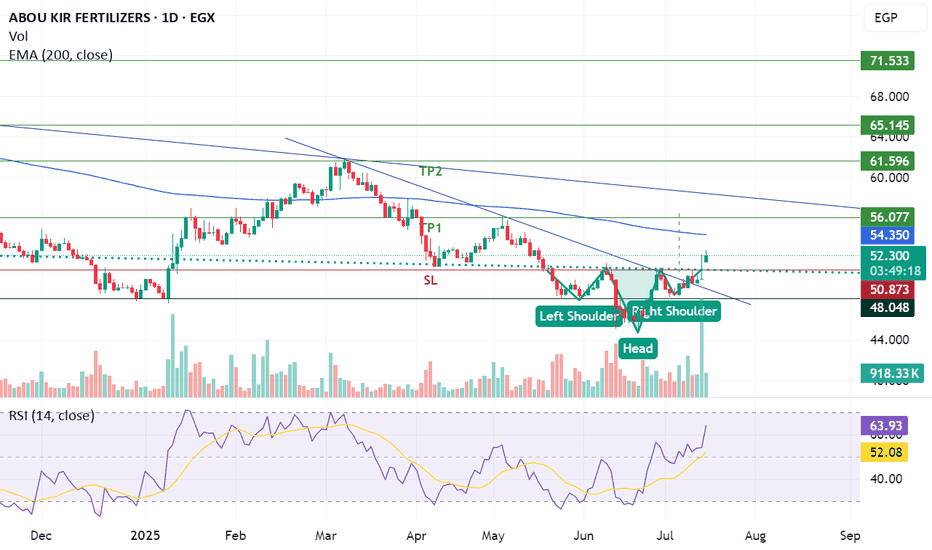

Breakthrough inverted head and shoulders and downtrend lineABUK has successfully breakthrough inverted head and shoulders pattern and downtrend resistance line supported with volume exceeding average 30 days allowing the stock to achieve the below targets:

- Potential buy range: 51 - 51.5

- TP1: 56

- TP2: 61.5

- SL: below 50.70 "Require confirmation"

ABUK trade ideas

#ABUK - very confusing / where is the bottom ??!!!!3 levels prices may respect it :

first : 49.18

secund : 43.64 ( may be )

third : 38.69 ( really, no one bigger than market )

i am waiting for any positive sign at any level, now MACD is negative on daily basis .

any way consider stop loss to save your capital

good luck

#ABUK Egyptian stock - great opportunity - great fundamental.#ABUK timeframe 1 HOUR.

created Gartley Bullish pattern ( and AB=CD ) , so we can see action price in this point .

Entry level at 48.85 .

Stop loss 47.15( loss may go to up -3.00% )

First target at 51.25 ( with profit around 4.87% )

Second target 53.15 ( with profit around 8.75% )

Third target 55.25 ( with profit around 13.20% )

RSI show a positive diversion that's may support our idea .

NOTE : this data according to time frame I hour,

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ABUK Short This stock is a short term bearish until 42.4 or if i dives dipper to 36.11 EGP. But more than likely it will stop at 42.4 EGP then full reversal should be in play.

The 80% likely scenario is the price further retraces and reverse. But if good news comes around and the price fully closes above 62 EGp, then wait for any retracement to 62 again and go long.

Also iam very convinced that this is a short play in hands, the price didnt make a lower lows yet and stalls at this support level, so it really depends on the news and its correlation to price action and how the stock will respond to it.

DYOR and check the news daily if you to take any trade since one negative or positive news that happens suddenly could change the whole setup.

#ABUK Egyptian stock - great opportunity - great fundamental.#ABUK time frame 1 DAY

created 2 Bullish pattern ( Gartley and AB=CD ) , so we can see action price in this point but in anther hand we are in a downtrend targeted 41.00 to 35.00 especially EGX30 is negative .

Entry level at 48.00 to 48.30

Stop loss 47.50 ( loss may go to up -1.7% ) or 46.80 the last stand with loss -4%

First target at 51.75 ( with profit around 7% )

Second target 54.25 ( with profit around 12% )

Third target 56.00 ( with profit 15% )

NOTE : this data according to time frame I DAY , it`s may take period up to 3 months to achieve targets , you must study well the Alternative opportunities before invest in this stock .

