirmation in the Central Zone.

Target Zone: Next Reversal Zone (0.250–0.255) and possibly Main SR (0.260).

Stop Loss: Below the Previous Reversal Zone (~0.224) for swing setups.

Risk-to-Reward: RR setup of 1:2 or higher possible depending on entry strategy.

accumulation phase means bullish sentiment We are seeing a bullish scenario in an accumulation phase, we should be seeing doge test the 200 ema before bouncing back or test the 20 ema before bouncing back. we see a change in character which as short lived after a day's breakout. After a 7 day's rally after breaking out of the 200 ema, we see a pull, I THINK WE SHOULD BE SEEING MORE OF THAT UNTIL BUYERS ARE CONVINCED THE MARKET IS NOT JUST FOLLOWING THE SUMMER RALLY TREND

DOGE Strategy — Momentum Entry, MA Trend Hold, Pullback PhaseThis chart showcases how the MACD Liquidity Tracker Strategy performed on DOGE over the past several days. The strategy entered during a clear momentum breakout and trended cleanly above its MA filter for nearly 48 hours.

Let’s break it down:

🔹 First Signal: Early compression breakout long, but price stayed flat. This entry was managed with a tight close before the second impulse began.

🔹 Second Long: Clean breakout on rising momentum — confirmed by MACD histogram expansion and strong Stoch RSI crossover.

🔹 Trend Structure: MA support held multiple times during this move, reinforcing the uptrend. Dotted trendline shows price respecting structure cleanly.

🔹 Exit Trigger: Price began consolidating and histogram showed waning momentum. The strategy correctly exited before the full reversal began.

🔹 Current Action: Pullback in progress. MACD histogram flipping red, Stoch RSI resetting. This may just be a correction… or the trend might be breaking.

📊 This setup is a textbook use of trend filters, confluence, and exit logic — and a good reminder that the strategy isn’t just about entry… it’s about managing exits with discipline.

Whether this develops into a higher low continuation or rolls into full reversal, momentum confirmation is key before the next entry.

#DOGE #TradingStrategy #AlgoTrading #MACDStrategy #QuantTrading #CryptoTechnicalAnalysis #PriceAction #TrendFollowing #Backtesting #CryptoCharts

