DOGEUSDT trade ideas

DOGEUSDT valid breakout to the upside As we can see price broke channel resistance and now only after a valid retest here we can expect heavy pump start but we should consider it that we are now in a short-term bear market so price can fall more here to our major buy zones which are mentioned on the chart with green zones and then start of pump.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

DOGE Breakout & Retest – Will Bulls Hold Support? CRYPTOCAP:DOGE has successfully **broken the descending trendline** and is now at a critical retest phase. Holding above this level could confirm bullish momentum.

📊 Daily Timeframe Update

🚀 Price is retesting the breakout level as support

🟢 A successful hold could trigger further upside movement

🔴 Losing support may result in a pullback before another breakout attempt

Crucial moment for DOGE—watch price action closely! 👀

Doge coin updateHey traders! 👋

We’ve just had a beautiful bounce off the demand zone for Dogecoin (DOGE), and things are looking exciting! 🐕💥

1️⃣ Solid Bounce at Demand Zone – The price showed incredible strength as it bounced off the demand zone, validating our entry point. It’s been an awesome ride so far, and the momentum is building.

2️⃣ First Take Profit at $0.24 – We are taking our first take profit at $0.24, which is a solid milestone. If you've been following this trade, now is the time to lock in some profits targets and adjust your strategy.

3️⃣ Moving Stop-Loss to Break Even – With the market moving in our favor, we’re shifting our stop-loss to break even, or even slightly into profit. This ensures that no matter what happens next, we walk away with a win! 📈💸

Keep an eye on the price action as we move forward. It’s all about managing risk and taking profits along the way. Let’s keep pushing for those gains! 💪🚀

DOGE/USDT bullish

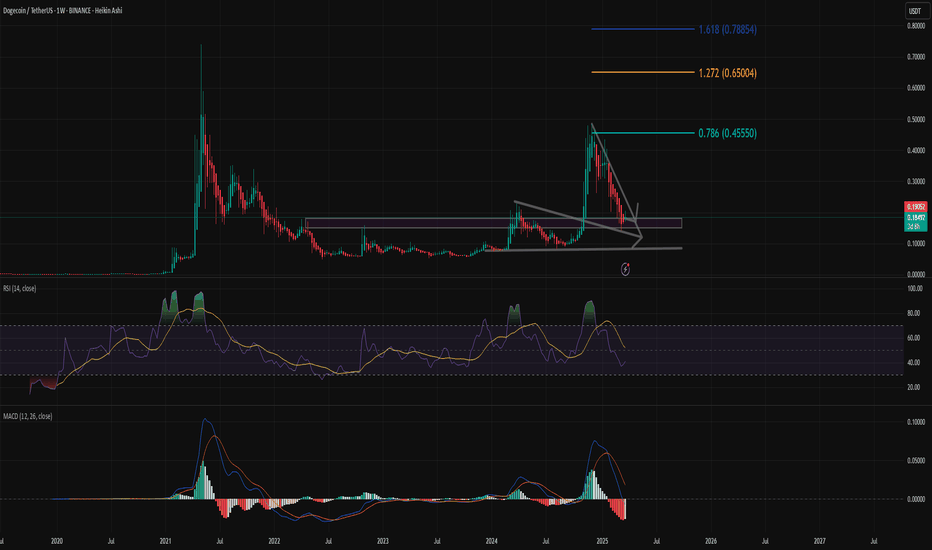

1. Chart Structure:

Current price: ~0.18497 USDT.

The chart uses Heikin Ashi candles for smoother trend visualization.

A falling wedge pattern is forming — typically a bullish reversal pattern.

A strong accumulation zone (purple box) is visible between ~0.07 – 0.19 USDT.

2. Price Behavior:

After a strong rally in early 2025, DOGE is currently retracing.

The latest candle shows signs of reversal (wick to the downside and green body), suggesting potential support bounce.