In addition EGX30 is negative.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

ABUK stock Just checked this stock, and even though all the fundamentals is bullish for this stock, something seems a bit off for me since the TA chart says otherwise since the stock is in a downtrend (which could also be considered a correction looking at the bigger picture) , as well as the fact that company earnings are on negative territory for the past two quarters.

So i ran some fundamental analysis on Chatgpt, which also gave bullish hints based on the information available.

Yet iam still leaning toward bearish scenario for this case, until the next earnings come out. If its positive, then that might be our final confirmation. if not, and their earnings still on a downtrend, then i would take the bearish opp.

below is the chatgpt analysis, and ofcourse, DYOR. This is only my POV, and i might be wrong.

1. Company Overview

Abu Qir Fertilizers is one of the largest producers of nitrogen-based fertilizers in Egypt. The company’s product range includes:

Urea fertilizers

Ammonia

Nitric acid

Various other nitrogen compounds and NPK blends

Its revenues largely depend on domestic and export fertilizer sales, which can be influenced by:

Crop prices and overall agricultural demand (both locally and internationally)

The cost of key inputs (especially natural gas)

Currency fluctuations (notably, the Egyptian pound’s performance)

2. Recent Financial Performance & Earnings Expectations

While exact current figures will depend on the latest releases, historically:

Revenue Growth:

Abu Qir has typically benefited from strong local demand for fertilizer (Egypt’s agriculture sector) and opportunities to export regionally.

Rising global fertilizer prices in the past couple of years—partly due to disruptions in supply from Eastern Europe—have often boosted revenue.

Profit Margins:

Abu Qir’s margins can be sensitive to natural gas prices (as natural gas is a feedstock for nitrogen fertilizers).

In Egypt, natural gas pricing policies for local fertilizer producers can sometimes be more favorable than in global markets, supporting higher margins.

Currency Devaluation Impact:

When the Egyptian pound weakens, exporters like Abu Qir often see revenue gains in local currency terms because they sell part of their production internationally in U.S. dollars.

However, currency fluctuations can also raise costs of any imported inputs or capital equipment.

Market Demand Outlook:

Global demand for nitrogen fertilizers is expected to remain robust in the medium term, supported by the need to increase crop yields.

Agricultural commodity prices (such as wheat, corn, etc.) influence farmer incomes and in turn fertilizer demand. Currently, demand remains relatively strong due to the ongoing need for crop security worldwide.

Earnings Expectations:

Many analysts forecast stable or modestly increasing net income over the medium term, assuming stable global fertilizer prices and a relatively favorable gas input cost in Egypt.

Macroeconomic challenges (e.g., further devaluation of the Egyptian pound or abrupt changes in energy pricing) could introduce volatility in earnings.

3. Stock Price Drivers & Outlook

Global Fertilizer Prices

Prices soared in 2022 and remained higher-than-usual in 2023 due to supply chain issues and geopolitical tensions. If fertilizer prices remain elevated, Abu Qir’s revenue can stay strong, potentially supporting share price.

Local Economic Conditions

Egyptian equities can be sensitive to local interest rates, currency moves, and investor sentiment. If interest rates remain high, some investors might rotate away from equities. Conversely, if real interest rates come down or if the currency continues to devalue, exporters like Abu Qir could benefit.

Profit-Taking and Valuation

If the stock has run up significantly over the past couple of years, short-term corrections or consolidations can happen if the market thinks shares have become expensive. Valuations (e.g., P/E ratio, EV/EBITDA) relative to peers or the broader market will influence whether investors see the stock as undervalued or overvalued.

Dividend Policy

Historically, Abu Qir has distributed dividends, which can attract income-focused investors. A consistent or growing dividend can support the share price. Any cuts or changes in the dividend policy could pose a downside risk.

Will the Stock Price Rise or Fall?

Bullish Case: Stable or rising fertilizer prices, favorable natural gas costs, continued (or growing) export revenue boosted by currency devaluation, and consistent dividend payouts could support a higher share price.

Bearish Case: A sudden drop in global fertilizer prices, local economic headwinds (such as rapidly rising interest rates or further currency turmoil), or significant cost increases (e.g., for natural gas) could pressure margins and weigh on the share price.

4. Key Watch Factors

Natural Gas Pricing: Changes in Egypt’s gas supply and pricing policies.