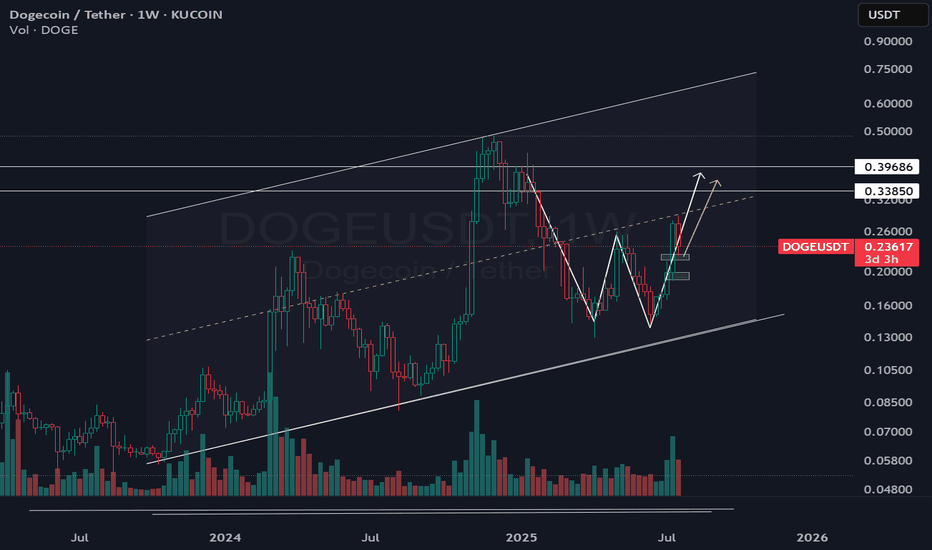

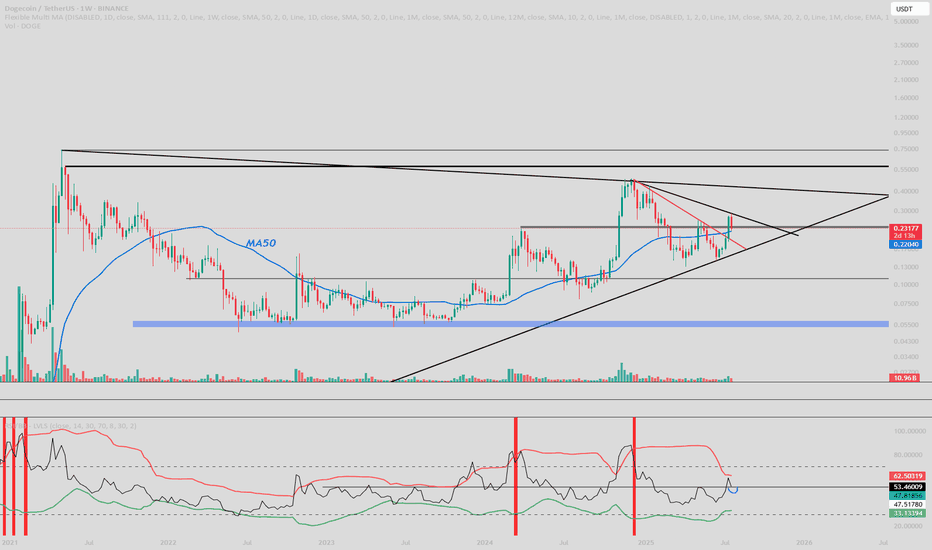

DOGE : Idea.Hello, good ? Good.

Enter in doge here is not a bad idea in SPOT.

• Above the last important resistance.

• Retest on 50 Weekly MA.

• Above 50 rsi weekly.

• Bollinger bands in consolidation.

Need to confirm rejection in weekly like always.

If rejectyion here : x2 incoming.

Good luck guys, take care of you.