3. Fibonacci Extension Levels (Potential Targets):

0.786 level: 0.45550 USDT (blue)

1.272 level: 0.65004 USDT (orange)

1.618 level: 0.78854 USDT (blue)

4. Potential Scenarios:

Bullish case: A breakout above the falling wedge could lead to a rally towards 0.45 – 0.65 USDT.

Bearish case: If support fails, DOGE might retest the lower support zone around 0.07 USDT (gray area below).

📌 Conclusion:

Main trend: Accumulation with possible bullish breakout.

Entry zone (support): 0.14 – 0.19 USDT.

Short-term target: 0.45 USDT.

Mid-to-long-term target: 0.65 – 0.78 USDT.

Stop-loss zone: Below 0.13 USDT.

DogeMonthly is bullish whereas the trend is retesting in lower time frame hence the bearish structure.

I would be looking to open longs from the golden zone. Above that is all smart money trap to induce retail traders in opening longs.

Golden zone order block has taken previous low liquidity, making it a high probability OB

#DOGE/USDT#DOGE

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.1630

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.18372

First target 0.18372

Second target 0.19350

Third target 0.20533

DOGE I Daily CLS within Weekly CLS I 3 Months OB, Model 1Hey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

Big picture view

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

Dave Hunter ⚔

DOGE New Update (3D)This analysis is an update of the analysis you see in the "Related publications" section

It seems to be forming a large diametric pattern. Currently, wave F is completing.

Wave F is a bearish wave.

Upon reaching the green zone, we expect the price to bounce upward.

A weekly candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

DOGE Will Show Relief Rally Before CrashHello, Skyrexians!

Yesterday we pointed out that Ethereum has not finished the global correction and is waiting for crush, today we found the same pattern for BINANCE:DOGEUSDT . We still have some space to go up, but finally we will see another one drop to new lows.

Let's take a look at the daily chart. Here we can see the potential Elliott waves counting. Recent dip was the wave 3, not a wave 5 because of awesome oscillator. It has not crossed the zero line which means that wave 4 has not been completed. Green dot on the bottom on the Bullish/Bearish Reversal Bar Indicator does not mean the global reversal, it's only the end of the wave 3. Target area for wave 4 is 0.38-0.5 Fibonacci. If there we will see the red dot, it can be great short opportunity. Target for DOGE wave 5 is very low, it can be even lower than $0.1.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

DOGECOINHello friends

Due to the price falling in the specified support area, the price has been well supported. Now, due to the good price support by buyers, we can buy in steps within the specified purchase ranges, with capital and risk management, and move towards the specified goals.

*Trade safely with us*

DOGE in coming days ...Currently, DOGE is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Long Trade

1Hr TF overview

Trade Breakdown – Buy-Side

Date: Tuesday, March 25, 2025

Time: noon NY Time (London to NY PM session)

Trade Direction: Long (Buy)

Trade Parameters:

Entry Price: 0.18921

Take Profit (TP): 0.20725 (+9.35%)

Stop Loss (SL): 0.18652 (-1.42%)

Risk-Reward Ratio (RR): 6.71

Reason: Observing price action since 23rd March, and momentum to the upside, I decided to place another buyside trade.

DOGE just broke the falling wedge! More pump ahead...Hello Traders 🐺

In this idea, I want to give you a quick update on my last DOGE analysis. That previous idea had a more mid-term perspective, and guess what? Just after I published it, DOGE pumped nearly 40% in just 3 days! 🚀🔥

So first of all, congratulations to everyone who followed that idea—and if you haven’t yet, make sure to follow me so you don’t miss the next big trade! Now let’s dive into what’s happening with DOGE right now: 👇

📊 Chart Overview

As you can see on the chart, we have a clear and beautiful falling wedge, and as I mentioned before, you can also interpret this as a bull flag, since the pattern formed during an uptrend.