Fertilizer Price Trends: Global nitrogen market outlook and any major shifts in supply/demand.

Egyptian Pound Movements: Impact on export competitiveness vs. cost of imported inputs.

Dividend Announcements & Policy: Investor perception of income stability.

Regulatory Environment: Subsidies, export rules, or energy-related policies.

5. Conclusion

Earnings Outlook: Generally positive for the medium term, given resilient demand for nitrogen fertilizers and favorable local gas input costs.

Stock Price Direction: Likely to be influenced by the balance between strong fertilizer demand (and favorable currency for exports) versus macroeconomic uncertainties.

Overall, most analysts maintain a cautiously optimistic view on Abu Qir Fertilizers, provided that global fertilizer demand remains robust and local gas pricing remains supportive. However, volatility can arise from shifts in commodity prices, further Egyptian pound devaluation, or abrupt policy changes.

Abu Qir scenarios Be careful when buying if the 47.8 level is broken, because in this case it will fall to the imbalance zone, which I think is the end of the downward wave for the stock.

Good luck everyone

Sorry for presenting the analysis in English, which I do not prefer, but because I have a problem when converting the chart to Arabic.

#ABUK#ABUK time frame 30m

created a bullish Gartley pattern

entry level at 51.90

stop loss 51.40

first target at 52.80

second target 53.65 up to 54

MACD indicator show positive diversion , may that is support our idea.

NOTE : this data according to time frame 30m

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

Abuk Jinny Gann Grid + LevelsJinny Gann Grid & Levels are on the Chart

Jinny Gann Grid/Horizontal Lines Works as Support / Resistance.

Important levels for the Big Cycle on the chart.

Please Make sure u need to zoom in to Present to see a good picture of Important Support/Resistance

Crosses Near the price The green trend and the Red.. Expect a Reversal at the Exact point with High Probabilities.

Every line on Chart was Drawn Based on Equations... not Manually

My Theories... Implemented it to Jinny GANN R

Best Regards

Trade Wisely.

Abuk Important LevelsHello Dear Traders,

- Important Levels

On the Chart "Horizontal Lines" Based on Gann Square of 9

Works as Support/Resistance. Watch for Price action around those levels

- Jinny Gann Grid

- Vertical lines works as time lines. Expect Reversal around them.

For 25-6-2024

Support : 52.62

Resistance :58.5 then 60.54

Wish you Good Luck Trading.

ABUKFull trading cycle started on 12/8/21 at 18.109, ending on 10/30/13 at 100 with a profit of 430%. The complete correction (3,3,5) closed on 4/28/24 at 58.780, resulting in a loss of 68%. A new trading cycle has begun.

Join us in investing in a first-class opportunity, capitalizing on the profit from the initial wave of Wave 1.

ABUK 22-5-2024echnical Analysis Report: Advanced Trading Strategies Using Multiple Indicators

Introduction:

In this educational video, a comprehensive approach to technical analysis is presented, focusing on the identification of trend reversals and entry points in the market. The strategy incorporates a diverse set of indicators and concepts to enhance trading precision and decision-making.

Key Components:

1. Indicators Utilized:

- Fibonacci Retracement (Fibonacci)

- Average True Range (ATR)

- Cumulative Volume Delta

- Smart Money Concepts

- Relative Strength Index (RSI)

- Trailing Stop Loss ATR

- Ichimoku Kinko Hyo (Ichimoku)

2. Objective:

The primary goal of the strategy is to pinpoint the transition from a downtrend to an uptrend, facilitating well-timed trading decisions. By combining various technical tools, traders aim to increase the probability of successful trades.

3. Trading Philosophy:

- The emphasis on Ichimoku Kinko Hyo as a foundational element underscores the strategy's commitment to deriving signals from this powerful indicator.

- The reference to being an "Ichimokian" reflects a dedication to mastering Ichimoku strategies and principles in trading practices.

Conclusion:

By integrating a spectrum of indicators such as Fibonacci, ATR, volume analysis, RSI, and Ichimoku, traders following this methodology can gain a more holistic view of market dynamics. The utilization of these tools in conjunction with each other enhances the ability to identify optimal entry and exit points, laying a strong foundation for informed and strategic trading decisions.

This video encapsulates the essence of the educational content, offering insights into the advanced technical analysis approach advocated by the "ICHIMOKUontheNILE" community.