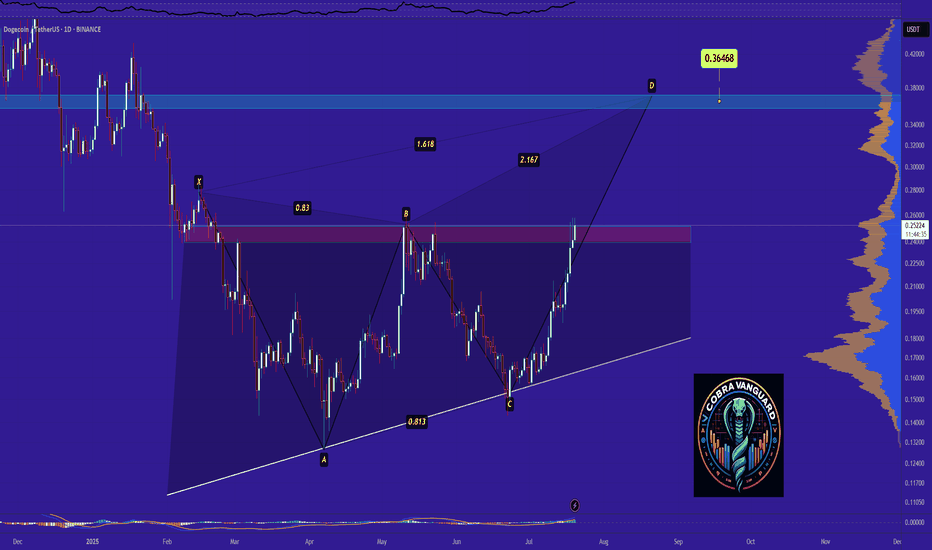

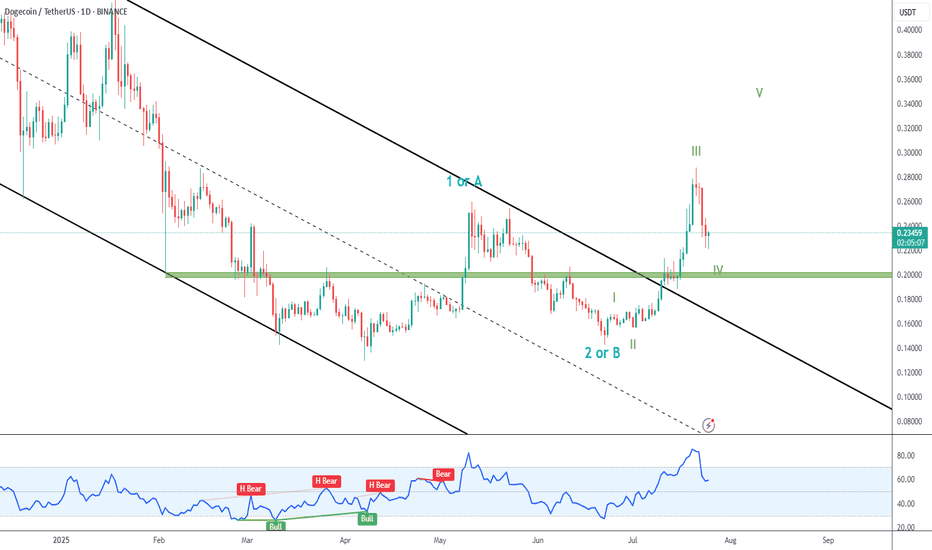

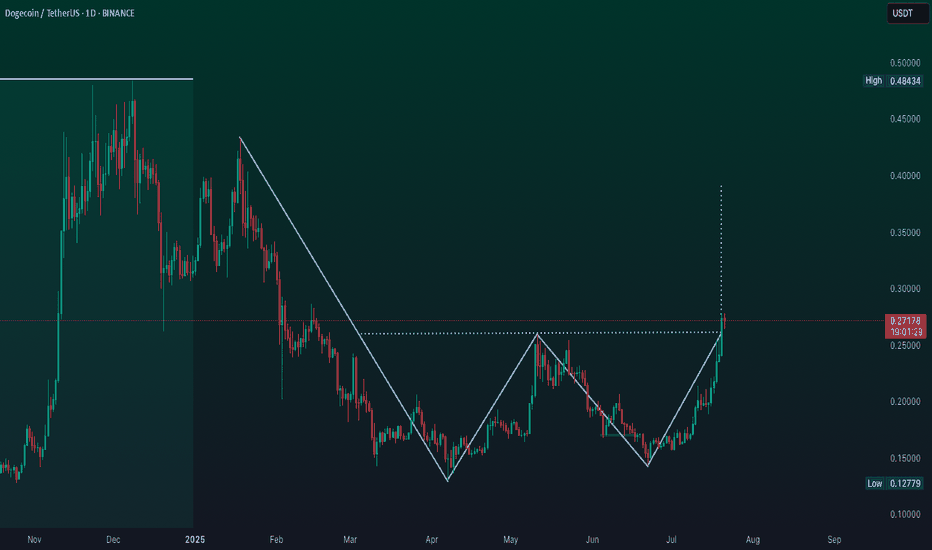

DOGE Breakout

➡️ Dogecoin blasted away from the black descending channel and past green resistance (now support).

➡️ In my primary count, we are currently in green IV correction, and expect new higher highs.

➡️ A retest of green support would be nice, but it is probable that price won´t go that far.

