US30 Holding Above Key Pivot – More Upside Ahead?US30 – Overview

The price has stabilized within the bullish zone after holding above the key pivot level at 44170, indicating continued upside momentum. As long as the price remains above this level, we expect a move toward the next resistance at 44360, with potential for an extension toward 44610. A confirmed breakout above 44610 on the 1H timeframe could open the path toward the next resistance at 44730.

However, a 1H close below 44170 may trigger a short-term correction toward 43960.

A break below 43960 would shift the bias to bearish, with further downside likely toward 43785 and potentially 43630.

Resistance: 44360, 44610, 44730

Support: 43960, 43785, 43630

DOWUSD trade ideas

Heist Alert: Dow 30 Bullish Surge Incoming – Lock In Targets🦹♂️💎 “US30 Gold Vault Heist” – Thief’s Bullish Break-In Plan! 🚨📈

(Brought to you by Thief Trader – Layered Entry. Zero Mercy. Big Bags.)

🌍 Welcome to the Heist Floor, Global Market Bandits!

🎯 US30 is the next vault on the hitlist – and we’re going in loud but calculated.

💣 The Setup: Bullish Raid in Progress!

The Thief has eyes on Wall Street's armored vault — US30 Index — gearing up for a multi-layered bullish assault.

💼 Using limit orders like C4 on the door hinges, we’re stacking precise entries for maximum loot extraction. This isn’t gambling — this is organized market crime.

🔓 Entry Protocol – Any Price Level Is Breachable

🪜 Layered Limit Orders: Entry at any market level, multiple orders spread like a thief’s toolkit.

No sniper candle required — we work the shadows and stack with precision.

(Use the 15m-1H TF to tighten your strike zone.)

🛑 Stop Loss – The Getaway Hatch

📍 SL parked at 43300.0 – if the mission fails, we vanish clean.

No chasing losses — the next heist awaits.

📈 Take Profit – The Loot Vault

🎯 Target: 45600

That’s the gold room, the top floor, the getaway car location.

Use trailing SLs to secure the bag mid-run if resistance agents start showing up.

🧠 Behind the Heist – What’s Fueling This Move?

Global risk-on tone? ✅

Dow futures resilience? ✅

Thief’s sentiment meter flashing GREEN? ✅

Index rebalancing & sector flow favoring bulls? ✅

We don’t just trade the chart. We rob the macro narrative.

🚫 News Caution – No Sudden Sirens

Avoid entering during red folder data drops or FOMC speeches.

Stay ghosted. Let the volatility settle, then strike. 🕵️♂️

💥 Smash the BOOST Button 💖 If You’re With the Crew!

Let’s run this like a proper cartel of information — share it, save it, tag your trader circle.

Every like supports the next robbery plan.

No signals. No fluff. Just pure market exploitation.

📌 Disclaimer: Educational analysis only. No financial advice. Manage your risk like a true thief — never expose the whole bag.

💼📊 Thief Trader Out — More heist maps coming soon.

🔐 Rob Smart. Stack Heavy. Run Fast. 🦹♂️💸📈

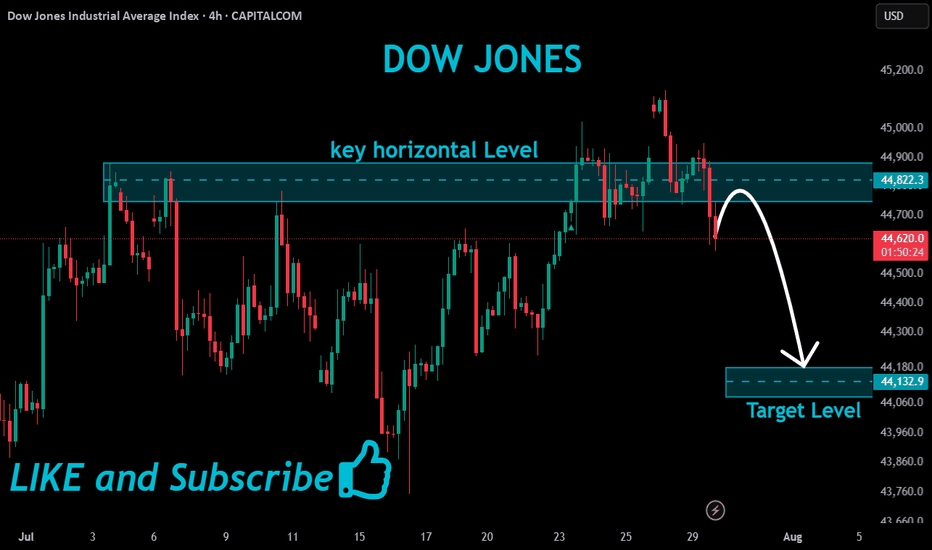

4H Analysis of Dow Jones | Selling Pressure Below Key Resistance4H Analysis of Dow Jones

🔸 Price is currently trading below a key resistance level and has yet to break above it.

