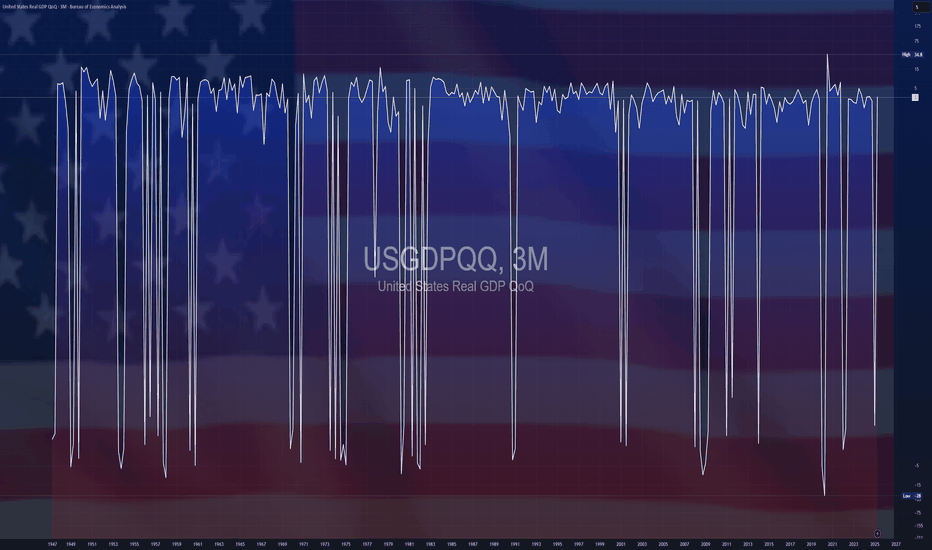

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

USGDPQQ trade ideas

$USGDPQQ -U.S Economy Unexpectedly Contracts in Q1/2025ECONOMICS:USGDPQQ

Q1/2025

source: U.S. Bureau of Economic Analysis

-U.S economy shrank 0.3% in Q1 2025, the first contraction since Q1 2022,

versus 2.4% growth in Q4 and expectations of 0.3% expansion, as rising trade tensions weighed on the economy.

Net exports cut nearly 5 percentage points from GDP as imports jumped over 40%. Consumer spending rose just 1.8%,

the weakest since mid-2023, while federal government outlays fell 5.1%, the most since Q1 2022.

$USGDPQQ -United States GDP (Q4/2024)ECONOMICS:USGDPQQ 2.3%

Q4/2024

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and in line with the advance estimate.

Personal consumption remained the main driver of growth, increasing 4.2%, the most since Q1 2023, in line with the advance estimate.

Spending rose for both goods (6.1%) and services (3.3%).

Also, exports fell slightly less (-0.5% vs -0.8%) and imports declined slightly more than initially anticipated (-1.2% vs -0.8%), leaving the contribution from net trade positive at 0.12 pp.

Government expenditure also rose more (2.9% vs 2.5%).

Private inventories cut 0.81 pp from the growth, less than 0.93 pp.

On the other hand, fixed investment contracted more (-1.4% vs -0.6%), due to equipment (-9% vs -7.8%) and as investment in intellectual property products failed to rise (0% vs 2.6%).

Residential investment however, rose more than initially anticipated (5.4% vs 5.3%).

Considering full 2024, the economy advanced 2.8%.

$USGDPQQ -US Economy Slows More than ExpectedECONOMICS:USGDPQQ 2.3%

(Q4/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and forecasts of 2.6%.

Personal consumption remained the main driver of growth, but fixed investment and exports contracted.

Considering full 2024, the economy advanced 2.8%.

$USGDPQQ -U.S GDP (Q3/2024)ECONOMICS:USGDPQQ

(Q3/2024)

source: U.S. Bureau of Economic Analysis

- The US economy expanded an annualized 3.1% in Q3, higher than 2.8% in the 2nd estimate and above 3% in Q2.

The update primarily reflected upward revisions to exports and consumer spending that were partly offset by a downward revision to private inventory investment.

Imports, which are a subtraction in the calculation of GDP, were revised up.

$USGDPQQ -U.S GDP (Q3/2024)ECONOMICS:USGDPQQ 2.8%

Q3/2024

source: U.S. Bureau of Economic Analysis

-The US economy expanded an annualized 2.8% in Q3 2024,

below 3% in Q2 and forecasts of 3%, the advance estimate from the BEA showed.