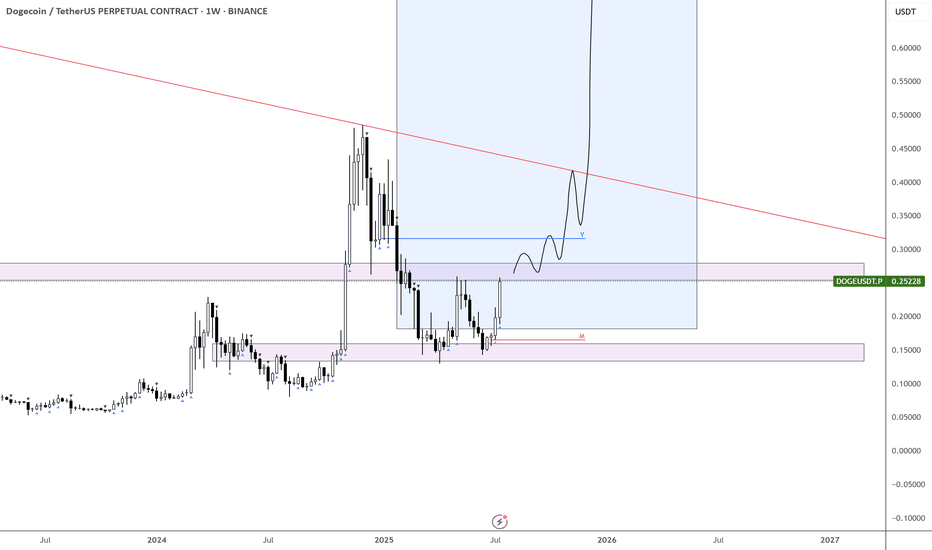

#DOGEUSDT: Swing Move In Making! Get ReadyThe cryptocurrency market is currently experiencing a rally due to the bullish trend of the underlying assets. The price has experienced a period of accumulation, followed by a distribution process. We have established a swing target based on the potential for the price to reach the previous record high. Technical indicators support our analysis, but we acknowledge the need for strong fundamental support to achieve this level.

We wish you the best of luck in your trading endeavours and encourage you to share our insights by liking and commenting on this post.

Sincerely,

Team Setupsfx_

Dogecoin at a Key Turning PointDogecoin is now sitting around $0.19, inside a green zone on the chart where buyers are expected to step in.

The price is starting to move up from here, heading toward the red zone between $0.23 and $0.26 . This red area is where sellers were active before, so it’s an important level to watch.

- If Dogecoin can break above this red zone with strong buying volume , it could aim for the previous high around $0.48.

- If it struggles to move past this level, it may mean that whales are still selling, and the price could fall back down toward $0.08.

COINBASE:DOGEUSD BINANCE:DOGEUSDT BYBIT:DOGEUSDT BINANCE:DOGEUSDT.P

DOGE Swing Trade – Key Support in PlayDOGE is currently holding a major support zone, offering a strong risk-reward opportunity for a long swing position. With bullish sentiment and meme coin narratives returning, this level is worth watching for upside continuation.

📌 Trade Setup:

• Entry Zone: $0.23 – $0.24

• Take Profit Targets:

o 🥇 $0.27 – $0.28

o 🥈 $0.37 – $0.44

• Stop Loss: Just below $0.215

DOGE MACD Liquidity Tracker Strategy – Trend Flip & Breakdown 1DThis DOGE 1D chart highlights two key directional shifts caught by the MACD Liquidity Tracker Strategy — a bullish breakout near $0.12 and a clean reversal near $0.33. The system flipped long once MACD momentum aligned with trend structure, and later rotated bearish as the trend exhausted.

Both moves were captured without guessing — using dynamic trend coloring and a momentum-backed entry logic. Visual bias (blue/pink) helps contextualize the trend at a glance, and the EMA filters reduce chop during sideways conditions.

To explore this setup yourself, search for the strategy by name and run your own backtests to refine inputs per asset and timeframe.

📊 Strategy Name:

MACD Liquidity Tracker Strategy

This is one of several strategy visualizations — more incoming.

DOGE daily timeframe updateOn-Demand Analysis: ❤️Like this post for more analysis!:

CRYPTOCAP:DOGE ’s surge combines a technical breakout, institutional validation, and sector rotation. While overbought signals suggest potential consolidation, the $0.25-$0.27 zone now acts as solid support

Support Zone: A strong base is at 0.2500-0.2700, where buyers might step in.

Resistance Level: The next big test is at 0.48434—break that, and it could climb higher!

Falling Wedge: This pattern, with its narrowing lines, often signals a bullish move if it breaks above 0.48434.

Momentum: The uptrend has steady volume, boosted by market activity.

Timeframe:Watch the next few days for the wedge to break out.

Possibilities:

Bullish Move: A jump above 0.48434 with good volume could push it to 0.5000 or more!

Bearish Drop: A fall below 0.2500 might take it back to 0.19621—stay careful!

Safety Tip: Set a stop-loss below 0.2500 to stay safe.

$1 in the Horizon for $DOGE!We’ve got something interesting brewing on CRYPTOCAP:DOGE right now:

Monthly trend is active

Uptrend in place for over a year (not relying on that timeline, but historically, targets hit within it)

If we can get above $0.30 and hold, the path to $1 opens up for the first time.

Other similar charts are also aligning for exponential moves, setting up to break out of multi-year consolidation patterns.

