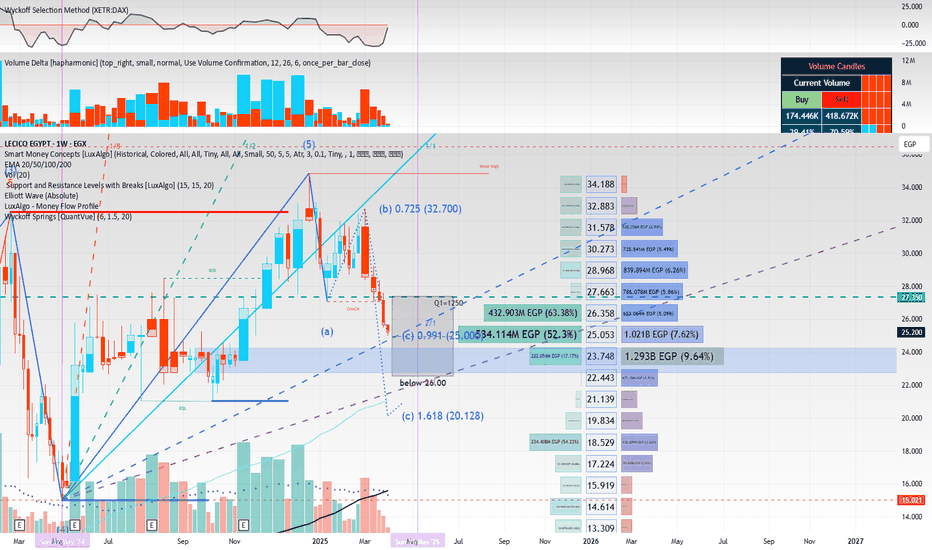

Bullish Breakout & Retest Setup - Great R:R Opportunity!- There's a **downtrend line** that got broken to the upside (marked with an arrow).

- After the breakout, price made a **small pullback** and seems to be finding support around the previous breakout zone.

- You're showing a **long setup** with a favourable risk/reward (small stop-loss area, large t

11.129 EGP

890.33 M EGP

6.64 B EGP

66.53 M

About LECICO EGYPT

Sector

Industry

CEO

Taher Gilbert Gargour

Website

Headquarters

Alexandria

Founded

1959

ISIN

EGS3C161C014

FIGI

BBG000BVZWH1

Lecico Egypt SAE provides sanitary ware and tiles. It operates through the following business segments: Sanitary Ware, Tiles, and Brassware. The Sanitary Ware segment handles the production of bathroom ceramics, consoles and washbasins, urinals, kitchen sinks, shower trays, and accessories. The Tiles segment focuses on the manufacture of ceramic tiles for floors and walls. The Brassware segment is involved in the production of Napoli and Verona faucets. The company was founded in 1959 and is headquartered in Alexandria, Egypt.

Related stocks

long-term investor (EGX:LCSW) (EGX:LCSW) Lecico Egypt (S.A.E.) produces and sells sanitary ware products and various tiles in Egypt and Lebanon. The company’s products include bathroom suites, toilets, washbasins, and bidets and urinals; and squatting pan, shower trays, kitchen sink, and taps, as well as other complementary prod

Lecico Egypt has a potential to re-hit Resistance line at 29.2Daily chart

The stock is trading in a broadening pattern (mainly between lines R and S); and the next level is 25.6

Above this resistance , the next targets will be 27.3, 28.0 and 29.2

The technical indicators RSI and MACD are supporting this view.

Consider the stop loss below 22.6 - And raise the

**Technical Analysis of LCSW****Technical Analysis of LCSW**

LCSW has recently been observed consolidating after closing 10 successive Heikin Ashi red candlesticks. A significant shift in market behavior was noted at a critical level of 17.42 EGP, which represented a major change in character. This was followed by a Market Str

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of LCSW is 25.500 EGP — it has increased by 0.51% in the past 24 hours. Watch LECICO EGYPT stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EGX exchange LECICO EGYPT stocks are traded under the ticker LCSW.

LCSW stock has risen by 2.86% compared to the previous week, the month change is a −7.34% fall, over the last year LECICO EGYPT has showed a 9.44% increase.

LCSW reached its all-time high on Dec 25, 2024 with the price of 34.840 EGP, and its all-time low was 1.613 EGP and was reached on Mar 19, 2020. View more price dynamics on LCSW chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LCSW stock is 1.89% volatile and has beta coefficient of 0.76. Track LECICO EGYPT stock price on the chart and check out the list of the most volatile stocks — is LECICO EGYPT there?

Today LECICO EGYPT has the market capitalization of 2.12 B, it has decreased by −4.40% over the last week.

Yes, you can track LECICO EGYPT financials in yearly and quarterly reports right on TradingView.

LCSW net income for the last quarter is 34.60 M EGP, while the quarter before that showed 227.84 M EGP of net income which accounts for −84.81% change. Track more LECICO EGYPT financial stats to get the full picture.

No, LCSW doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LECICO EGYPT EBITDA is 1.34 B EGP, and current EBITDA margin is 19.96%. See more stats in LECICO EGYPT financial statements.

Like other stocks, LCSW shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LECICO EGYPT stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So LECICO EGYPT technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating LECICO EGYPT stock shows the buy signal. See more of LECICO EGYPT technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.