However, if we treat this as a falling wedge, the price target becomes more conservative and likely more realistic. 💡

📍 Key Confluence Zone: $0.40 – $0.42

We’re now approaching a strong supply area at the top of the wedge. In this zone, we have 3 key points of confluence:

1️⃣ Falling wedge target 🎯

2️⃣ 0.786 Fibonacci level

3️⃣ Major horizontal resistance line

This makes the $0.40–$0.42 zone a great area to take partial profits 💰—and then hold the rest in case of further upside momentum. 🧠⚡

I hope you enjoyed this idea, my friends! And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

DOGEIn my opinion, Dogecoin needs to confirm a breakout and hold above the $0.205 resistance level. After that, we can expect a bullish outlook for Dogecoin, targeting the $0.30 to $0.339 range. Additionally, holding the $0.16 support level is crucial. The scenario I have outlined on the chart may play out, but only if the conditions mentioned above are met. What do you think? Share your thoughts with me.

Dogecoin Foundation Bolsters Reserves with 10M Token Purchase

The Dogecoin Foundation, the non-profit organization dedicated to the development and advocacy of Dogecoin (DOGE), has made a significant move by purchasing 10 million DOGE tokens.1 This strategic acquisition, part of a broader initiative to establish a robust DOGE reserve, signals the Foundation's commitment to the long-term sustainability and growth of the meme-turned-cryptocurrency.2 The purchase coincides with a notable price surge, as traders weigh potential shifts in US tariff and Federal Reserve policies, fueling speculation about Dogecoin's future trajectory.3

In February, the Dogecoin Foundation announced a five-year partnership with House of Doge, designating them as its official commercialization partner.4 This collaboration aims to enhance Dogecoin's utility and adoption by exploring innovative applications and fostering strategic partnerships.5 The establishment of a DOGE reserve, now augmented by the 10 million token purchase, appears to be a crucial component of this broader strategy, intended to provide financial stability and support future development initiatives.6

The purchase reflects a proactive approach by the Foundation to manage Dogecoin's ecosystem. By building a reserve, the Foundation can potentially fund future projects, support community initiatives, and mitigate potential market volatility.7 This move underscores the Foundation's commitment to ensuring Dogecoin's long-term viability, moving beyond its meme origins to establish a more structured and sustainable framework.

Simultaneously, the cryptocurrency market has witnessed a resurgence of interest in Dogecoin, with its price jumping by approximately 7% in a single day.8 This surge is attributed to a confluence of factors, including speculation that upcoming US tariffs might be less severe than initially anticipated. Traders are also closely monitoring potential shifts in Federal Reserve policies, which could impact the broader cryptocurrency market.9

The renewed optimism surrounding Dogecoin has led to its outperformance against major cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP.10 This surge in interest highlights the enduring appeal of meme coins, which often experience significant price fluctuations driven by social media sentiment and speculative trading.11

Dogecoin's Bullish Momentum: Analyst Predicts Surge to $0.4

Technical analysis indicates that Dogecoin has recently broken above a bullish daily pattern, further fueling optimism among traders.12 This breakout suggests a potential upward trend, with analysts predicting a possible surge to $0.4.13 The bullish pattern, often characterized by a series of higher lows and higher highs, signals increased buying pressure and a shift in market sentiment.

The $0.4 target represents a significant milestone for Dogecoin, potentially marking a substantial increase from its current price. This prediction is based on technical indicators and historical price action, which suggest that a breakout from the current pattern could lead to a sustained upward trend.

Analysts emphasize the importance of monitoring key support and resistance levels. A sustained break above the current resistance could validate the bullish prediction, while a failure to maintain momentum could lead to a price correction. The volatile nature of the cryptocurrency market necessitates a cautious approach, as unexpected developments can significantly impact price movements.14

The confluence of factors, including the Dogecoin Foundation's token purchase, the potential easing of US tariffs, and the bullish technical analysis, has created a perfect storm for Dogecoin. The surge in trading volume and increased social media activity further amplify the bullish sentiment, contributing to the overall market optimism.15

However, it's crucial to acknowledge the inherent risks associated with cryptocurrency trading. The market is highly volatile, and price predictions are subject to significant uncertainty.16 While the current momentum appears promising, unexpected news or market corrections could quickly reverse the trend.

