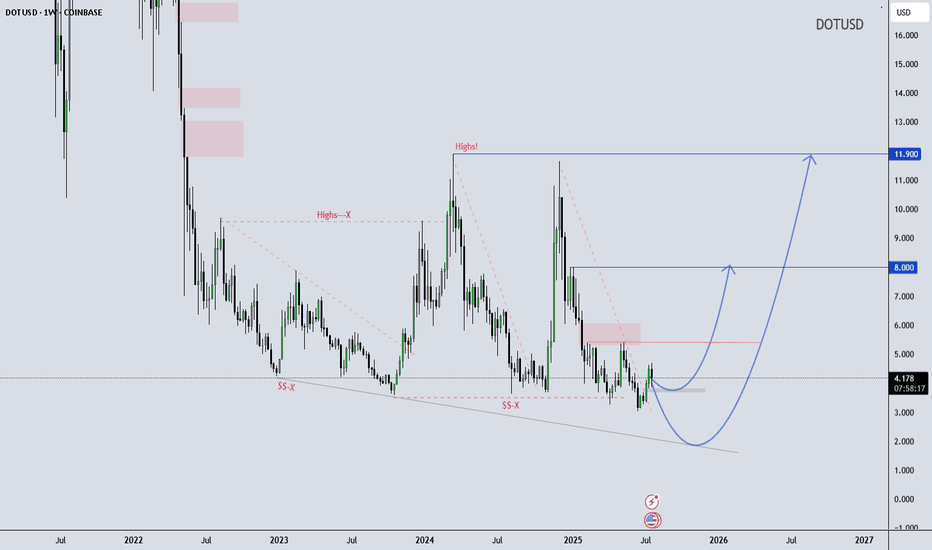

DOT/USD Weekly Structure - - Reversal Possibility Developing DOT/USD Weekly Outlook – Educational Perspective

Polkadot (DOT) is trading near the lower boundary of a long-term falling wedge structure, showing early signs of stabilization around the $4.20 support zone. Price has respected this level multiple times, potentially forming a rounded bottom, whic

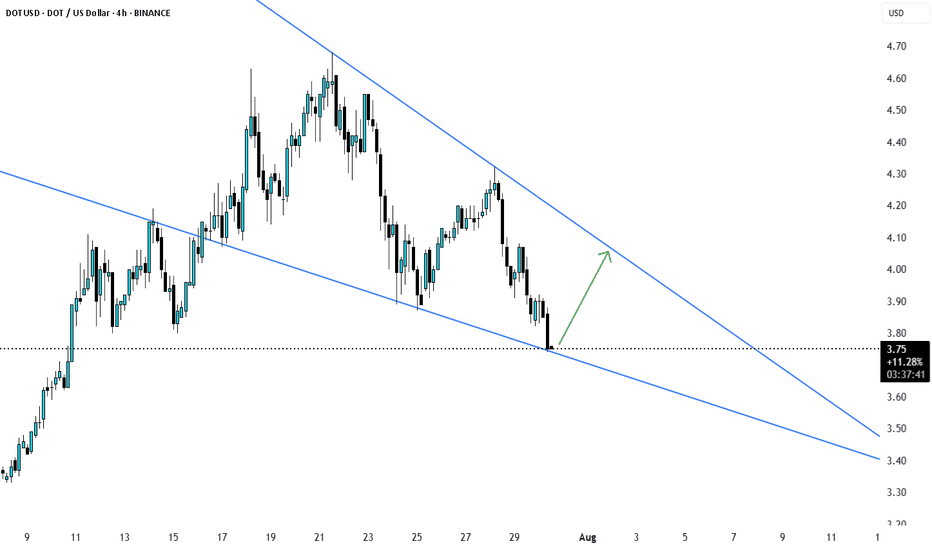

DOTUSD H4 | Bearish dropDOT/USD has rejected the sell entry and could drop lower to the take profit, which acts as a multi-swing low support.

Sell entry is at 3.702, which is a pullback resistance.

Stop loss is at 4.128, which is a potential pullback resistance.

Take profit is at 3.143, which is a multi-swing low suppor

DOTUSD – Bottom Bounce or Trap?DOT dropped hard through $4.13 and 200 SMA but found strong buyers near $3.91. It’s now rebounding with decent RSI momentum, pushing toward $4.08. If this strength holds and price breaks $4.09, a move to $4.13 is possible. But failure to reclaim $4.09 might cap this as just a lower high.

Polkadot Daily Chart: Uptrend Continues Above Mid-Band Support

DOT is trading above the 20-day moving average (middle band of the Bollinger Bands), which is a bullish signal suggesting upward momentum.

If price holds above the middle Bollinger Band, the bullish bias remains intact.

A close below it could weaken the short-term bullish case.

Key support: $4.