Personal spending increased at the fastest pace since Q1 2023 (3.7% vs 2.8% in Q2),

boosted by a 6% surge in consumption of goods (6% vs 3%) and a robust spending on services (2.6% vs 2.7%), mostly prescription drugs, motor vehicles and parts, outpatient services and food services and accommodations.

Government consumption also rose more (5% vs 3.1%), led by defense spending.

In addition, the contribution from net trade was less negative (-0.56 pp vs -0.9 pp), with both exports (8.9% vs 1%) and imports (11.2% vs 7.6%) soaring, led by capital goods, excluding autos. On the other hand, private inventories dragged 0.17 pp from the growth, after adding 1.05 pp in Q2.

Also, fixed investment slowed (1.3% vs 2.3%), led by a decline in structures (-4% vs 0.2%) and residential investment (-5.1% vs -2.8%).

Investment in equipment however, soared (11.1% vs 9.8%).

$USGDP - Quarterly DataECONOMICS:USGDPQQ (Q3/2023)

The American Economy ( ECONOMICS:USGDPQQ ) expanded an annualized 4.9% in the Third Quarter of 2023, slightly below 5.2% in the second estimate,

but matching the 4.9% initially reported in the advance estimate.

It still marks the strongest growth since Q4 2021.

Consumer spending rose less than initially anticipated (3.1% vs 3.6% in the second estimate), but remained the biggest gain since Q4 2021.

The slowdown was mainly due to services spending.

Also, private inventories added 1.27 pp to growth, below 1.4 pp in the second estimate and both exports (5.4% vs 6%) and imports (4.2% vs 5.2%) increased less than initially anticipated.

On the other hand, nonresidential investment was revised higher to show a 1.4% rise (vs 1.3% in the second estimate) as investment in structures surged way more than expected (11.2% vs 6.9%).

Both residential investment (6.7% vs 6.2%, the first rise in nearly two years) and government spending (5.8% vs 5.5%) were also revised higher.

source: U.S. Bureau of Economic Analysis

Connection US GDP and Bitcoin quarterly performanceBitcoin and Crypto Nation... eat this ‼️

Found an interesting connection of quarterly reported US GDP and the prediction of the following quarter performance of BTC - no joke - look at the chart ‼️

Kind of sentiment effect IMO

Thursday GDP increase expected - bullish Q3 for Bitcoin ??!!

Tell me your thoughts in that idea

*not financial advice

do your own research before investing

Why isn't the US officially in a recession? The US has technically entered a recession in the second quarter 2022 as the economy contracted 0.9% year over year, following a 1.6% decline in the first quarter. However, the official body that is tasked to make a call on whether the economy is in a recession has yet to declare that the US is in fact in an economic downturn.

Slowdown in private and public spending

In the April-June period, GDP shrank for the second straight quarter, which the US Department of Commerce attributed to the drag in private inventory and residential fixed investments, reduced federal government spending and a drop in non-residential fixed investment.

General merchandise stores and motor vehicle dealers in the US eased their inventory build-up in the recent quarter, leading to the drop in private inventory investment, while the government’s move to cut down on its non-defense spending resulted in lower federal government spending.

These factors offset the increase in exports and personal consumption spending in the second quarter.

While the second consecutive drop in GDP reached the widely accepted definition of a recession, the US, according to a body that gets to say when the country is already in one, has yet to make a call.

Who makes the call?

The National Bureau of Economic Research, a nonprofit organization founded in 1920, serves as the “official” arbiter of whether the US, the world’s largest economy, is in a recession or not. The NBER’s Business Cycle Dating Committee consists of eight members who are among the country’s top economists working at leading academic institutions.

The committee keeps track of the dates of peaks and troughs that frame economic recessions and expansions and its decision is based on a wider set of indicators including income, spending and employment.

The NBER defines a recession as a period that involves a “significant decline in economic activity that is spread across the economy and lasts more than a few months.”

Growth slowing

While the US is not in an official recession, many analysts acknowledged that the country’s economic growth is slowing. Even US President Joe Biden said “it’s no surprise that the economy is slowing down” as the economy came off of last year’s historic growth, regaining all the private sector jobs lost during the COVID-10 pandemic.

“But even as we face historic global challenges, we are on the right path and we will come through this transition stronger and more secure,” Biden said in a statement last week following the release of the quarterly GDP report.