Will Dogecoin Reach $1? The Speculative Frenzy

The question on many traders' minds is whether Dogecoin can reach the coveted $1 mark. This milestone, once considered a distant dream, now seems within reach for some optimistic investors. The recent price surge and positive market sentiment have reignited speculation about Dogecoin's potential to achieve this target.

Achieving $1 would represent a significant increase from Dogecoin's current price, requiring a substantial influx of capital and sustained buying pressure.17 The cryptocurrency market is known for its rapid and unpredictable price swings, making such predictions inherently speculative.18

The Dogecoin community, known for its enthusiastic support and social media prowess, plays a crucial role in driving price movements.19 The power of social media and online communities to influence market sentiment cannot be underestimated, particularly in the case of meme coins like Dogecoin.20

However, fundamental factors, such as adoption rates, technological developments, and regulatory clarity, will ultimately determine Dogecoin's long-term success. The Dogecoin Foundation's efforts to enhance the cryptocurrency's utility and establish a stable ecosystem are crucial steps in this direction.21

The partnership with House of Doge and the establishment of a DOGE reserve demonstrate a commitment to building a more sustainable and functional cryptocurrency. These initiatives aim to move beyond the meme-driven hype and establish a solid foundation for long-term growth.

In conclusion, the Dogecoin Foundation's purchase of 10 million tokens, coupled with positive market sentiment and bullish technical indicators, has created a wave of optimism.22 While the $1 target remains speculative, the recent developments suggest that Dogecoin is experiencing a resurgence of interest and potential for further growth.

Traders should remain vigilant and exercise caution, as the cryptocurrency market is inherently volatile.23 The blend of community, development, and market conditions all contribute to the current and future potential of Dogecoin.

The key is whether it supports around 0.18951

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

The key is whether it can maintain the price by rising above 0.18951.

If it rises after receiving support near 0.18951, we need to see whether it can rise above the M-Signal indicator on the 1W chart.

In other words, we need to see whether it can maintain the price above 0.21409.

If not, it is likely to show a downward trend like the previous trend.

-

Therefore, I think this is a great opportunity to turn into an upward trend in line with the flow of BTC.

What we need to do is to check if it is supported around 0.18951.

If it is supported, it is a time to buy.

Since the M-Signal indicator of the 1M chart is passing around 0.18951, it is highly likely that it will show a different flow than before.

Since OBV has to break through the upper line of the Price channel to surge, it is better not to rush too much and check if it is supported around 0.18951 before trading.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

DOGEUSDT soon after or before touching 0.10 pump is coming Two major daily supports which are:

A. 0.13$

B. 0.09

are ahead and can soon pump the price and after breaking this descending channel to the upside heavy pump will lead and we are looking for targets like 0.50$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

DOGE is Waking Up — 200% Potential in Sight! Hello Traders 🐺

In this idea, I want to talk about DOGE, but I’ll keep it short and sweet—because everything is already very clear on the chart!

As you can see, DOGE is forming a falling wedge pattern, which you could also consider as a bull flag, since we’re currently in an uptrend. This falling wedge may simply be a pause before the next leg up! 🔥📈

🟢 Two Bullish Scenarios:

1️⃣ Falling Wedge Target ➜ The top of the wedge

2️⃣ Bull Flag Target ➜ Close to the previous all-time high (~$0.87) 🚀

💡 What Should You Do?

Take 50% profit at the first target (top of the wedge), and hold the rest for the second target—the potential ATH retest.

I hope you enjoyed this quick idea! Don’t forget to like and follow for more updates and support! 🙌🔥

And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