🔻 If weakness persists, a bearish reversal toward lower support levels is likely.

🔹 A confirmed breakout above the resistance could open the path for further upside.

✅ Price reaction to this resistance will determine the next market direction.

US30 at the Turn: Buy Setup from the Pullback ZoneHey friends 👋

Here’s my latest analysis on US30 (Dow Jones). I’m watching a potential pullback into the zone I marked: 44,292 – 44,190. I plan to open a buy position from that range, targeting 44,692 as my take-profit level.

Every single like you send is a huge source of motivation for me to keep sharing these insights. Big thanks to everyone supporting with a tap of appreciation 🙏

DowJones The Week Ahead Key Support and Resistance Levels

Resistance Level 1: 44390

Resistance Level 2: 44720

Resistance Level 3: 45100

Support Level 1: 43360

Support Level 2: 43140

Support Level 3: 42800

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow Jones Industrial Average (DJIA) – 1H Chart Analysis | Aug 8,Current Structure:

Price is trading between 44,119 resistance and 43,816 support, consolidating after a sharp drop and partial recovery.

Resistance Zone:

The 44,119 level is acting as immediate intraday resistance; a clean breakout could push toward 44,514.

Support Zone:

43,816 remains a strong floor; below this, 43,524 is the key level where last strong bullish reversal started.

Momentum Outlook:

Recovery candles are showing smaller bodies with upper wicks, suggesting buyers are cautious and momentum is fading.

Trading Bias:

Bullish: Break above 44,119 → target 44,514.

Bearish: Break below 43,816 → retest of 43,524 likely.

DowJones oversold bounce back supported at 44020Key Support and Resistance Levels

Resistance Level 1: 44708

Resistance Level 2: 44925

Resistance Level 3: 44128

Support Level 1: 44020

Support Level 2: 44760

Support Level 3: 43477

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Dow Jones Index (US30) Technical Analysis:The Dow Jones is currently trading near $44,100, after a strong bullish move that failed to break through the $44,300 resistance zone.

🔹 Bearish Scenario:

If the price breaks below $44,000 and holds, it may head toward the $43,350 support level.

🔹 Bullish Scenario:

If bullish momentum returns and the price breaks above $44,300, the next target may be around $45,100.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

DowJones at pivotal zoneKey Support and Resistance Levels

Resistance Level 1: 44515

Resistance Level 2: 44710

Resistance Level 3: 45100

Support Level 1: 43945

Support Level 2: 43756

Support Level 3: 43482

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30: Will Go Down! Short!

My dear friends,

Today we will analyse US30 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 47,577.1 will confirm the new direction downwards with the target being the next key level of 43,436.6 .and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

US30 Technical Breakdown – 08/04/2025📍 US30 Technical Breakdown – 08/04/2025

US30 sold off sharply, breaking down from the 44,600–44,700 range and diving as low as 43,500. Price is currently bouncing near 43,750, but the trend remains weak with lower highs and a breakdown structure intact.

The market lost its key support zone and is now attempting a weak relief rally. Bulls must reclaim 44,000 to avoid further selling pressure.

📊 Current Market Behavior:

📉 Sharp downside momentum

🔄 Small bounce after aggressive breakdown

🧱 Old support at 44,600–44,700 now acting as resistance

⚠️ Bearish structure intact unless reclaimed

📌 Key Levels:

🔹 Resistance Zones:

43,950–44,000 → Minor intraday resistance

44,600–44,720 → Major breakdown zone

44,943 → Swing high before selloff

🔹 Support Zones:

43,600 → Intraday bounce zone

43,500 → Recent low

43,200 → Next potential demand area

🧠 Bias:

📉 Bearish Intraday

Market still under heavy pressure with no major reversal signals. Relief rallies likely to be sold until key levels are reclaimed.

US30 _BUY RETRACEMENT-SELL CONTINUATION-HIGHER TIMEFRAME-FVGThe week of July 28th the market reacted off the resistance around the 45,097 level to the sellside creating a downward trend. On the Monthly and the weekly, the market has traded down into a higher timeframe FVG, possibly creating a buy model for the upcoming week. On the 4hour it's possible a continuation will occur to the sellside.

US30 Faces Pressure Below 44610US30 Overview

Technical Outlook:

US30 is showing bearish momentum while trading below the pivot zone at 44610. As long as the price remains under this level, downside pressure may continue toward 44360, with further support at 44180.

However, a confirmed breakout above 44720 would shift the bias to bullish, opening the path toward 44910 and potentially 45100.

Support Levels: 44480 • 44360 • 44180

Resistance Levels: 44720 • 44910 • 45100

Bias: Bearish below 44610, Bullish above 44720