Federal Reserve Chairman Jerome Powell also remains optimistic on the economy, telling reporters in a recent press conference: “I do not think the US is currently in a recession and the reason is there are too many areas of the economy that are performing too well.”

Strong jobs data

“This is a very strong labor market ... it doesn’t make sense that the economy would be in a recession with this kind of thing happening,” Powell said.

In June, non-farm payrolls rose by 372,000 month over month, topping the 250,000 market estimate, with the unemployment rate unchanged at 3.6%, according to the US Bureau of Labor Statistics.

“The strong 372,000 gain in non-farm payrolls in June appears to make a mockery of claims the economy is heading into, let alone already in, a recession,” Andrew Hunter, senior US economist at Capital Economics, was quoted by CNBC as saying.

The strength in US consumption and employment are still providing support to the economy, but some analysts are warning that it is only a matter of time before the US succumbs to a recession as soaring inflation continues to dampen consumer appetite, while the volatility in financial markets linger due to uncertainties surrounding the COVID-19 pandemic, stagflation concerns and other factors.

The International Monetary Fund last week lowered its outlook on the US economy, now expecting a 2.3% growth this year, down from its previous 3.7% expansion forecast, while it expects the world economy to rise 4.2%, slower than its anticipated 3.6% growth forecast.

USA: That GDP HeadlineCNBC: U.S. GDP fell at a 1.4% pace to start the year as pandemic recovery takes a hit

First thing we need to do is ignore the headline completely and dig into the details.

"Just tell me if it's good or bad!"

It's not that simple. The problem with any broad-based measurement like GDP is that the good stuff is hiding in the details.

Quick recap of the GDP calculation:

GDP = private consumption + gross private investment + government investment + government spending + (exports – imports)

And it's that last part that matters most: (Exports - Imports).

Take a look at this chart comparing US imports and exports 👇

Usually, the two move roughly in lockstep even as the US maintains a large trade deficit with the world (by importing more than it exports). That trade deficit has ballooned since the pandemic with imports massively outpacing exports.

Why does that matter?

Because Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Imports, by definition, aren't produced within the country's borders. One countries' imports are another countries' GDP (the exporter).

So the yuuuuge trade deficit was a big part of the picture.

There was plenty to be positive about in the report. Demand was strong and as Jason Furman notes private final domestic demand was up 3.7% in Q1.

Consumption: +2.7%

Business fixed investment: +9.2%

Residential investment: +2.1%

Yes, it's a negative GDP print, but the underlying economy is still strong.

However, it's also a negative GDP print, so we shouldn't just dismiss it out of hand.

We need to frame the recession talk.

A recession is defined as:

"A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

Then there's a technical recession which is defined more simply as:

"Two consecutive quarters of negative GDP growth"

We're nowhere near it on the first measure, but just one quarter away on the second measure... 😜

And the data today was once again indicative of a strong economy in March.

Income & Consumption both came in above expectations.

The Employment Cost Index at 1.4% will be hot enough to keep the Fed sweating about a wage-price spiral embedding inflation in the economy.

For now , the US economy is ticking along nicely.

GDP Growth / Macro Economic Commentary - Forecast 2022

The Macro Trend for 2022 for the 6th consecutive year remains - Aggression for every Point on the Curve.

__________________________________________________________________________________________

Commodity Hoarding to the Space Race to Territorial Disputes, 2022 will be a remarkable year for the

Rising Dragon.

One of more interesting but non-topics has been the Velocity with which China has demonstrated their

intent o assert dominance - Space.

Plans to Inhabitat the Southern Pole of the Moon have been moved forward 10 years, from 2035 to 2025.

Why is this remotely significant?

Excellent question.

It provides for the colonization of the Moon as well as its weaponization.

Water, Platinum, Rare Earths, Titanium, Oxygen, hydrogen, and Immense Solar Power are abundant.

Two items of interest caught my attention in reading through their forward Plans:

1. A large 1 Megawatt Nuclear Reactor

2. A large Mass - Rail Accelerator

By the time Blue Origin and Space Prime intend to attempt a planned mission to the South Polar region of the

Moon - the welcome mat will have been rolled up.

The Space Wars will begin ahead of 2024.

China is seeking dominance within the interior of the Solar System within the decade while CERN fiddles with

every larger experiments here on Earth 175 Meters below the surface.

As James T. would utter - "Space the Final Frontier"

How else does a World Power collateralize the Future... it ain't here.