Keep a close eye on CRYPTOCAP:XLM as well — it’s shaping up with a very similar structure.

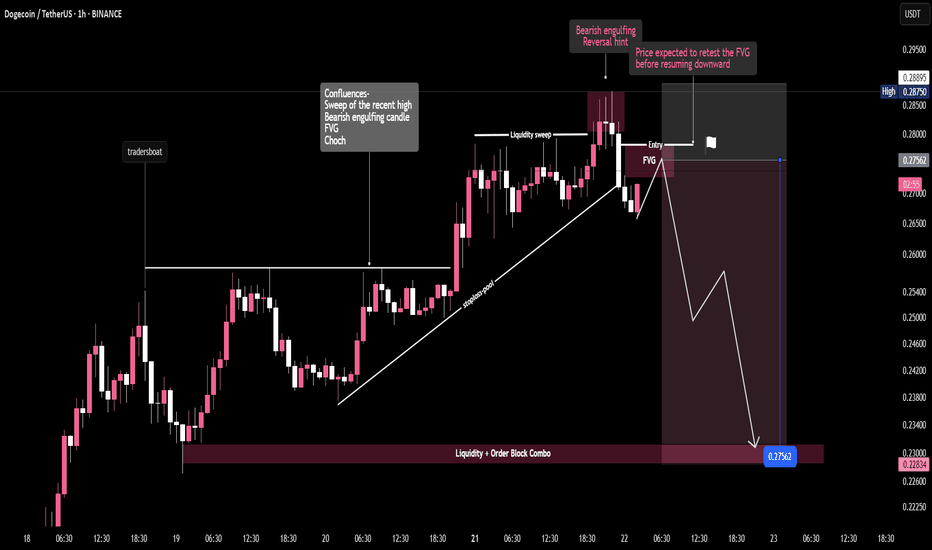

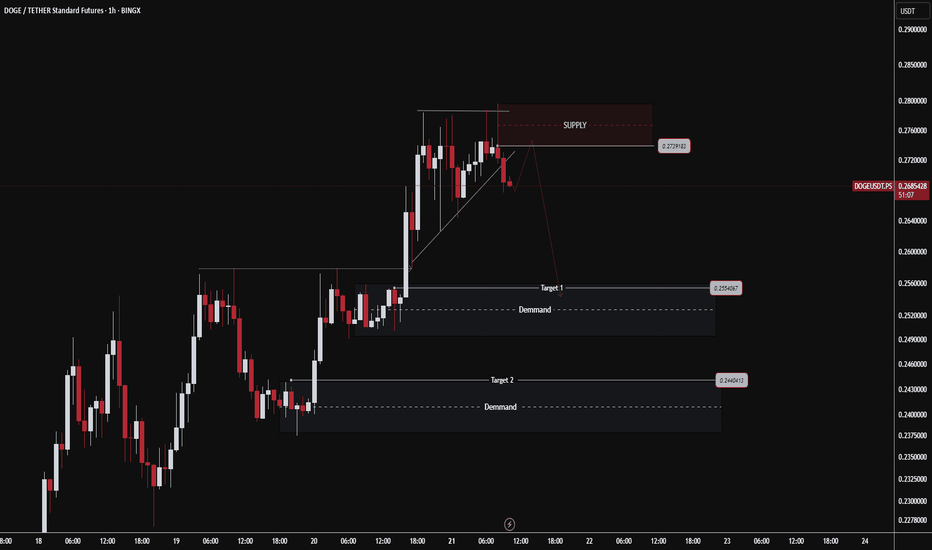

$DOGE Potential koreksi Analyst 🧠 Brief Analysis of the DOGE/USDT Chart (1H Timeframe)

1. Supply Zone Formed

Above is the SUPPLY area (around $0.2739), where sellers previously accelerated.

The price has rejected that area and is now starting to fall below the trendline → signaling buyer weakness.

2. Trendline Break = Potential Correction

The price has broken the ascending trendline → signaling an early reversal or at least a short-term correction.

3. Downward Targets

Target 1 = $0.2550 (mild demand zone)

Target 2 = $0.2440 (strong demand zone, likely solid support)

4. Stochastic Remains Neutral, Tends Down

Not yet overbought/oversold, but starting to form a subtle downward divergence = indicating further decline.