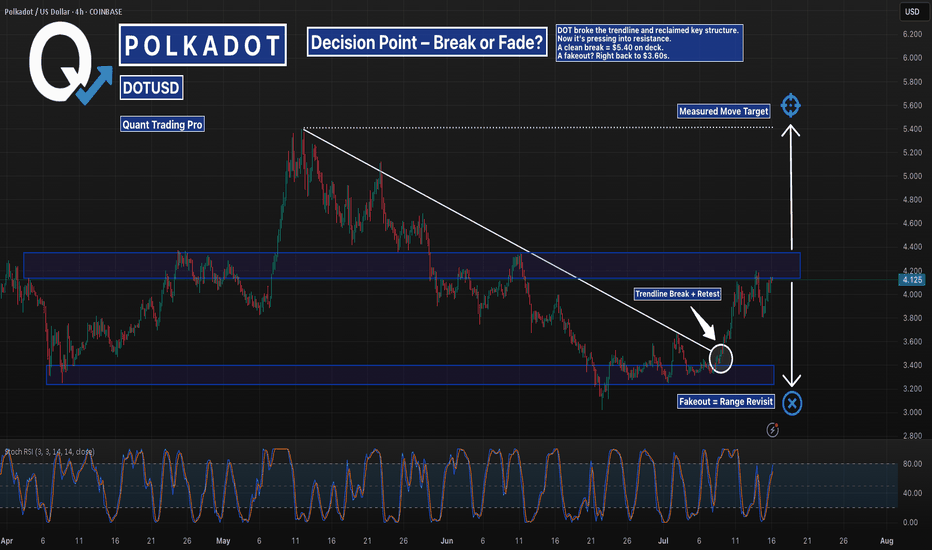

DOTUSD – Trendline Break Retested | Breakout or Trap?Polkadot broke its multi-week descending trendline and reclaimed support, but now faces resistance just above $4.20.

With a clean structure retest and rising momentum, this becomes a classic breakout-or-fakeout setup.

Measured move points to $5.40 if it runs.

Invalidation sends us back to $3.60.

#

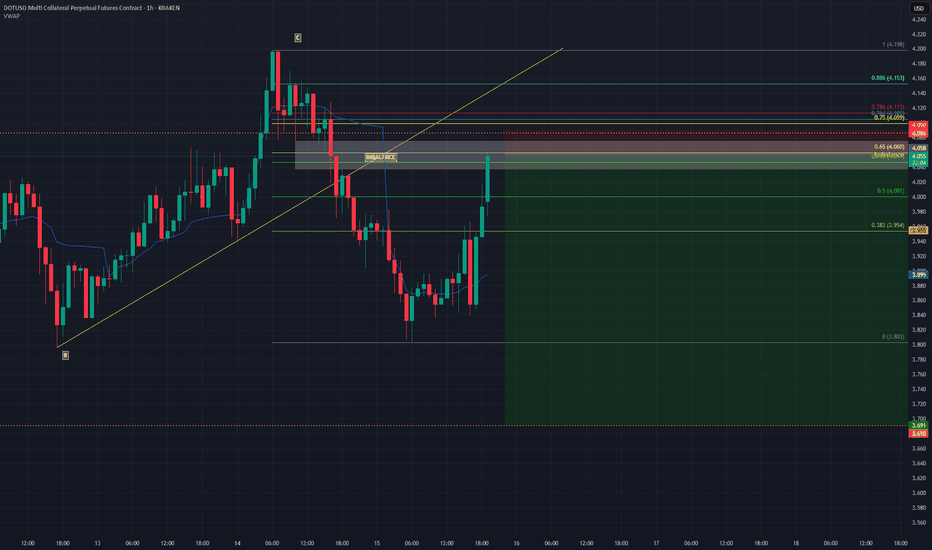

SHORT DOTUSDT.P - KrakenLimit Order Set-Up

Entry: 4.058

Take Profit (TP): 3.691

Stop Loss (SL): 4.091

Market Context:

Price is slowly retracing into a Fair Value Gap (FVG) / imbalance zone. However, Open Interest (OI) is decreasing across all derivatives exchanges, while price is climbing — a classic sign of a weak upw

WaverVanir Update: Navigating Markets with Clarity and Convictio📊 WaverVanir Update: Navigating Markets with Clarity and Conviction

At WaverVanir, we don’t just analyze charts — we decode institutional behavior.

Every chart we share is powered by our proprietary DSS system, integrating:

🔍 Smart Money Concepts (SMC)

🧠 LSTM-AI forecasting

📈 VWAP & Volume Prof

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where DOTUSD.P is featured.

Gen 3 crypto: A new day dawns…

25 No. of Symbols

Interoperability Crypto: Communication station

14 No. of Symbols

Polkadot Ecosystem: Spot the best

19 No. of Symbols

Proof of Stake: Seeking validation?

26 No. of Symbols

Smart contracts: Make the smart decision

36 No. of Symbols

Staking Coins: Pick up a stake

18 No. of Symbols

Top altcoins: Choose your alternatives carefully

28 No. of Symbols

See all sparks