_______________________________________________________________________________________________

Commodity Hoarding has been well underway in the Land of the CCP for 6 straight years.

Slowly, methodically - China has been amassing resources at a pace unparalleled in Human History.

I'm quite certain, it is not for nothing, mixed metaphors aside.

Stockpiling / Inflation Hedging

Global Food prices in 2021 increased 30.127%

Wassup CP Lie

3% gains month over month... Wheat and Oils were up significantly in 2021.

Money Supply increases Globally were up 27.14%

51% of the World's Grains belong to China.

Relying on Supply Chains?

Foolish.

20.12% of the Worlds Population has 51+% of its grains. 60% of Rice and 51% of Wheat.

Clearly, the CCP is front running higher Inflation.

Intertest Hedge - Had you purchased MRE's or Survival Foods in Dried Form... Congratulations,

you outperformed the S&P 500 by a large margin. Gold / Silver, you would have crushed by a

factor of 20X. 2012 Au Average Price ~ $1,668.86 while in 2022 it is $1,798.89.

Silver - we won't bother, a clear loser by an enormous margin. YArd relics in the Age of REAL

RETURNS.

Bonds - If you enjoy Net Negative REAL RETURNS - Load up.

You can't eat Door Stops or Paper which Provide your capital being sent asymptotically to ZERO

in Purchasing Power Parity in 11.37 Year - this is using the Bullshit Data, in REAL Terms at 2021

rates of REAL RETURNS - yeah, it's less than 3.4 Years.

Speaking of Supply Chains prior to the Reality of PPP, China is claiming Fisheries in Asia and the South

Pacific with rather large swaths of Net.

Who's going to stop them? The land of Oz... unlikely - they're too busy being enormous knee benders.

Japan?

Unlikely.

The Philippines?

There aren't enough shoes in Imelda's closet to throw at them?

The United States?

Every simulation I've seen shows the United States is crushed in War Games in the South China Sea.

Biden's bellicose rhetoric only pissed them off and accelerated their aggressions.

Taiwan... 50 years later, the United States of America acknowledges it is a Territory of China.

Bradon isn't going to stop them from taking what we have long permitted to occur.

Doubt it?

See Hong Kong.

_______________________________________________________________________________________________

Resource Wars which accelerated in 2021 will only increase in both Scope and Scale in 2022.

Something to consider prior to getting encouraged about illusory Gains.

We are facing daunting changes most Americans will struggle to accept.

Squander.

Apathy is the Glove into which Evil slips its Hand.

_______________________________________________________________________________________________

I began 2022 with Rainbows and Butterflies and Compromise...

The Dragon isn't "Toothless" and we aren't going to "Train" him.

Liechtenstein, Luxembourg, Monaco, and Singapore are the residences

of the level pullers, well out of the way.

_______________________________________________________________________________________________

20% Gains in 2021 for the NQ & ES is not sustainable.

Fed Policy is changing in a few months

VX for 2021 held a number of Flash Crashes.

Instability.

VAX Variants and boosts... creating effectiveness panics.

Real Estate in China remains a Large Risk end of January during the Lunar New Year.

$212 Billion in Balance SHeet... Sh_t. M&A won't prop this Junk Up.

Deflating Real Estate in China is De Facto, CCP is no better than the FED... hard to believe,

but they are indeed worse.

3.7 Million Speculators in the US joined the likes of BTC, ETH, and DOGE - most are

underwater HODLings.

Shiba - the Hope Coin... Tokens for Tulips, the Greatest Fools.

NFT''s - the Hot Air Ballon for Buyers, give it a few years. JPEGs have zero Intrinsic Value.

Too much $ chasing Submariners to Oysters... Tick Tock... it's a clock, I've got one on my

phone.

Bubble troubles are everywhere.

The Genius of Bull Markets... is not Genius at all, it is simply a freakout.

5 Variant of Covid, a new one in China over the weekend, right in time for the Lunacy New Year.

Het your booster Jab before it's too late... oops, another Variant -XIan

A news Cycle filled with Mania and Setups.

Trave Restrictions and Camping with Covid are in Trend.

Germany, the Congo degenerates are waiting on head wrappings for far higher energy prices

in the fatherland... Putin enjoying the NATO Squeeze as it fits the return of NatGAs from the

Pipes to Poland.

Energy will be one of the more Volatile Instruments to Trade in 2022.

Buckle up, Sporty is an understatement.